In 2026, cryptocurrency markets remain highly volatile, operating 24/7 with rapid regime shifts driven by macro events, on-chain activity, and sentiment.

AI-powered trading bots have matured into essential tools that deliver disciplined execution, adaptive strategies, and reduced emotional bias.

These platforms combine machine learning for signal generation or parameter optimization, rule-based automation, and sometimes natural-language interfaces to help traders implement complex workflows like grid trading,

dollar-cost averaging (DCA), arbitrage, and portfolio rebalancing. For example, tools like

BingX Recurring Buy can automate the entire process, letting you buy BTC at regular intervals, starting as low as 1 USDT.

This guide ranks the top 10

AI-powered crypto trading bots based on real-world usability, AI depth, exchange support, s

ecurity, pricing transparency, and user feedback as of early 2026. Rankings prioritize practical value over hype: seamless integration, reliable execution, and features that complement human oversight.

What Are AI-Powered Crypto Trading Bots and What Can They Do?

AI-powered crypto trading bots are sophisticated software platforms that leverage artificial intelligence, machine learning algorithms, and automated rule-based systems to monitor cryptocurrency markets, analyze vast amounts of data in real time, generate

trading signals, and execute orders without constant human intervention.

In 2026, these bots go beyond basic automation by incorporating adaptive features such as natural-language processing for strategy creation (for example, converting English prompts into executable configurations), volatility-aware position sizing, strategy scoring and rotation based on current market regimes, and portfolio-level optimization for risk-adjusted returns. They can handle a wide range of strategies including grid trading for ranging markets,

dollar-cost averaging (DCA) for long-term accumulation, arbitrage across exchanges, market making, trailing stops, and even multi-order workflows with dynamic adjustments.

The primary benefits include enforcing strict discipline to eliminate emotional decision-making, operating continuously in the 24/7 crypto ecosystem, scaling complex strategies consistently, simplifying backtesting and paper

trading to validate ideas before risking capital, and significantly reducing the operational workload for active traders. However, they are not infallible; while they excel at pattern recognition and rapid execution, they rely on historical data and cannot predict black swan events, extreme volatility spikes, or sudden regime shifts, meaning they amplify both good and poor strategies alike.

What Can AI Trading Bots Do for Crypto Traders?

• Run 24/7 without fatigue in non-stop crypto markets.

• Execute disciplined strategies:

DCA, grid trading, martingale, arbitrage, trailing stops, and multi-order workflows.

• Handle complex risk management: dynamic position sizing, drawdown limits, and regime detection.

• Enable backtesting, paper trading, and performance analytics to validate ideas before deploying capital.

• Reduce operational burden for active traders while embedding guardrails against overtrading.

Bots function best as execution engines and decision assistants, not autonomous “set-and-forget” profit machines. Human oversight remains essential.

How Does an AI Crypto Trading Bot Work?

An AI crypto trading bot operates through a continuous, structured feedback loop that transforms raw market data into actionable trades while allowing for ongoing refinement. A typical AI trading bot follows a repeatable loop:

1. Data ingestion: Pulls price feeds, order books, volume, on-chain metrics, funding rates, or external signals.

2. Analysis / Model: Applies technical indicators, statistical models, or ML algorithms to detect patterns, forecast short-term probabilities, or score strategies.

3. Signal generation: Produces clear actions (buy, sell, adjust size) with confidence thresholds and risk parameters.

4. Execution: Places orders via exchange API (market, limit, conditional) while optimizing for slippage and fees.

5. Monitoring: Tracks positions, fills, latency, and market conditions in real time; triggers alerts or auto-adjustments.

6. Feedback: Logs performance and refines parameters or models (in more advanced systems).

Many 2026 bots add natural-language processing, ex., PionexGPT or

BingX AI, so users describe goals and receive ready-to-deploy configurations. The best platforms combine this with strong guardrails: stop-loss enforcement, cooldown periods, and regime-aware switching. Many modern bots in 2026 enhance accessibility with natural-language interfaces that translate user goals directly into bot setups, but the core strength lies in reliable, emotion-free execution rather than prophetic prediction.

What Are the 10 Best AI-Powered Trading Bots for Crypto Traders in 2026?

In 2026, AI-powered crypto trading bots have evolved from simple automation tools into intelligent execution engines that help traders navigate 24/7 volatility with greater speed, discipline, and strategic precision.

1. BingX AI

BingX AI serves as an intelligent assistant that analyzes portfolios, reviews past trades, suggests strategies, and provides real-time insights, eliminating third-party API risks and latency. Built-in grid, infinity grid, and martingale bots enjoy massive adoption (hundreds of thousands of users and over $1 billion in deployed capital). It excels for beginners and intermediates seeking simplicity, speed, and volatility management without subscriptions.

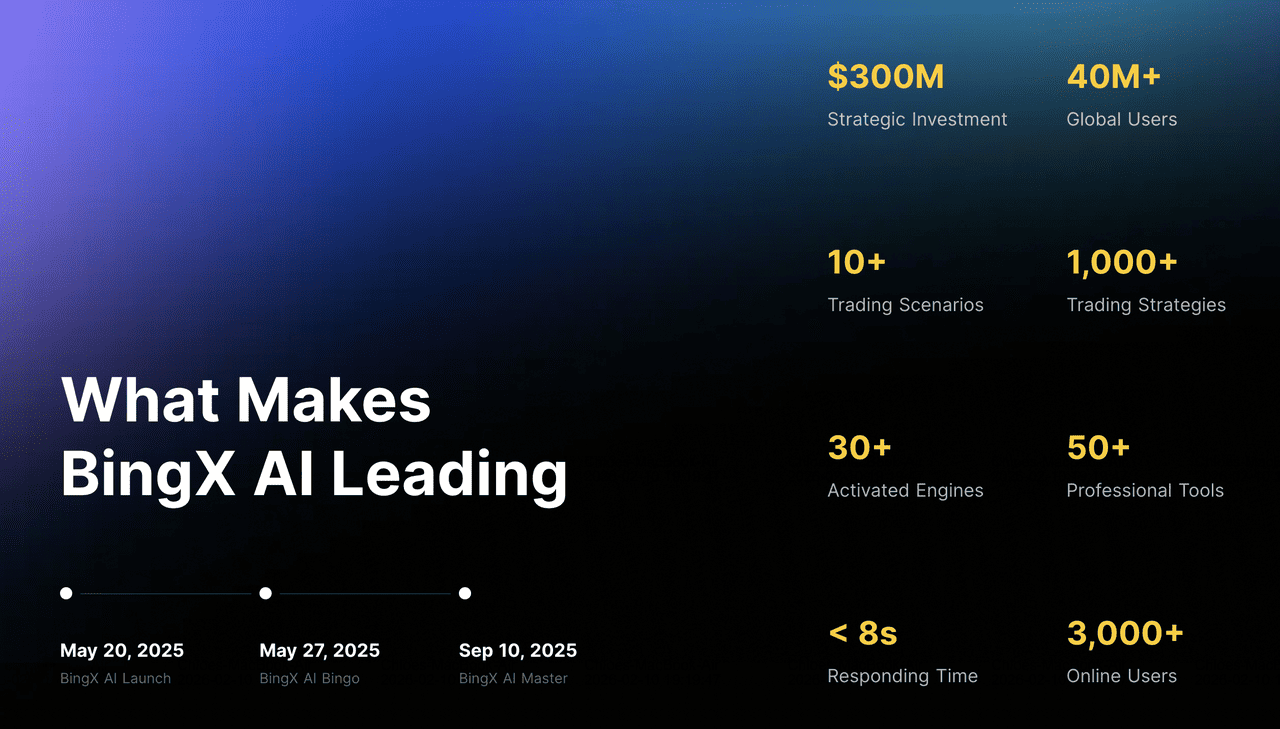

Why it's one of the best: BingX AI stands out for its native, zero-extra-cost integration directly on the BingX exchange. These tools support seamless 24/7 execution with built-in risk controls like stop-loss, take-profit, and leverage limits, making setup fast and accessible. BingX AI excels for beginners and intermediate traders seeking simplicity, speed, low overhead, and effective volatility management in a single, secure platform backed by BingX's broader ecosystem of over 40 million users and a $300 million commitment to AI development for ongoing enhancements.

Supported exchanges: Native to BingX spot and futures; seamless across pairs.

Fee structure: With BingX AI, you pay only standard, highly competitive maker/taker trading fees; there are no additional bot or AI subscription costs.

UX: Exceptionally clean and mobile-first. Guided wizards, visual range selectors for grids, one-click martingale setup, and conversational

BingX AI chat make configuration intuitive. Risk controls (stop-loss, take-profit, leverage limits) are built-in and prominent.

Best for: Traders who want a frictionless, all-in-one exchange-native experience.

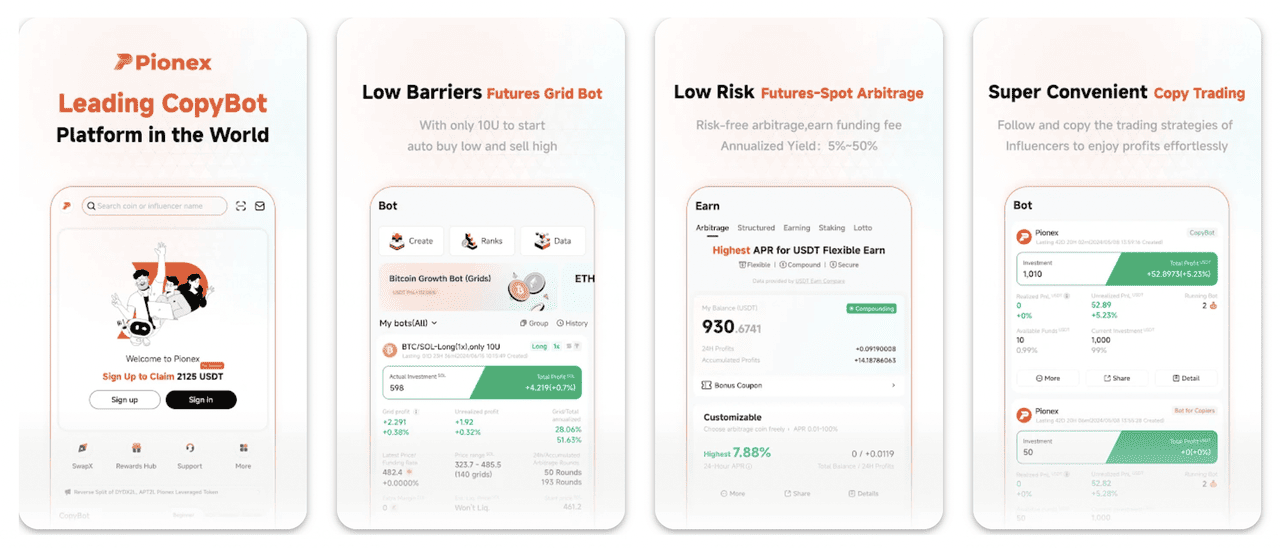

2. Pionex

Pionex is a dedicated crypto exchange with 16+ free built-in bots, including grid,

DCA, infinity grid, leveraged grid, trailing bots, etc. Pionex provides trading bots like Grid Trading Bot, which allows you to securely and automatically trade currencies like

Bitcoin, Ethereum,

Dogecoin and so on. PionexGPT lets users generate strategies via plain-English prompts, dramatically lowering the learning curve. Direct venue execution removes third-party risk and latency.

Supported exchanges: Native to Pionex (spot, margin, futures).

Fee structure: Spot 0.05%, futures competitive (maker/taker around 0.02-0.05%); no bot subscription fees.

UX: Clean dashboard with visual bot selection, real-time statistics, and guided prompts. Excellent for beginners.

Best for: Cost-conscious beginners seeking low-overhead automation.

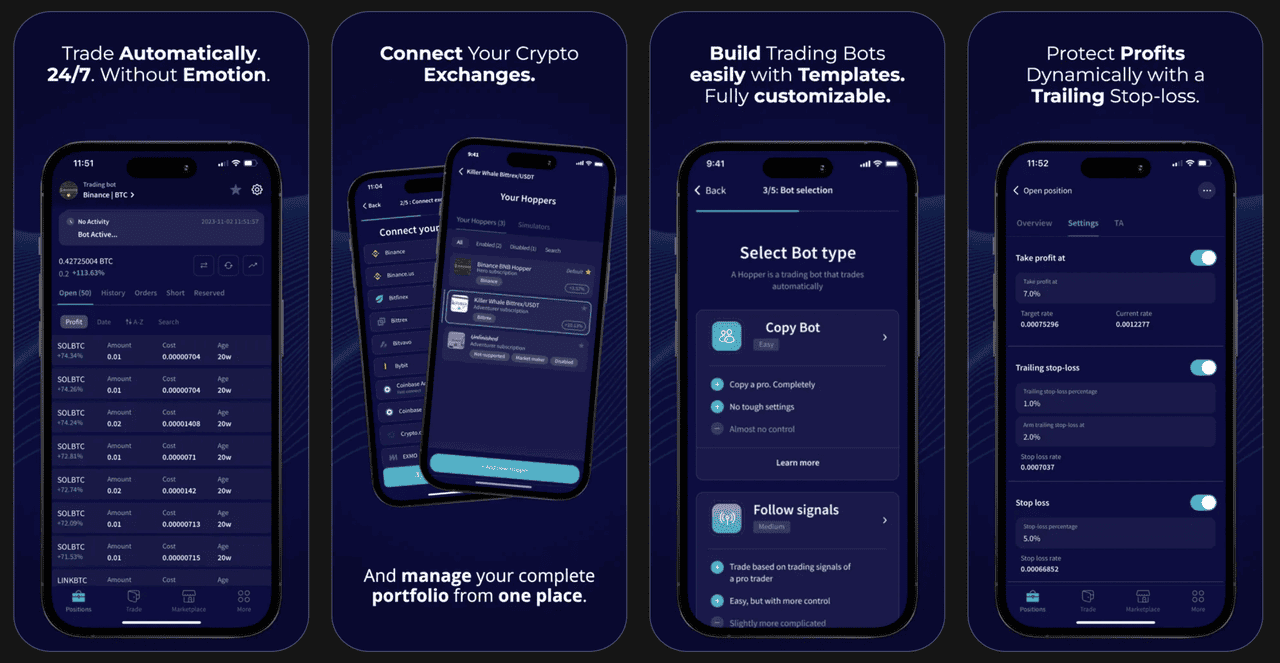

3. CryptoHopper

Strong strategy marketplace,

copy trading, and Algorithm Intelligence that scores and auto-rotates strategies based on market conditions (trend, volatility, volume). Visual Strategy Designer and backtesting tools suit users who like experimenting. Cryptohopper positions itself as an accessible, beginner-friendly crypto trading platform that serves as both an automated trading bot and a portfolio manager, often described as your "pocket hedge fund."

Even without prior trading experience, users can quickly get started by selecting from more than 40 experienced crypto traders to copy-trade, allowing automatic replication of their strategies. The platform emphasizes time-saving automation with 24/7 trade execution, stress reduction through continuous scanning for buy and sell opportunities combined with built-in technical analysis, robust risk management features including

dollar-cost averaging (DCA), stop-loss orders, trailing stops, and trailing features, and effortless portfolio diversification. This combination makes Cryptohopper particularly appealing for newcomers seeking a hands-off yet sophisticated approach to crypto trading while maintaining strong controls over risk and exposure.

Supported exchanges: Binance, Bybit, OKX, Coinbase Advanced, Kraken, KuCoin, and 10+ more.

Fee structure: Free tier available; paid plans from ~$24/month (Explorer) to $107+/month (annual billing).

UX: Cloud-based with intuitive drag-and-drop designer, marketplace browsing, and clear performance dashboards.

Best for: Traders who enjoy strategy switching and community templates.

4. TradeSanta

Straightforward cloud platform focused on template-driven

DCA, grid, and indicator strategies with trailing take-profit. Quick setup and reliable alerts suit users wanting minimal configuration overhead. TradeSanta is a powerful all-in-one platform for automated cryptocurrency trading. Its trading bot runs 24/7, monitoring markets and executing trades so you never miss opportunities.

The free trading terminal unifies multiple exchange accounts (like Binance, OKX, and more) into one easy interface for portfolio management. The mobile app lets you track and adjust bots anytime, anywhere. Use trading signals like

MACD, RSI, Bollinger Bands, or TradingView alerts to trigger precise bot actions. With copy trading, browse and replicate profitable strategies from top traders to boost your performance effortlessly.

Supported exchanges: Binance, OKX, and Kraken

Fee structure: Plans start around $18-$45/month depending on bot count and features.

UX: Simple cloud terminal with rule editors and demo mode; mobile alerts keep monitoring easy.

Best for: Beginners and mid-level traders preferring templates over deep customization.

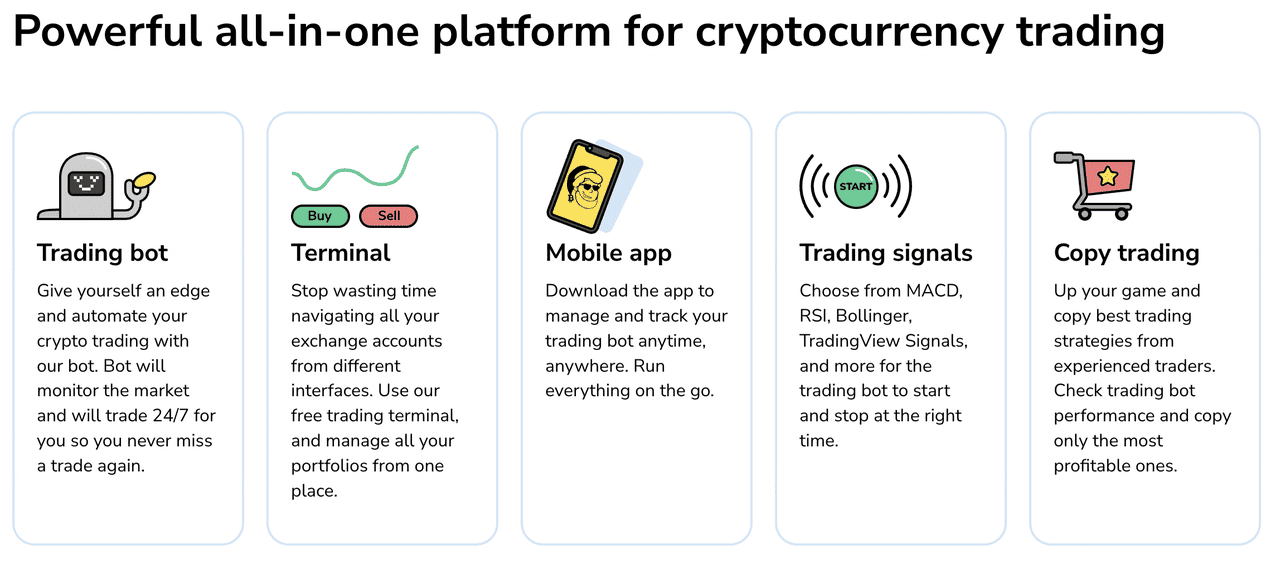

5. 3Commas

Excellent multi-exchange SmartTrade terminal unifies manual and automated workflows.

DCA bots, grid bots, signal routing from TradingView, and AI-driven suggestions in the workspace provide structured yet flexible control.

Supported exchanges: Binance, Bybit, OKX, Coinbase, Kraken, KuCoin, and more.

Fee structure: Starts ~$12-$30/month (Starter/Pro, annual); higher tiers for advanced features.

UX: Professional workspace with centralized order management; paper trading available.

Best for: Active multi-exchange traders who want hands-on oversight.

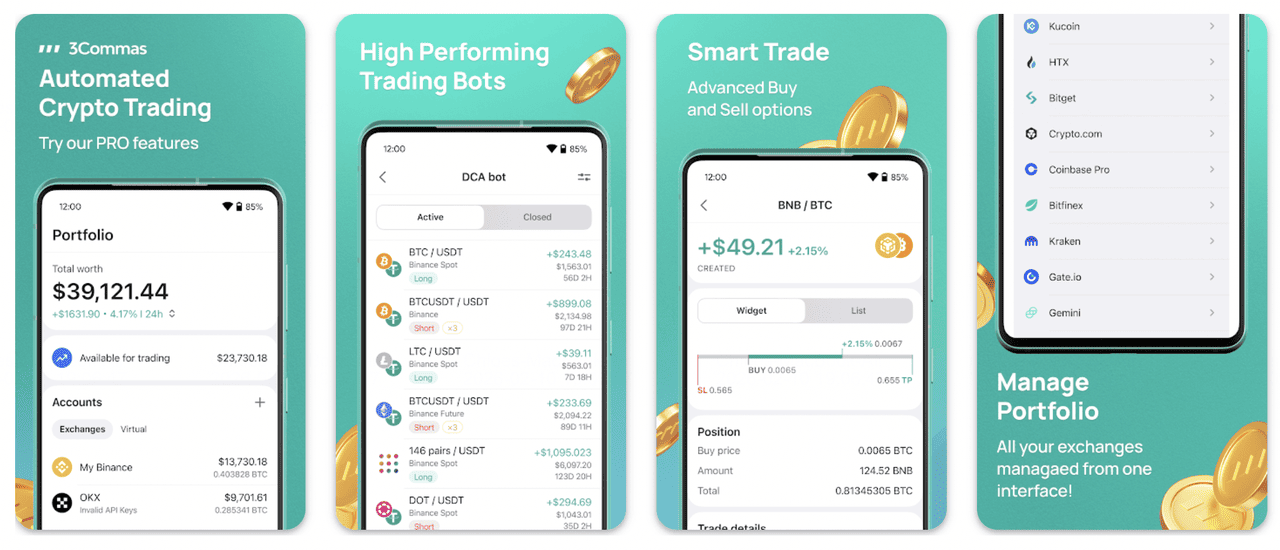

6. Coinrule

No-code “if-then” rule builder with reusable templates and

AI Trading for adaptive optimization. Strong demo exchange and clear risk controls make it accessible yet powerful. Coinrule is a powerful, no-code automated trading platform that empowers users to create trading bots and follow smart investors to seize the next market opportunities across crypto, stocks, and

ETFs.

Start free and automate your strategies effortlessly, build custom bots in minutes using intuitive conditions, powerful indicators, time-based logic, and 350+ pre-built templates to catch pumps, avoid dips, and run 24/7 across more than 20 top exchanges and chains like Binance, Coinbase, Kraken, OKX, Bybit, KuCoin, Bitget, and on-chain networks. With military-grade security and encryption, plus seamless integration for spot and futures trading, Coinrule puts full algorithmic control in your hands without any coding required.

Supported exchanges: Binance, OKX, Bybit, Bitget, Coinbase, Kraken, KuCoin, etc.

Fee structure: Free starter; paid from ~$30/month (Investor) upward.

UX: Visual editor reduces coding friction; templates accelerate onboarding.

Best for: Non-programmers who want rule-based automation with growing AI assistance.

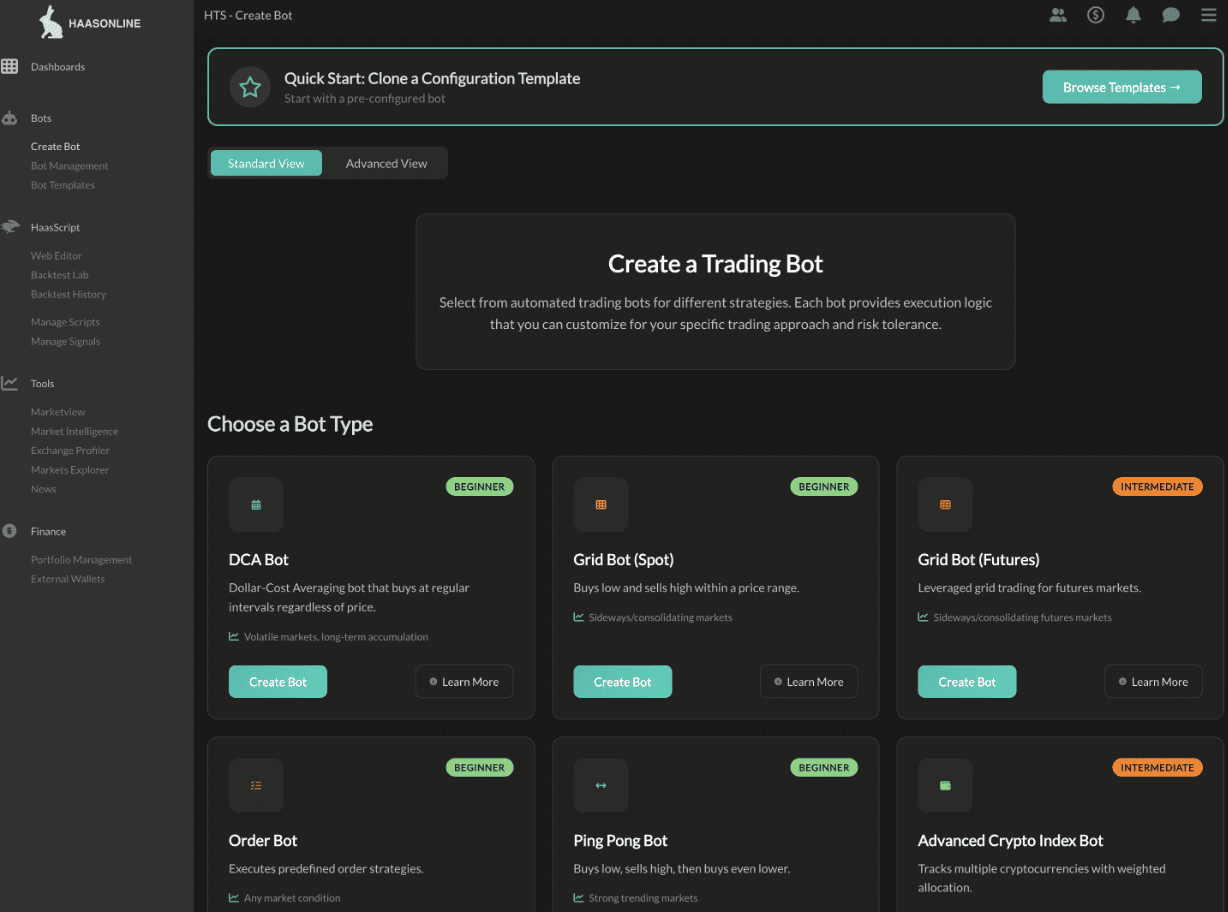

7. HaasOnline

Deepest customization via HaasScript (visual + code editors) for market making, arbitrage, scalping, and proprietary logic. Built-in backtesting and paper trading suit advanced users and developers. Users get instant access to all features, including backtesting, paper trading, and live trading across 20+ exchanges.

Supported exchanges: Binance, Bybit, OKX, Kraken, KuCoin, Bitget, and more.

Fee structure: Plans from ~$17-$125+/month (Starter to Enterprise; some tiers rolling out).

UX: Powerful but steeper learning curve; rewards technical users with full control.

Best for: Advanced traders and quants needing bespoke strategies.

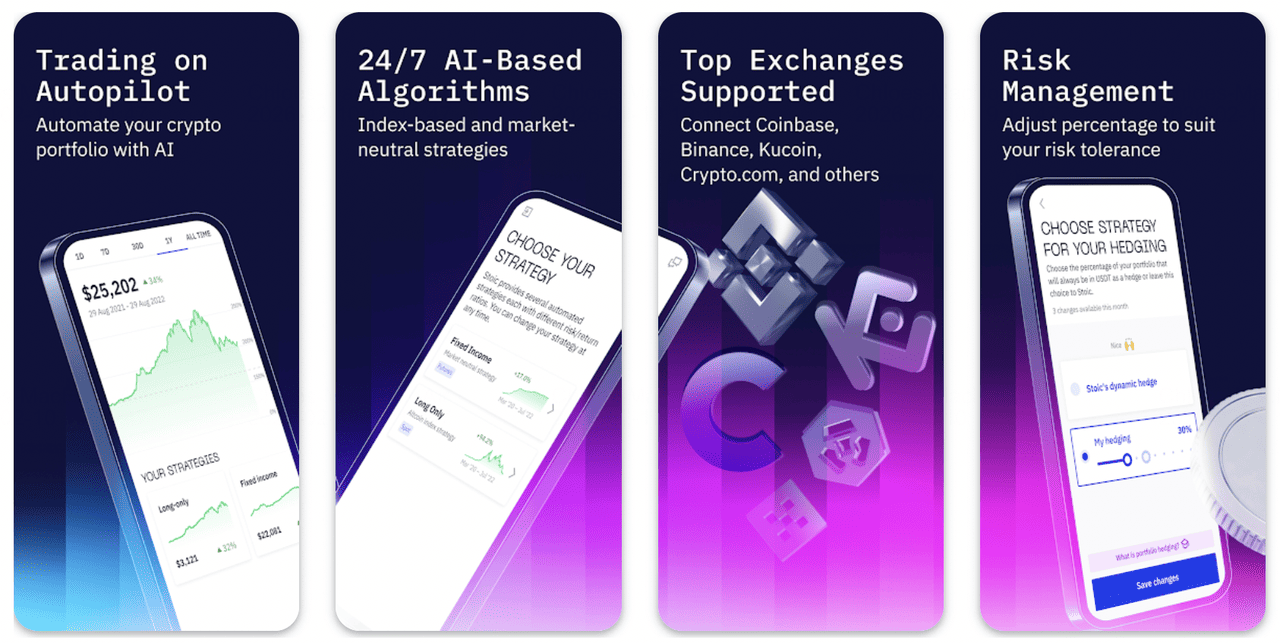

8. Stoic.AI

Institutional-grade quantitative strategies (market-neutral Meta, Fixed Income, Crypto Index, BTC Yield) delivered as true set-and-forget portfolio automation. Non-custodial, rigorously tested models, and multi-year track record make it ideal for hands-off investors. Stoic AI is a fully automated AI-powered crypto trading bot that delivers institutional-grade quantitative strategies with zero setup required.

It securely connects via read-only API keys to major exchanges like Binance, Binance US, Coinbase, KuCoin, Crypto.com, and Bybit, keeping your funds safely in your exchange account. With a

user-friendly app and real-time tracking, Stoic AI offers stress-free, time-efficient trading to maximize returns effortlessly, just connect, select a strategy, and let the bot handle the rest.

Supported exchanges: Binance, Bybit, Coinbase, KuCoin, Crypto.com (via secure API).

Fee structure: Subscription based on AUM or fixed tiers (Starter ~$9-19/month, higher for larger portfolios); minimum ~$1,000.

UX: Extremely simple, choose strategy, connect exchange, enable autopilot. Real-time transparency into every trade.

Best for: Long-term investors seeking professional-grade automation without daily management.

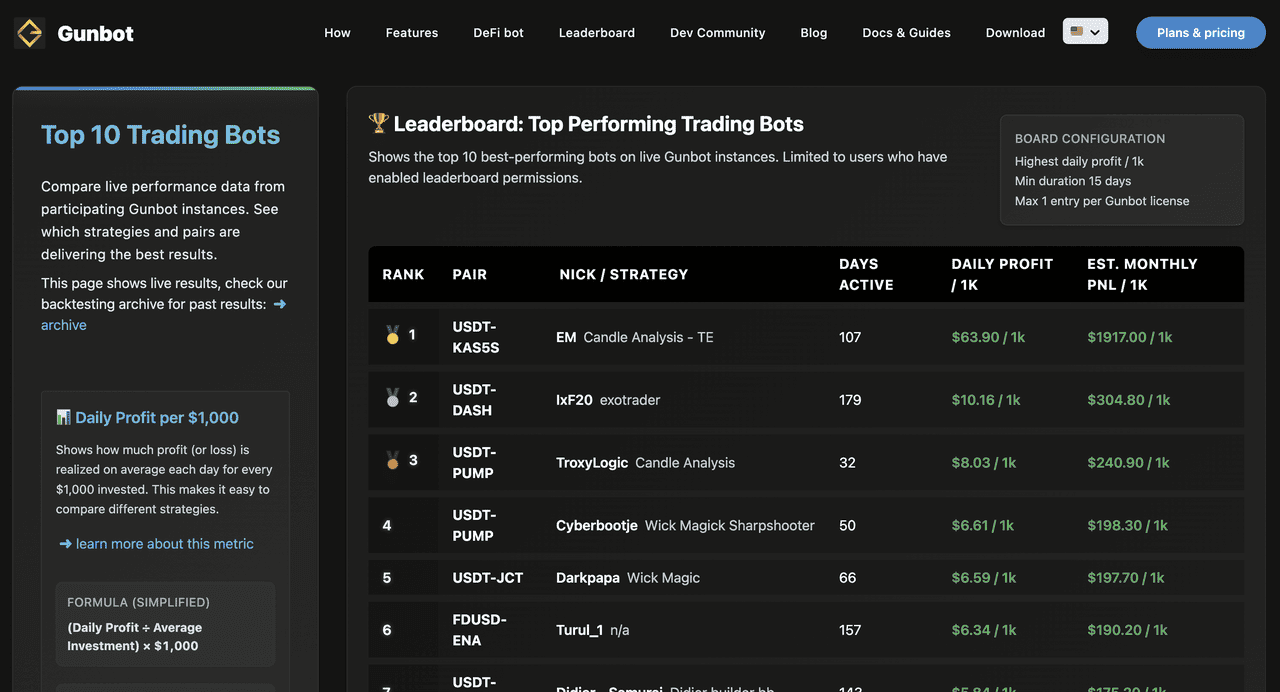

9. GunBot

Privacy-first self-hosted bot with lifetime licensing. 2026's Gunbot AI generates custom strategies from text prompts, while the no-code builder and advanced scripting (including JavaScript) offer unmatched flexibility. Runs locally for maximum control and data security.

Supported exchanges: 20+ (spot and futures, including major CEXs and

DeFi connectors).

Fee structure: One-time lifetime licenses (~$149-$249 depending on edition); no recurring fees.

UX: Desktop app (Windows/macOS/Linux) with visual tools, TradingView integration, and simulator. Requires trading knowledge but rewards power users.

Best for: Privacy-conscious traders who want ownership and customization.

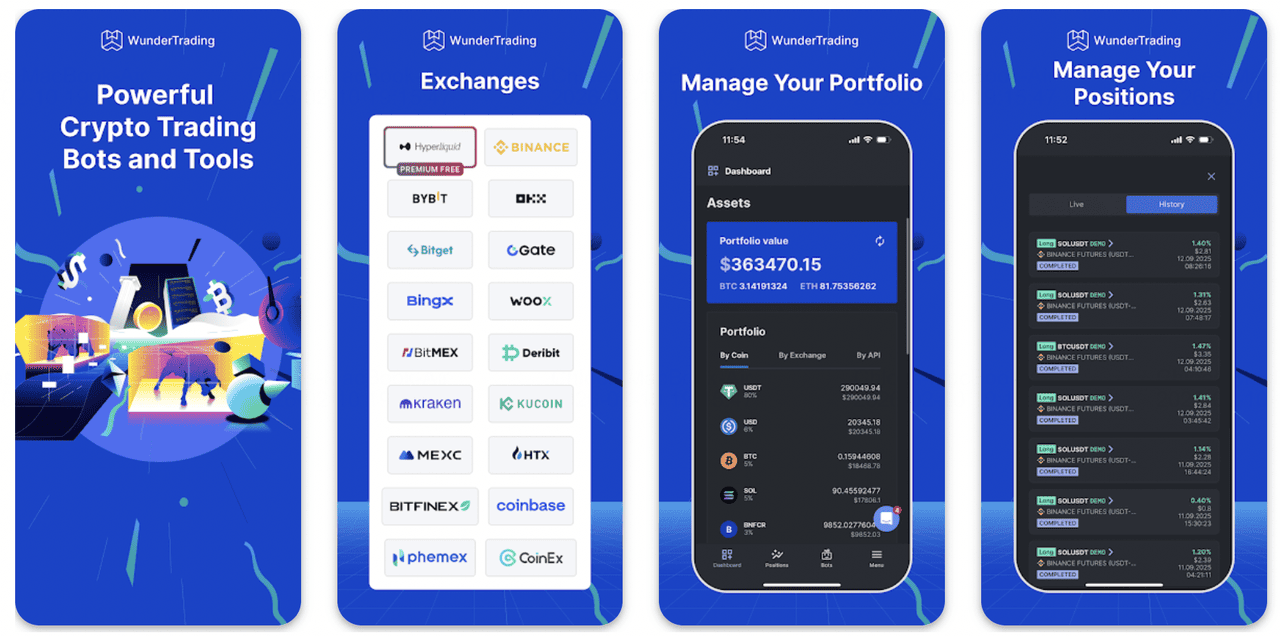

10. WunderTrading

Combines

copy trading (mirror proven traders), AI-enhanced bots (grid,

DCA, arbitrage, market-neutral), and deep TradingView Pine Script integration. Multi-account and multi-exchange management plus affordable tiers make it versatile.

Supported exchanges: 10+ major platforms including Binance, Bybit, OKX, Bitget, etc. (spot, futures, margin).

Fee structure: Free tier; paid from ~$10-$40/month (Basic to Premium, with annual discounts).

UX: Unified terminal with intuitive bot builders, performance analytics, and c

opy-trading controls.

Best for: Traders who blend automation with social/copy elements and want value pricing.

How to Choose the Right AI Trading Bot for the Crypto Market

To choose the right AI-powered crypto trading bot in 2026, focus on aligning the platform with your goals, involvement level, strategy preferences, budget, exchange needs, and risk tolerance while

BingX AI stands out as the top recommendation for most users. Beginners and active traders alike benefit from its seamless native integration on the

BingX exchange, offering guided setup, zero additional subscription fees, powerful built-in grid, infinity grid, and martingale bots, plus an intelligent AI Bingo assistant that analyzes portfolios, suggests strategies, and delivers real-time insights in plain language. Its mobile-first, exceptionally clean UX with visual tools and one-click configurations makes it ideal for simple, low-cost automation on a single reliable venue, eliminating third-party API risks and latency.

Whether you prioritize grid/

DCA strategies, volatility management, or frictionless execution,

BingX provides everything most traders need without the complexity of multi-exchange setups or recurring costs. For security, always use trade-only API keys (never grant withdrawal permissions), enable IP allowlisting where available, rotate keys regularly, start with paper trading or small live positions, and monitor alerts and performance closely. If you want a straightforward, high-adoption, all-in-one solution that combines powerful AI features with simplicity and zero extra fees,

BingX AI is the clear choice to get started safely and effectively.

What to Expect in the BingX AI Ecosystem

• BingX AI Chat: Engage in conversations, offering real-time strategy guidance and context-driven advice to help traders make informed decisions.

• AI News Briefing: Stay ahead with trending news, market shifts, and community sentiment, and give quick insights into the latest developments.

• Trend Forecasting: Combine technical indicators and sentiment analysis, and predict market movements, helping traders act ahead of trends.

• Smart Position Analysis: Evaluate open positions, and give personalized recommendations on risk management and trade adjustments.

• Pro Trader Recommender: Find top traders to follow with its analysis, ensuring traders' strategies align with the goals.

• AI Trade Review: Analyze past trades, reveal patterns, and provide insights to help improve future decisions.

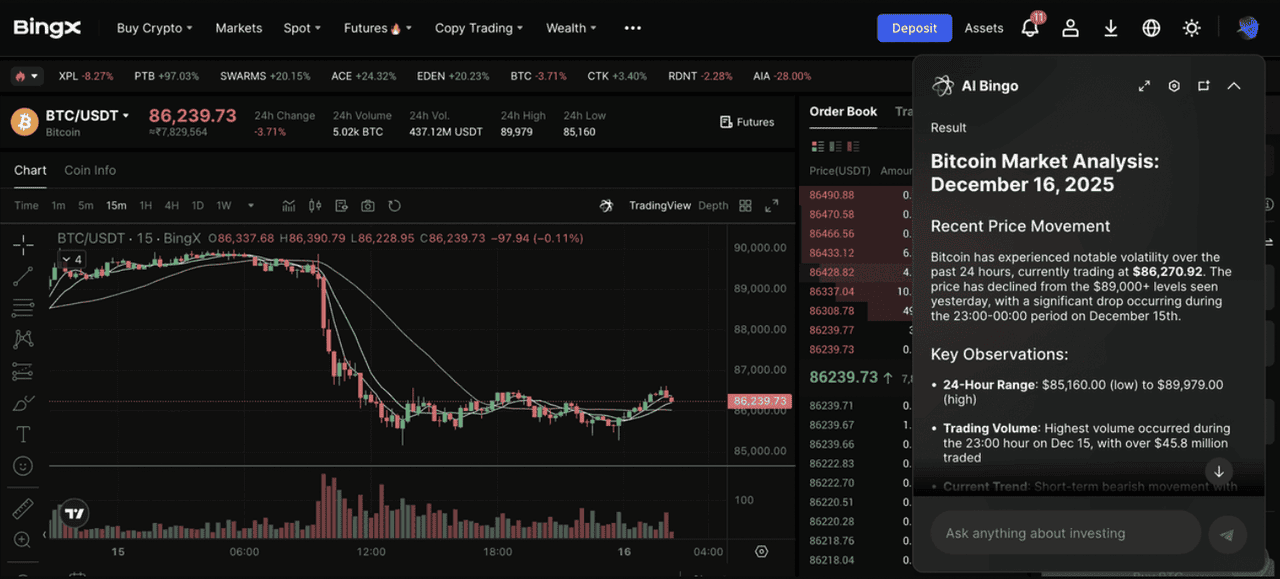

How to Trade Bitcoin (BTC) on the Spot Market with BingX AI

BTC/USDT trading pair on the spot market powered by BingX AI insights

Here’s a simple step-by-step guide to trading Bitcoin (BTC) on the BingX Spot market using BingX AI for smarter insights and disciplined execution.

Step 1: Log in to BingX and go to

Spot, then search for

BTC/USDT trading pair.

Step 2: Decide whether you want to buy instantly (

Market Order) or at a specific level (Limit Order).

Step 3: Use limit orders around major support zones identified by charts or on-chain data, e.g., deep dips into the $60,000–$90,000 region in bearish scenarios.

Step 4: Hold your BTC in your Spot wallet or transfer it to a secure storage method if needed.

Step 5: Review your position periodically and adjust based on

ETF flow trends, macro events, or technical signals.

Conclusion

The best AI-powered crypto trading bot in 2026 is the one that matches your workflow, risk tolerance, and willingness to stay involved. In 2026,

BingX AI stands as the leading AI-powered crypto trading bot, providing seamless native integration on the

BingX exchange with powerful built-in tools for grid trading, infinity grid, and martingale strategies, enhanced by an intelligent BingAI assistant that analyzes portfolios, suggests configurations via natural-language prompts, and offers real-time insights. This approach eliminates third-party API risks and latency while incurring no extra subscription fees beyond competitive trading costs, delivering a clean, mobile-optimized experience with guided setup and robust risk controls.

For traders seeking disciplined, low-friction automation,

BingX AI offers professional-grade functionality suitable for beginners and experienced users alike. AI optimizes execution based on historical patterns but cannot predict future events, so backtest rigorously, paper trade extensively, and deploy small positions; monitor actively during volatility or regime shifts; and maintain strict security with trade-only API keys, IP allowlisting, regular key rotation, and two-factor authentication. Automation amplifies effective strategies while exposing flaws quickly, so pair

BingX AI with disciplined oversight, continuous review, and realistic expectations. Begin with small positions, document each deployment, and treat it as a controlled experiment.

Important disclaimer: No bot guarantees profits. AI excels at pattern recognition and automation but cannot predict black swan events or create an edge from poor strategy design. Always use trade-only API permissions, start small, backtest thoroughly, and maintain active monitoring.

Related Reading