Tokenized stocks or tokenized equities are digital assets on a blockchain that mirror the price of traditional company shares or ETFs. In 2025, this niche has quietly turned into a serious market. As of November 2025, over $664 million worth of public equities are now held

on-chain as tokenized stocks, not counting cumulative trading volume, as per RWA.xyz.

Real-world asset (RWA) tokenization more broadly has crossed $36 billion on-chain, with

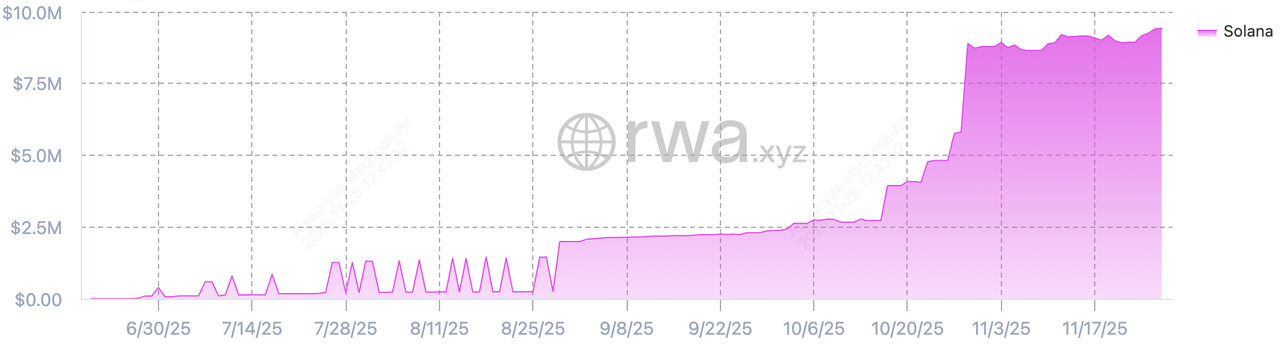

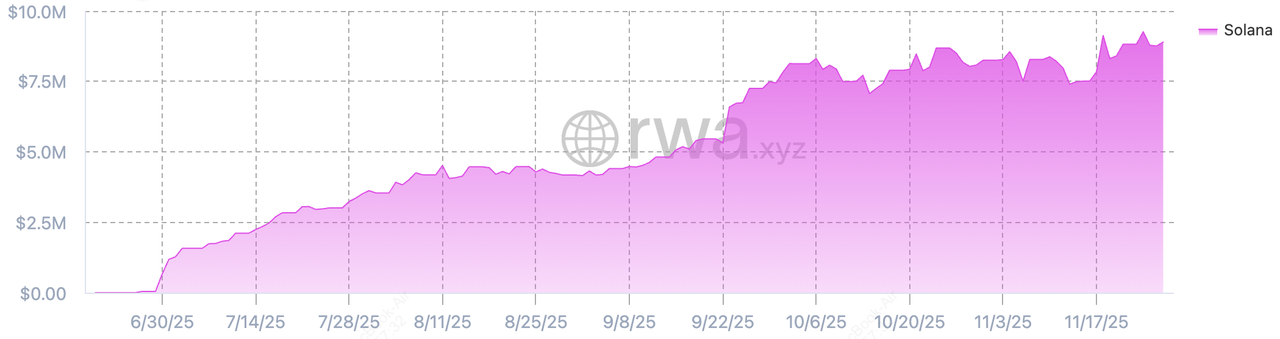

Solana emerging as one of the leading rails for tokenized securities.

In this article, you’ll see how stock tokenization works, why Solana leads this market, and what risks to consider before trading tokenized equities.

What Are Tokenized Stocks and How Does Stock Tokenization Work?

A tokenized stock is a blockchain-based token that represents economic exposure to a traditional share, such as Tesla (TSLA), Apple (AAPL) or an ETF like QQQ. In many designs, each token is backed 1:1 by an underlying share held with a regulated custodian. In others, the token is a synthetic derivative that tracks the price via oracles and hedging strategies.

In practical terms, tokenized stocks give you price exposure to real equities through on-chain tokens, allow fractional ownership of expensive assets, enable 24/7 trading beyond traditional market hours, and offer full DeFi composability for use in

lending, LPing (liquidity provisioning), or collateral strategies.

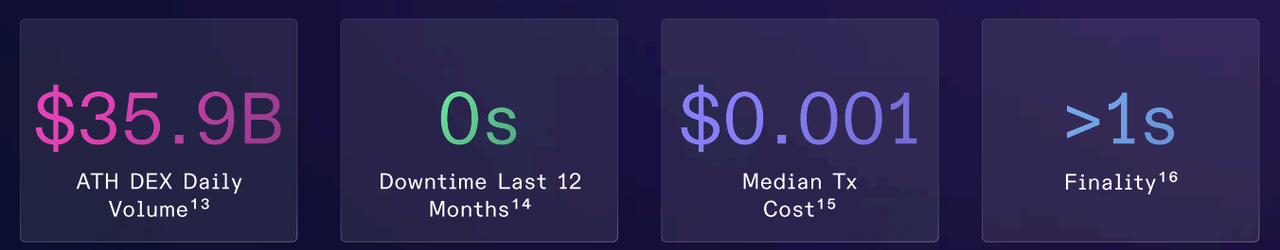

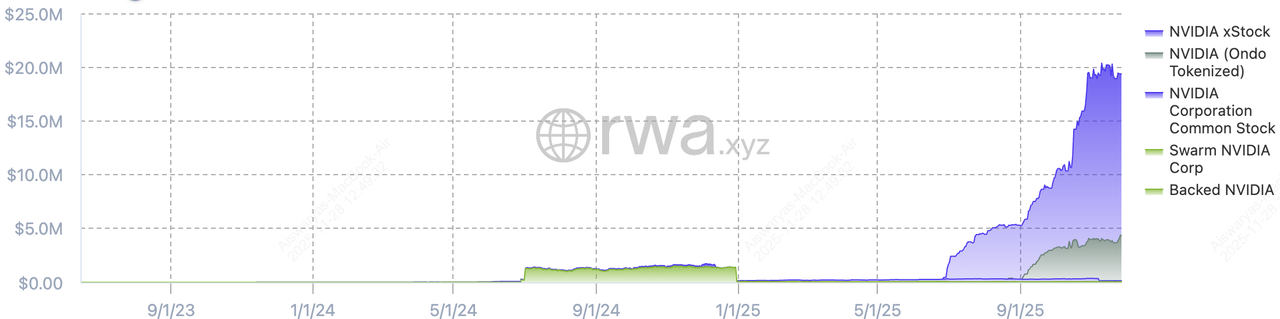

Total value of tokenized stocks (xStocks) | Source: RWA.xyz

By late 2025, tokenized stocks have become one of the fastest-growing segments in real-world asset (RWA) markets, with over $664 million in tokenized public equities on-chain and more than $36 billion in total RWA value across categories. xStocks alone has processed over $10 billion in transaction volume within four months, including over $2 billion on-chain, supported by 116,000+ holders, 74,000+ monthly active addresses, and $1.16 billion in monthly transfer volume.

Within this, Solana dominates tokenized stock trading. Multiple analyses show that Solana has captured more than 95% of tokenized stock trading volume for several consecutive months in 2025, even hitting 99% in October thanks to platforms like xStocks, Dinari and Securitize-powered listings. This number may still lok tiny compared to the over $120 trillion global equity market, but is growing at one of the fastest adoption rates in crypto.

How Do Solana's Tokenized Stocks Work Under the Hood?

Most modern Solana-based equity tokenization platforms follow a similar model:

1. Share acquisition and custody: A regulated issuer like Backed or Securitize purchases real shares through traditional brokers and holds them with a licensed custodian under local securities laws

2. Token minting: The issuer mints blockchain tokens, e.g., NVDAX for NVIDIA, 1:1 against shares in custody. So one NVDA share equals one NVDAX token. If more shares are bought, more tokens can be minted; if shares are sold, tokens are burned.

3. On-chain trading and DeFi use: These tokens live as SPL tokens on Solana. You can trade them on CEXs like BingX or via Solana DEXs/aggregators like

Jupiter,

Raydium and

Kamino. In DeFi, they can be used as collateral, put into liquidity pools, or integrated into structured products.

4. Corporate actions and pricing: Oracles like

Chainlink and Solana’s Token Extensions are used to handle price feeds, splits, and sometimes dividend reinvestment directly via token metadata and scaling multipliers.

Note: In many cases you don’t become a shareholder on the company’s cap table. You hold an SPL token that represents economic exposure and may or may not carry rights like dividends or voting, depending on the issuer and jurisdiction. Always read the product’s documentation carefully.

Why Is Solana Dominating Tokenized Stock Trading in 2025?

Why is Solana popular for tokenized equities? | Source: Solana Foundation

Tokenized stocks on Solana are gaining popularity due to a mix of performance, costs, and built-in compliance tools:

• High throughput and low fees: Solana routinely handles thousands of transactions per second with median fees around a fraction of a cent, making small trades and DeFi strategies feasible even for retail traders

• Token Extensions and programmable compliance: Solana’s SPL Token Extensions allow issuers to embed KYC/KYB checks, transfer hooks, lockups, and corporate actions directly at the token level, reducing custom smart contract risk and boosting regulatory comfort.

• DeFi-native design: Platforms like Jupiter, Kamino and Raydium act as liquidity hubs for xStocks, letting you swap Tesla tokenized stock for SOL in one transaction, LP your AAPLx in a pool, or borrow stablecoins against NVDAX collateral.

As a result, reports show Solana holding over 95% of global tokenized stock trading volume in mid–late 2025, far ahead of

Ethereum, Gnosis and other L1s and L2s.

What Are the Best Tokenized Stocks to Trade on Solana in 2025?

Below are seven of the most notable tokenized stocks on Solana, all available via xStocks tickers that end with “x”, such as TSLAX and NVDAX. These combine strong underlying companies with rising on-chain liquidity.

Important: Availability, pair listings and legal access depend heavily on your jurisdiction and the platform you use. Always check local rules and each venue’s terms before trading any stock tokens.

1. Tesla Tokenized Stock (TSLAX)

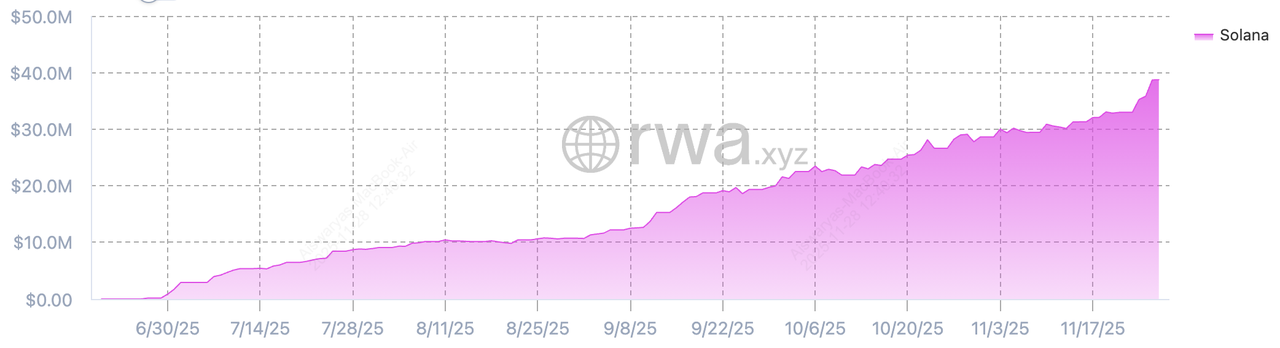

Tesla tokenized stock (TSLAX) market value | Source: RWA.xyz

TSLAX is the Solana-based tokenized version of Tesla (TSLA), offering on-chain exposure to one of the world’s most actively traded EV and AI-themed equities. As of November 2025, TSLAX has a market value of over $38.7 million. It consistently ranks among the deepest and most liquid tokenized stocks on Solana, with strong daily volumes, multiple trading pairs like TSLAX/SOL, TSLAX/USDC, and a relatively large on-chain market cap compared to peers. Traders gravitate to TSLAX because Tesla’s historically high volatility translates into strong short-term opportunities on

Solana DEXs, enabling directional trades, arbitrage, LP yield, and even collateralized borrowing strategies within compatible DeFi protocols.

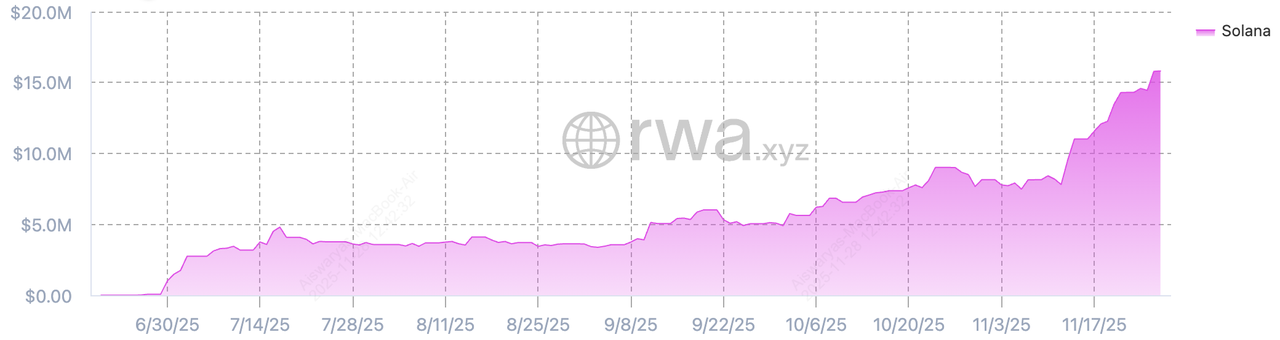

2. Circle Tokenized Stock (CRCLX)

Circle tokenized stock (CRCLX) market value | Source: RWA.xyz

CRCLX is the tokenized Solana version of

Circle equity, giving on-chain traders exposure to the company behind USDC, now involved in trillions of annual stablecoin settlement volume and rapidly expanding global payment rails. As of November 2025, CRCLX has a market value of over $15.8 million. As

stablecoin adoption grows and more treasuries, fintech platforms, and L2 ecosystems integrate

USDC, CRCLX has become a thematic “infrastructure play” within the tokenized-stock market. It typically shows steady on-chain liquidity for a non-public company, and serves as a clear example of how private-market equities can be tokenized, traded 24/7, and made composable with

Solana DeFi. Traders use CRCLX to express views on stablecoin adoption, the growth of regulated crypto payments, and Circle’s expanding role in institutional blockchain finance.

3. NVIDIA Tokenized Stock (NVDAX)

NVDAX is the tokenized Solana version of NVIDIA (NVDA), one of the strongest AI, GPU, and data-center plays globally, with NVDA becoming a multi-trillion-dollar company and one of the most traded equities of the decade. NVDAX has a total market value of over $15 million as of November 2025. On-chain, NVDAX consistently ranks among the top individual tokenized stocks by market cap, daily DEX volume, and number of active holders, with multiple deep liquidity pairs such as NVDAX/USDC and NVDAX/SOL. Its high volatility and powerful AI-driven narrative make it a favorite for short-term traders, arbitrage desks, and users running basis or delta-neutral strategies between CeFi xStock platforms and Solana DEX prices. NVDAX is also increasingly supported in whitelisted collateral pools, letting traders use their

NVIDIA exposure inside Solana’s expanding DeFi ecosystem.

4. Nasdaq 100 Tokenized ETF (QQQX)

Nasdaq xStock (QQQX) market value | Source: RWA.xyz

QQQX is the tokenized Solana version of the Invesco QQQ ETF, giving on-chain traders exposure to the Nasdaq-100, one of the most traded equity benchmarks in the world, with over $200 billion in traditional AUM and heavy daily volume. QQQX has a market value of over $9.4 million as of November 2025. As a token, QQQX functions as a “crypto-native Nasdaq tracker,” offering instant diversification across large-cap tech and growth names without concentrating risk in a single stock. On-chain data typically shows stronger liquidity for QQQX/USDC compared with smaller tokenized equities, enabling lower slippage and smoother execution for active traders. Its versatility makes QQQX useful for portfolio hedging, thematic tech exposure, leveraged DeFi strategies, or collateral where diversified large-cap exposure is preferred.

5. Alphabet/Google Tokenized Stock (GOOGLX)

Aphabet xStock (GOOGLX) market value | Source: RWA.xyz

GOOGLX is the tokenized Solana version of

Alphabet (GOOGL), giving on-chain traders exposure to one of the world’s largest tech giants across search, ads, cloud, YouTube, and AI. It typically ranks among the stronger “blue-chip” tokenized stocks on Solana, with higher DEX liquidity, steadier daily volumes, and deeper TVL than smaller equities, making execution smoother and slippage lower. For users evaluating which tokenized stocks to buy, GOOGLX frequently appears alongside NVDAX and AAPLX as part of a core big-tech basket, offering a more defensive, lower-beta profile while still remaining fully composable with Solana DeFi strategies.

6. MicroStrategy Tokenized Stock (MSTRX)

MicroStrategy xStock (MSTRX) market value | Source: RWA.xyz

MSTRX is the tokenized Solana version of MicroStrategy (MSTR), a company whose stock has become one of the highest-beta Bitcoin proxies in traditional markets thanks to its multibillion-dollar BTC treasury. On-chain, MSTRX regularly ranks among the most actively traded tokenized equities, with deeper liquidity and higher daily volumes than many non-crypto-native stocks because it strongly mirrors Bitcoin’s volatility and narrative cycles. This makes it popular for traders running correlation or relative-value strategies, such as comparing price movements between MSTRX, BTC, and Bitcoin ETFs, or seeking amplified exposure to bullish BTC momentum. Its use cases range from hedge trades lik long MSTRX / short BTC, or vice versa, to pure directional bets on the expanding

Bitcoin-as-corporate-treasury thesis packaged in a tokenized equity format.

7. Apple Tokenized Stock (AAPLX)

Apple xStock (AAPLX) market value | Source: RWA.xyz

AAPLX is the tokenized Solana version of Apple (AAPL), giving on-chain investors access to one of the world’s largest and most stable mega-cap companies, with Apple still accounting for significant weights in global index funds and ETFs. Within the tokenized-stock ecosystem, AAPLX consistently shows strong tracking on Solana analytics dashboards, multiple active liquidity pools, and steady daily trading volume, making it one of the most liquid and reliable blue-chip equities available on-chain. Its broad familiarity makes AAPLX a common entry point for users exploring tokenized stocks, and it serves as a lower-volatility counterpart to high-beta names like Tesla or MicroStrategy while still supporting fractional ownership and integration into Solana DeFi strategies.

How to Invest in Tokenized Stocks on Solana: Step-by-Step Guide

You can invest in tokenized stocks on Solana by setting up a compatible wallet like

Phantom,

buying SOL or USDC on a regulated exchange, and trading stock tokens such as TSLAX or NVDAX on BingX or Solana DEXs, depending on your region and risk tolerance. You have two main options, depending on whether you prefer CeFi convenience or full on-chain DeFi access.

Tokenized stocks are not available everywhere. Many platforms restrict U.S. persons or residents of other regulated regions. Always review the terms of service for venues like BingX, xStocks, Securitize, or any platform you intend to use.

I. Trade Tokenized Equities on BingX

TSLAX/USDT trading pair on the spot market powered by BingX AI insights

BingX is one of the easiest places to trade tokenized equities such as TSLAX, NVDAX, QQQX, AAPLX, and others. Follow these steps to get started:

Step 1: Create or Log In to Your BingX Account

Go to bingx.com or open the BingX app. Sign up with your email or phone number and complete any required

KYC, depending on your region.

Step 2: Deposit Funds (Fiat or Crypto)

You can fund your account through bank card or local payment methods,

P2P trading, or

crypto deposits like

USDT, USDC, etc. Once funded, your balance will appear in your Spot Wallet.

Step 3: Navigate to the Tokenized Stocks Market

In the search bar, type the ticker of the stock token you want to trade, for example:

- TSLAX (Tesla)

- NVDAX (NVIDIA)

- QQQX (Nasdaq-100 ETF)

- AAPLX (Apple)

Tap or click the trading pair, e.g.,

TSLAX/USDT, to open the chart and order panel.

Step 4: Trade Tokenized Stocks on the Spot Market

Choose your preferred order type:

• Market Order: Executes instantly at the current price (best for beginners).

• Limit Order: Executes at the price you set.

Enter the amount of USDT you want to spend and confirm the trade. Your tokenized stocks will appear in your Spot Wallet immediately.

Step 5 (Optional): Trade Tokenized Stock Futures on BingX

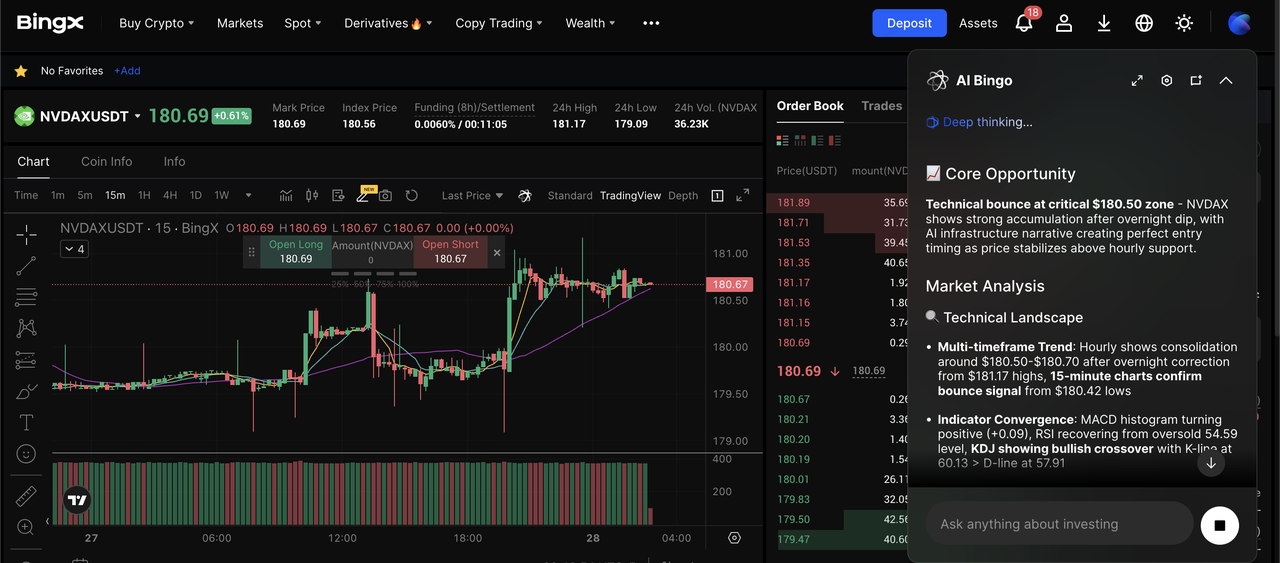

NVDAX/USDT perpetual contract on the futures market powered by BingX AI

For experienced users, BingX offers

futures trading on selected tokenized equities.

1. Transfer USDT from Spot Wallet to Futures Wallet.

3. Select your leverage; use low leverage if you’re new.

4. Choose Long if you expect prices to rise, or Short if you expect them to fall.

6. Open the position and monitor it in the Futures dashboard.

Step 6: Manage or Close Your Positions

You can close spot or futures positions anytime. Spot sales return USDT to your Spot Wallet; futures PnL (profit and loss) settles in your Futures Wallet.

Why Trade Tokenized Stocks on BingX?

BingX offers a smooth UI, fast execution, AI-powered market insights, and both spot and futures markets for tokenized equities, making it one of the most accessible CeFi platforms for this growing sector.

II. How to Trade Tokenized Stocks on Solana DEXs (Step-by-Step Guide)

Solana DeFi is ideal if you want

self-custody, on-chain settlement, and access to composable DeFi tools. Follow these steps to trade tokenized stocks such as TSLAX, QQQX, NVDAX, and more on Solana DEXs like Jupiter and Raydium.

1. Set Up a Solana Wallet: Create an SPL-compatible wallet such as Phantom or Solflare, then secure your seed phrase and enable extra protections like password and hardware wallet integration.

2. Fund Your Wallet With SOL and/or USDC: You need SOL for gas and USDC/SOL for trading. Buy them on BingX, then withdraw to your Solana wallet address.

3. Connect to a Solana DEX: Visit Jupiter, Raydium, or Kamino, tap Connect Wallet, and select Phantom or

Solflare.

4. Swap Into Tokenized Stocks: Choose USDC/SOL, select the stock token you want, e.g., TSLAX. Keep slippage low, around 0.1–0.5%, and confirm the transaction in your wallet. Your tokenized stocks will appear instantly in your wallet.

5. Use Advanced DeFi Features (Optional): You can provide liquidity, use whitelisted stock tokens as collateral, or access structured yield products compatible with xStocks, depending on venue and compliance.

6. Manage Custody and Risk: Secure your wallet, monitor liquidity and spreads, and track token activity using Birdeye, Solscan, or RWA.xyz. Self-custody offers maximum control, but also requires careful risk management.

What Are the Key Benefits of Trading Tokenized Stocks on Solana?

Solana has become the leading chain for tokenized equities because it offers faster execution, lower fees, and stronger on-chain compliance tooling than any other blockchain. Here are the advantages of trading tokenized equities on Solana:

1. 24/7 Global Access: Unlike traditional equity markets with limited hours, tokenized stocks let you trade around the clock, react to news instantly, and avoid Monday-gap risk.

2. Fractional Ownership: You can buy tiny fractions of high-priced stocks like NVIDIA or Tesla via NVDAX or TSLAX, making it easier to dollar-cost average or run small-ticket strategies.

3. Composability with DeFi: You can use tokenized stocks as collateral, LP positions, or components in structured DeFi strategies, something impossible with traditional brokerage accounts.

4. Fast Settlement and Low Fees: Solana’s low fees and high throughput enable near-instant settlement and low-cost portfolio rebalancing, ideal for active traders and market makers.

5. New Arbitrage and Strategy Space: The ability to trade the same underlying exposure across CeFi tokenization platforms, Solana DEXs and even traditional markets opens up arbitrage, basis, and hedging strategies unavailable in legacy-only setups.

What Are Risks of Trading Tokenized Equities?

Before you dive into tokenized stock trading, it’s crucial to understand the risk profile.

1. Evolving Legal Landscape: Many tokenized stocks function as on-chain representations or synthetic exposures rather than direct share ownership, and their legal treatment can vary by region as different markets continue shaping digital-asset guidelines.

2. Counterparty and Custody Risk: You depend on the issuer, e.g., Backed, Securitize, and their custodians to actually hold and manage the underlying shares. Failures, mismanagement, or legal issues at these entities could impact your token’s value or redeemability.

3. Liquidity Risk: Some tokenized stocks have thin liquidity, especially outside the top names like TSLAX, NVDAX, QQQX, AAPLX, MSTRX, etc.. Low liquidity can result in wider spreads, higher slippage and difficulty exiting large positions.

4. Market and Volatility Risk: You’re still exposed to the normal volatility of the underlying stock or ETF; Tesla or MicroStrategy can move 10–20%+ in a day. Leveraged DeFi positions using tokenized stocks can amplify losses.

5. Smart Contract and Platform Risk: Bugs in token contracts, bridges, or DeFi protocols can lead to losses. Always check audits, use reputable protocols, and avoid obscure forks or unreviewed contracts.

Final Thoughts: Are Tokenized Stocks on Solana Right for You?

If you're considering investing in tokenized equities, Solana has become one of the most active real-world environments to watch this market evolve. Tokens like TSLAX, CRCLX, QQQX, NVDAX, GOOGLX, AAPLX, and MSTRX now offer on-chain exposure to themes such as EVs, big tech, AI, digital payments, and Bitcoin-treasury strategies, all with 24/7 trading, fractional ownership, and optional DeFi integration.

At the same time, tokenized equities introduce risks not present in traditional brokerages, including smart-contract vulnerabilities, varying legal treatment across regions, and counterparty dependencies. A balanced approach for many users is to start with regulated platforms where available, use BingX to acquire core assets like SOL or USDC, and then experiment with small amounts on Solana DEXs while monitoring liquidity, slippage, and platform security. Tokenized stocks won’t replace traditional markets anytime soon, but they are already reshaping how equity exposure can be accessed, and today, Solana sits at the center of that transformation.

Related Reading