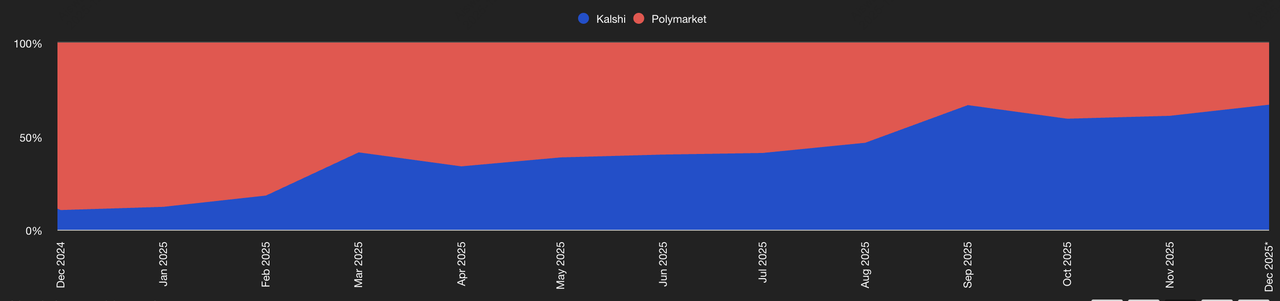

Prediction markets are moving from niche crypto experiments to a serious new asset class. In November 2025 alone, Kalshi processed around $5.8 billion in volume, while

Polymarket hit $3.74 billion, bringing their combined monthly activity close to $10 billion.

Polymarket and Kalshi monthly volume market share | Source: The Block

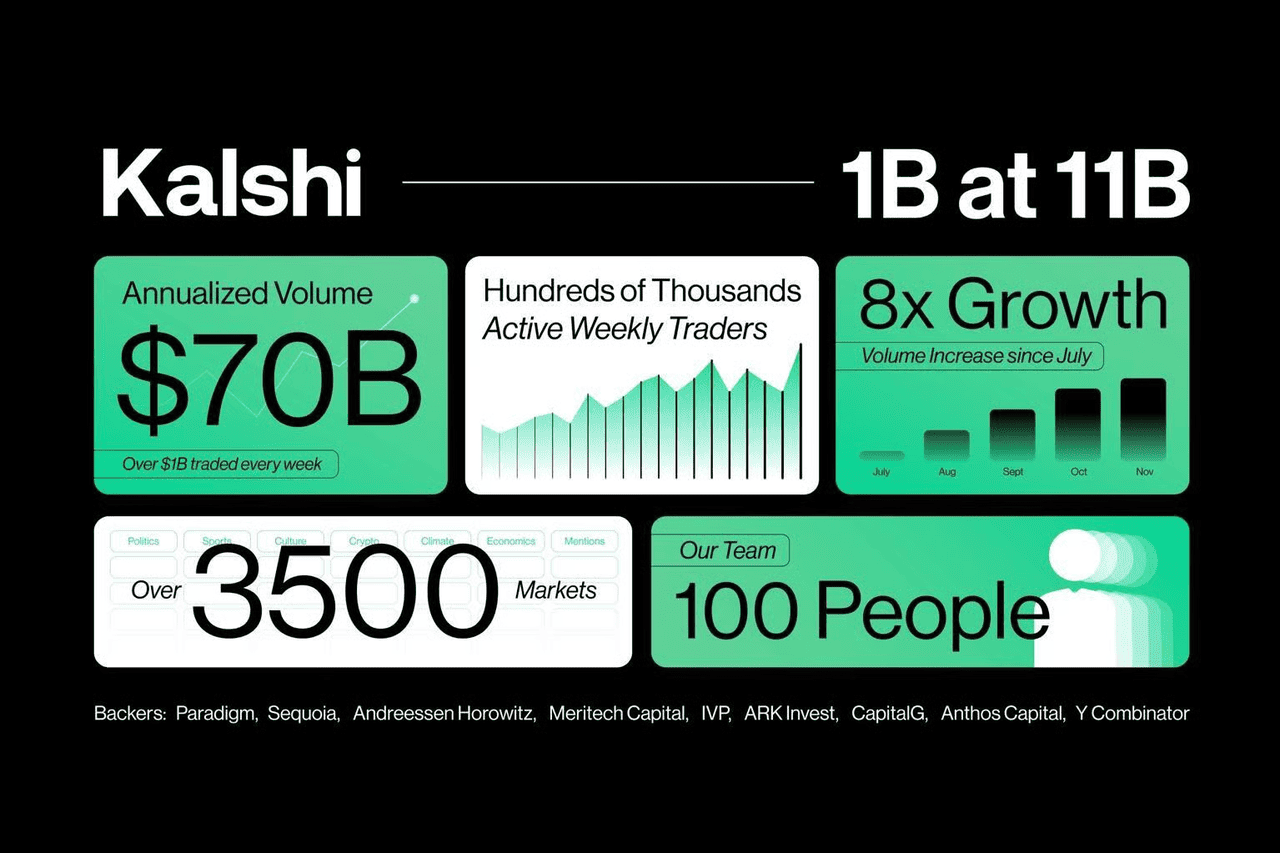

At the same time, Kalshi closed a $1 billion round at an $11 billion valuation on December 2, 2025, while Polymarket secured CFTC approval to return to the U.S. via regulated brokerages in October 2025. Both are racing to turn real-world events into liquid, tradable markets, but they take very different paths.

In this guide, you’ll learn how Polymarket and Kalshi work, where they differ on fees, regulation, markets, and UX, who each platform is best for, the main risks to watch before you trade, and how to get started by first buying USDC on BingX if you plan to use Polymarket.

What Are Prediction Markets, and How Do They Work?

Prediction markets are platforms where you trade on the likelihood of real-world events, such as elections, inflation numbers, interest-rate cuts, sports outcomes, or crypto milestones. Instead of betting, you buy and sell event contracts that reflect what you believe will happen. Each contract typically trades between $0 and $1:

• If the event happens, a “Yes” contract pays out $1.

• If it doesn’t, it settles at $0.

• A price of $0.70 means the market estimates a 70% chance the event will occur.

This simple design lets anyone turn an opinion, like “Will the Fed cut rates in March?,” into a tradeable position, and platforms like Polymarket and Kalshi are now among the leading destinations for this kind of event-based trading.

Together, Polymarket and Kalshi now operate as a fast-consolidating duopoly in the prediction-market sector, driving nearly $10 billion in combined trading volume in November 2025 alone. Their growth is fueled by surging retail activity around elections, CPI releases, and major sports events, alongside rising institutional involvement and high-visibility integrations with platforms like Google Finance, Yahoo Finance, and the UFC. At the same time, capital formation is accelerating: Kalshi has raised $1 billion at an $11 billion valuation in December 2025, while Polymarket is in talks for a valuation of up to $15 billion, cementing both platforms as the dominant forces shaping the future of event-based trading.

How Polymarket Works: A Crypto-Native, On-Chain Prediction Market

Polymarket is a decentralized, on-chain prediction market built on

Polygon and other EVM chains, where users trade event outcomes using

USDC. You connect a

non-custodial wallet like

MetaMask, deposit or bridge USDC, and buy “Yes/No” outcome shares that trade between $0 and $1, with the price reflecting the market’s probability of an event occurring. Each outcome is represented by tokenized shares, and when the event settles, winning shares pay $1, while losing shares go to $0. Markets update instantly based on blockchain liquidity, decentralized oracles handle resolutions, and users maintain full control of their funds at all times.

Polymarket’s crypto-native design makes it one of the largest global prediction platforms for fast-moving, news-driven topics, from elections and CPI prints to sports, tech headlines, and meme events. Its real-time responsiveness helped build its reputation during major geopolitical cycles, where markets often outperformed traditional polls.

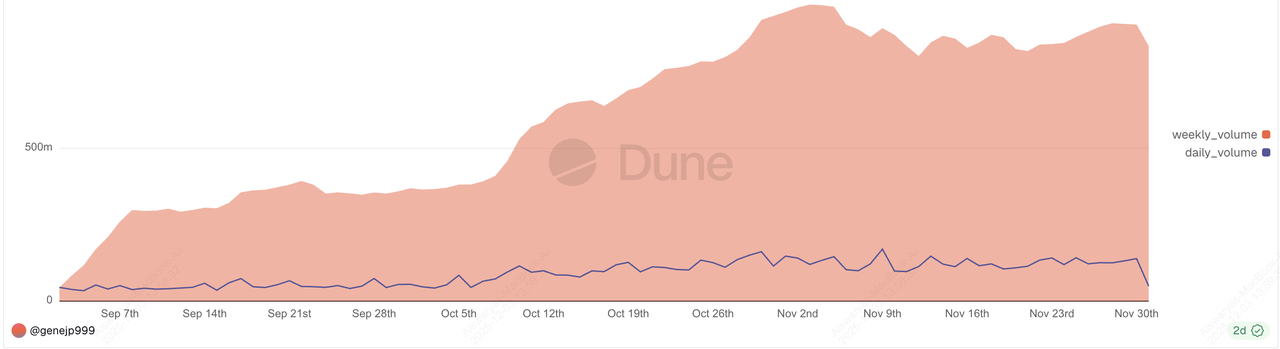

Polymarket's daily and weekly volume | Source: Dune Analytics

In November 2025, Polymarket reached a record $3.74 billion in monthly trading volume, highlighting accelerating global adoption. After paying a $1.4 million CFTC fine in 2022 and blocking U.S. users, Polymarket has now secured CFTC approval for a regulated U.S. return via licensed brokerages following its acquisition of derivatives exchange QCEX, positioning it for its next phase of growth. With this regulatory pathway in place, and growing speculation around

Polymarket’s plans to launch a native POLY token, the platform is positioning itself for its next major phase of expansion.

You can

buy USDC instantly on BingX and transfer it to your wallet to start trading prediction markets on Polymarket.

Kalshi is a CFTC-regulated U.S. event-contract exchange that operates like a simplified derivatives market, letting users trade Yes/No contracts on measurable outcomes such as elections, CPI prints, Fed decisions, sports results, and climate events.

To start, users complete full

KYC, deposit USD via ACH, card, or wire, and place

limit or market orders through a traditional order-book interface, with Kalshi’s clearing entity handling all USD payouts and settlement rules. Its regulated structure, Kalshi is registered as both a Designated Contract Market (DCM) and supported by a Derivatives Clearing Organization (DCO) affiliate, makes it one of the most compliant and institution-ready platforms in the sector.

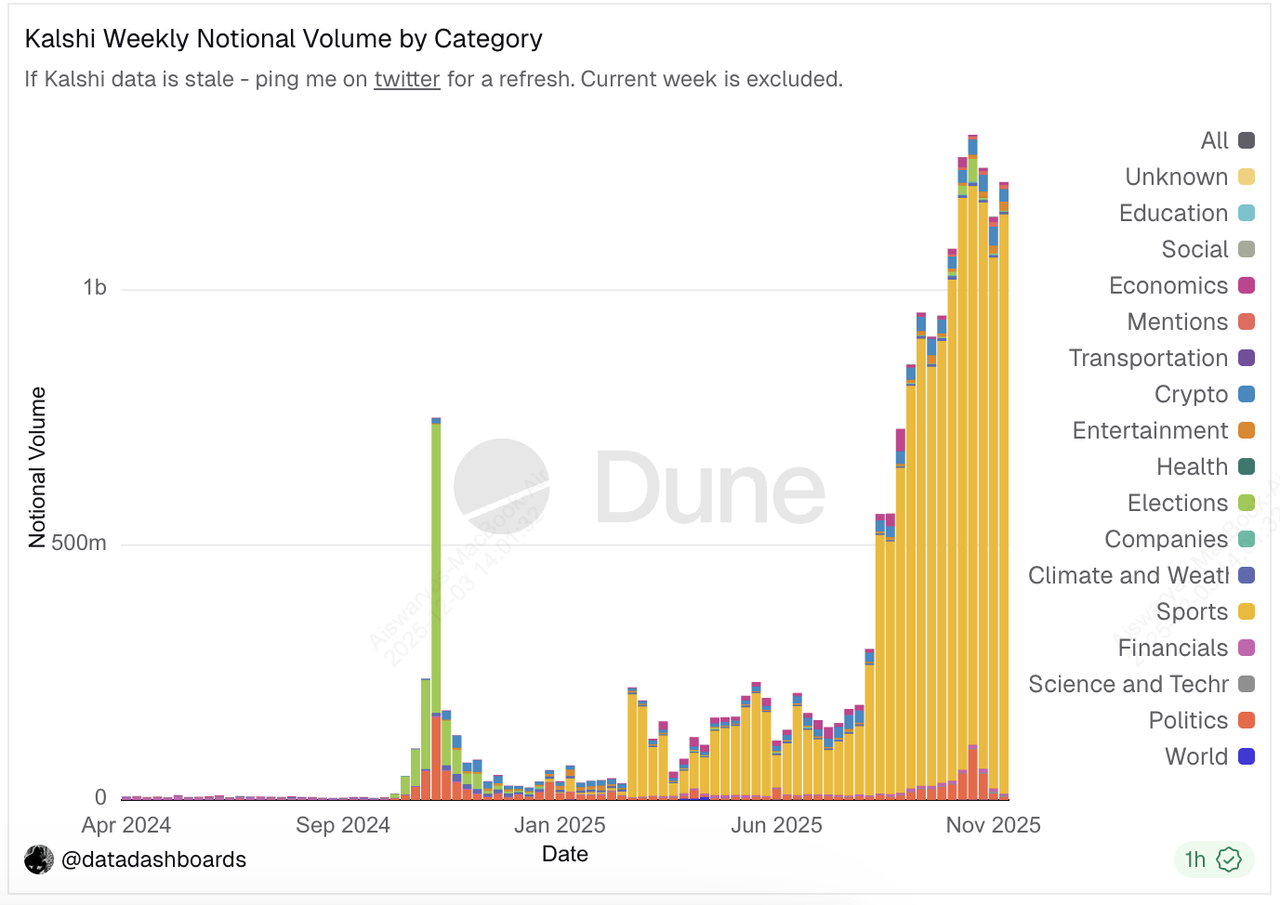

Kalshi's weekly notional volume by category | Source: Dune Analytics

Kalshi’s focus on macro and political markets has driven rapid growth: in November 2025, it posted a record $5.8 billion in monthly volume, up 32% from October. The exchange is also expanding into crypto territory with tokenized event contracts on Solana, which can trade on

DEXs like

Jupiter, giving users access to on-chain liquidity while maintaining regulated settlement rails. With a $1 billion Series E raising its valuation to $11 billion, and integrations with platforms like Robinhood and Google Finance, Kalshi is emerging as the institutional, regulated counterpart to crypto-native platforms like Polymarket.

Polymarket vs. Kalshi: Key Differences at a Glance

To help you understand how these two leading prediction platforms differ in practice, here’s a quick, data-driven comparison of their core models, regulation, user access, fees, and who each platform is best suited for. This table highlights the key factors traders consider when choosing between a crypto-native, on-chain experience like Polymarket and a regulated, fiat-based event exchange like Kalshi.

| Factor |

Polymarket |

Kalshi |

| Core model |

Decentralized, on-chain prediction market using USDC |

Centralized, regulated event-contract exchange in USD |

| Regulation |

Settled with CFTC in 2022; re-entering U.S. via CFTC-approved QCEX route |

Fully registered with CFTC as a Designated Contract Market (DCM) and Derivatives Clearing Organization (DCO) affiliate |

| Access |

Global access via crypto wallet; U.S. users coming back through brokerages |

Primarily U.S. users with mandatory KYC; available in all 50 states but facing some state-level gambling challenges |

| Funding & valuation |

Backed by major investors; recent CFTC-cleared U.S. return; reported multi-billion valuation range |

Raised $1B Series E at $11B valuation in Dec 2025, following a $300M round just weeks earlier |

| November 2025 volume |

~$3.74B |

~$5.8B |

| Assets & payments |

USDC on Polygon (and other chains), non-custodial wallets |

Fiat deposits (ACH, cards, wires) plus crypto deposits (e.g. USDC, BTC, SOL) converted to USD balances |

| Fees |

No platform trading fees; you pay network gas and spreads |

Per-contract trading and settlement fees, plus some deposit/withdrawal fees, with special promos around major events |

| Best for |

Crypto-native users, global access, on-chain composability |

Users who want a regulated, compliant environment with clear legal protections |

Polymarket vs. Kalshi Markets and Liquidity

Trading volume of Polymarket and Kalshi | Source: Messari

Polymarket’s markets and liquidity are driven by real-time internet conversation, with thousands of active markets that often appear and resolve within days or even hours. Its biggest liquidity pools form around politics, where open interest during major election cycles can reach hundreds of millions of dollars, making it the platform’s strongest vertical.

Polymarket also sees consistent volume in macro-economic events such as CPI and Fed decisions, as well as crypto and tech narratives including

Bitcoin price thresholds, ETF approvals, and protocol launches. Sports, culture, and meme-driven events further boost activity, creating a trading environment that resembles a blend of Twitter, DeFi, and derivatives, with high turnover and fast market creation. This contributed to Polymarket’s $3.74 billion in trading volume in November 2025, its highest month on record.

Source: Kalshi

Kalshi’s liquidity is concentrated in regulated macro and policy markets, attracting users who want structured exposure to U.S. economic data and political outcomes. Its largest categories include CPI releases, unemployment data, interest-rate decisions, and U.S. election markets, which relaunched after Kalshi won a key case against the CFTC.

Kalshi also lists sports markets legally across all 50 states, with weekly trading in major leagues reportedly approaching $1 billion during peak periods, and maintains strong participation in climate and weather markets used by both speculators and hedgers. With a record $5.8 billion in November 2025 volume, up 32% from the previous month, Kalshi now commands deeper liquidity in macro-focused segments, while Polymarket leads in fast-moving, internet-driven prediction markets.

Kalshi or Polymarket Fees: Which Platform Is Cheaper?

Polymarket is generally the cheaper platform for active traders because it does not charge platform trading or deposit fees. Users only pay network gas costs, typically a few cents on Polygon or other L2s, and the market’s bid–ask spread, which serves as the effective cost of entering and exiting a position. For

high-frequency or small-size traders, this structure can be extremely cost-efficient, especially when batching transactions or trading during low-fee periods. The absence of commission-style fees is one reason Polymarket has grown rapidly among crypto-native users who prioritize low friction and self-custody.

Kalshi, by contrast, uses a traditional derivatives-style fee model: each executed order incurs a per-contract trading fee, and winning positions pay a settlement fee when the market resolves. Deposits via ACH are usually free, while card deposits and withdrawals can carry small flat or percentage-based fees, historically around $2 per withdrawal, with occasional fee waivers tied to major events. While still inexpensive relative to sportsbook vig or options spreads, Kalshi is not fee-free, making it less cost-efficient for rapid trading compared to Polymarket, though some users prefer Kalshi’s regulated USD environment despite the added costs.

Kalshi vs. Polymarket: Regulations and Geographic Access

Polymarket has taken a complex regulatory path. After being fined $1.4 million by the CFTC in 2022 and required to block U.S. users, the platform later acquired QCEX, a fully licensed CFTC derivatives exchange and clearinghouse, creating a compliant infrastructure for regulated access. In late 2025, the CFTC approved Polymarket’s plan to re-enter the U.S. through intermediated brokerages, meaning Americans will no longer connect wallets directly but will trade Polymarket markets through regulated partners. For non-U.S. users, the experience remains unchanged: you access Polymarket globally with a wallet and trade on-chain in USDC without KYC.

Kalshi, however, has been regulated from day one. It is registered with the CFTC as both a Designated Contract Market (DCM) and, through its affiliate, a Derivatives Clearing Organization (DCO), giving it the same legal footing as traditional futures exchanges. Kalshi operates nationwide with mandatory KYC, though some states continue to challenge whether certain markets should be treated as gambling rather than derivatives. For users who prioritize regulatory clarity, consumer protections, documented settlement rules, and USD custody, Kalshi currently provides the strongest compliance framework, while Polymarket is rapidly closing the gap through its newly approved U.S. regulatory model.

Security, Transparency, and Wash-Trading Concerns in Polymarket and Kalshi

Polymarket relies on an on-chain security model: smart contracts audited by firms like Quantstamp, non-custodial trading where funds remain in user wallets, and full blockchain transparency that allows anyone to verify flows, positions, and settlement logic. But this openness comes with trade-offs.

A 2025 academic study from Columbia University found that around 25% of Polymarket’s historical volume showed characteristics of wash trading, with 15% of active wallets displaying patterns consistent with self-trading. During peak political cycles in late 2024, estimated wash-trading activity reached up to 60% in certain markets. The research does not allege wrongdoing by the platform, but it highlights how permissionless, stablecoin-denominated markets can be manipulated by sophisticated actors to artificially boost liquidity.

Kalshi uses a centralized, institution-style risk framework instead. Customer funds are kept in segregated collateral accounts with insurance coverage, and retail exposure is limited through per-market caps, often around $25,000, to prevent outsized losses.

Because Kalshi is regulated as a DCM and DCO, disputed outcomes follow documented rulebooks and CFTC-monitored processes, offering clearer recourse than decentralized systems. However, users have reported occasional withdrawal delays, app glitches, and support bottlenecks, and Kalshi is not BBB-accredited despite being subject to federal oversight. In practice, Polymarket delivers on-chain transparency with DeFi risks, while Kalshi provides centralized safeguards with TradFi constraints.

Polymarket or Kalshi: Which Platform Is Better for You?

When it comes to prediction markets, there is no universal “winner.” It depends on your priorities:

Choose Polymarket If You:

• Prefer crypto-native, non-custodial trading with a personal wallet.

• Want fast, global access and markets on anything from politics to memes and niche events.

• Care about on-chain composability, potentially integrating positions with DeFi strategies.

• Value zero platform trading fees, and you’re comfortable managing gas, keys, and

stablecoins.

Choose Kalshi If You:

• Prioritize a fully regulated U.S. venue supervised by the CFTC.

• Want clear KYC, fiat on-ramps, and simple USD balances instead of juggling multiple chains and tokens.

• Prefer macro and institutional-style markets, e.g., CPI, Fed decisions, structured election markets, with documented rulebooks.

• Don’t mind trading fees in exchange for regulatory protections, dispute-resolution frameworks, and fiat-native UX.

In many cases, experienced traders may use both: Kalshi for regulated macro and election exposure, and Polymarket for fast-moving, global, and more experimental markets.

Alternative Option: Trade on BingX Futures

Prediction markets like Polymarket and Kalshi are designed for trading real-world events, while

BingX Futures is better suited for users who simply want leveraged exposure to crypto price movements. For readers who aren’t interested in forecasting elections, CPI prints, or sports outcomes, and prefer a regulated environment with high liquidity and familiar trading tools, BingX Futures offers a practical, structured alternative.

Key Risks and Limitations of Polymarket and Kalshi

Before you trade on either platform, consider these risks:

1. Regulatory risk: Prediction markets sit between finance and gambling. Legal interpretations can change, especially at the state level in the U.S. That affects what markets can list, how they’re taxed, and whether products remain available.

2. Resolution and oracle risk: Ambiguous event definitions, data errors, or disputes about “what really happened” can lead to contentious resolutions on both Polymarket and Kalshi.

3. Liquidity and slippage: While headline volumes are large, individual markets can still have thin order books. Large orders may move prices significantly or be hard to exit without loss.

4. Smart-contract and custody risk: On Polymarket, you face DeFi risks such as contract bugs, bridge failures, or wallet compromises. On Kalshi, you face centralized custody and operational risks, like outages or delayed withdrawals.

5. Behavioral risk: Prediction markets can feel like high-frequency gambling. Rapid intraday swings and social-media-driven sentiment can encourage overtrading and emotional decisions.

Always size positions conservatively and avoid treating prediction markets as guaranteed income.

Closing Thoughts: Should You Choose Polymarket or Kalshi?

Polymarket and Kalshi now anchor the prediction-market ecosystem, with nearly $10 billion in combined November 2025 volume underscoring how quickly event-based trading is becoming mainstream. Polymarket excels as the crypto-native option, offering global access, real-time markets, and full on-chain transparency. Kalshi, by contrast, stands out as the regulated U.S. venue, with fiat deposits, documented settlement rules, and growing institutional integrations, now expanding into on-chain liquidity through Solana-based tokenized contracts.

Neither platform is objectively “better”; the right choice depends on whether you prefer decentralized flexibility or regulated structure. Before trading, users should understand each platform’s fees, liquidity, jurisdictional restrictions, and resolution rules, and remember that prediction markets are high-risk, speculative products that can move sharply around news events. For straightforward crypto exposure, spot or derivatives trading on regulated exchanges like BingX may be more suitable. But if you want to trade your view on real-world outcomes, Polymarket and Kalshi are where this new financial frontier is taking shape.

Related Reading

FAQs on Polymarket vs. Kalshi

1. Is Polymarket better than Kalshi?

Polymarket isn’t universally “better” than Kalshi. It’s better for crypto-native users who want global access, non-custodial wallets, and zero platform trading fees. Kalshi is better for users who prioritize U.S. regulation, fiat rails, and CFTC-supervised event contracts. The right choice depends on your jurisdiction, risk tolerance, and technical comfort.

2. Can U.S. users trade on Polymarket?

Yes, but with nuance. After its 2022 enforcement action, Polymarket blocked direct U.S. users. In October 2025, the CFTC approved Polymarket’s regulated return via intermediated access through brokerages, meaning U.S. users will increasingly trade Polymarket markets through licensed intermediaries rather than connecting wallets directly.

3. Is Kalshi legal in all 50 U.S. states?

Kalshi is federally regulated by the CFTC, and it markets itself as available in all 50 states. However, some states, such as Nevada, argue that certain Kalshi sports contracts fall under state gambling law, leading to ongoing legal disputes and appeals. You should always check the latest terms and local regulations before opening an account.

4. Which platform has lower fees, Kalshi or Polymarket?

Polymarket typically has lower explicit fees because it doesn’t charge platform trading fees. You pay gas and spreads. Kalshi charges per-contract trading and settlement fees, plus some deposit/withdrawal fees, but offers a familiar, fiat-native experience with regulatory oversight.

5. Can I use Polymarket or Kalshi to hedge real-world risks?

Yes. That’s one of the most promising use cases. Businesses and investors can hedge exposure to things like inflation prints, rate cuts, election outcomes, or climate events by taking positions on Kalshi or Polymarket instead of using complex futures or options. However, liquidity, regulatory limits, and basis risk mean these hedges are not perfect.