Ripple USD (RLUSD) is a regulated

stablecoin designed to bring trust and transparency to digital payments.

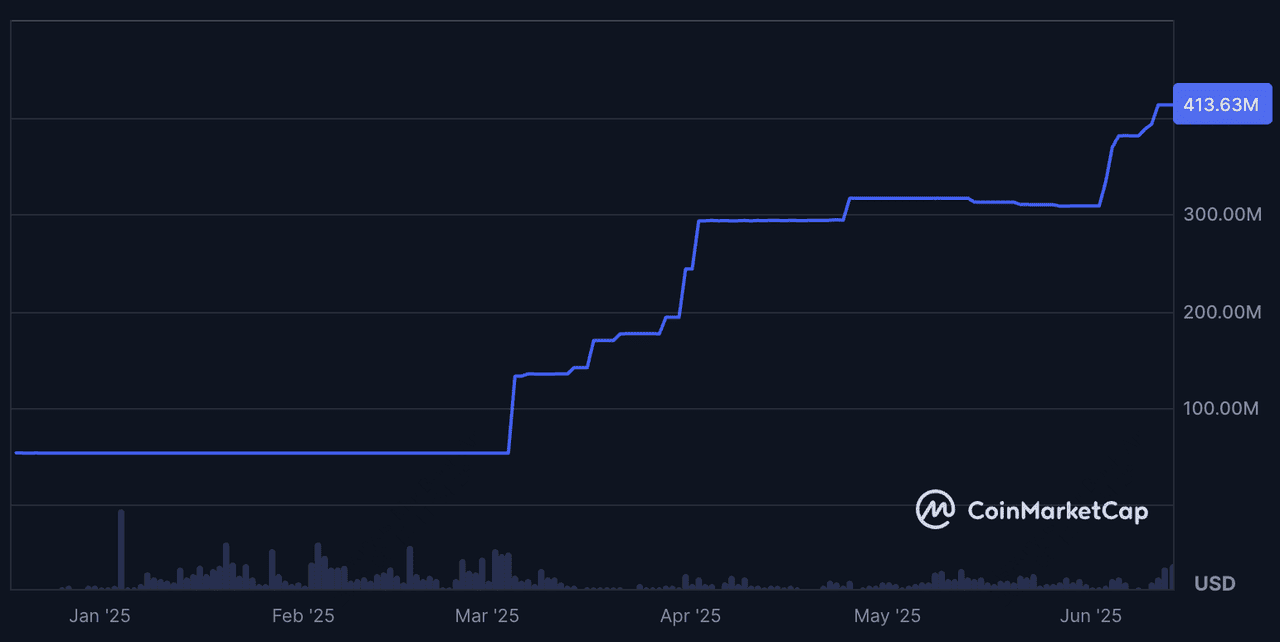

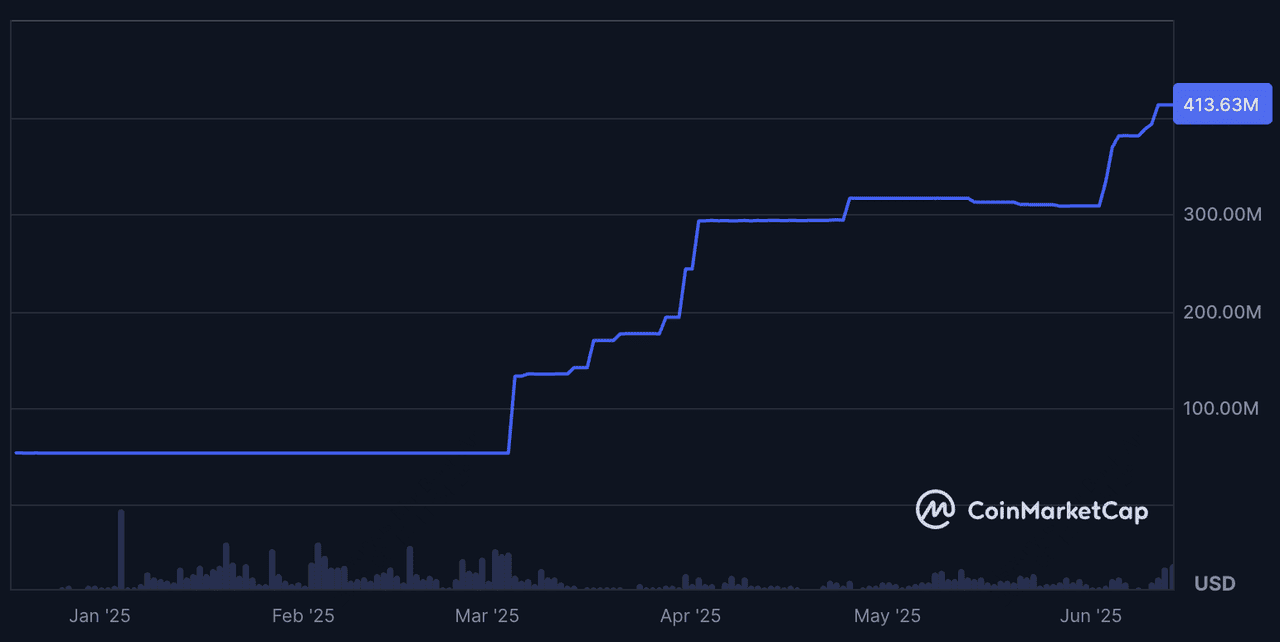

In June 2025, RLUSD surpassed $413 million in supply following regulatory approval in the UAE, where it was greenlit for use in the Dubai International Financial Centre (DIFC). Ripple is now expanding the stablecoin’s utility beyond payments into sovereign infrastructure, institutional settlements, and digital asset custody, positioning RLUSD as a serious alternative to leading players like

Tether (USDT) and

USD Coin (USDC) in the global stablecoin market.

This guide covers how RLUSD works, where it’s issued, its regulatory strengths, use cases, and how it compares to other leading stablecoins like USDC and USDT.

What Is Ripple USD (RLUSD) Stablecoin?

RLUSD's market cap crosses $410 million as of June 2025 | Source: Coinmarketcap

RLUSD is a U.S. dollar-pegged stablecoin issued by Ripple’s fully owned subsidiary, Standard Custody & Trust Company (SCTC). Launched in December 2024, it’s backed 1:1 by U.S. dollar reserves, short-term Treasuries, and cash equivalents, and issued under a New York trust charter. RLUSD is available on both the

XRP Ledger and

Ethereum, making it suitable for cross-border payments,

DeFi, and

tokenized asset transfers.

The token is designed to maintain a stable value of $1 at all times. It's built for use in cross-border payments, institutional settlements, and DeFi applications. RLUSD is currently issued on both the XRP Ledger and Ethereum blockchain, making it flexible for use across centralized exchanges, payment platforms, and

smart contracts.

RLUSD stands out for its strong regulatory backing and focus on transparency. It is one of the few stablecoins approved by both the New York Department of Financial Services (NYDFS) and the Dubai Financial Services Authority (DFSA). This dual approval signals compliance with some of the world’s highest regulatory standards.

Under New York trust law, RLUSD also follows strict

KYC and AML rules. That means identity verification is required, making it better suited for institutions and regulated platforms. With strong oversight, full collateralization, and legal safeguards, RLUSD offers a high level of trust and reliability in the stablecoin market.

How Does Ripple's Stablecoin RLUSD Work?

RLUSD is a fully backed, fiat-pegged stablecoin. For every 1 RLUSD in circulation, there’s an equivalent $1 held in reserves. These reserves include U.S. dollar deposits, short-term Treasury bills, and cash equivalents stored in regulated U.S. financial institutions.

When you buy RLUSD, Ripple’s licensed subsidiary, Standard Custody & Trust Company (SCTC), mints new tokens. When RLUSD is redeemed, the tokens are burned. This ensures the circulating supply always reflects the actual dollar value held in reserve. Ripple does not reissue previously redeemed tokens, which adds transparency and accountability.

To maintain trust, Ripple publishes monthly attestation reports. These are third-party

audits that confirm the reserves are fully collateralized. The reports follow strict regulatory requirements from the New York Department of Financial Services (NYDFS), giving RLUSD a strong compliance foundation. This level of oversight makes RLUSD one of the most transparent and trustworthy stablecoins available today.

Which Blockchains Support RLUSD?

RLUSD is available on two major blockchain networks: XRP Ledger (XRPL) and Ethereum. Each offers unique benefits depending on your needs.

On the XRP Ledger, RLUSD benefits from fast transaction speeds, low fees, and built-in features like trust lines. These trust lines allow you to control which issuers and assets your wallet can receive, adding an extra layer of security. Transactions on XRPL settle in 3–5 seconds and cost just fractions of a cent, making RLUSD ideal for cross-border payments and merchant payouts.

On Ethereum, RLUSD is issued as an

ERC-20 token. This means you can use it across thousands of DeFi platforms, wallets, and exchanges. RLUSD supports upgradeable smart contracts using the proxy pattern, which allows Ripple to update the contract without changing the token address. This keeps the token compatible while enhancing security and functionality over time.

Together, these two networks give you flexibility. Whether you’re transacting cheaply on XRPL or using RLUSD in Ethereum’s DeFi ecosystem, the stablecoin offers seamless access to the broader crypto economy.

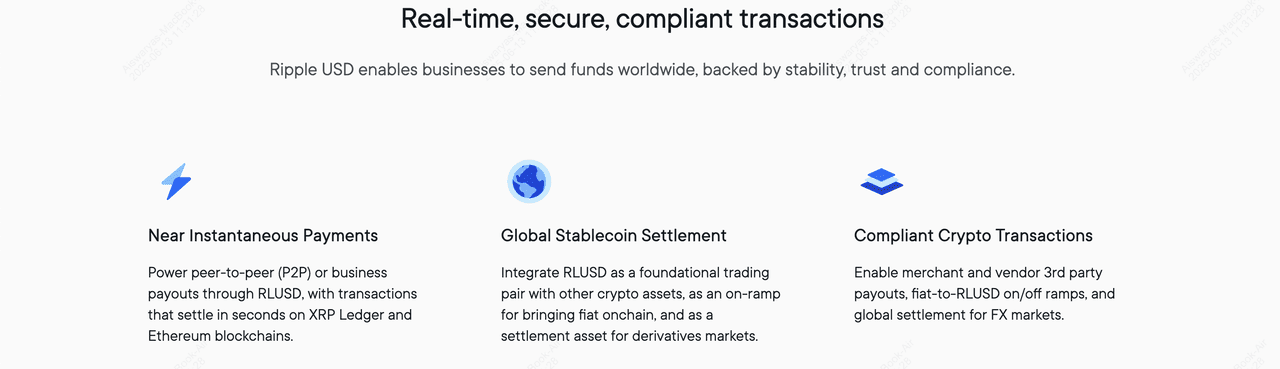

Use Cases of Ripple's RLUSD Stablecoin

RLUSD supports a wide range of real-world and digital finance applications. Designed for speed, compliance, and global access, it goes far beyond a typical stablecoin.

1. Cross-Border Payments and B2B Settlement: Ripple has integrated RLUSD into its enterprise payment platform, already used in over 90 payout markets. You can send money across borders in seconds with near-zero fees. Businesses benefit from faster treasury workflows, lower costs, and reduced settlement risk. RLUSD also improves

liquidity when paired with XRP as a bridge asset.

2. Crypto On/Off-Ramps: RLUSD is available on platforms like MoonPay, Uphold, and Bullish, making it easier for you to move between fiat and crypto. It minimizes volatility when you cash in or out, offering a reliable gateway into the blockchain economy.

3. DeFi Participation: On Ethereum, RLUSD can be used in DeFi protocols like

Aave and Euler. You can lend it,

stake it, or use it as collateral for borrowing. This brings the benefits of yield and liquidity to a stable, fully backed digital dollar.

4. FX Markets and Trade Settlement: In traditional foreign exchange markets, transactions can take days. RLUSD allows on-chain FX settlement in seconds. It removes costly intermediaries and gives smaller businesses fairer access to global currencies. Fund managers and banks can also use RLUSD to speed up institutional trade settlement and reduce capital inefficiencies.

5. Real-World Asset Tokenization: In Dubai, RLUSD is already being used to tokenize real estate deeds in partnership with the Dubai Land Department. Stablecoins like RLUSD help price tokenized assets accurately and bring liquidity to previously illiquid markets.

6. Peer-to-Peer Transfers and Global Payments: If you're unbanked or based in an economy with a volatile local currency, RLUSD gives you access to a stable U.S. dollar alternative. You can use it to store value, send money to family, or pay for goods, without needing a bank.

7. Merchant Payments and Treasury Use: RLUSD can also be used for real-time settlements in cross-border trade and foreign exchange. Its compliance makes it suitable for institutional partners, while its blockchain base enables 24/7 global operations.

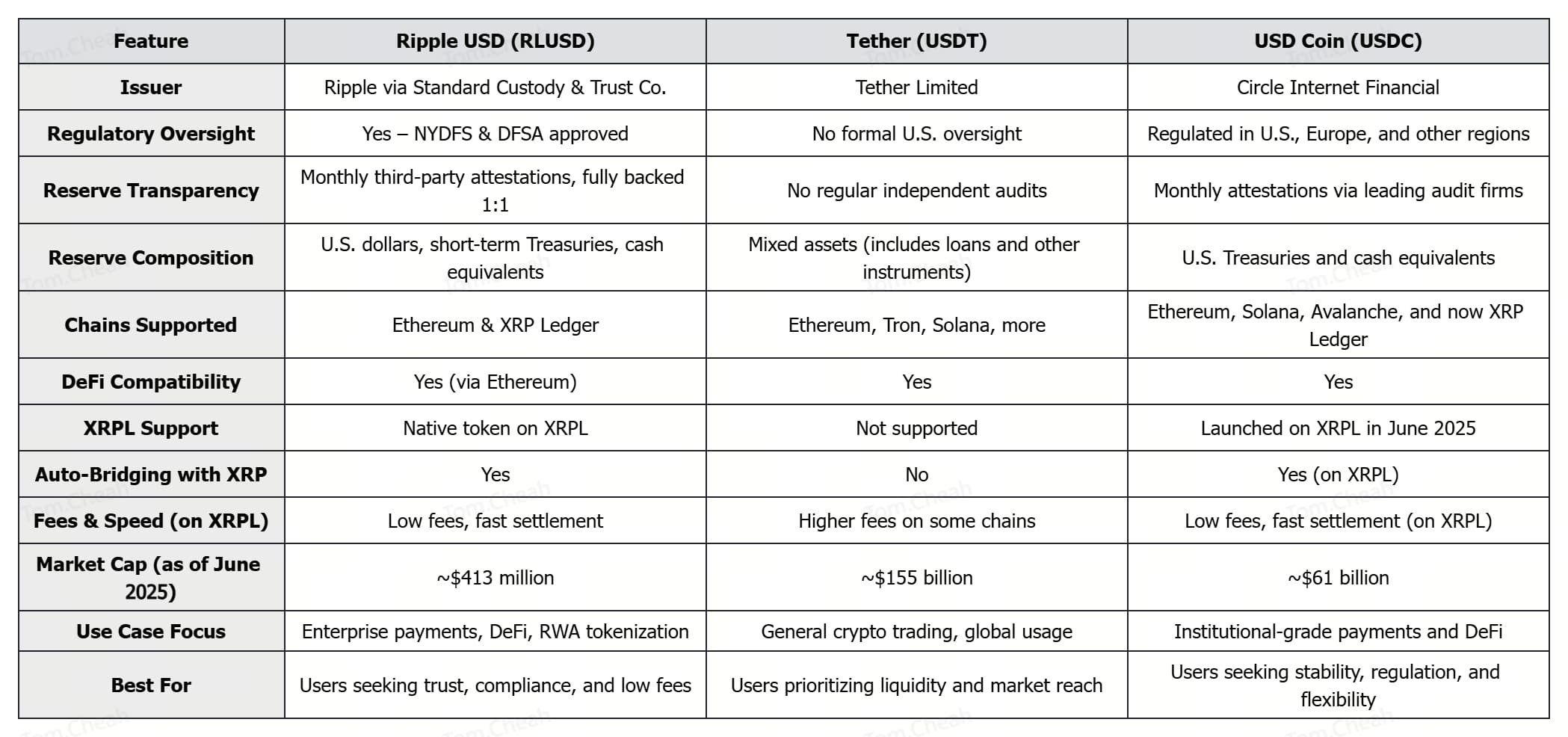

How RLUSD Compares with USDT and USDC

RLUSD enters a stablecoin market led by giants like

USDT and USDC, but it sets itself apart with strong regulatory oversight and dual-chain deployment on Ethereum and XRP Ledger.

Ripple USD (RLUSD) vs. Tether (USDT)

Compared to USDT, RLUSD offers far more transparency. While USDT is the largest stablecoin with a market cap of over $155 billion as of June 2025, it’s often criticized for its lack of independent audits and unclear reserve quality. RLUSD, on the other hand, is issued under a New York trust license, fully backed by U.S. dollars and short-term Treasuries, and publishes

monthly third-party attestation reports. As per the latest audit report published on June 6, 2025, RLUSD has a market cap of over $369 million while RLUSD reserve funds exceed $395 million. As of mid-June, RLUSD's market cap has increased to over $413 million. If regulatory compliance and reserve clarity are important to you, RLUSD offers a more trustworthy alternative.

Ripple USD (RLUSD) vs. USD Coin (USDC)

When compared to USDC, RLUSD shares similar strengths. Both are regulated, fully backed, and provide monthly attestation reports. However, RLUSD adds a layer of flexibility by being available on both Ethereum and the XRP Ledger. This allows for faster, cheaper transactions on XRPL and full DeFi compatibility via Ethereum. For users seeking speed, low fees, and multichain access, RLUSD delivers more options. USDC has a market cap of over $61 billion against RLUSD's market cap of over $413 million as of writing.

In June 2025, USDC also launched on the XRP Ledger. This move gives USDC access to XRPL’s low-cost, high-speed infrastructure and signals a broader trend: regulated stablecoins are going multichain. The launch strengthens the XRP ecosystem and enables features like auto-bridging, which uses XRP to route trades between stablecoins like USDC and RLUSD on decentralized exchanges. This not only improves trading efficiency but also boosts liquidity for both tokens.

The bigger picture? USDC’s presence on XRPL reinforces the credibility of Ripple’s blockchain and the demand for dollar-backed digital assets. Both USDC and RLUSD now play a growing role in defending the global utility of the U.S. dollar, offering fast, compliant alternatives to legacy financial systems. As stablecoins become tools of monetary strategy, RLUSD’s integration with Ripple’s enterprise-grade infrastructure makes it a serious player in the next wave of digital finance.

Where to Buy and Store RLUSD

You can buy RLUSD on several major platforms, such as Uphold, MoonPay, and Revolut. These services offer both fiat on-ramps and crypto swap options, making it easy to acquire RLUSD with your local currency or other stablecoins.

Once purchased, you’ll need a

wallet that supports RLUSD. If you're using the XRP Ledger, choose wallets like Xaman (formerly Xumm),

Ledger (hardware),

Trust Wallet,

MetaMask (for Ethereum), or custodial solutions like Ripple Custody. Non-custodial options give you full control, while custodial wallets offer convenience and backup services. Wallets like Zengo also support RLUSD and XRP in a secure, user-friendly interface.

Should You Buy and Use RLUSD Over Other Stablecoins?

RLUSD stands out in the stablecoin sector for its strong regulatory foundation, full 1:1 reserve backing, and growing cross-chain utility. It’s issued under a New York trust charter, backed by U.S. dollars and short-term Treasuries, and audited monthly, giving you peace of mind if transparency and compliance matter. You can use RLUSD for fast payments, DeFi lending, tokenizing real-world assets, or cross-border settlements. Its availability on both Ethereum and XRP Ledger makes it versatile for traders, institutions, and developers alike.

However, like any centralized stablecoin, RLUSD isn’t without risks. It depends on trusted custodians and regulatory frameworks, which may evolve over time. There’s also the challenge of maintaining its peg during extreme market stress. Additionally, RLUSD’s market cap, around $413 million as of June 2025, is still far smaller than USDT’s $155 billion and USDC’s $61 billion, meaning it has less liquidity and network effects by comparison. That said, Ripple’s conservative reserve strategy, third-party audits, and regulatory licenses help reduce these concerns. If you're looking for a stablecoin that balances regulatory clarity with real-world utility, RLUSD is worth considering alongside more established options like USDC and USDT.

Related Reading

FAQs on Ripple USD (RLUSD)

1. What is RLUSD Stablecoin?

RLUSD is a U.S. dollar-pegged stablecoin issued by Ripple. It’s fully backed 1:1 with cash, short-term U.S. Treasuries, and cash equivalents. The token launched in December 2024 and runs on both the Ethereum and XRP Ledger blockchains.

2. How is RLUSD different from XRP?

XRP is a volatile cryptocurrency used as a bridge asset for payments. RLUSD is a stablecoin, designed to maintain a constant value of $1. You use RLUSD for stable transfers and DeFi, while XRP helps move value quickly across currencies and networks.

3. Is Ripple USD stablecoin RLUSD safe?

Yes, RLUSD is one of the most regulated stablecoins available. It’s issued under a New York trust charter, backed by real-world assets, and audited monthly by independent firms. This ensures transparency and peg stability.

4. Can I use RLUSD in DeFi?

You can. RLUSD is available on Ethereum, making it compatible with leading DeFi apps like Aave and Euler. It's also gaining traction for use in staking, lending, and liquidity pools across multiple protocols.

5. What does USDC's launch on XRP Ledger mean for RLUSD?

USDC’s launch adds more liquidity to XRPL and supports stablecoin swaps using XRP. It shows growing trust in regulated stablecoins. While USDC adds competition, it also helps position RLUSD as part of a broader ecosystem focused on compliant digital dollars.

6. How will an XRP ETF approval by the US SEC impact RLUSD adoption?

An

XRP ETF would likely boost institutional interest in the XRP ecosystem. That could drive more demand for assets built on XRP Ledger, including RLUSD. As more investors and financial platforms explore XRP, RLUSD may benefit from increased liquidity, utility, and visibility as a compliant, dollar-pegged stablecoin within the same network.

RLUSD's market cap crosses $410 million as of June 2025 | Source: Coinmarketcap

RLUSD's market cap crosses $410 million as of June 2025 | Source: Coinmarketcap