Avantis (AVNT) is a Base-native perpetuals DEX bringing global-macro trading on-chain, so you can long/short synthetic crypto, forex, metals, and indices straight from a

non-custodial wallet. Since launch in February 2024, Avantis has processed roughly $22 billion in cumulative perp volume and continues to add depth across markets on Base. Its edge comes from Zero-Fee Perpetuals (ZFP); you pay nothing to open/close and share a fraction of profits only if you win, plus loss rebates, positive slippage for OI-balancing trades, and risk-tranche LP vaults for capital-efficient liquidity.

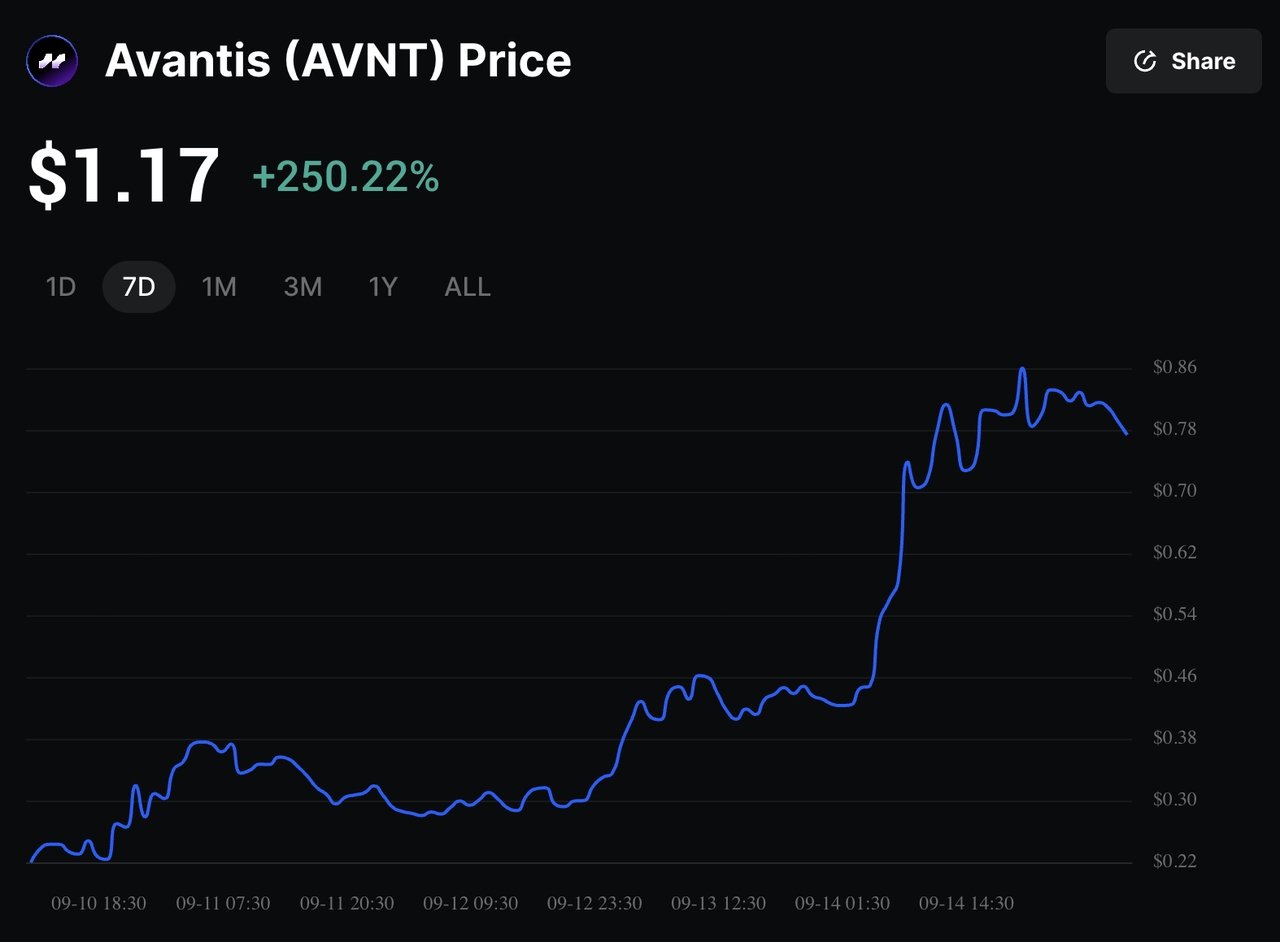

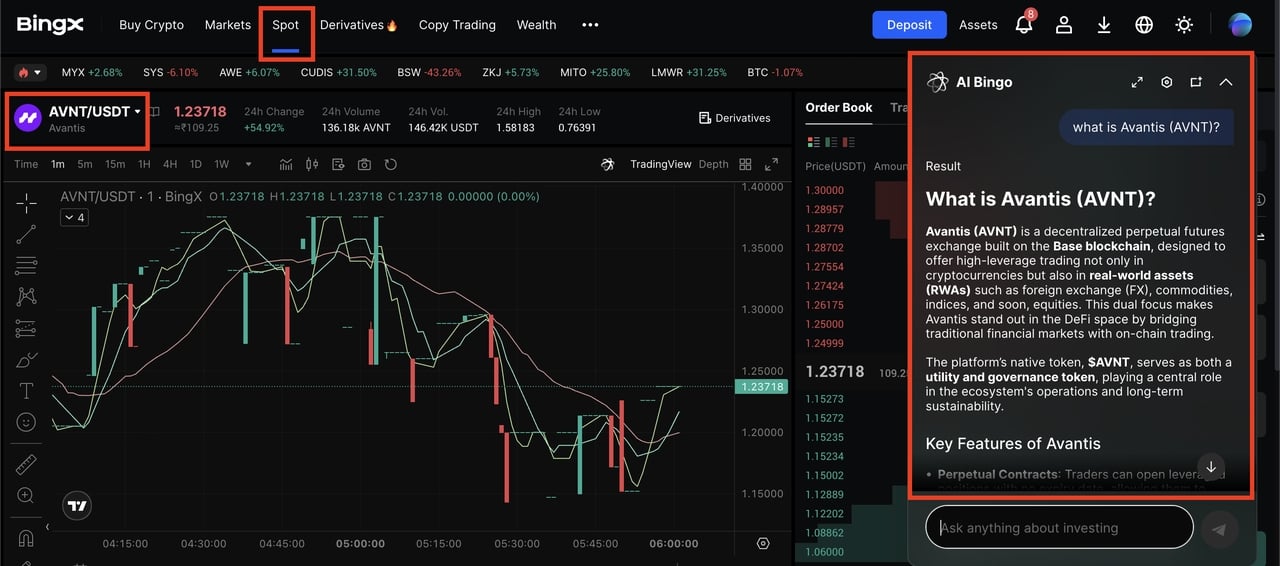

Avantis price surges after major exchange listings | Source: BingX

Momentum accelerated in mid-September 2025 with new listings on Binance and Upbit alongside a Coinbase “experimental” listing, driving fresh liquidity and price discovery for AVNT. Backed by a $8 million Series A co-led by Pantera Capital and Founders Fund, the AVNT token powers governance,

staking via Security Module, fee discounts, and XP boosts, positioning Avantis as a credible bid to become DeFi’s “universal leverage layer.”

In this guide, you’ll learn what Avantis is, how its zero-fee perps work, the AVNT token utility and tokenomics, and how to buy and trade AVNT tokens on BingX.

What Is Avantis (AVNT) and How Does It Work?

Avantis is a decentralized exchange (DEX) built for perpetual futures trading, a type of derivative contract that lets you speculate on the price of assets without owning them. What makes Avantis unique is that it doesn’t limit you to crypto. On a single platform, you can trade

Bitcoin and

Ethereum, but also gold, oil, and forex pairs like USD/JPY, all with leverage that magnifies both potential gains and risks.

To open a trade, you deposit

USDC stablecoins as collateral. The protocol then allows you to take long (buy) or short (sell) positions on synthetic assets that mirror real-world prices. Because Avantis is fully on-chain, every position, liquidation, and fee is recorded transparently on the Base network, an

Ethereum Layer-2. This gives you the speed and low fees of a CEX (centralized exchange), while keeping custody of your funds in your own wallet.

Avantis also introduces several features designed to make trading fairer and more efficient:

1. Zero-Fee Perpetuals (ZFP): You only pay fees if your trade is profitable, reducing costs for scalpers and active traders.

2. Loss Rebates: If you take a position that balances market skew, you may get part of your loss refunded, lowering net risk.

3. Positive Slippage: Some trades can be executed at better-than-market prices when they help liquidity.

4. Risk Tranches for LPs: Liquidity providers can choose low- or high-risk vaults with different lockups, tailoring yield strategies to their risk tolerance.

By combining crypto and

real-world assets (RWAs) in one terminal, Avantis is building what it calls a “universal leverage layer” for DeFi. Backed by $8 million in Series A funding from Pantera Capital and Founders Fund, the project is scaling quickly and positioning itself as a decentralized alternative to centralized futures exchanges.

What Are Zero-Fee Perps (ZFPs) on Avantis and How Do They Work?

Avantis’ Zero-Fee Perpetuals (ZFP) are designed to remove the constant drain of trading fees that most traders face. On regular perpetual exchanges, you pay fees to open and close positions and often a funding or borrow fee while holding them. With ZFP, you pay nothing upfront—fees only apply if your trade ends in profit.

This system is especially useful for scalpers and active traders. Small, frequent trades are no longer eaten up by fee costs, making it easier to keep more of your gains. Longer-term traders also benefit since they can hold positions without worrying about rolling funding charges cutting into their collateral.

In practice, ZFP aligns incentives between traders and liquidity providers (LPs). Traders only pay when they win, and LPs still earn through profit-sharing and other rewards. For beginners, the takeaway is simple: ZFP reduces your risk of death by “fee bleed,” letting you focus on market moves instead of cost management.

How to Claim the Avantis (AVNT) Airdrop

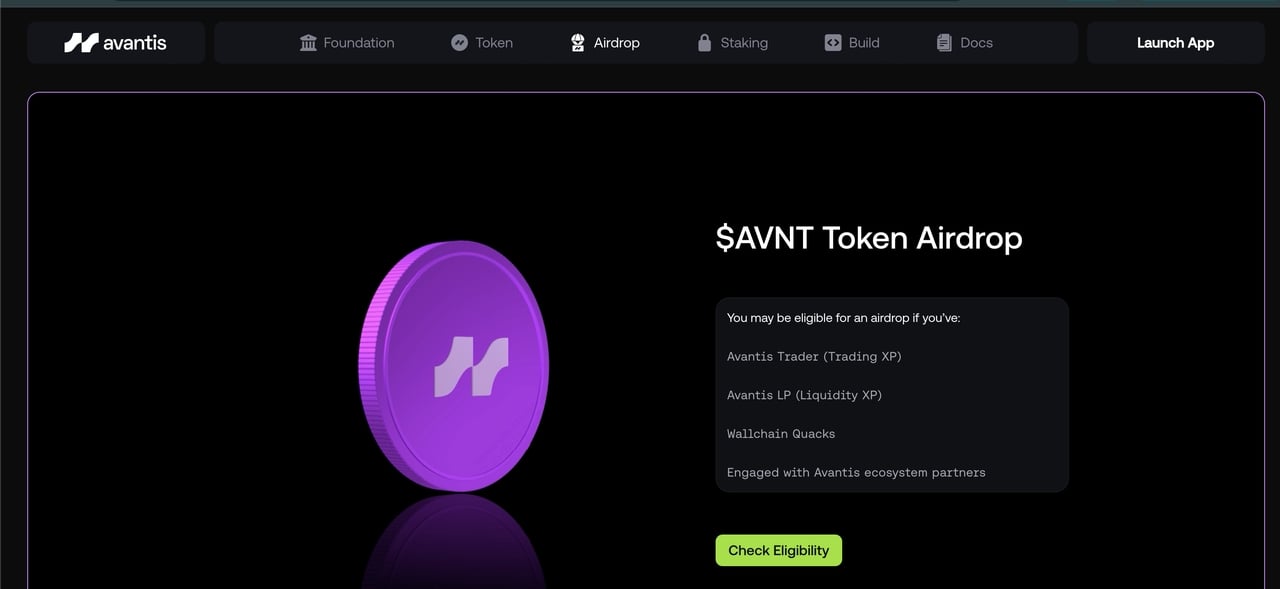

The Avantis airdrop is the first distribution of AVNT tokens to early users who supported the protocol before its token launch. It’s designed to reward traders, liquidity providers (LPs), and community members who helped test, trade, or provide liquidity on Avantis.

Eligibility Criteria for $AVNT Airdrop

1. Active Avantis traders who accumulated Trading XP points.

2. Liquidity providers (LPs) who locked USDC and earned Liquidity XP.

3. Early ecosystem participants who engaged with Avantis partner protocols.

4. Community members included in special campaigns (e.g., Wallchain Quacks, referrals).

When Is the AVNT Token Airdrop?

• Snapshot: Taken on January 18, 2025 to record eligible wallets.

• Claim Period: Opened on September 9, 2025 and runs until November 8, 2025 on the official Avantis Foundation portal.

How to Claim Your AVNT Tokens After the Airdrop

Claiming AVNT tokens after the Avantis airdrop | Source: Avantis

1. Go to the official claim page: foundation.avantisfi.com/airdrop.

2. Connect your wallet. Ensure it’s the same address used during trading/LP activity.

3. Check your eligibility and view your allocation.

4. Click Claim to receive AVNT directly in your

Base wallet.

5. Always double-check the contract address before transferring or trading.

👉 Tip: If you plan to stake or trade your tokens, claim early so you don’t miss out on staking rewards, XP boosts, or fee discounts tied to holding AVNT.

AVNT Token Utility and Tokenomics

What Is the AVNT token in Avantis?

The AVNT token is the backbone of the Avantis ecosystem, designed to align traders, liquidity providers, and the protocol itself. Holding and using AVNT isn’t just about speculation; it unlocks concrete benefits within the platform.

1. Governance: AVNT holders can vote on key decisions such as which new assets (crypto, forex, or commodities) get listed, how fees are structured, and how the community treasury is allocated. This gives token holders a direct say in shaping the future of Avantis.

2. Staking & Security Module: By staking AVNT, users secure the protocol against extreme LP shortfalls. In return, stakers earn additional AVNT rewards and protocol incentives. There is a small theoretical risk of slashing, where up to 20% of staked tokens could be used to cover losses in rare, extreme events, but Avantis reports that no such events have occurred in its operating history.

3. Fee Discounts & XP Boosts: Active traders who stake AVNT can receive up to 40% discounts on both fixed-fee and Zero-Fee Perpetuals (ZFP). Stakers also unlock XP boosts in Avantis’ loyalty seasons, which increase their share of future airdrops and rewards. For example, a 3x XP boost means your trading activity counts three times more toward reward eligibility than a non-staker.

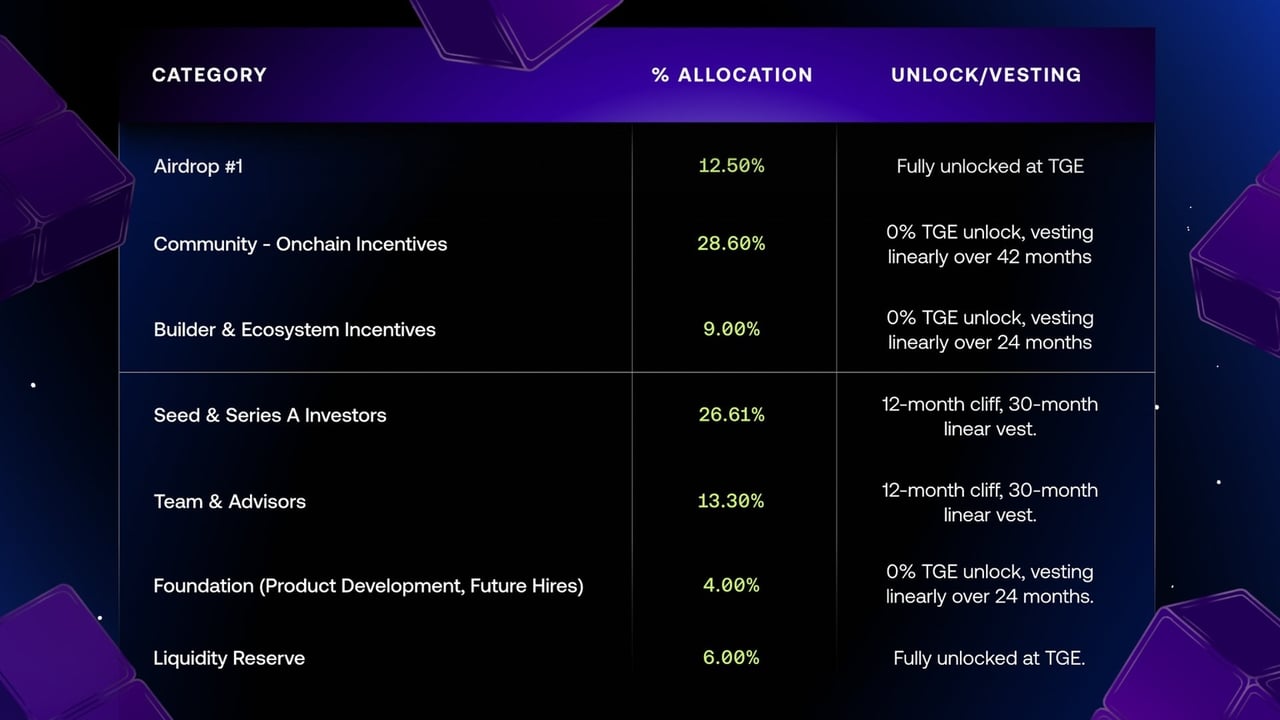

AVNT Token Allocation

• Airdrop Season 1 – 12.5%: Fully unlocked at the Token Generation Event (TGE).

• Community (On-chain incentives) – 28.6%: 0% unlocked at TGE; vests linearly over 42 months.

• Builder & Ecosystem Incentives – 9%: 0% unlocked at TGE; vests linearly over 24 months.

• Seed & Series A Investors – 26.61%: 12-month cliff, followed by linear vesting over 20 months.

• Team & Advisors – 13.3%: 12-month cliff, followed by linear vesting over 30 months.

• Foundation (Product Development & Future Hires) – 4%: 0% unlocked at TGE; vests linearly over 24 months.

• Liquidity Reserve – 6%: Fully unlocked at TGE to support exchange listings and market making.

How to Buy and Sell Avantis (AVNT) Tokens on BingX

AVNT/USDT trading pair on the spot market, powered by BingX AI

Trading Avantis (AVNT) on BingX is simple, but you’ll want to follow a few steps carefully, especially if you’re new to spot markets or trading newly listed tokens.

Step 1: Create and Verify Your BingX Account

Go to BingX and sign up with your email or phone. Complete

KYC verification to unlock full trading access and higher withdrawal limits.

Step 2: Deposit USDT into Your Spot Wallet

You can add

USDT by buying with a card or bank transfer directly on BingX. Alternatively, transfer USDT from another exchange or wallet to your BingX deposit address. Make sure to select the correct network, e.g., TRC20, ERC20, or Base, when depositing.

Step 3: Search for the AVNT Trading Pair

On the Spot market page, type

AVNT/USDT in the search bar. Click on the trading pair to open the order screen.

Step 4: Place Your Order

• Market Order → Buy AVNT instantly at the best available price. Best for beginners.

• Limit Order → Set your desired price. Your order executes only if the market hits that level. This gives you more control.

Step 5: Manage Risk Like a Pro

Key Considerations Before You Trade AVNT

Before trading AVNT, keep in mind a few key considerations. New listings on major exchanges, including BingX, can quickly boost liquidity but also create sharp volatility, so always confirm the official trading pairs and supported network (Base) before moving funds.

Monitor how actively Avantis is being used, such as the share of Zero-Fee Perps, the range of supported assets, and the health of its liquidity vaults, as this reflects real demand for the protocol. Finally, track token flow carefully: staking participation, fee-discount usage, and upcoming claim or airdrop events can all influence circulating supply and short-term price action.

How to Stake and Earn Rewards with AVNT Tokens

How to stake AVNT tokens on Avantis

Avantis makes the AVNT token more than just a governance coin; it’s designed to give you ways to earn rewards while supporting the protocol. Here’s how it works in practice:

Staking AVNT Tokens in the Security Module (SM)

You can stake your AVNT tokens into the Security Module, which acts like an insurance pool for Avantis’ liquidity providers (LPs). In return, you:

• Earn additional AVNT rewards over time.

• Get access to fee discounts of up to 40% on your trading, including both fixed-fee and Zero-Fee Perps.

• Qualify for XP boosts, which increase your chances of receiving bigger allocations in future airdrops or loyalty campaigns.

Staking comes with a small risk called slashing; if extreme volatility creates heavy LP losses, up to 20% of staked AVNT may cover them. So far, Avantis vaults have grown steadily with no slashing events, but it’s worth keeping in mind.

For active traders, staking AVNT cuts fees and increases rewards. For long-term believers, it’s a way to

earn passive income while boosting your XP score for bigger future perks. Beginners can start small; stake part of your AVNT, watch how rewards and XP points add up, and scale as you grow confident.

Practical tip: Always check the Avantis dashboard for live staking rewards, XP multipliers, and updates before committing your tokens.

Final Thoughts

Avantis (AVNT) is building toward the idea of a universal leverage layer in DeFi, offering traders access to both crypto and real-world assets under one on-chain platform. Features like Zero-Fee Perps, loss rebates, and risk-based LP vaults make it stand out in the growing derivatives space, while backing from established investors adds credibility to its roadmap.

That said, Avantis (AVNT) is still a relatively new protocol and token. Market volatility, smart contract risks, and changing liquidity conditions can all impact performance. Always verify official links, contract addresses, and exchange announcements before trading, and never invest more than you can afford to lose.

Related Reading