Pocket Network (POKT) is a decentralized infrastructure protocol that connects

dApps to blockchain data through a permissionless network of RPC nodes.

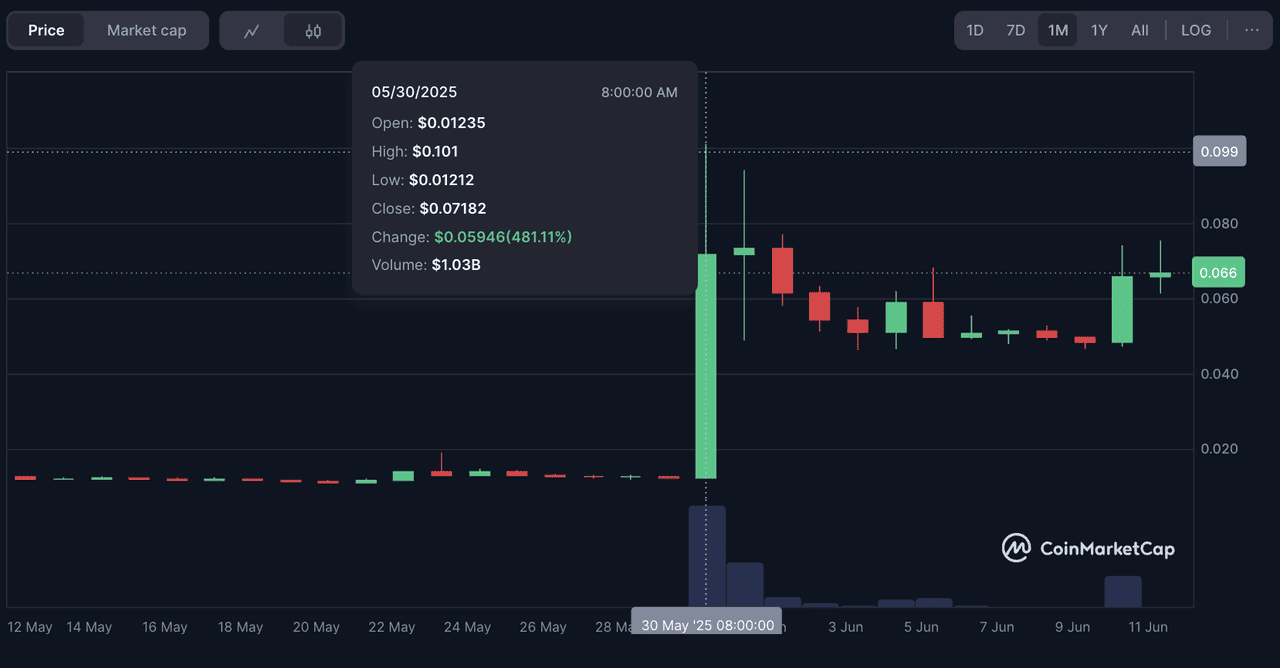

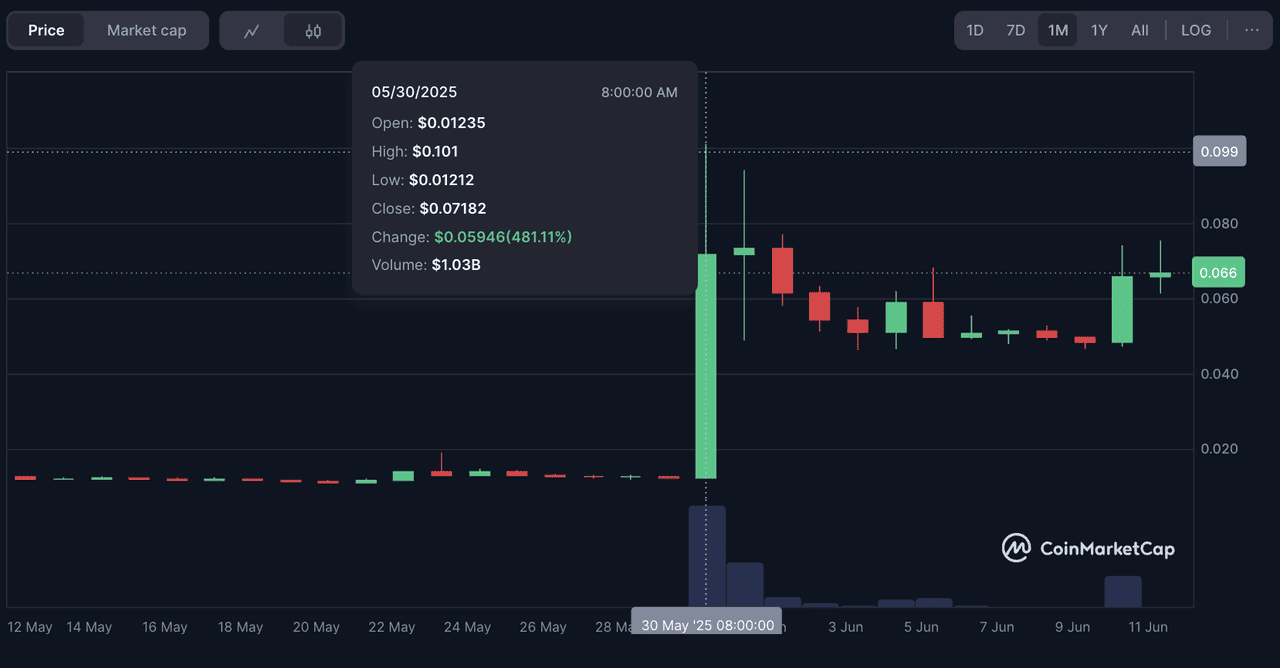

In June 2025, $POKT surged more than 450% since May 30, drawing renewed attention across the crypto ecosystem. The sharp rise follows a major protocol upgrade and growing interest in decentralized,

censorship-resistant blockchain infrastructure.

What Is Pocket Network ($POKT) and How Does It Work?

Source: Pocket Network

Pocket Network is a decentralized protocol that provides blockchain data and open

APIs to applications through a distributed network of nodes. Instead of relying on centralized infrastructure providers, Pocket uses a permissionless network of independent node operators to relay blockchain data and serve open datasets in a secure, censorship-resistant way. This model is especially relevant for emerging fields like

AI agents and autonomous

smart contracts, where reliable, tamper-resistant data access is essential.

What Is RPC?

RPC stands for Remote Procedure Call. In the context of blockchains, RPC allows applications to communicate with a blockchain network to send transactions, read data, or fetch on-chain information. Every time a

wallet loads your balance or a dApp fetches token prices, it is usually making an RPC request in the background. Pocket Network decentralizes this process by allowing anyone to run a node and serve RPC data.

Pocket Network's Long-Term Vision

Pocket Network aims to become the foundational open data layer of Web3 and beyond. It is building a public utility that can serve billions of requests per day across blockchain ecosystems and

AI applications, including machine learning models,

AI trading bots, and autonomous agents. Its goal is to make blockchain data and open datasets accessible in a permissionless and scalable way. In an environment where

AI-generated scams and manipulated data are becoming more difficult to detect, Pocket offers a trust-minimized alternative for accessing verified, chain-native information.

By aligning incentives between developers and

node operators, Pocket offers a decentralized infrastructure model that is resilient, modular, and ready for the next generation of multichain and AI-native applications.

Key Features of Pocket Network

By aligning incentives between developers and node operators, Pocket Network offers a more resilient and scalable way to connect decentralized applications with blockchain data and open datasets across Web3 and AI ecosystems.

• Decentralized Infrastructure Layer: Eliminates single points of failure by distributing requests across thousands of nodes.

• Open Data Access: Beyond blockchain RPCs, now serves AI models, privacy protocols, and other open data sources.

• Permissionless Access: Developers can access the network by

staking $POKT without needing centralized approval.

• Incentivized Node Operators: Anyone can run a node and earn $POKT for serving verified traffic.

• Censorship Resistance: With no central gatekeepers, data access cannot be easily blocked or controlled.

Why Did Pocket Network (POKT) Surge 450% in June 2025?

$POKT climbed over 450% from May 30 to June 2025, marking one of the strongest monthly moves among infrastructure tokens this year. This breakout was fueled by the launch of the Shannon upgrade, a major turning point in the protocol’s development.

$POKT Jumped over 450% on May 30, 2025 | Source: CoinMarketCap

Shannon didn’t just improve performance. It redefined what Pocket Network is. The upgrade introduced a modular architecture, restructured node operator rewards, and laid the foundation for Pocket to evolve into a fully permissionless Open API network. Investors responded quickly to the shift, viewing it as a step beyond decentralized RPC and into a more scalable and service-oriented role within the Web3 stack.

The rally also reflects a broader change in sentiment. As developers seek infrastructure that is faster, more affordable, and not controlled by any single provider, Pocket is gaining traction as a real alternative. With Shannon now live and the demand for decentralized data access accelerating, $POKT is riding a renewed wave of relevance.

That said, the token has been flagged with an "ST"(Special Treatment) label on major exchanges like BingX, signaling elevated risk and potential for delisting. Sharp price movements often come with increased volatility, and $POKT’s recent surge is no exception. While the Shannon upgrade strengthens Pocket’s long-term prospects, investors should carefully weigh these short-term risks and consider whether they are prepared for fluctuations as the market continues to adjust.

What Is the Pocket Network's Shannon Upgrade?

The Shannon upgrade marks a turning point for Pocket Network. It transitions Pocket from a focused RPC relay system into a scalable, developer-friendly Open API network capable of serving any type of open data. It also rearchitects the protocol as a fully native Cosmos chain, expanding its interoperability and modularity for the future of Web3.

Source: Pocket Network

1. From RPC to Open Data: Shannon expands Pocket's mission beyond blockchain RPC. The network can now serve any type of open data, from onchain queries to indexing oracles and AI models. This shift positions Pocket as a broader infrastructure layer in Web3 and beyond.

2. Now a Native Cosmos Chain: With the upgrade, Pocket is fully rebuilt as a

Cosmos-native blockchain. This brings compatibility with Cosmos SDK tooling, wallets like Keplr, and sets the stage for future

interoperability through IBC. It also makes the network more modular and upgradeable.

3. Fairer Rewards for Node Operators: Node rewards are now tied to actual data served, not just uptime. This reduces wasteful emissions and makes the network more sustainable by rewarding operators who contribute real value.

4. Smoother Developer Experience With simplified pricing, faster gateway onboarding, and better multichain support, developers can build on Pocket more easily and scale across ecosystems without friction.

These changes go beyond a typical protocol upgrade. Shannon lays the foundation for Pocket Network to become a key pillar of the decentralized data layer, ready to grow with Web3's next wave of applications.

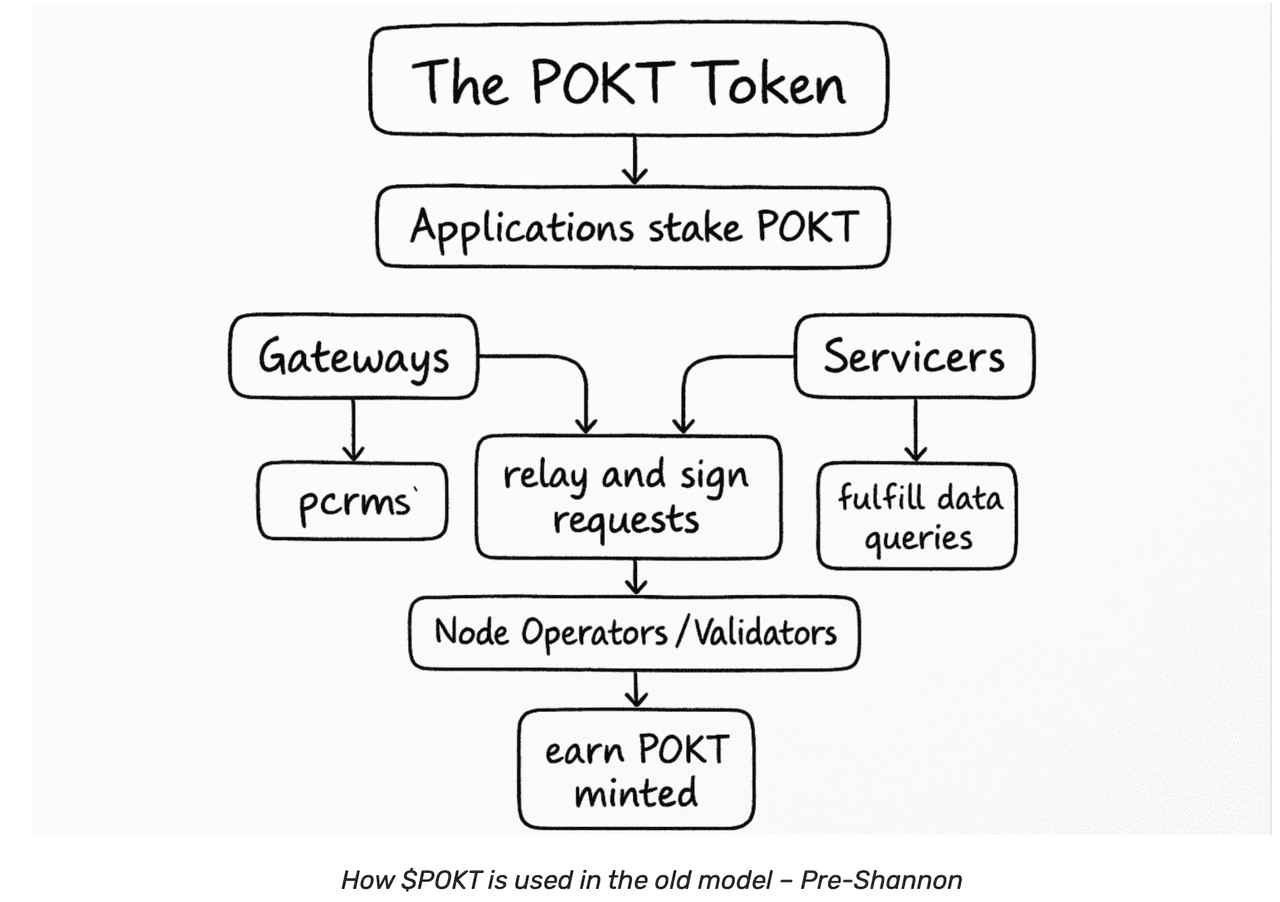

What’s $POKT Tokenomics?

$POKT is the utility token that powers Pocket Network. Its value and supply are directly tied to real usage. Tokens are created when developers access the network, and with the Shannon upgrade, a portion of each transaction is now burned. This turns $POKT into a usage-driven asset that becomes more scarce as adoption grows.

Pocket Network currently has 2.35 billion tokens in total, with 2.01 billion in circulation. There is no fixed cap, but new token emissions are now based on actual network demand.

POKT Token Utility

$POKT serves several functions across the ecosystem:

• Payment: Developers burn $POKT to access blockchain data through the network

• Staking for Rewards: Node operators stake at least 60,000 $POKT to earn 10–40% annually by serving requests

• Throughput Access: Applications stake tokens to unlock higher request volume

• Usage Rebates: High-volume apps can receive up to 40% of burned tokens back

• Liquidity Mining: Liquidity providers earn 0.30% in trading fees

Pre-Shannon Upgrade Token Distribution

When Pocket launched in July 2020 with 650 million tokens, the distribution was designed to support core development, early ecosystem growth, and long-term decentralization:

• Team, Advisors, and Treasury: ~66%. 23.2% was allocated to the founding team, 21.1% to employees and advisors, and 21.9% to the company treasury for protocol development and operations

• Investors and Foundation DAO: ~33%. 16.8% was distributed to early investors and 16.5% to the Foundation DAO for governance, grants, and ecosystem initiatives

• Early Participants: 0.5%. A small allocation went to early testers and contributors who supported Pocket’s launch

Today, that original distribution accounts for less than 30% of the total supply. Over 70% of all circulating tokens have been earned by node operators who actively serve data across the network.

POKT Token Distribution After the Shannon Upgrade

Following the Shannon upgrade, all new token emissions follow a usage-based model tied to real infrastructure contributions:

• 78% goes to node operators

• 14% goes to validators

• 8% is allocated to community development

This new distribution reflects Pocket’s shift toward long-term sustainability. Contributors are rewarded for delivering value, while increased usage drives token scarcity through ongoing burns.

Pocket Network Future Roadmap: What’s Next?

With the Shannon upgrade now live, Pocket Network is entering a new chapter focused on scalability, interoperability, and long-term developer adoption.

1. Modular Expansion: Shannon was just the beginning. Pocket plans to expand its modular architecture, making it easier for different blockchains to integrate with its Open API Network. This includes tooling for new chains, more flexible service levels, and simplified onboarding for developers.

2. Enhanced Token Utility: Future releases aim to strengthen the use of $POKT within the ecosystem. This includes fine-tuning incentives for node operators, refining the

token burn model, and introducing more granular pricing options for high-volume applications.

3. Ecosystem Growth: Pocket is actively supporting growth through developer grants, ecosystem partnerships, and expanded cross-chain support. As demand for decentralized infrastructure increases, Pocket’s goal is to become the default data layer across Web3.

Important Things to Consider Before Investing in $POKT

Before buying $POKT on BingX or any other exchange, it’s important to understand the current risks and context surrounding the token.

• "ST" Tag on BingX: On BingX, $POKT is currently flagged with an

"ST" (Special Treatment) tag. This means the token is under review for potential delisting due to factors such as low

liquidity, low trading volume, or project-related concerns. While this does not automatically indicate a problem, it signals that the exchange is monitoring the asset more closely. Trading may be suspended or removed.

• Long-Term Vision vs. Short-Term Volatility: Pocket Network has a compelling long-term vision as an Open API layer for Web3 and AI applications. However, its token price may still be subject to significant short-term volatility, especially during its transition under the Shannon upgrade. Investors should evaluate the token based on long-term fundamentals and consider whether they are comfortable with near-term uncertainty.

• Token Liquidity and Accessibility: Because $POKT is not a standard

ERC-20 or

Solana SPL token, it is not directly supported by wallets like

MetaMask or Phantom unless

wrapped. While it can be traded on BingX, holding and withdrawing it may require specialized wallets like PoktWallet, C0D3R Wallet, or Cosmos-compatible wallets such as Keplr. This adds an extra step for users unfamiliar with native wallet setups.

• Project Transparency and Ecosystem Maturity: Pocket Network is still in an active growth phase. While the Shannon upgrade marks a major technical milestone, its long-term success depends on continued adoption, stable governance, and ecosystem development. Keeping track of project updates and community participation is essential for staying informed.

Final Thoughts

Pocket Network is evolving from a decentralized RPC provider into a broader infrastructure platform for Web3. The Shannon upgrade represents a major step in that direction, unlocking new possibilities for scalability, modularity, and developer adoption.

The recent surge in $POKT signals growing interest in infrastructure that is reliable, cost-efficient, and truly decentralized. As demand for multichain access and censorship resistance increases, Pocket is well positioned to serve a critical role in the next wave of blockchain applications.

Whether you're a developer, investor, or just exploring the space, Pocket Network is a project worth keeping an eye on as the Web3 ecosystem continues to mature.

Disclaimer: This content is for informational purposes only and should not be considered financial or investment advice. Cryptocurrencies carry significant risk, and past performance is not indicative of future results. Always conduct your own research and consult a licensed financial advisor before making any investment decisions.

Related Reading