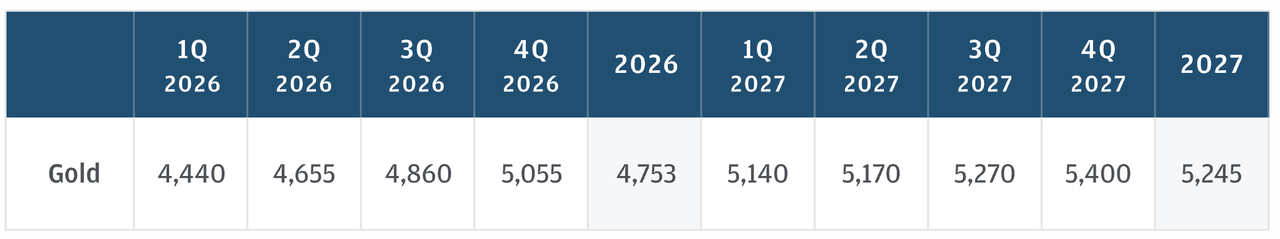

Gold is no longer just a traditional safe haven but it has also become one of the strongest macro trades of the decade. In 2025, gold surged more than 69% and hit a fresh all-time high above $4,440 per ounce on December 22, 2025, driven by escalating geopolitical tensions, falling U.S. interest rates, a weaker dollar, and record demand from central banks and ETFs, according to Reuters and J.P. Morgan Global Research. With institutional and sovereign buyers continuing to reallocate into gold, J.P. Morgan forecasts prices to average $5,055/oz by Q4 2026, reinforcing gold’s role as both a macro hedge and a core diversification asset in an increasingly uncertain global environment.

Gold price forecasts | Source: JP Morgan

Now, crypto traders can speculate on gold's volatility with futures trading, making the most of this gold supercycle without holding physical bullion or trading on legacy commodity exchanges. On BingX, you can trade gold using crypto collateral in two flexible ways, in the form of gold futures–linked perpetual contracts on the

BingX Futures market, and via XAUT/USDT perpetual contracts, which track tokenized gold prices and offer 24/7, crypto-native exposure to gold’s price movements.

This guide explains how gold futures work, what are the different ways to trade gold futures with crypto, how to trade them using crypto on BingX, and when to choose gold futures or XAUT perpetuals, especially for crypto-native traders.

Gold Futures Market Outlook for 2026: What to Expect

The outlook for gold futures in 2026 remains structurally bullish, with price action increasingly driven by institutional flows and short-term speculation. J.P. Morgan Global Research expects gold prices to average around $5,055 per ounce by Q4 2026, supported by sustained central bank buying, continued investor diversification, and a macro backdrop of slowing growth and lower real interest rates

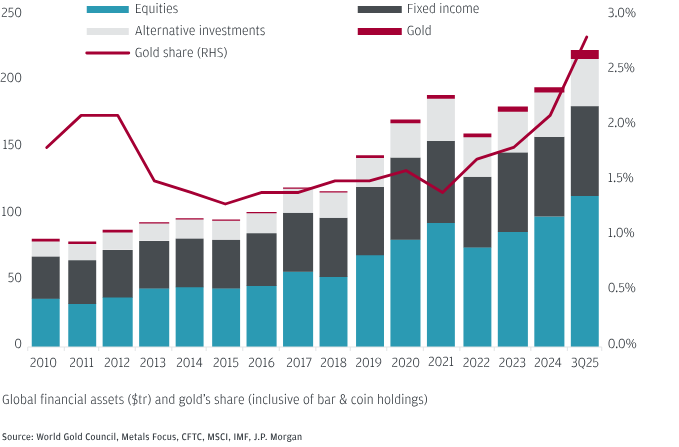

Gold AUM | Source: JP Morgan

Gold futures are heading into 2026 shaped by geopolitical risks, trade and tariff uncertainty, and ongoing U.S. dollar volatility. Central banks including those in Brazil, South Korea, Poland, and Indonesia are expected to continue buying gold at an average pace of around 585 tonnes per quarter, well above pre-2022 levels, reinforcing gold’s role as a strategic reserve asset rather than a short term trade.

On the investment side, ETF and futures inflows are projected at roughly 250 tonnes per year, as gold allocations rise from about 2.8% of total AUM toward a potential 4–5% long term range. This structural demand helps support prices during pullbacks, while gold futures remain highly sensitive to macro catalysts such as Federal Reserve policy shifts, currency movements, and geopolitical developments heading into 2026.

What Are Gold Futures and How Do They Work?

Gold futures are standardized derivative contracts that allow you to agree today on a price to buy or sell gold at a specific future date. Instead of owning physical gold bars, you’re trading price movements, which makes futures faster, cheaper, and easier to manage for most traders.

Here are the basics of gold futures you should know before you start trading them:

• Contract size: A standard gold futures contract typically represents 100 troy ounces of gold, the benchmark contract on COMEX.

• Long vs. short:

- Go long if you expect gold prices to rise.

- Go short if you expect prices to fall.

• Margin and leverage: You don’t pay the full value upfront. Futures use margin, meaning a small deposit controls a much larger position, amplifying both gains and losses.

• Settlement: Most traders close positions before expiry to avoid physical delivery; profits or losses are settled in cash.

Why Investors Trade Gold Futures With Crypto vs. Traditional Gold Futures

Trading gold with crypto combines gold’s long-standing role as a safe-haven asset with the flexibility, leverage, and

risk-management tools of a modern crypto futures platform.

1. No physical storage or purity risk: You gain exposure to gold price movements without worrying about vault storage, insurance, transport, or verifying gold purity.

2. Lower capital requirements through leverage: Futures trading allows you to control a larger gold position with a smaller upfront margin, improving capital efficiency compared with spot gold investing.

3. 24/7 access to global gold markets: Unlike traditional commodity exchanges with fixed trading hours, BingX lets you trade gold-related contracts around the clock, reacting instantly to macro and geopolitical news.

4. Effective hedge for crypto portfolios: Gold often outperforms during risk-off periods, making it a practical hedge when crypto markets face volatility, drawdowns, or liquidity stress.

5. Professional-grade risk controls: BingX offers take-profit and stop-loss orders, along with cross and isolated margin modes, helping traders manage downside risk and position exposure more precisely.

Because gold typically behaves differently from equities and crypto during market stress, trading gold on BingX can enhance portfolio diversification while providing tactical trading opportunities.

What Are the Different Ways to Trade Gold Futures Using Crypto?

Crypto traders can access gold price movements through several routes, depending on whether they want leverage, simplicity, or self-custody. These options span centralized exchanges, decentralized protocols, and spot markets.

1. You can trade gold perpetual futures on centralized crypto exchanges like BingX, where gold-linked contracts allow you to go long or short using

USDT collateral, apply leverage, and manage risk with

take-profit and stop-loss orders, without physical delivery or contract expiry. This is well suited for active traders positioning around macro events such as inflation data, rate cuts, or geopolitical shocks.

2. You can trade tokenized gold futures contracts, which track tokenized gold prices and offer continuous, 24/7 exposure in a fully crypto-native format. These contracts remove the complexity of futures expiries while still supporting leverage and short selling.

4. Some traders use

decentralized exchanges (DEXs) like

Hyperliquid and

dYdX to access gold exposure through tokenized gold assets or synthetic gold products, enabling self-custody and on-chain trading without intermediaries. While DEXs offer greater transparency and control, they may come with lower liquidity, higher slippage, and smart-contract risk, making them better suited for experienced DeFi users.

Together, these approaches let traders choose between leveraged futures, perpetual contracts, spot exposure, or fully decentralized trading, all using crypto infrastructure rather than traditional commodity markets.

How to Trade Gold Futures on BingX Futures: Step-by-Step Guide

Trading gold futures on BingX lets you gain direct exposure to gold’s price movements using crypto collateral, combining the depth of traditional gold markets with the speed, leverage, and risk controls of a modern crypto futures platform.

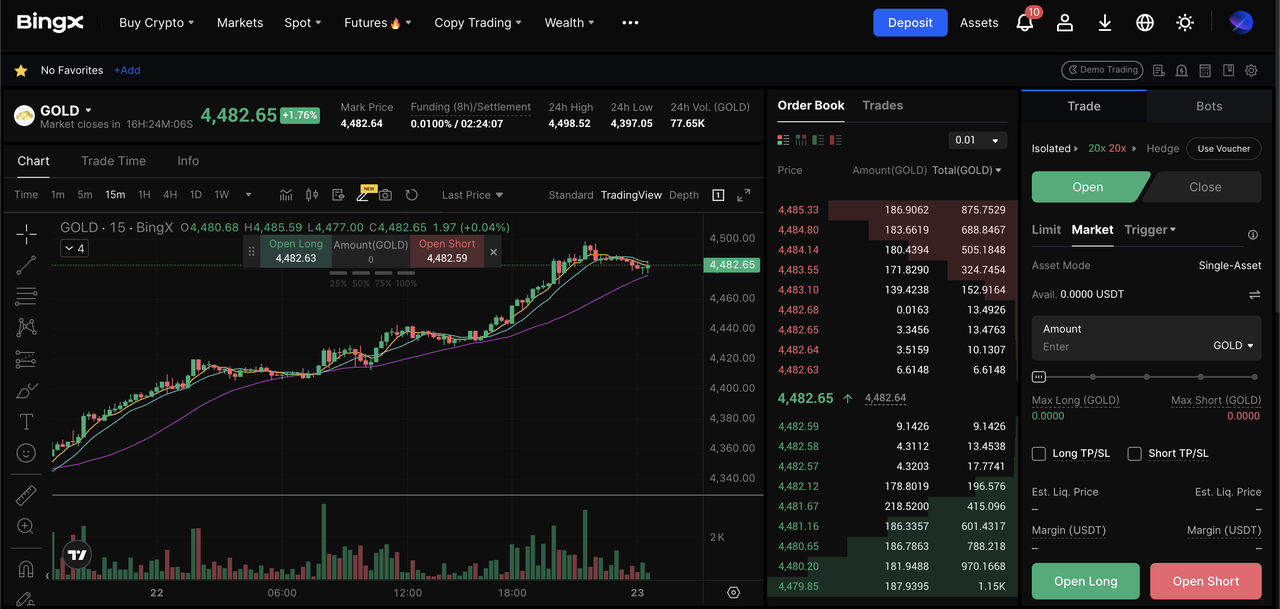

Trading gold futures with crypto on BingX futures market

How Gold Futures Trading Works on BingX

Traditionally, gold futures are traded on exchanges like COMEX or MCX through specialized commodity brokers. BingX removes this friction by letting you trade gold price movements directly using USDT-margined crypto futures, in the same way you trade

BTC or

ETH.

In short, gold futures let you trade the world’s most trusted safe-haven asset, now with crypto-native speed and flexibility on BingX. Instead of owning gold or rolling expiring futures contracts yourself, you:

• Trade price movements only

• Use leverage

• Set long or short positions

• Set TP/SL risk controls

This makes gold futures trading faster, more flexible, and accessible for crypto traders.

Step 1: Create and Fund Your BingX Futures Account

Step 2: Open the Futures Trading Interface

Navigate to Futures → USDT-M Contracts. Select the

gold-linked futures product available on BingX

Step 3: Choose Long or Short

• Go long if you expect gold prices to rise, owing to inflation, rate cuts, geopolitical risk, etc.

• Go short if you expect gold prices to fall due to rate hikes, stronger USD, etc.

Step 4: Set Leverage and Order Type

Adjust leverage based on your risk tolerance. Choose market order for instant execution or limit order for a specific price entry.

Step 5: Manage Risk

Always use stop-loss (SL) and take-profit (TP). Monitor margin levels to avoid liquidation

This approach mirrors traditional gold futures trading, but with crypto-native speed, leverage, and flexibility.

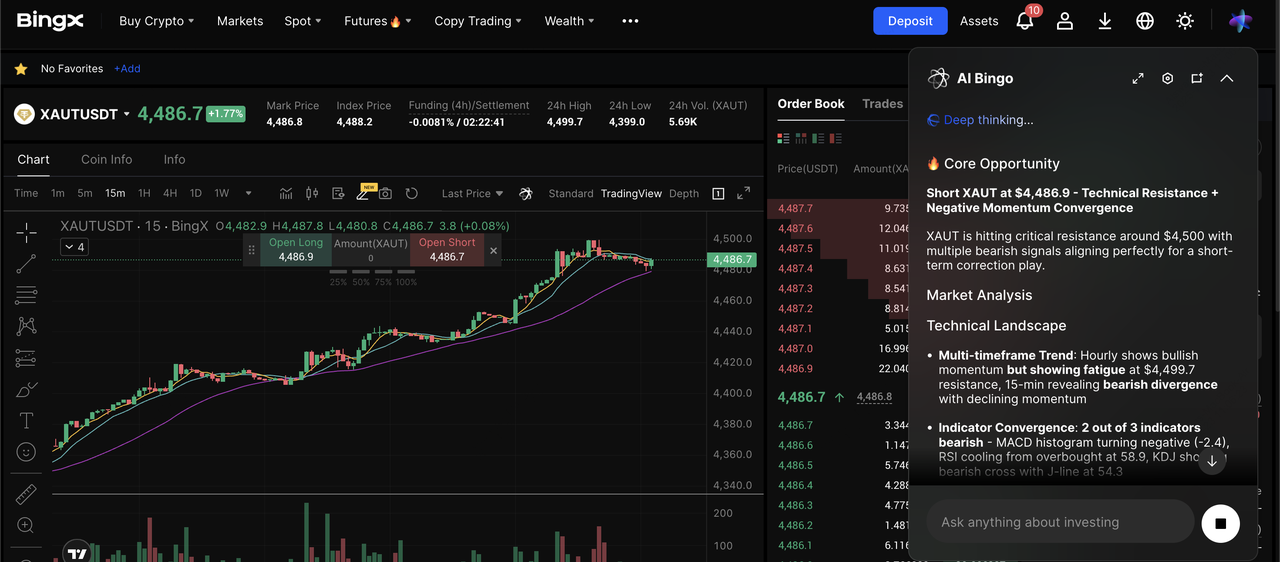

How to Trade XAUT/USDT Perpetual Contracts on BingX

XAUT/USDT perpetual contract on the futures market powered by BingX AI

What Is Tether Gold (XAUT)?

XAUT (Tether Gold) is a tokenized representation of physical gold, where 1 XAUT is backed 1:1 by one troy ounce of allocated gold bars held in professional vaults, allowing investors to gain direct gold exposure without storage or custody complexity. As of late December 2025,

XAUT trades around $4,480, reflecting gold’s macro rally, with a market cap of $1.7 billion, 24-hour trading volume above $150 million, and a total supply of 520,000 tokens, making it one of the largest and most liquid

gold-backed real-world asset (RWA) tokens.

Its recent performance, up 11% over 30 days and 19% over 90 days, has been driven by record gold prices, rising institutional adoption of tokenized gold, and increased crypto market risk aversion, positioning XAUT as a crypto-native, 24/7-traded alternative to traditional gold futures.

Trading Tokenized Gold Futures (XAUT-USDT Perpetuals) on BingX

To trade XAUT/USDT perpetual contracts on BingX, start by funding your Futures wallet with USDT, then navigate to the Futures trading interface and select the XAUT/USDT perpetual pair. You can go long or short on gold’s price movements, adjust leverage based on your risk tolerance, and place market or limit orders while setting take-profit and stop-loss levels to manage risk.

Because XAUT perpetuals do not expire and trade 24/7, they offer a straightforward, crypto-native way to gain continuous exposure to gold without contract rollovers or physical settlement.

Why Trade XAUT/USDT Instead of Traditional Gold Futures?

XAUT perpetuals remove contract-expiration complexity and are ideal for crypto traders hedging portfolios, gaining gold exposure during macro volatility, and holding long-term directional positions without rollover risk.

1. No expiry or contract rollovers: XAUT/USDT perpetual contracts do not expire, eliminating the need to manage settlement dates or roll positions forward.

2. Fully crypto-native gold exposure: XAUT tracks tokenized physical gold while trading like a standard crypto pair, making it easier for crypto traders to understand and manage.

3. 24/7 global trading: Unlike traditional gold futures with fixed exchange hours, XAUT/USDT trades around the clock, allowing instant reaction to macro and geopolitical news.

4. Simpler position management: There is no risk of physical delivery, complex contract specifications, or futures settlement mechanics.

5. Leverage and short selling: Traders can go long or short on gold prices using leverage, similar to other crypto perpetual contracts.

6. Seamless portfolio hedging: XAUT/USDT provides a practical way to hedge crypto portfolios during risk-off markets without leaving the crypto ecosystem.

When Should You Trade Gold Futures vs. XAUT Perpetuals?

Choosing between gold futures and XAUT perpetuals depends on whether you want traditional macro-driven gold exposure with futures-style trading or a simpler, crypto-native way to track gold prices continuously without contract expiries.

Trade Gold Futures on BingX If You

• Want exposure similar to institutional gold markets

• Trade macro events like CPI, Fed meetings, or geopolitical shocks

• Prefer structured futures-style trading

Trade XAUT/USDT Perpetuals If You

• Want continuous gold exposure with no expiry

• Are already comfortable trading crypto perpetuals

• Prefer simpler position management and 24/7 liquidity

Both instruments allow long and short positions, leverage, and advanced risk tools on BingX.

What Are the Top Factors That Move Gold Futures Prices?

Gold futures prices are driven less by short-term chart patterns and more by macro liquidity conditions, monetary policy, and large institutional flows. The 2025 gold rally, and the 2026 outlook, clearly show how these forces interact.

1. Inflation and interest rates: Gold does not generate yield, so its relative appeal rises when real interest rates fall. In 2025, expectations of U.S. rate cuts and easier financial conditions helped push gold to new all-time highs above $4,400/oz, as investors rotated out of cash, Treasuries, and money-market funds into hard assets. Looking into 2026, J.P. Morgan expects further support from lower real rates, reinforcing gold’s role as both an inflation hedge and a store of value.

2. US dollar strength: Gold is priced globally in U.S. dollars, creating a strong inverse relationship. The weaker dollar environment in 2025 made gold cheaper for non-U.S. buyers and amplified futures demand. Continued currency volatility in 2026, especially if U.S. rate cuts materialize, could remain a key tailwind for gold futures prices

3. Central bank demand: Central banks have become one of the most powerful drivers of gold prices. According to J.P. Morgan Global Research, investor and central bank demand totaled 980 tonnes in Q3 2025, more than 50% above the average of prior quarters, equivalent to roughly $109 billion in quarterly inflows at prevailing prices. For 2026, central bank buying is projected to remain elevated at 585 tonnes per quarter, well above pre-2022 norms, providing a structural floor under gold futures.

4. Geopolitical and macro risk: Gold futures react quickly to wars, trade tensions, fiscal instability, and political risk. In late 2025, renewed geopolitical tensions helped trigger momentum breakouts to fresh record highs, as safe-haven flows accelerated into gold futures and ETFs. J.P. Morgan notes that these flows can compound rapidly when combined with futures positioning and ETF inflows, leading to sharp price moves

What Are the Key Risks to Know Before Trading Gold Futures?

Gold futures can be powerful tools for trading macro trends, but they also carry meaningful risks, especially when traded with leverage. Understanding these risks, and managing them proactively, is essential.

1. Leverage can amplify losses. Leverage increases exposure, meaning even small price moves against your position can cause large losses.

Tip: Use conservative leverage, size positions appropriately, and always set stop-loss and take-profit orders before entering a trade.

2. Rapid price swings during macro events: Gold futures often react sharply to inflation data, central bank announcements, interest-rate decisions, or geopolitical headlines.

Tip: Avoid trading purely on emotion or FOMO during major news events, and consider reducing position size or waiting for volatility to settle.

3. Liquidation risk from poor margin management: If margin levels fall below maintenance requirements, positions may be automatically liquidated in fast-moving markets.

Tip: Monitor margin closely, use isolated margin when appropriate, and keep sufficient buffer capital to absorb short-term volatility.

4. Funding costs on perpetual contracts: Holding gold-related perpetual futures over time may incur funding fees that can slowly erode profits, especially in range-bound markets.

Tip: Factor funding rates into your strategy and avoid holding highly leveraged positions for long periods without a clear directional bias.

Because of these risks, gold futures should be traded with disciplined risk management, realistic expectations, and a clear trading plan, rather than impulsive positioning or excessive leverage.

Final Thoughts

Gold continues to play a critical role as a global safe-haven asset, particularly during periods of inflation, monetary easing, and geopolitical uncertainty. BingX enables you to access gold price movements using crypto, without physical custody, storage concerns, or reliance on traditional commodity exchanges.

Depending on your strategy, you can trade gold futures on the BingX Futures market for macro-driven positioning, use XAUT/USDT perpetual contracts for continuous, crypto-native exposure, or consider spot trading gold-backed tokens like XAUT as a lower-risk alternative without leverage. As with all derivatives trading, gold futures involve significant risk, so it’s essential to use prudent leverage, clear risk controls, and only trade amounts you can afford to lose.

FAQs on Trading Gold Futures With Crypto

1. Can I trade gold futures using crypto?

Yes. BingX allows gold exposure using USDT-margined futures and XAUT perpetual contracts.

2. Is XAUT backed by real gold?

Yes. XAUT is backed by allocated physical gold bars held in professional vaults.

3. Do gold futures on BingX expire?

On BingX, gold exposure is offered through gold perpetual futures, which do not have an expiry date, allowing you to hold positions as long as margin requirements are met. Similarly, XAUT perpetual contracts also do not expire, making both options suitable for continuous gold trading without contract rollovers.

4. Is gold trading suitable for beginners?

Gold is often less volatile than crypto, but leverage still carries risk. Beginners should use low leverage and strict stop-losses.

5. Can gold hedge my crypto portfolio?

Yes. Gold often performs well during risk-off periods when crypto markets decline, making it a popular hedge.