The

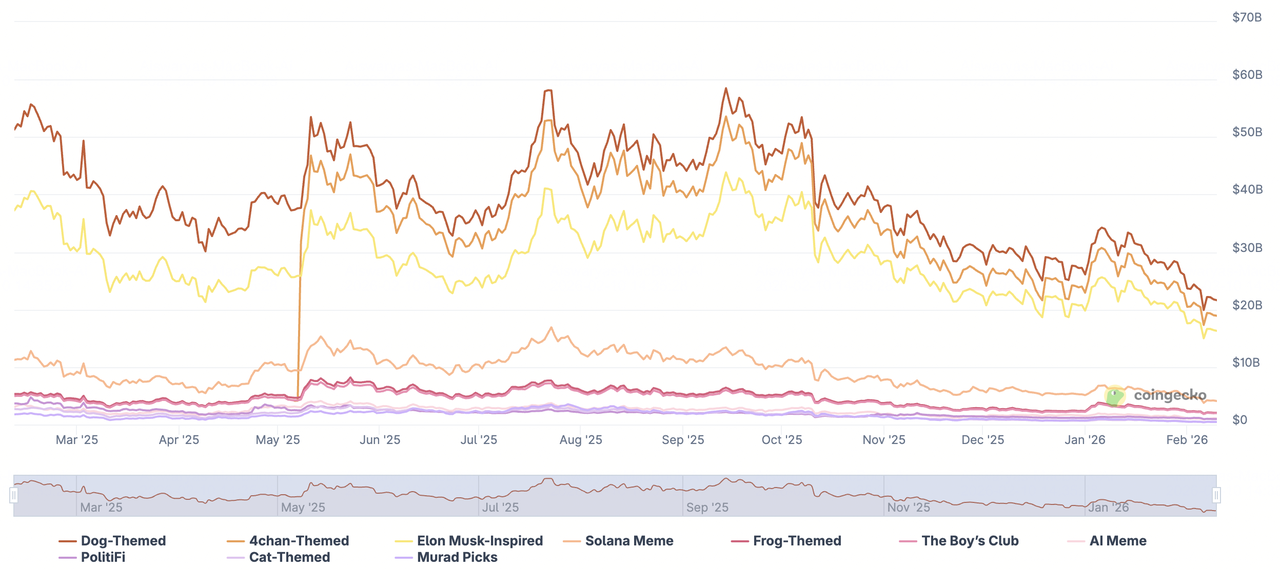

meme coin market of 2026 has evolved from simple "joke tokens" into a sophisticated sub-economy driven by

AI-generated narratives and high-speed on-chain execution. While 2025 saw a painful -31.6% YTD drawdown for the narrative, the sector has stabilized at a $33.2 billion market cap, with activity shifting toward "culture-as-a-service" integrated with prediction markets and

AI agents.

Top memecoin sectors by market cap | Source: CoinGecko

Whether you are "sniping" fresh launches on

Pump.fun, managing a diverse bag of

"Elon-inspired" tokens on BingX, or using AI-powered bots to front-run social sentiment, selecting the right crypto trading app is now a matter of both performance and strategic access.

Why Trade Meme Coins in 2026?

By February 2026, the meme coin market has transitioned from an unregulated "wild west" into a data-driven psychological game theory arena. While the sector faced a staggering 61% market cap plunge in late 2025, the early weeks of 2026 have signaled a "Retail Revenge" comeback. In the first week of January 2026 alone, the meme sector recorded a 23% market cap pump, with trading volumes surging by 300% to reach $8.7 billion daily.

The 2026 memecoin landscape is defined by three specific, data-backed shifts:

• Solana’s Infrastructure Dominance: Solana now captures over 80% of new token launches. With the Firedancer upgrade live, the network handles a sustained 2,000–4,000 TPS with sub-second finality. For traders, this means "latency-zero" execution, where priority fees often <$0.01 determine the success of time-sensitive "snipes."

• The AI-Meme Fusion: 2026 is the year of Agentic Memes. Tokens like

AI16Z and

AIXBT leverage autonomous AI agents to manage treasuries and generate content. These assets outperformed the broader market's -50.2% AI narrative loss in 2025 by offering verifiable on-chain utility through the ElizaOS framework.

• Institutional-Grade Access for Retail: The "survival of the fastest" is no longer exclusive to whales. Advanced tools like Trojan and Jupiter have democratized "anti-MEV" protection and automated copy-trading. This has compressed the signal-to-trade latency, allowing retail users to track 1.17 trillion token whale accumulations, as seen with

PEPE in January 2026, in real-time.

Memecoin trading is best for tactical investors looking to capitalize on high-velocity social sentiment and the 23%+ weekly growth bursts common in the 2026 environment.

What Are the 10 Best Crypto Platforms for Trading Meme Coins in 2026?

When choosing a platform in 2026, traders must balance on-chain speed with CEX liquidity. Here are the top 10 choices tailored for the current meme cycle.

1. BingX

By February 2026, BingX has solidified its position as the premier Web3-AI powerhouse, serving over 40 million global users and supporting an industry-leading 1,100+ cryptocurrencies. It has become the definitive bridge for traders looking to transition from the "on-chain trenches" to a professional-grade execution environment without losing their edge.

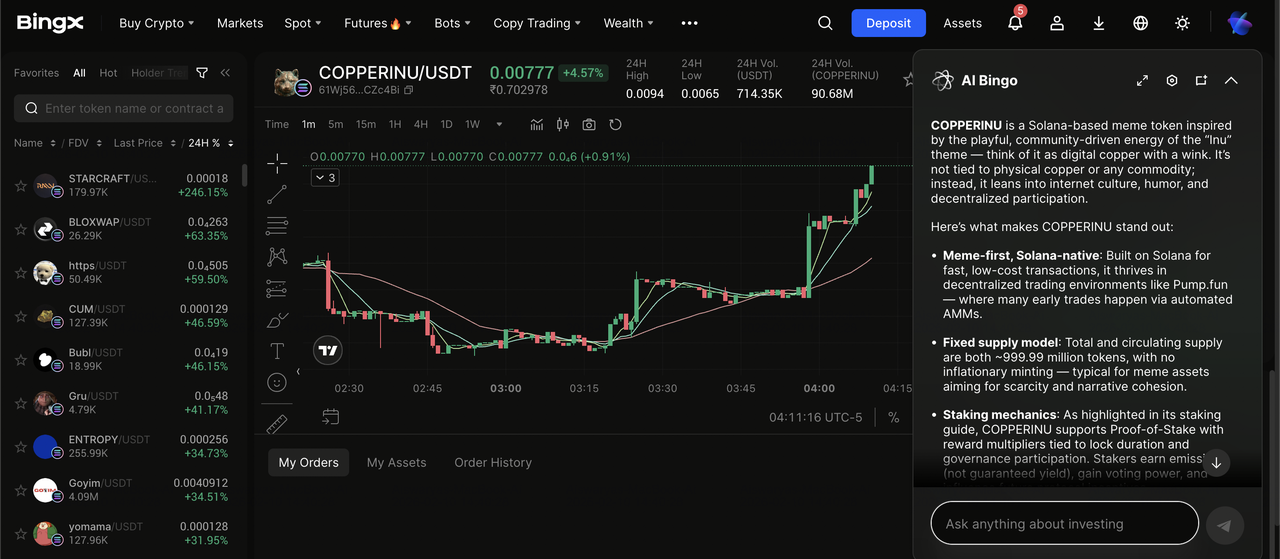

• BingX ChainSpot, the "Gem" Hunter: ChainSpot is a pioneering CeDeFi solution that allows you to swap high-octane Solana and Ethereum memes like

BIGTROUT,

COPPERINU, or

USOR directly from your BingX Spot account using

USDT. It eliminates the friction of managing seed phrases,

hardware wallets, or manual bridging. Gas fees are automatically calculated and deducted in USDT, meaning you never have to worry about running out of native

SOL or

ETH during a critical pump.

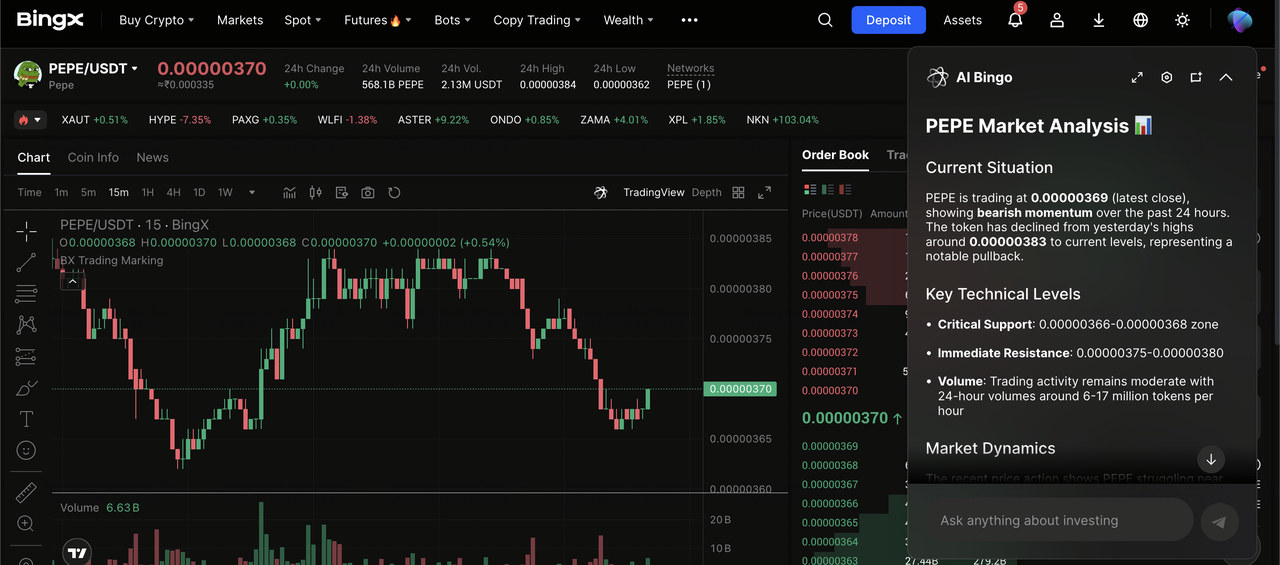

• BingX AI Intelligence Layer: With its $300 million AI integration, BingX provides AI Bingo and AI Master tools. These features act as your 24/7 technical analyst, scanning the 1,100+ pairs to identify "Meme Breakouts" and sentiment shifts in real-time. For the 2026 market, this means catching a trend before it goes viral on social media.

• Advanced Futures and Leverage: For high-conviction plays, BingX offers USDT-settled Perpetual Futures on top-tier memes like

DOGE and

SHIB. Traders can access up to 50x leverage, allowing for massive capital efficiency. Its TradFi integration also lets you hedge your meme profits by pivoting into

tokenized gold or

oil within the same interface.

• Elite Copy Trading: Meme coin volatility is notoriously difficult to manage. BingX’s

Copy Trading ecosystem, the largest in the world with over 15,000 elite traders, allows you to mirror the exact moves of "Meme Specialists." You can automate your portfolio to follow traders who have successfully navigated the 2025 drawdowns, benefiting from their timing and

risk management.

• Institutional-Grade Security: While "the trenches" are rife with exploits, BingX protects its users with a $150 million Shield Fund and a monthly-verified

100% Proof of Reserves (PoR). This institutional safety net ensures that while the assets you trade might be speculative, the platform you trade them on is not.

Best for: Tactical investors who want the speed of decentralized "gem" discovery via ChainSpot combined with the power of AI-automation and high-leverage futures.

2. Jupiter (JUP)

As of early 2026,

Jupiter remains the undisputed king of

Solana DEX aggregators, processing approximately 42% of all Solana network transactions and maintaining a near-total 95% market share in the aggregator space. Its sophisticated routing engine scans over 20 liquidity sources, including

Raydium,

Orca, and

Meteora, to execute multi-hop swaps that identify the lowest possible cost for the user. Beyond simple swaps, Jupiter has matured into a full-scale DeFi terminal, supporting Value Averaging (VA) and

DCA strategies that allow traders to automatically scale into meme positions during volatility.

Key Consideration: While Jupiter minimizes slippage through intelligent routing, users must manually adjust their "Slippage Settings" during hyper-volatile meme launches to prevent transaction failures.

Best for: On-chain Solana traders seeking the best available swap rates and advanced automation tools like limit orders and scheduled purchases.

3. Trojan Telegram Bot on Solana

For "trench" veterans, Trojan has established itself as the fastest and most reliable Telegram-based execution tool, surpassing $30 billion in cumulative volume by January 2026. The platform recently expanded its reach with a web-based terminal and

MetaMask integration, allowing for seamless cross-chain liquidity movement. Trojan’s specialized "Sniper Tools," including lightning-fast auto-buys, anti-MEV protection, and custom priority fee adjustments, are designed to beat standard DEX interfaces by up to 70% in broadcast speed.

Key Consideration: Base fees typically sit at 1%, but high-volume traders can reduce this significantly through a tiered cashback program that offers up to 20% back on all trades.

Best for: High-speed "sniping" and professional-grade copy trading where sub-second execution is the difference between profit and exit liquidity.

4. Pump.fun and PumpSwap

Pump.fun is the definitive launchpad of the 2026 meme economy, having minted over 11 million tokens since its inception. Utilizing a linear bonding curve model, it democratizes token creation by requiring no custom code or initial liquidity from creators. A token graduates to

PumpSwap, the platform's native AMM, once its bonding curve hits a $30,000–$35,000 market cap threshold. By February 2026, the protocol has generated over $1 billion in total revenue, proving that its "no-rug" bonding mechanism is the preferred entry point for new social experiments.

Key Consideration: The bonding curve rewards early conviction, meaning the price increases non-linearly; however, graduated tokens on PumpSwap face intense competition from established DEXs like Raydium.

Best for: Discovering moonshots at the absolute earliest stage and launching community-driven memes with zero upfront cost.

5. Four.meme

By February 2026,

Four.meme has established itself as the leading

meme coin launchpad on the

BNB Chain, successfully challenging Solana’s dominance in the "fair launch" sector. Leveraging the low-cost infrastructure of the Binance ecosystem, the platform supports over 812,000 daily unique users and has facilitated the creation of more than 52,000 tokens. Four.meme's competitive edge lies in its "Meme Rush" feature, developed with Binance Wallet, which streamlines trading and its robust Accelerator Program that provides up to $10 million in liquidity support and CEX listing assistance for top-performing projects.

Key Consideration: While deployment is ultra-affordable at 0.005 BNB, around $3, the platform is primarily BNB Chain-centric; traders looking for Solana-specific viral memes will need to look elsewhere.

Best for: BNB Chain enthusiasts and creators looking for a high-visibility, low-fee launchpad with direct integration into the Binance ecosystem.

6. Phantom Wallet

Phantom has transitioned from a simple Solana wallet into a comprehensive Web3 social terminal, now serving over 25 million active accounts in 2026. A standout feature is the Phantom Prediction Markets powered by

Kalshi, allowing users to trade "Yes/No" positions on real-world events, sports, and crypto trends directly within the app using any Solana token. Its "Trending" tab and native Sign-to-Swap functionality, which has processed over $1 billion in internal swap volume, make it the most frictionless mobile gateway for managing diverse meme portfolios across Solana,

Ethereum, and

Bitcoin.

Key Consideration: In-app swaps are highly convenient but include a small convenience fee; power traders may still prefer direct DEX terminals like Jupiter for high-volume transactions.

Best for: Beginners and mobile-first investors who want a "super-app" experience that combines portfolio management, social trading, and prediction markets.

7. Raydium (RAY)

Raydium remains the foundational liquidity layer of the Solana ecosystem, holding approximately $1.1 billion in Total Value Locked (TVL) as of Q1 2026. It serves as the primary "graduation" destination for the 11 million+ tokens launched on Pump.fun; once a token reaches its bonding curve threshold, liquidity is automatically migrated to Raydium’s CLMM (Concentrated Liquidity Market Maker) pools. Despite intense competition, Raydium processes cumulative volumes exceeding $600 billion, offering the deep liquidity necessary for executing high-slippage meme trades without devastating the price.

Key Consideration: While Raydium is the home of "graduated" tokens, its interface is more technical than aggregators; most retail users interact with its liquidity indirectly through Jupiter or BingX ChainSpot.

Best for: Liquidity providers seeking yield and traders handling large-cap meme positions that require deep, institutional-grade liquidity pools.

8. Kraken

By early 2026, Kraken has solidified its reputation as the "Security-First" CEX, making it the preferred choice for traders who want meme coin exposure without the "wild west" risks of unvetted DEXs. Kraken’s 2026 roadmap highlights a massive expansion into on-chain integration, including its Ink

Layer-2 network, built on the

Optimism Superchain, which bridges the gap between Kraken’s centralized liquidity and DeFi apps. With a catalog of over 450+ cryptocurrencies and a proven track record of 24/7 armed surveillance for cold storage and regular Proof of Reserves, Kraken provides a robust environment for trading high-cap memes like DOGE, SHIB, and PEPE with professional-grade charting via Kraken Pro.

Key Consideration: Kraken typically offers lower maker/taker fees (0.00%–0.40%) compared to Coinbase, but its "listing bar" is higher, meaning the newest, most speculative micro-caps often arrive here later than on DEXs.

Best for: Security-conscious traders and institutional investors who require a compliance-first platform and advanced margin/futures capabilities for established meme assets.

9. Uniswap (v4 / Unichain)

Uniswap remains the gravitational center of the Ethereum meme economy, capturing over 60% of all DEX trading volume in 2026. The rollout of Uniswap v4 has been a paradigm shift, introducing "Hooks," customizable smart contracts that allow for professional features like automated stop-losses, take-profit orders, and dynamic fees directly on the blockchain. For traders priced out of Ethereum Mainnet, Uniswap’s own Unichain Layer-2 offers 1-second block times and minimal gas fees, serving as the primary liquidity hub for the "Base and Friends" narrative where assets like

BRETT and

TOSHI thrive.

Key Consideration: While v4 Hooks allow for "Singleton" contract architecture, saving up to 99% in pool creation gas, the ecosystem is highly technical; users should verify the security of specific hooks before interacting with them.

Best for: DeFi power users and "Blue Chip" meme investors on Ethereum and

Base who want to use advanced trading logic like limit orders without a centralized intermediary.

10. Coinbase

As the only crypto exchange to maintain a dominant Super Bowl presence in 2026,

Coinbase has become the primary retail on-ramp for the "Meme Supercycle." Its native Layer-2 network, Base, has exploded into a self-contained micro-economy with over $10 billion in total value locked (TVL) and hundreds of viral memes. Coinbase has turned meme trading into a social experience through its mobile app, which features a "Trending on Base" feed and direct integration with

Base App, allowing users to pivot from centralized holdings to on-chain "gems" like

DEGEN or MIGGLES in a single tap.

Key Consideration: Coinbase Advanced offers competitive taker fees of up to 0.60%, but the primary retail app often charges a "convenience premium"; use the Advanced interface for better pricing on high-volume meme trades.

Best for: Retail investors and beginners who want the safest, most user-friendly entry point into the Base ecosystem and mainstream "blue-chip" meme coins.

Why BingX ChainSpot Is a Game Changer for Meme Traders

The biggest hurdle for meme coin traders in 2026 is the friction of managing multiple wallets and bridging funds across chains. BingX ChainSpot solves this by offering a "One Tap, All Chains" experience.

By using ChainSpot, you gain:

• No External Wallets: Buy trending

Solana memes using the USDT already in your BingX Spot account.

• AI-Driven Success Priority: Use "Success Priority" mode to let AI automatically adjust your slippage and gas to ensure your buy order goes through during high-volatility pumps.

• Risk Vetting: ChainSpot surfaces high-quality projects while providing "risk alerts" on suspicious contract addresses, helping you avoid malicious copycat tokens.

How to Trade Meme Coins on BingX: Quick Guide

BingX lets you trade meme coins through spot markets for major tokens and ChainSpot for early on-chain gems, all from one platform.

1. Fund your account: Buy USDT via

P2P, credit card, using local bank transferr, or other supported payment methods, or

deposit USDT from an external wallet or exchange.

PEPE/USDT trading pair on the spot market powered by BingX AI insights

2. Trade high-cap meme coins on the Spot Market: Search pairs like

DOGE/USDT or PEPE/USDT, analyze price action with BingX AI indicators, and place market or limit orders for instant or price-specific execution.

3. Trade early on-chain meme coins on ChainSpot: Go to Spot and select ChainSpot, search the token or paste its contract address, and swap USDT directly, with no external wallet, gas handling, or bridging needed.

4. Manage risk: Meme coins are highly volatile, so use stop-loss orders on spot trades and limit position size when trading early-stage tokens.

How to Choose Your Meme Trading App: 3 Key Considerations

Selecting the right platform in 2026 requires more than just looking for the lowest fees; it’s about balancing the "need for speed" in the trenches with the security required to protect your gains.

1. Liquidity and Slippage Management: In the hyper-volatile 2026 market, a coin’s price can shift 10% in seconds. Ensure your platform uses advanced routing, like BingX ChainSpot or Jupiter, to aggregate liquidity from multiple pools, reducing the "slippage tax" that often eats into retail profits.

2. Narrative & Sentiment Tools: Meme coins are 90% psychology and 10% code. Prioritize apps that integrate AI-driven sentiment analysis or "Trending" tabs like those in Phantom or BingX AI to help you identify whether a narrative like "

AI-Meme Fusion" or "PolitiFi" is gaining genuine traction or just bot-driven noise.

3. Custody vs. Speed: Decide on your "battle station" based on your goal. Use high-speed Telegram bots like Trojan for "sniping" fresh launches where every millisecond counts, but always pivot to a secure, audited exchange like BingX or a hardware wallet like Ledger once you've secured your initial "moonbag."

Final Thoughts: Strategy Over Hype

The meme coin market of 2026 is defined by an ecosystem of AI tools, Solana speed, and CEX reliability. Success requires a clear separation between long-term holdings and trading capital deployed on high-performance platforms. As global crypto frameworks evolve toward the July 2027 enforcement deadlines, utilizing secure and transparent ecosystems remains a priority for maintaining a compliant portfolio.

Risk Reminder: Meme coins are hyper-volatile and highly speculative. Most lose value over time. Perform your own due diligence, monitor your annual purchase limits, and never invest more than you can afford to lose.

Related Reading