In a dramatic shift that could reshape the

stablecoin industry,

Tether unveiled the launch of USAT on September 12, 2025. USAT is a U.S.-compliant dollar-pegged token designed to meet the requirements of the newly passed

GENIUS Act.

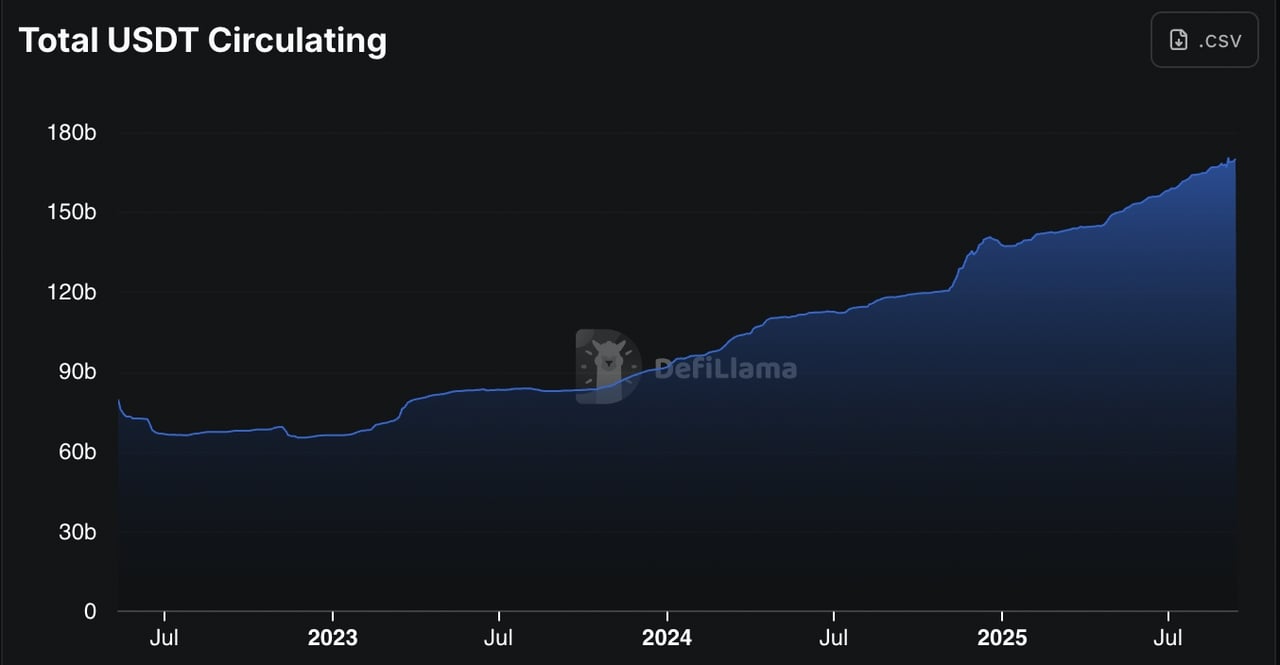

Tether's USDT is the backbone of the digital asset economy, with a market cap of over $169 billion and daily transaction volumes surpassing even leading credit card networks and global remittance giants.

With the launch of USAT, the world's

largest stablecoin issuer is signaling a readiness to play by American rules. The goal of USAT according to Tether's website is the "highest standards of transparency, compliance, and financial resilience [of the new digital dollar]."

USAT is Tether's upcoming U.S.-regulated, dollar-backed stablecoin, designed specifically for the American market and aligned with domestic regulatory standards. Positioned as the foundation for the next wave of commerce, trade, and finance, USAT aims to bring stability and compliance to the U.S. digital economy. The launch highlights Tether's commitment to strengthening U.S. leadership in the global digital asset space. As part of the wider Tether ecosystem, USAT is set to raise the bar for utility-focused stablecoins by delivering long-term value, robust governance, and practical real-world use cases.

What Is Tether USAT Stablecoin and How Does It Work?

Tether USAT is a U.S.-compliant,

dollar-pegged stablecoin created to meet the requirements of the GENIUS Act, a new federal law governing stablecoin issuers. Unlike Tether’s flagship USDT, which operates offshore, USAT is issued by Anchorage Digital Bank, a federally chartered crypto bank, with reserves custodied by Cantor Fitzgerald, one of Wall Street’s major financial institutions. This structure is designed to ensure transparent, fully-backed reserves and robust governance standards.

USAT works much like other stablecoins: every token is backed 1:1 by liquid assets such as U.S. dollars and short-term Treasury bills. Holders can use it for payments, trading, remittances, or treasury management, while institutions gain a regulatory-approved option for dollar-denominated digital transactions. Unlike Bitcoin or Ethereum, USAT does not fluctuate in price. It is built to maintain parity with the U.S. dollar, offering stability in the fast-moving crypto markets. By operating on regulated rails with traceable transactions, USAT combines Tether’s global liquidity expertise with compliance features tailored for the American market.

Why Is Tether Launching USAT Stablecoin for the US Market?

Tether's timing to launch USAT is no accident. The GENIUS Act is a sweeping federal law aimed at tightening oversight of stablecoin issuers, which has forced offshore operators to either adapt or risk exclusion from the lucrative U.S. Market. Tether's flagship token, USDT, commands more than $170 billion in market cap, accounting for roughly 60–66% of the global stablecoin market.

USDT has become widely recognized as the digital dollar in emerging and developing markets, now reaching close to 500 million users. Its primary impact lies in serving the underbanked, unbanked, and underserved, communities historically excluded by traditional financial institutions due to prohibitive fees. At the same time, Tether Group has made headlines for its profitability, generating over $13 billion in 2024 and remaining on pace for another strong year in 2025. By launching USAT, issued through Anchorage Digital with reserves held by Wall Street giant Cantor Fitzgerald, Tether is signaling it is ready to comply to the U.S.

Tether Taps Bo Hines, Trump's Crypto Advisor, to Lead USAT

The face of USAT is Bo Hines, a 30-year-old former college athlete and Trump-era policy insider. His political trajectory accelerated in 2025 when President Trump appointed him to the Presidential Council on Digital Assets and later the White House's digital assets advisory council.

Hines's deep ties to governance and innovation make him a logical choice to guide USAT through the U.S. regulatory maze.“I am honored to lead USAT as we prepare for its launch, creating a U.S.-regulated dollar-backed stablecoin designed to strengthen America's role in the global economy,” said Bo Hines, CEO-Designate of Tether USAT. “By building USAT with compliance, transparency, and innovation at its core, we are ensuring that the dollar remains the foundation of trust in the digital asset space.”

How Does USAT Differ from USDT?

Unlike its offshore sibling, USAT is built to check every box of the GENIUS Act including transparent reserve requirements, strict governance standards, and custody by federally chartered institutions. It is worth noting, however, that USAT is not legal tender, not FDIC insured, and not government-backed, echoing the caveats that apply to all private stablecoins. Pairing Anchorage Digital and Cantor Fitzgerald signals Tether's determination to shed its reputation for shadowy practices. If executed properly, USAT could bridge the gap between Tether's global liquidity and U.S. regulatory trust.

Tether vs. Circle: What's at Stake in the Stablecoin Wars?

The stablecoin market is now worth over $288 billion, with two titans dominating: Tether and Circle. While USDT dominates trading and payments, particularly in emerging economies serving nearly 500 million underbanked users, USDC has cultivated trust among institutions thanks to regular audits and full U.S. regulatory alignment. By launching USAT, Tether is directly challenging Circle on its home turf. Could this be the move that tips the scales, or will USDC's reputation keep it ahead in regulated markets?

What Does Tether's US-Based USAT Launch Mean for the Future of Stablecoins?

Will USAT be the token that finally legitimizes Tether in the U.S., or the beginning of an even more intense rivalry with Circle? Early reactions are mixed. Supporters see USAT as a “major step for U.S. dollar dominance,” while skeptics worry about market fragmentation.

If USAT succeeds, Tether could extend its influence from emerging markets to Wall Street, cementing the dollar's digital supremacy worldwide. But much depends on whether it can win the transparency battle it has long avoided.

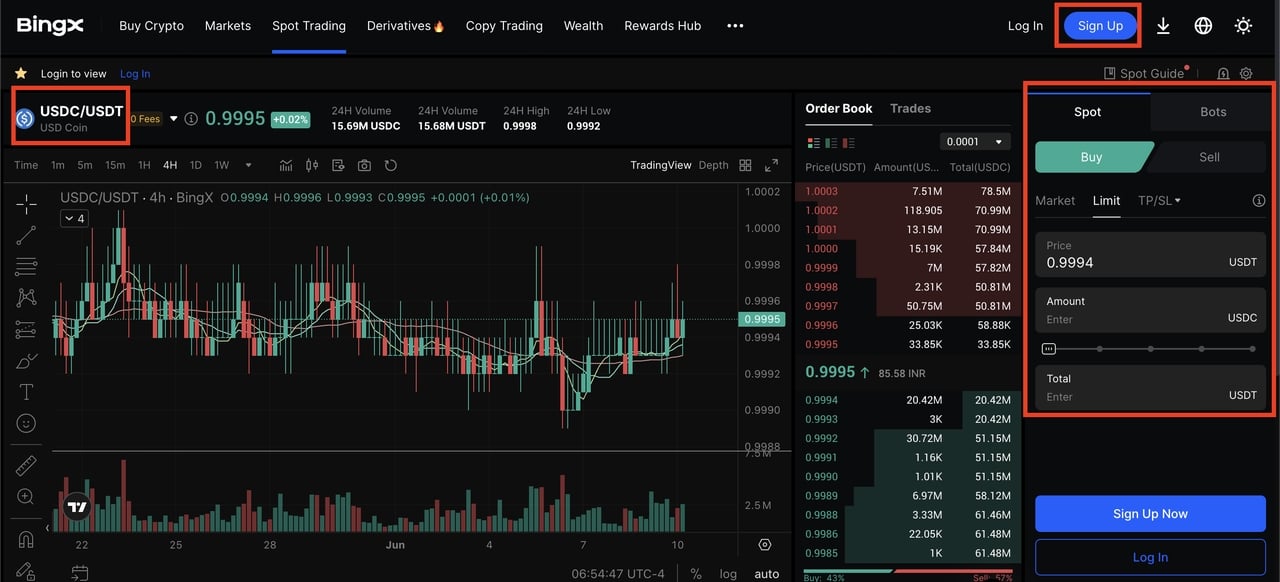

How to Buy Tether (USDT) on BingX

Getting started with USDT on BingX is simple. Just follow these steps:

Step 1: Create and Secure Your BingX Account

Sign up for free on the BingX website or app using your email, phone number, Google, or Apple account. Complete KYC verification by uploading your ID and a selfie. This unlocks deposits, trading, and withdrawals. For extra safety, enable 2FA (two-factor authentication), set up anti-phishing codes, or use Passkeys.

Step 2: Add a Payment Method or Deposit Crypto

You can fund your account using fiat money or by transferring crypto from another wallet:

• Credit/Debit Cards (Visa/Mastercard): Buy instantly via partners like MoonPay, Alchemy Pay, or Mercuryo.

• Apple Pay/Google Pay: Quick checkout with your linked mobile wallet.

• Bank Transfers: Deposit EUR, BRL, AUD, JPY, INR (via UPI), and other local currencies through SEPA, Pix, or regional transfer rails.

• Crypto Deposit: Already own BTC, ETH, or USDC? Deposit and later convert them to USDT with BingX Convert.

Step 3: Choose How to Buy USDT

BingX gives you multiple purchase options:

• Quick Buy (Instant Buy): Enter how much you want to spend, choose your payment method (card, Apple Pay, bank transfer), and get USDT at real-time prices with ultra-low fees.

• Spot Trading: Go to the BingX Spot Market, search for USDT pairs (e.g., BTC/USDT, ETH/USDT), set your order size, and confirm. Perfect for those who want live market pricing.

• Convert: Instantly swap one crypto for USDT without worrying about trading fees or order books.

• P2P Trading: Buy directly from other verified users in over 60 fiat currencies. Pay via bank transfer, UPI, mobile wallets, or cash, while BingX’s escrow protects your trade.

Step 4: Start Using Your USDT

Once you’ve bought USDT on BingX, you can hold it securely in your wallet, trade it against 1,000+ cryptocurrencies in Spot, Futures, or Convert markets, copy top traders’ strategies, earn passive rewards through BingX Earn, or send it worldwide 24/7 at low fees via TRC-20, ERC-20, or Polygon networks.

Conclusion

The launch of USAT represents more than a new stablecoin, it is a turning point in the power struggle between offshore giants and U.S. regulators. For Tether, it is a calculated gamble, comply now, dominate later. For the industry, it is proof that the age of unregulated stablecoins is ending. One thing is clear: stablecoins are more dominant in crypto than ever and USAT may be the spark that ignites the next phase in crypto.

Related Reading

FAQs About Tether (USAT)

1. What is Tether USAT stablecoin?

Tether USAT is a U.S.-compliant, dollar-pegged stablecoin launched in September 2025. It is issued by Anchorage Digital Bank, with reserves custodied by Cantor Fitzgerald, and designed to meet the requirements of the U.S. GENIUS Act.

2. How does Tether USAT work?

USAT maintains a 1:1 peg with the U.S. dollar by being backed with liquid assets like cash and short-term U.S. Treasury bills. It offers regulated, transparent, and traceable transactions tailored for American businesses and institutions.

3. What makes USAT different from USDT?

USDT is an offshore stablecoin serving global markets, while USAT is built specifically for U.S. compliance under the GENIUS Act. Unlike USDT, USAT has federally chartered issuers, regulated custody, and stricter governance standards.

4. Who is leading Tether USAT?

Bo Hines, a former White House advisor on digital assets, was appointed CEO of Tether USAT in 2025. He is responsible for guiding the token through U.S. regulatory requirements and institutional adoption.

5. Is Tether USAT legal tender or FDIC insured?

No. Like all private stablecoins, USAT is not legal tender, not government-backed, and not FDIC insured. Its value depends on transparent reserves and compliance with federal regulations.

6. Why did Tether launch USAT in the U.S.?

Tether launched USAT to comply with the GENIUS Act and expand into the U.S. market. It allows Tether to compete directly with Circle’s USDC while strengthening the role of the U.S. dollar in the digital economy.

7. When was Tether USAT launched?

Tether officially announced USAT on September 12, 2025, with plans to make the stablecoin available to U.S. residents by the end of the year.

8. How can I buy Tether USDT or USAT on BingX?

On BingX, you can buy Tether (USDT) instantly using credit/debit cards, Apple Pay, or bank transfers. You can also use P2P trading to buy with local currency, or deposit other cryptos and convert them into USDT. Once USAT is listed, it will likely follow similar steps.