tokenbot (CLANKER) is the leading

AI-powered token factory for the

Base ecosystem. Launched in late 2024 and reaching critical mass in early 2026, it represents a shift from manual smart contract deployment to "social-first" tokenization. As of early February 2026, Clanker-powered tokens have generated over $7.62 billion in all-time trading volume, with $8.77 million in the past 24 hours alone, while the protocol has market-purchased 90,488 CLANKER; the treasury now holds 110,379 CLANKER, and 1.37% of total supply has been permanently burned, demonstrating measurable, fee-driven value accrual.

Originally launched within the Farcaster social network, Clanker automates the entire lifecycle of a token, from deployment to liquidity locking, allowing users to launch "utility memes" by simply tagging a bot. Following its 2025 acquisition by Farcaster and subsequent transfer to Neynar, Clanker has become a foundational infrastructure for the "Agentic Web." By integrating with decentralized social protocols like Farcaster, Clanker allows both humans and other AI agents to launch tradable assets via text-based instructions.

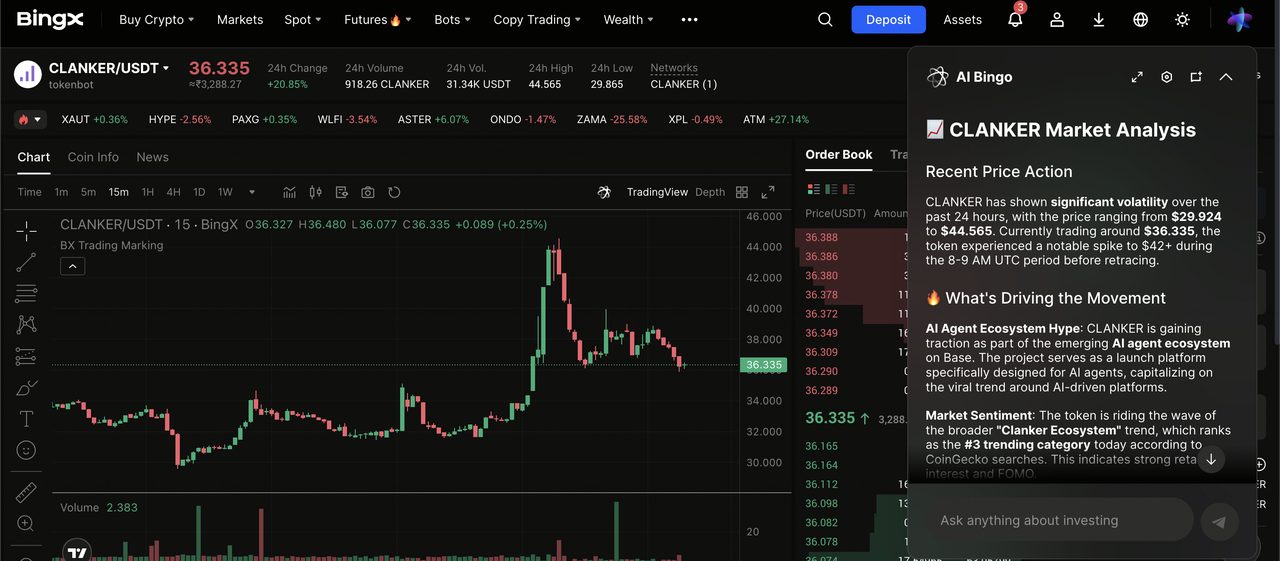

CLANKER/USDT price chart on BingX

CLANKER/USDT is a cornerstone utility token on the

Base blockchain that has become a proxy for the entire

AI Agent Economy. In early February 2026, activity on Clanker skyrocketed following the viral rise of AI-only platforms like

Moltbook and

Clawstr, with the protocol generating record-breaking daily fees of over $600,000. Clanker is no longer just a "meme bot"; it is the liquidity engine behind a new wave of autonomous machine-to-machine commerce.

This article breaks down how the Clanker AI agent functions, its strategic role in the Farcaster/Neynar ecosystem, and a comprehensive guide on how to trade $CLANKER on BingX.

What Is Clanker Base AI Agent and How Does It Work?

Clanker is a "Self-Sovereign Agent" built to simplify the complex world of decentralized finance (DeFi). Unlike traditional launchpads that require users to navigate web forms and wallet approvals, Clanker operates through a conversational interface.

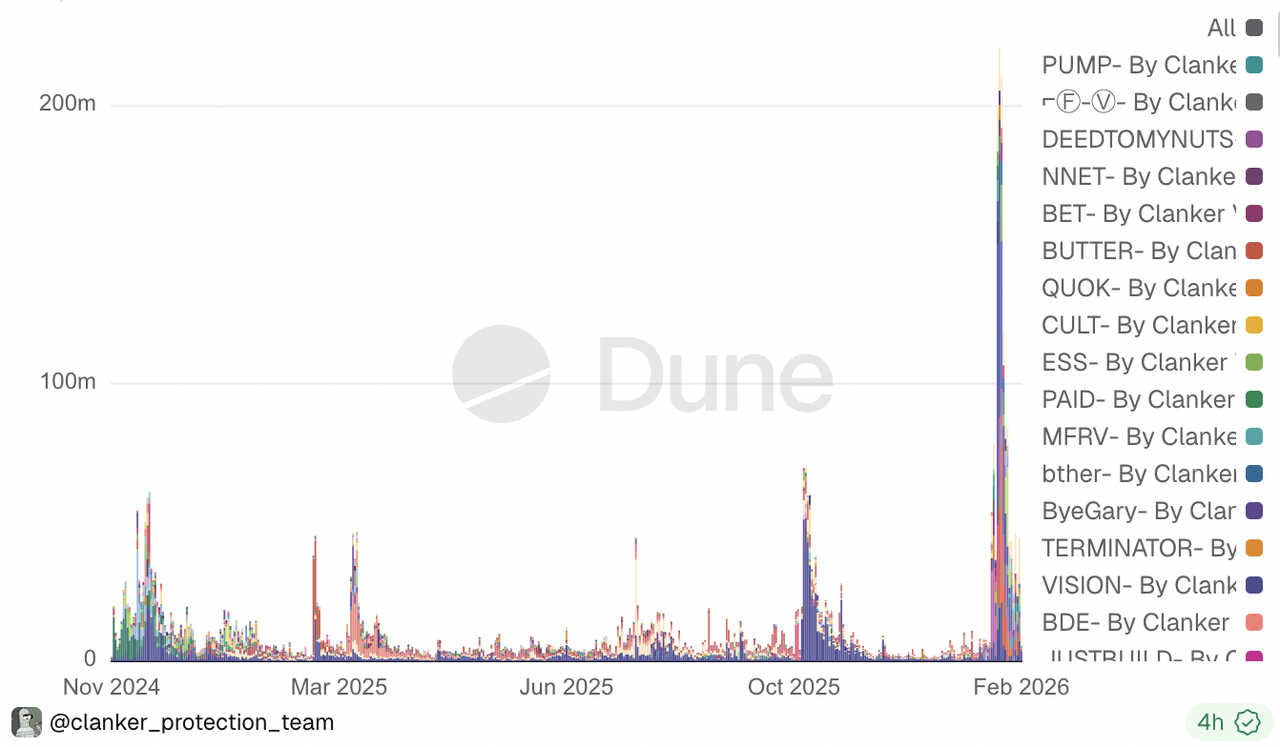

Daily volume on Clanker | Source: Dune Analytics

How Clanker AI Agent Launchpad Works

1. User Request: A user or another AI tags @clanker on a Farcaster client like Warpcast or Supercast, providing a token name, ticker, and optional image.

2. Autonomous Deployment: Clanker's AI backend powered by Anthropic's Claude series parses the request and automatically deploys an ERC-20 contract on the Base

Layer 2 network.

3. Liquidity Provisioning: Clanker pairs the total supply of 100 billion tokens with WETH in a Uniswap V3 pool. It defaults to a starting market cap of roughly 10 WETH.

4. Liquidity Locking: To prevent "rug pulls," Clanker automatically locks the liquidity pool (LP) NFT in a locker contract until the year 2100.

5. Fee Sharing: The protocol implements a 1% swap fee. 40% of these fees are distributed back to the original token creator, while 60% flows to the Clanker protocol treasury.

Clanker's Farcaster Acquisition and Neynar Transition

In October 2025, Clanker was officially acquired by Farcaster, the decentralized social protocol. By January 2026, the project was further transitioned to Neynar, Farcaster's primary infrastructure provider.

This move transformed $CLANKER from a speculative asset into a buy-back-and-burn utility token. Protocol fees generated from every Clanker-deployed token are now used to purchase and hold $CLANKER, creating a direct economic link between the bot's popularity and the token's value.

What Is Clanker (CLANKER) Coin?

Clanker (CLANKER) is the native “real-yield” utility token of the Clanker protocol on Base, engineered with a hard cap of 1,000,000 tokens, making it one of the lowest-supply AI ecosystem assets in the market. As of February 2026, roughly 986,277 CLANKER or around 98.6% is already in circulation, leaving minimal future dilution. Since launching in late 2024, the protocol has generated over $50 million in cumulative fees, including a record $8.02 million in a single week in early February 2026, fueled by nearly 13,000 new token launches per day. This high-volume, on-chain automation directly converts ecosystem activity into measurable revenue, positioning CLANKER as a fee-backed asset rather than a purely narrative-driven token.

CLANKER’s value accrual model is anchored in its automated fee-driven buyback engine. Every token launched via the Clanker bot incurs a 1% transaction fee, with 60% flowing to the protocol treasury, which is used to market-buy CLANKER. Weekly buybacks have averaged $400,000–$500,000, creating consistent buy pressure. A portion of acquired tokens is permanently burned, and by February 2026 the treasury had accumulated roughly 10% of total supply, tightening effective float. Because Clanker underpins liquidity for Base AI agents like $ANON, $LUM, and

$MOLT, investors increasingly treat CLANKER as a “Base AI Beta” index, capturing ecosystem-wide growth without needing to select individual AI tokens.

Clanker vs. Pump.fun: Comparison of Token Launchpads

While both platforms enable one-click token creation, they serve distinct economic niches in the 2026 market.

Pump.fun remains the high-volume juggernaut of the

Solana ecosystem, having generated over $600 million in cumulative revenue and facilitating millions of launches through its signature bonding curve. This model requires tokens to reach a $69,000 market cap threshold before "graduating" to

Raydium, a process that filters for early momentum but often leads to intense PvP (player-vs-player) volatility during the internal trading phase.

In contrast, Clanker operates as an institutional-grade "DeFAI" engine on Base, skipping the bonding curve entirely. By deploying directly to

Uniswap V3 with single-sided liquidity, Clanker provides immediate access to professional-grade trading features and permanent liquidity locks. This technical differentiator has allowed Clanker to capture a "quality over quantity" segment; while its token count is lower than Pump.fun's, its protocol revenue surged to $27 million by early 2026, with daily trading volumes peaking at $364 million. This stable, direct-to-DEX approach is preferred by autonomous AI agents like $LUM and $ANON, which require reliable on-chain infrastructure to maintain long-term utility.

| Feature |

Pump.fun (Solana) |

Clanker (Base) |

| Pricing Model |

Bonding Curve |

Uniswap V3 (Single-Sided) |

| Interface |

Web Dashboard |

Social-First (Farcaster/API) |

| Creator Reward |

Minimal |

40% of LP Fees |

| AI Integration |

Manual |

Fully Autonomous Agent |

| Ecosystem |

Speculative Memes |

"Utility Memes" & AI Agents |

Clanker represents the next frontier of the "Agent Internet." While the

$CLANKER token is highly volatile and driven by social media

FOMO, its integration into the Farcaster and Neynar infrastructure provides a level of utility that many standard memecoins lack. By powering the liquidity of thousands of other agents, Clanker has established itself as the "central bank" of the Base AI ecosystem. As with all high-beta assets, Always Do Your Own Research (DYOR).

How to Trade tokenbot (CLANKER) on BingX

The

BingX AI ecosystem, featuring AI Bingo and AI Master, provides traders with real-time technical analysis and automated risk management to navigate the high-volatility Base AI agent market.

Buying and Selling CLANKER on the BingX Spot Market

CLANKER/USDT trading pair on the spot market powered by BingX AI

The Spot market is ideal for investors looking to hold the primary "narrative proxy" for the Base AI ecosystem without the complexities of leverage.

• Access the Innovation Zone: $CLANKER is typically listed in the BingX Innovation Zone, a specialized category for high-growth, high-volatility assets like AI agent tokens.

• Use AI Bingo for Market Sentiment: Before buying, ask AI Bingo (the natural-language assistant) for the "current market sentiment for CLANKER." It will analyze order book depth and social hype to provide a data-driven entry suggestion.

• Execute with Precision: Select the

CLANKER/USDT pair and use a Limit Order to specify your exact buy price, avoiding the slippage common in fast-moving

meme markets.

Trading CLANKER Perpetuals with Leverage on the Futures Market

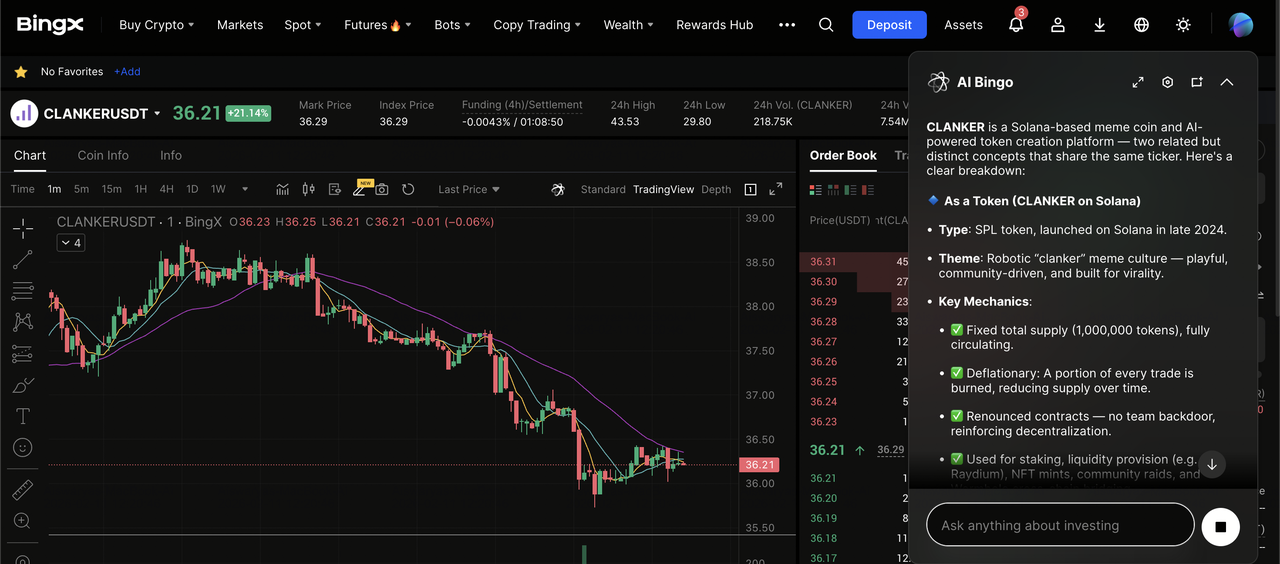

CLANKER/USDT perpetual contract on the futures market featuring Bingx AI insights

For advanced traders,

BingX Futures allow you to capitalize on both the "hype cycles" and the inevitable "cool-down" periods of AI agent trends.

• Leverage and Direction: You can trade

CLANKER/USDT Perpetual Contracts with up to 20x leverage. Go Long if you anticipate further growth in the OpenClaw ecosystem, or Short if you expect a pullback.

• Automated Risk Control with AI Master: Use BingX AI Master to set your position size. The "Protector" agent can help you calculate a safe liquidation price and automatically suggest

Stop-Loss (SL) and Take-Profit (TP) levels based on the asset's 24-hour volatility.

• Monitor 24/7: Since the AI agent economy never sleeps, use BingX AI Monitor to receive instant alerts on your mobile app regarding whale movements or sudden liquidity shifts in the $CLANKER pool.

5 Key Considerations Before Trading $CLANKER

While the Clanker protocol offers a groundbreaking fusion of social media and automated finance, investors must weigh the high-velocity returns against the technical and market-specific risks inherent to the AI agent economy.

1. Extreme "Slop" and Saturation: Clanker is an entirely permissionless bot. As of early February 2026, the protocol set a record of 21,870 new tokens launched in a single day. Data suggests that over 95% of tokens launched via Clanker fail to maintain liquidity for more than 48 hours. $CLANKER value relies on the aggregate volume of these launches rather than the survival of individual "slop" tokens.

2. The "Micro-Supply" Volatility: Unlike many other utility tokens, $CLANKER has a fixed maximum supply of only 1 million tokens. This low-float structure means that even modest capital inflows or outflows, e.g., a $100,000 buy or sell, can cause massive price displacements. Intraday price swings of 20% to 40% are common and expected.

3. Infrastructure Dependency (Neynar/Farcaster): Following the January 2026 acquisition by Neynar, the protocol's roadmap is now controlled by a centralized infrastructure provider. Any changes to the 60/40 fee-sharing model or the manual vs. automated nature of the token buy-backs, which recently averaged $65,000 in a single day), can immediately impact the token's deflationary narrative.

4. Base Network and Execution Economics: While Base is a high-performance Layer 2, massive spikes in AI agent activity, such as the $364 million volume peak on January 31, can lead to "inference economics" challenges. AI agents must calculate ROI before executing trades; if the underlying Base gas fees or transaction latency spike during an "Agentic Summer," the bot's usage and protocol revenue may throttle.

5. Sector Correlation, the AI Basket: $CLANKER exhibits a high positive correlation with other Base-native AI projects like Virtuals Protocol ($VIRTUAL) and Bankr ($BANKR). News affecting the broader "OpenClaw" or "Agentic Web" narrative often moves these tokens as a single basket, making it difficult to find "alpha" without monitoring the entire sector.

Conclusion: Is $CLANKER a Good Investment?

Clanker has transitioned from a social experiment into a core infrastructure layer for the Base AI Agent economy. By enabling autonomous "AI-to-AI" commerce and providing a stable, direct-to-DEX liquidity model, it has secured a professional niche that distinguishes it from purely retail-driven launchpads. The protocol's ability to generate over $8 million in weekly fees by early 2026 demonstrates a level of product-market fit that aligns with the broader institutional interest in "Agentic Finance."

However, potential investors must approach $CLANKER with a neutral perspective on its long-term sustainability. While the fee-driven buyback engine provides a consistent "buy-side" demand, the token’s value remains intrinsically linked to the high-velocity, high-risk nature of the AI agent narrative. Risk Warning: Trading $CLANKER involves significant exposure to extreme price volatility, potential liquidity fragmentation, and evolving regulatory standards for AI-generated assets. Investors should only allocate capital they can afford to lose and prioritize rigorous risk management when navigating this emerging sector.

Related Reading