DePIN, or Decentralized Physical Infrastructure Networks, is reshaping blockchain in 2025 by taking decentralization beyond finance into the physical world. From wireless networks and sensor grids to GPU compute marketplaces, DePIN uses token incentives to mobilize communities instead of corporations to build critical infrastructure.

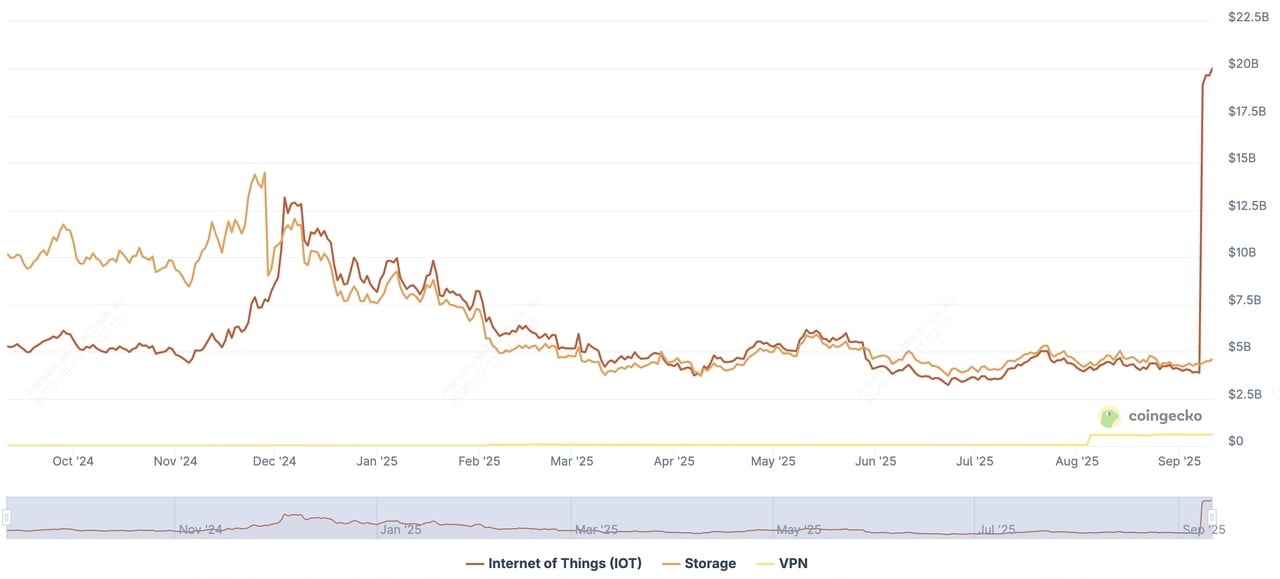

Total market cap of DePIN projects in the crypto market | Source: CoinGecko

The impact is already measurable, as of September 2025, CoinGecko tracks nearly 250 DePIN projects with a combined market cap above $19 billion, up from just $5.2 billion a year ago. Fueled by rising global demand for compute, bandwidth, and edge data driven by

AI and

IoT, DePIN is fast emerging as a practical, cost-effective, and community-powered alternative to legacy systems.

In this article, we’ll explore how DePIN works, why it matters, and

top DePIN projects that are leading the movement in 2025.

What Is DePIN (Decentralized Physical Infrastructure Networks)?

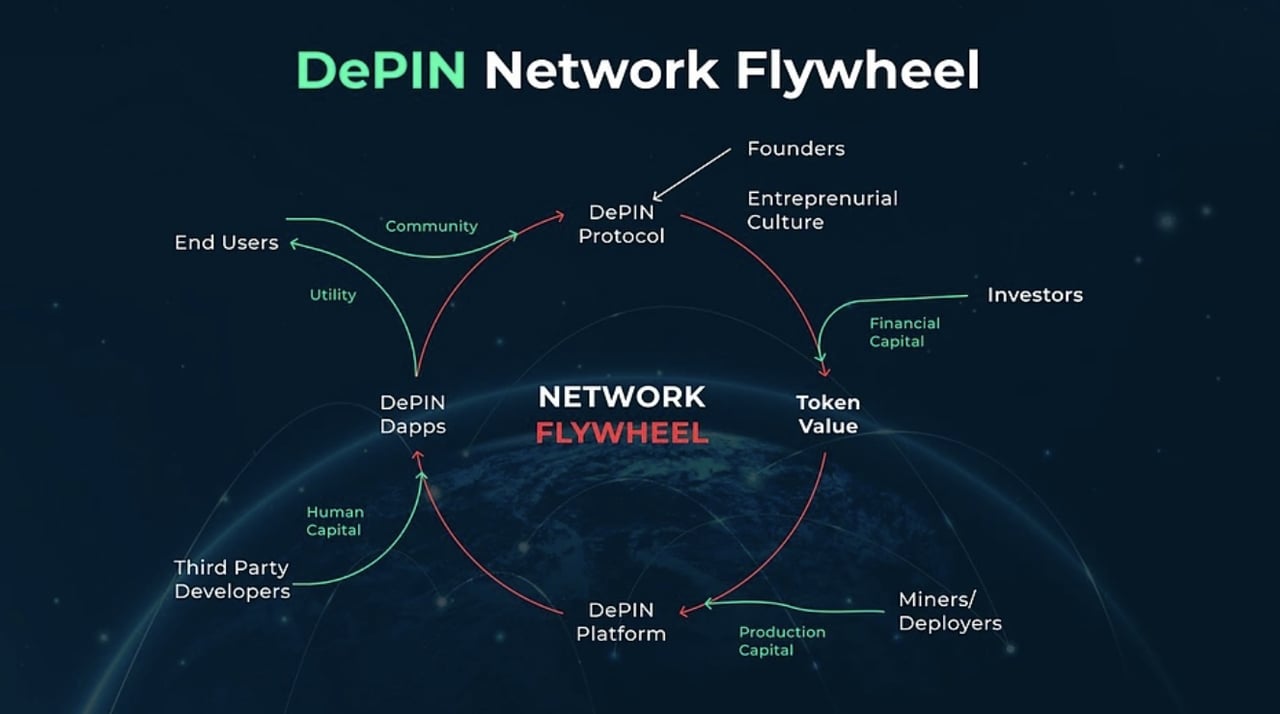

DePIN, short for Decentralized Physical Infrastructure Networks, refers to blockchain-based systems that coordinate and incentivize the deployment of real-world infrastructure through token rewards. These networks enable individuals to contribute resources like connectivity hardware, sensors, energy nodes, or compute power, building essential infrastructure without relying on centralized control.

At its core, DePIN uses

smart contracts, on-chain verification, and token incentives to create community-owned systems that are more democratic, resilient, and cost-effective than traditional models.

DePIN projects generally fall into two categories:

1. Physical Resource Networks (PRNs)

Physical Resource Networks incentivize individuals to deploy location-dependent hardware for offering tangible, real-world services like mobility, energy, or connectivity.

These include:

• Wireless Networks: 5G, WiFi, and IoT connectivity

• Mobility Networks: Ride-sharing, data collection, and robotics

• Energy Networks: Decentralized power grids and energy trading

• Sensor Networks: Environmental monitoring and geospatial data collection

2. Digital Resource Networks (DRNs)

Digital Resource Networks incentivize individuals to deploy hardware for providing fungible, digital resources such as storage, bandwidth, or compute networks.

These include:

• Compute Networks: Transcoding, indexing, and distributed processing

• AI Networks: Machine learning models and GPU marketplaces

• Storage Networks: Databases and file storage

• Bandwidth Networks: CDN, VPN, and real-time communication services

The key innovation behind DePIN is the tokenized coordination of infrastructure, enabling open participation, bottom-up scalability, and programmable integration with other Web3 services. From wireless networks to AI compute marketplaces, DePIN is transforming how physical infrastructure is built and governed.

How Does DePIN Work?

DePIN lets everyday people contribute infrastructure and earn rewards in return. Instead of relying on centralized corporations to build networks for connectivity, storage, or computing, DePIN uses blockchain incentives to coordinate thousands of individual contributors.

Here’s how it works in practice:

1. Hardware Deployment: Participants install or connect physical devices, such as WiFi hotspots, weather sensors, GPUs, or routers, that deliver real-world services to the network. These devices form the physical backbone of DePIN projects, powering everything from decentralized wireless to AI compute grids.

2. Proof of Resource: To ensure the network remains trustworthy, DePIN protocols use on-chain validation mechanisms, like Proof of Coverage, Proof of Uptime, or Proof of Compute, to verify that contributed resources are real, active, and functional. This ensures contributors are rewarded fairly and prevents fraud.

3. Token Incentives: Contributors earn native tokens as rewards. These incentives are typically based on usage metrics, uptime, geographic demand, or other performance-based criteria. The more valuable your resource is to the network, the more you’re rewarded.

This model enables DePIN networks to scale rapidly, lower infrastructure costs, and reach underserved areas by tapping into community participation. The result is a more open and resilient way to build the physical layer of the decentralized internet.

Why Is DePIN Trending in 2025?

DePIN continues its surge as a standout crypto sector, underpinned by growing real-world traction, expanding community participation, and rising capital flows. According to CoinGecko, the total market capitalization of DePIN tokens now sits at about US$19.2 billion, with nearly 250 active projects contributing devices, connectivity, storage, compute, and other infrastructure services.

1. DePIN Market Cap Hits $19.2B, Up 270% Year-over-Year

DePIN categories on CoinGecko

The DePIN sector has entered a new growth phase in 2025, with its combined market capitalization climbing to $19.2 billion as of September 2025, up from just $5.2 billion a year earlier. This represents nearly a 270% year-over-year increase, highlighting its structural momentum despite broader market volatility. DePIN tokens now account for roughly 0.5% of the total crypto market, reflecting a shift from niche infrastructure experiments to a recognized asset class in the Web3 ecosystem.

2. Over 423 Projects and 41.8M Devices Powering Real-World Networks

DePIN projects and devices | Source: DePINscan

The scale of deployment has accelerated dramatically. According to DePINscan, there are now 423 active DePIN projects spanning compute, bandwidth, energy, storage, and wireless networks. These protocols collectively support over 41.8 million devices worldwide, compared to fewer than 10 million in mid-2023.

This explosion in physical deployment proves DePIN is no longer theoretical, real hardware is being installed, verified, and used across industries ranging from IoT to decentralized energy grids. This surge spans across sectors such as compute, wireless, energy, mobility, mapping, and environmental data, indicating that DePIN is no longer a niche experiment, but a rapidly diversifying infrastructure layer for the Web3 world.

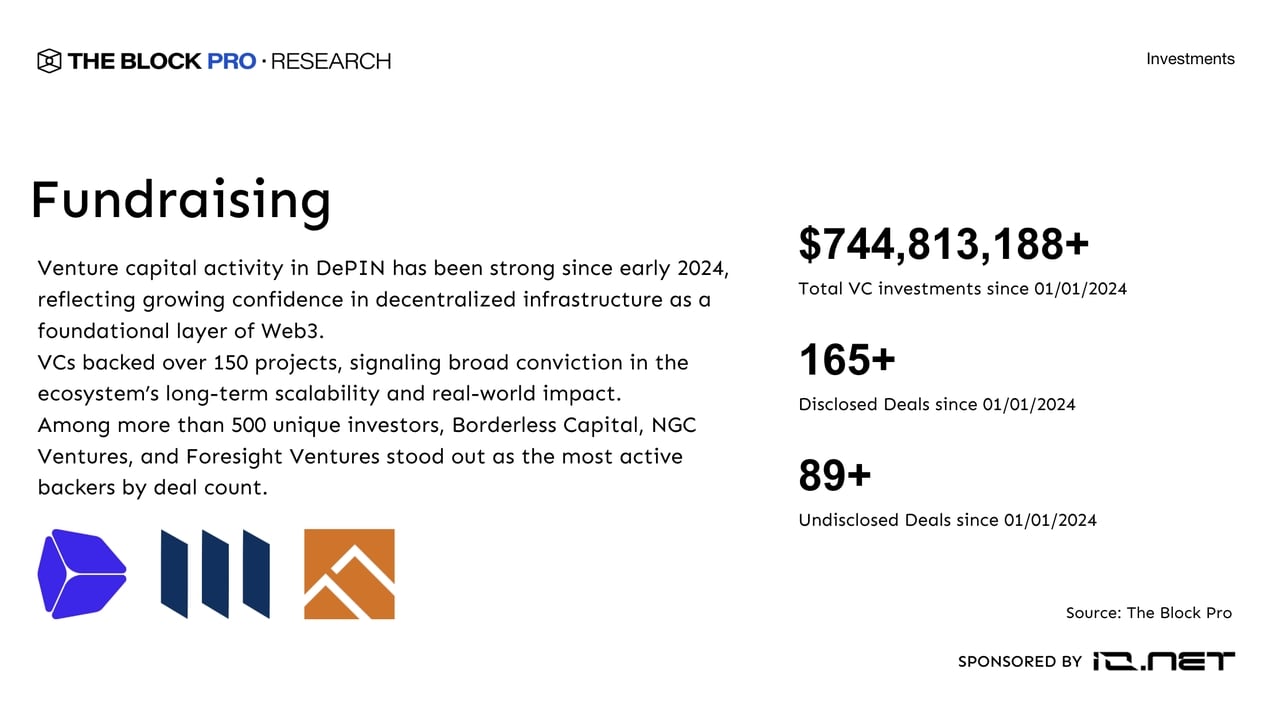

3. $744M+ Raised: VCs and Communities Fuel DePIN Growth

DePIN fundraising on the rise | Source: TheBlock

Capital formation around DePIN is diversifying beyond traditional VC funding. Between January 2024 and July 2025, The Block Pro Research reported over $744 million invested in 165+ DePIN startups in addition to over 89 undisclosed deals in this sector.

By mid-2025, leading projects like Bittensor (TAO), Render (RENDER), and Filecoin (FIL) are each valued above US$1–3 billion, while community-driven projects such as Grass Network (GRASS) scaled from 200,000 to 3 million users in a year. This blend of institutional capital and community participation is powering rapid adoption.

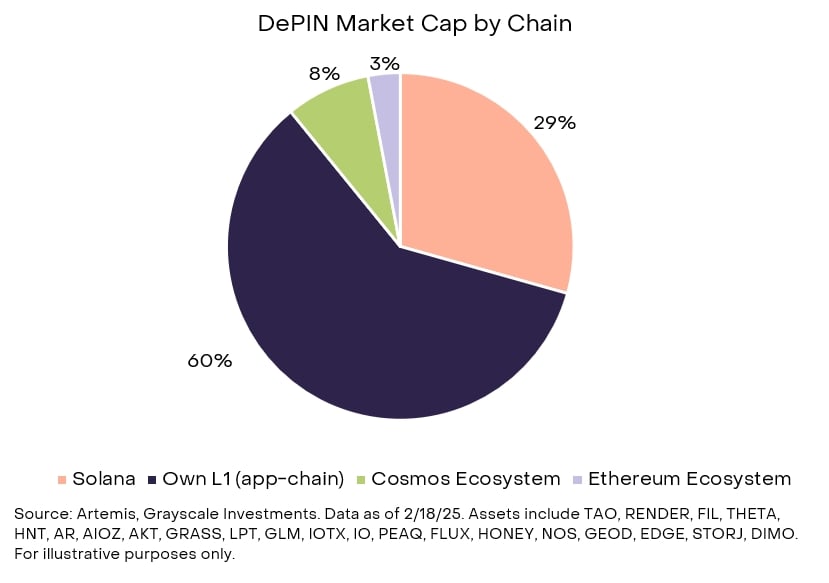

4. Solana, Ethereum L2s, Filecoin Lead as DePIN’s Go-To Blockchains

Source: Grayscale Research

The choice of base chain is proving critical to DePIN’s success. Grayscale Research highlights

Solana as the leading chain for high-throughput DePIN applications, hosting projects like Helium, Grass, and Hivemapper, due to its low transaction costs and ability to handle real-time, data-intensive workloads.

Ethereum L2s such as

Arbitrum and

Optimism are seeing traction in compute and AI-focused DePIN projects, while Filecoin continues to dominate decentralized storage. This diversification signals that DePIN is becoming a cross-chain movement, with each ecosystem carving out strengths.

What Are the 10 Best DePIN Projects to Watch in 2025?

DePIN technologies are bringing blockchain’s transparency and efficiency to real-world services, from energy grids to logistics. Here are 10 groundbreaking DePIN projects poised to redefine physical infrastructure in 2025.

1. Bittensor (TAO)

Bittensor is a decentralized machine learning network that turns AI into an open, community-owned resource rather than a service controlled by tech giants. It works by creating a marketplace of “subnets,” where developers and miners contribute compute power, models, or data to train and refine AI systems. Each subnet specializes in a task, such as natural language processing, image generation, or data analysis, and contributors are rewarded in

TAO tokens for the measurable value they provide. This incentive structure ensures constant innovation, with thousands of participants worldwide building toward a scalable, bottom-up AI infrastructure.

As of September 2025, Bittensor’s market cap exceeds $3.39 billion with roughly 9.6 million TAO in circulation out of a fixed 21 million supply. The network has expanded to 50+ active subnets and supports over 141,000 accounts, reflecting rapid adoption from both AI developers and crypto miners. What makes it practical is that businesses can tap into this decentralized compute layer at lower costs than centralized providers, while individuals can monetize idle GPUs or contribute models. By bridging blockchain incentives with machine learning, Bittensor positions itself as one of the most important Decentralized AI (DeAI) projects, offering a transparent, resilient, and user-owned alternative to today’s AI oligopolies.

2. Internet Computer (ICP)

The

Internet Computer (ICP) is a decentralized blockchain network built by the DFINITY Foundation to host software, data, and applications directly on-chain, removing reliance on Big Tech cloud providers. Unlike traditional blockchains that only handle transactions,

ICP enables developers to build fully decentralized web apps, DeFi platforms, games, social media, and even AI models that are secure, tamperproof, and resistant to cyberattacks. With features like on-chain smart contracts that connect across multiple blockchains, ICP positions itself as a “world computer” capable of running scalable, DAO-controlled applications that integrate seamlessly with Web2 and Web3 ecosystems.

As of September 2025, ICP holds a market cap of about $2.65 billion with 537 million tokens in circulation. The network processes more than 6 billion blocks and burns over 45 billion cycles per second to sustain active applications, showing strong throughput and resource efficiency. Recent milestones include the launch of Caffeine, a self-writing AI app builder, and an integration with Solana, expanding its multichain interoperability. For businesses and developers, this means faster, cheaper, and censorship-resistant deployment of internet-scale applications, making ICP one of the most practical blockchain platforms for real-world Web3 and AI use cases.

3. Render Network (RENDER)

Render Network is the world’s first decentralized GPU rendering platform, designed to turn idle GPUs into a global pool of high-performance compute for 3D rendering, generative AI imaging, and metaverse content creation. Instead of relying on expensive centralized render farms, creators can tap into distributed GPU power at lower costs and faster turnaround times, with real-time job distribution across hundreds of nodes. The platform integrates seamlessly with industry-standard tools like OctaneRender, Redshift, and Blender Cycles, as well as emerging AI engines from Runway, Luma Labs, and Stability AI, making it practical for studios, artists, and AI developers who need scalable rendering without upfront infrastructure investment.

As of September 2025, Render Network’s market cap is about $2.03 billion, with 518 million

RENDER tokens in circulation. The network’s compute capacity is large enough to run 300–1,000 AI models concurrently, demonstrating its significant infrastructure power. Beyond numbers, Render is proving real-world adoption through collaborations on VR and cinematic projects like

Batman: The Animated Series and

Westworld. Supported by the Render Network Foundation, the ecosystem is expanding with a strong community of node operators, artists, and token holders. Recent updates include the rebrand from RNDR to RENDER and the deprecation of legacy RNDR on Polygon in July 2025, underscoring its focus on security and long-term sustainability.

4. Filecoin (FIL)

Filecoin is one of the largest DePIN projects by market cap, offering a decentralized storage marketplace built on the Interplanetary File System (IPFS). Instead of relying on centralized cloud providers, users can buy and sell storage directly from providers worldwide, with security guaranteed by Filecoin’s blockchain. The network has shifted from raw capacity growth to actual client usage, onboarding petabytes of new data daily across industries like AI training, scientific research, and Web3 applications. As of September 2025, Filecoin’s market cap is around $1.74 billion, with a circulating supply of 687 million FIL, making it one of the top infrastructure tokens in the crypto market.

Recent upgrades are making the network more practical for real-world adoption. The launch of Fast Finality (F3) in April 2025 increased transaction speeds by 100x, while Proof of Data Possession (PDP) in May 2025 enabled more efficient hot storage without the overhead of traditional sealing. These improvements support Filecoin’s push toward paid storage deals, client satisfaction, and real retrievability of data. Network utilization now stands at roughly 31%, reflecting growing demand beyond speculative capacity building, and paid deals above 0.001

FIL are driving meaningful ecosystem revenue. With integrations across Solana, Cardano, and emerging DeFi use cases like USDFC, a FIL-backed stablecoin, Filecoin is positioning itself as the backbone of decentralized data storage for Web3 and AI-driven applications.

5. BitTorrent (BTT)

BitTorrent (BTT) is a TRC-20 token built on the

TRON blockchain that powers the world’s largest decentralized file-sharing network. Through integrations with products like BitTorrent Speed and the BitTorrent File System (BTFS),

BTT incentivizes users to share bandwidth and storage by rewarding them for seeding files and contributing resources. For everyday users, this means faster torrent download speeds, while for developers it provides access to a decentralized file storage system with greater fault tolerance, censorship resistance, and lower costs than traditional cloud solutions.

As of September 2025, BTT has a market cap of about $634 million with an enormous circulating supply of 986 trillion tokens. The network continues to expand beyond simple peer-to-peer file sharing into broader DePIN use cases, enabling storage and distribution for Web3 applications. With millions of BitTorrent clients worldwide already integrated, BTT represents one of the most practical examples of blockchain adoption at scale, turning an established file-sharing protocol into a tokenized ecosystem for faster, fairer, and more resilient digital content distribution.

6. Aethir (ATH)

Aethir (ATH) is a decentralized cloud infrastructure project that provides on-demand access to enterprise-grade GPUs for AI, gaming, and other compute-intensive industries. With over 430,000 GPUs valued at more than $400 million distributed across 94 countries, Aethir enables businesses to scale AI model training, inference, and high-performance cloud gaming without relying on centralized data centers. Its products include Aethir Earth, a bare-metal GPU cloud for AI workloads, and Aethir Atmosphere, a low-latency GPU network optimized for real-time cloud gaming. This edge-focused design ensures 99.99% uptime while reducing costs and bringing compute closer to end-users.

The

ATH token powers the ecosystem by rewarding GPU providers and enabling enterprises to purchase compute credits for AI and gaming services. As of September 2025, ATH has a market cap of about $560 million with a circulating supply of 11.4 billion tokens. Aethir also launched a $100 million ecosystem fund to support developers building AI and gaming solutions on its infrastructure, making it both a practical tool for enterprises and an income opportunity for GPU providers. By combining scalability, security, and decentralization, Aethir positions itself as a competitive alternative to centralized cloud giants like AWS and Azure, with a Web3 model that shares value between users, providers, and developers.

7. Helium (HNT)

Helium (HNT) is a decentralized wireless network that enables anyone to deploy Hotspots, small devices that provide connectivity for mobile phones and IoT devices, while earning rewards in

HNT tokens. The network operates two layers: Helium IoT, a global long-range, low-power network for sensors and devices, and Helium Mobile, a decentralized cellular network designed to offload mobile traffic and fill coverage gaps. Instead of relying on telecom giants, Helium flips the model by rewarding individuals and businesses that contribute coverage, creating a people-powered wireless ecosystem that offers lower costs and broader accessibility.

As of September 2025, Helium has a market cap of about $496 million with 186 million HNT in circulation. The network boasts over 379,000 active Hotspots worldwide, with use cases ranging from smart agriculture and logistics tracking to neighborhood-scale mobile coverage. Recent initiatives include a $50 million Helium Foundation grant program to expand coverage, along with partnerships like Movistar in Mexico to extend Helium Mobile adoption. For users, Helium provides a way to monetize spare internet bandwidth and hardware, while enterprises gain cost-effective, decentralized connectivity for both IoT and mobile networks.

8. Grass Network (GRASS)

Grass Network (GRASS) is a decentralized bandwidth-sharing protocol that lets users monetize their unused internet connection. By simply installing the Grass app, users can securely share idle bandwidth with verified institutions, such as AI companies or research organizations, in exchange for Grass Points, which convert into

GRASS Tokens over time. This creates a new passive income stream from a resource most people already pay for but rarely use to its full capacity. Importantly, Grass is designed with privacy in mind: it does not access personal data or browsing activity, only the portion of bandwidth that would otherwise go unused.

As of 2025, Grass is trusted by over 3 million users worldwide, making it one of the fastest-growing DePIN projects on the Solana blockchain. The protocol has already distributed hundreds of millions of dollars in rewards to users while contributing to large-scale AI training and data-intensive industries. With strong security certifications and support from leading antivirus providers, Grass has built a reputation for safe participation. For everyday users, it offers a simple way to turn excess internet into token rewards; for enterprises, it provides affordable, decentralized access to bandwidth at scale.

9. JasmyCoin (JASMY)

JasmyCoin (JASMY) is the native token of the Jasmy IoT Platform, a Japanese project focused on giving individuals full ownership and control over their personal data. By combining IoT devices with blockchain technology, Jasmy enables consumers to securely store, manage, and decide how their data is shared, turning information into a personal asset rather than something monopolized by big tech platforms. Its two core services, Secure Knowledge Communicator (SKC) for personal data management and Smart Guardian (SG) for secure IoT device registration, provide the foundation for practical use cases in identity verification, data monetization, and trusted IoT connectivity.

As of September 2025,

JASMY has a market cap of about $702 million with nearly 48.4 billion tokens in circulation out of a fixed 50 billion supply. The project has been actively expanding real-world partnerships in Japan, including collaborations with sports clubs like Sagan Tosu, regional carbon credit initiatives, and enterprise IoT solutions. For users, Jasmy offers a pathway to monetize their personal data while maintaining privacy; for businesses, it creates a trusted framework to access verified consumer data and deploy IoT services securely. This makes Jasmy one of the few blockchain projects tackling data sovereignty and IoT integration at scale.

10. Akash Network (AKT)

Akash Network (AKT) is a decentralized cloud computing marketplace designed for AI and data-heavy workloads. It connects enterprises and developers with idle GPU power worldwide, offering compute for tasks like machine learning training, generative AI, LLM inference, and large-scale analytics at up to 80% lower cost than centralized providers like AWS or Google Cloud. With over 50 provider locations and average deployment speeds of just 2 minutes, Akash enables real-time, on-demand scaling for everything from AI startups to enterprise-grade applications. Its infrastructure is censorship-resistant, blockchain-secured, and optimized for both flexibility and cost savings, making it a strong alternative to traditional cloud services.

The

AKT token fuels the network, serving as the settlement currency for GPU transactions and incentivizing providers who contribute compute capacity. As of September 2025, Akash has a market cap of about $330 million with 278 million AKT in circulation. The ecosystem recently expanded to support

NVIDIA’s B200 and H200 GPUs, boosting performance for AI training and inference workloads. On top of compute rentals, Akash offers plug-and-play AI tools like Akash Chat for multi-model benchmarking and Akash Gen for instant image generation, lowering entry barriers for developers. By combining low-cost access with Web3 transparency, Akash is positioning itself as a “supercloud” for the AI economy.

How to Trade DePIN Tokens on BingX

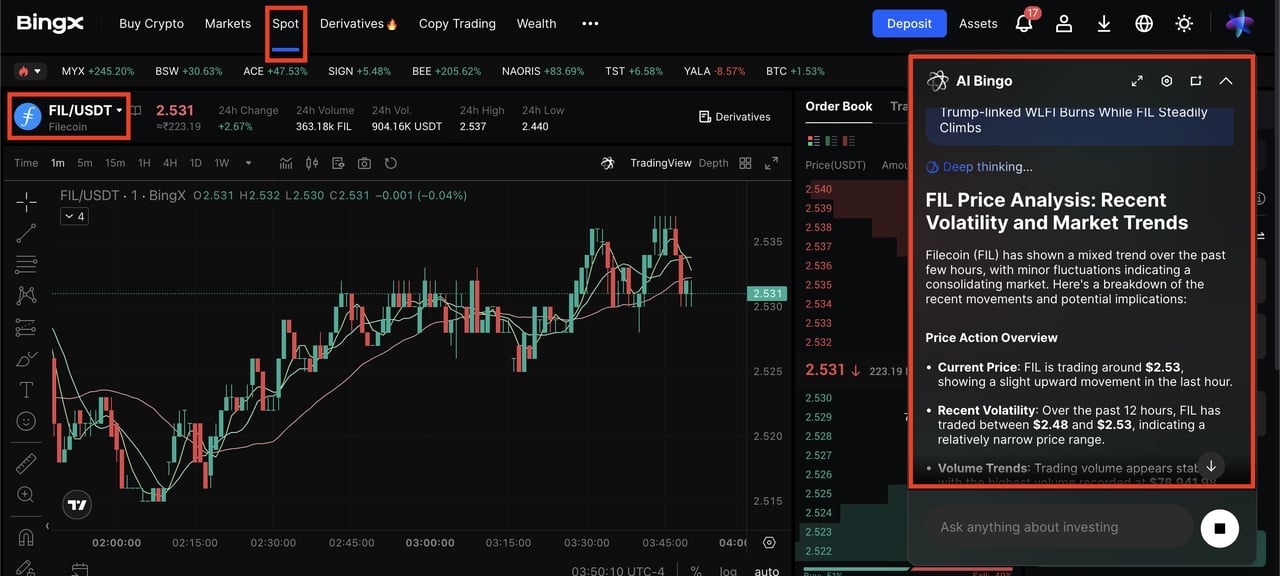

FIL/USDT trading pair on the spot market, powered by BingX AI

Trading DePIN tokens on BingX gives you access to deep liquidity, low fees, and a user-friendly interface. You can start trading DePIN tokens with as little as $10 and leverage AI-powered tools for flexible spot, convert, and launchpad options, all in one place.

Step 1: Create and Fund Your Account: Sign up on BingX and complete identity verification. Deposit assets via credit/debit card, P2P transfers, or crypto wallet. You can fund with

USDT or other major tokens.

Step 2: Spot Trading: Navigate to Trade → Spot on BingX’s main menu. Search for your DePIN token trading pairs, such as

FIL/USDT,

RENDER/USDT, or

GRASS/USDT. Use

BingX AI trading assistance to identify entry and exit points more effectively. Choose a Market Order for instant execution at current prices or a Limit Order to buy or sell at your target price. Enter the amount and confirm to place your order.

Choose a

Market Order for instant execution at current prices or a Limit Order to buy or sell at your target price. Enter the amount and confirm to place your order.

Key Considerations When Investing in DePIN Crypto Projects

Before investing in DePIN projects, carefully evaluate each network's fundamentals, utility, and growth metrics. This emerging sector requires thorough due diligence to identify sustainable opportunities amid the hype.

1. Infrastructure Utility & Adoption: Prioritize projects with measurable real-world usage and growing network statistics. Look for increasing node counts, infrastructure utilization, like Filecoin's 32% storage utilization or Theta's 10,000+ active Edge Nodes, and revenue metrics that demonstrate actual market demand.

2. Token Economics & Value Accrual: Focus on tokens with sustainable distribution models and clear value capture mechanisms. The most resilient DePIN projects like Helium and Render directly tie token value to infrastructure services provided, creating natural demand beyond speculation.

3. Technical Moat & Scalability: Evaluate the project's technological differentiation and scaling capabilities. Leading DePIN networks demonstrate unique innovations, like Bittensor's 50+ specialized subnets or The Graph's support for 40+ blockchain networks, that create defensible competitive advantages.

4. Corporate Partnerships & Integration: Seek projects forming strategic relationships with established enterprises. AT&T's integration with Helium and Render's collaboration with major media productions indicate mainstream validation and potential customer acquisition channels.

5. Regulatory Alignment & Compliance: Consider regulatory exposure based on the physical infrastructure being decentralized. DePIN projects handling sensitive data like Grass Network face different regulatory challenges than compute networks, potentially affecting long-term operational viability in certain jurisdictions.

Conclusion

DePIN projects represent blockchain's evolution from theoretical applications to practical infrastructure solutions that unlock value from underutilized digital resources. By connecting providers with users through efficient marketplaces, these networks transform how we access and monetize essential computing resources.

The seven highlighted projects demonstrate impressive real-world adoption metrics, from Theta's extensive node network, to Filecoin's growing storage utilization and Grass's millions of users, signaling value creation beyond token speculation. For strategic investors, DePIN offers exposure to the fundamental infrastructure powering next-generation applications, where projects balancing technological innovation with sustainable economics will form the backbone of Web3's physical layer.

Related Reading