Layer-1 blockchains (L1s) run their own consensus and finalize transactions directly on-chain. In November 2025, the L1 sector sits above $2.96 trillion in total market cap with $145 billion in 24h trading volume, and competition has shifted from theory to real usage, including

stablecoin payments,

gaming,

perps DEXs, creator tools, and app-specific chains. The winners are separating themselves through throughput, fees, decentralization, and developer traction, not just hype.

Below are the 10 most popular L1s you should know this year, with what they do best, where they’re headed, and how to access them on BingX.

What Is a Layer-1 Blockchain (L1) and How Does It Work?

A Layer-1 (L1) blockchain is the base network that records and finalizes transactions on its own chain. Think

Bitcoin,

Ethereum,

Solana,

BNB Chain, or

TRON. Every transfer, swap, or smart-contract call is written into blocks on this mainnet, and you pay fees in the chain’s native coin, such as

BTC,

ETH,

SOL,

BNB, or

TRX. Because L1s run their own security, via miners (Proof-of-Work) or validators (Proof-of-Stake), they’re the ultimate “source of truth” that other layers rely on. For context: Bitcoin targets 10-minute blocks and typical “finality” after 3–6 confirmations, around 30–60 minutes; Ethereum’s Proof-of-Stake confirms blocks in 12 seconds with economic finality within a few minutes; Solana targets sub-second block production with fees usually well under a cent.

Here’s how an L1 transaction works in practice. You create a transaction in a wallet, sign it with your private key, and broadcast it to the network. Nodes check that you have the funds and that the signature is valid. Miners orvalidators compete or are selected to add your transaction to the next block, prioritizing higher fees when the network is busy. Once your transaction is included, the block is appended to the chain; each new block after it makes reversal exponentially harder; more confirmations = higher assurance. You can track all of this on public explorers, e.g., mempool status, fee paid, block height, confirmations.

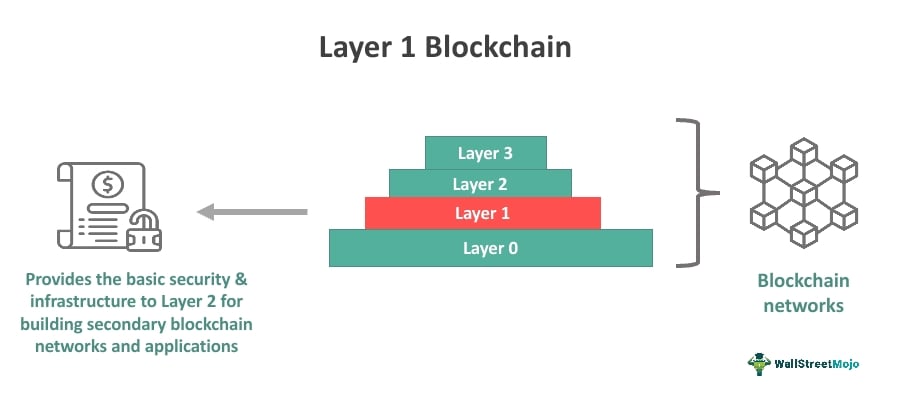

How Does a L1 Blockchain Differ From Layer-2 and Layer-3 Networks?

Layer-1 vs. Layer-2, Layer-3, and Layer-0 | Source: WallStreetMojo

Layer-1 blockchains finalize transactions on their own chain using native miners or validators. They provide the base security guarantees: once a transaction is confirmed on Bitcoin or Ethereum, reversing it becomes economically or cryptographically impractical. But L1 block space is scarce. When traffic spikes, users compete with higher gas fees. For example, Ethereum mainnet has processed 15–30 TPS (transactions per second) historically, and fees can surge during popular mints or token launches. That’s why L1s focus on decentralization and security first, while higher layers handle scale.

Layer-2 and Layer-3 networks offload computation while inheriting security from the L1. L2s like rollups on Ethereum or

Lightning Network on Bitcoin batch hundreds or thousands of transactions, post proofs or settlement data to the L1, and deliver cheaper fees. For instance, popular

Ethereum L2s often process transactions for cents instead of dollars while still settling back to mainnet. Layer-3s go even further, such as custom app chains or encrypted execution layers built on top of L2s, letting games,

DEXs, or

AI apps run ultra-cheap transactions without crowding base layers.

A simple rule of thumb: L1 = security + finality, L2 = scale + lower fees, L3 = specialized performance.

The 10 Best Layer-1 Blockchains of 2025

Here are the 10 Layer-1 blockchains that matter most in 2025, chosen for their real usage, developer traction, ecosystem growth, and clear technical advantages.

1. Bitcoin (BTC)

Bitcoin remains the most secure Layer-1 in crypto, built for censorship-resistant money and high-assurance settlement. Its Proof-of-Work network has never been hacked, and large transfers continue to settle directly on-chain while smaller payments move to Lightning. Markets still treat BTC as “digital gold.” Bitcoin dominance sets liquidity, risk appetite, and often leads broader crypto cycles. In 2025,

Bitcoin DeFi (BTCFi) is finally real: total value locked jumped from $304 million on Jan 1, 2024 to over $7.1 billion as of November, driven by tokenized BTC, lending, yield, and restaking on

Stacks,

Rootstock, and Botanix.

Institutional capital is accelerating this shift. Stacks hit its 5,000 sBTC bridge cap in under 2.5 hours, and Rootstock hit all-time-highs in TVL and active addresses as users borrow stablecoins or generate yield on BTC. Stablecoins are the unlock;

USDT is launching on Lightning via

Taproot Assets, and Rootstock just added USDT0, giving Bitcoin a native stable asset to trade and lend. The challenge: a survey shows 77% of BTC holders have never used BTCFi, signaling UX and trust gaps. Still, between real yields, safer bridges like BitVM2/3, and institutional demand for Bitcoin-backed credit, analysts expect BTCFi adoption to keep growing as holders look to use, and not just store, Bitcoin.

2. Ethereum (ETH)

Ethereum remains the home base for DeFi and tokenization, and the 2025 numbers prove it. After moving to Proof-of-Stake and cutting energy use by 99.95%, ecosystem activity hit new all-time highs across daily transactions, active wallets, and contract interactions. As of November 2025,

Ethereum DeFi holds $81.7 billion TVL with $4.3 billion in 24h DEX volume, the deepest liquidity in crypto. The overlooked metric: $165 billion in

Ethereum-based stablecoins, a reserve pool larger than the FX holdings of countries like Singapore and India, showing Ethereum now functions as a global settlement layer for digital dollars.

Most of that growth is powered by Layer-2 rollups like

Arbitrum,

Optimism,

Base, and zk-rollups processing millions of transactions per day with sub-dollar fees, while still settling back to Ethereum for finality and security. On-chain data shows large wallets accumulating ETH and stablecoins, signaling a shift toward Ethereum as a macro-level asset. With upgrades like EIP-4844 lowering rollup costs and increasing throughput, more activity keeps migrating on-chain. In short: Bitcoin is digital gold; Ethereum is becoming digital economic infrastructure, powering stablecoins, credit markets, tokenization, and billions in daily user transactions.

3. Solana (SOL)

Solana is engineered for high-throughput consumer apps and on-chain trading, using Proof-of-History, a single-shard design, and local fee markets to keep transactions fast and cheap. The data in 2025 shows the demand: DeFi TVL climbed to $11.5 billion in November 2025, while daily spot DEX volumes hover around $4–$5.1 billion, and stablecoin supply hit an all-time high of $14–15 billion, with

USDC alone accounting for around $10 billion. Apps are monetizing activity better too; Solana’s App Revenue Capture Ratio reached 263%, meaning for every $100 in fees paid on-chain, apps generated $263 in revenue. Alpenglow upgrades aim to improve finality and fee smoothness during congestion, keeping Solana attractive for high-velocity traders and memecoin launches.

Reliability has improved versus past outage cycles, and the network is cementing itself as the home of fast consumer crypto. Perp DEX volume averaged $1.6 billion/day, around 67% of SOL is staked, and

LSTs (liquid staking tokens) like jitoSOL and bnSOL continue to grow. Outside DeFi, Solana is gaining mainstream use:

Helium Mobile in

DePIN has 1.3 million daily users,

RWAs reached $682 million,

xStocks passed 70,000 holders, and

Phantom introduced CASH for seamless spending. With stronger performance, deeper liquidity, and mobile-first distribution via

Solana Mobile Seeker, Solana remains a top Layer-1 for trading, payments, and consumer apps in 2025.

4. BNB Chain (BNB)

BNB Chain continues to dominate retail on-chain activity thanks to EVM compatibility and ultra-low fees. During peak memecoin trading on Oct 7, 2025,

BNB DEXs processed $6.05 billion in 24h volume, with

PancakeSwap near $4.29 billion. As of November 2025, daily active addresses hit 3.46 million, annual actives approached 200 million, and DeFi TVL rebounded to $7.9 billion, showing users are returning for cheap swaps, yield, and gaming. Dashboards also show BNB Chain repeatedly challenging other L1s on daily fees and app revenue as retail liquidity rotates into its ecosystem.

Investor confidence strengthened after

President Trump pardoned CZ, removing a long-standing reputational drag. Institutions followed: Nasdaq-listed CEA Industries raised $500M to accumulate

BNB as a treasury reserve asset, and YZi Labs launched a $1 billion Builder Fund to back BNB Chain startups with regulatory-compliant infrastructure. With record usage, rising liquidity, and fresh capital flowing into developer tooling, BNB Chain remains one of 2025’s most active and retail-heavy Layer-1 networks.

5. TRON (TRX)

TRON matters in 2025 because it has become crypto’s stablecoin highway. TRC-20 USDT supply sits above $80 billion, and multiple trackers confirm TRON handles the largest share of Tether in circulation. That shows up in usage: 2.6–6.2 million daily active addresses, 65% of global retail USDT transfers of less than$1,000, and 74% of wallets transacting peer-to-peer. A major fee cut in August 2025 lowered average daily fees from $1.9 million to $1.2 million, reinforcing TRON as a cheap settlement layer for remittances, exchanges, and emerging-market payments.

Behind the payments layer, the ecosystem is still expanding. DeFi TVL has climbed toward $6 billion, SunSwap volumes rose 18%, and new integrations such as

LayerZero,

PayPal USD,

NEAR Intents, and

MetaMask support deepen liquidity and bridge access. TRX markets handled $82 billion in Q3 trading volume with strong order-book depth and $4.5 million in positive value capture, showing TRON generates revenue beyond emissions. In short: it’s the most widely used chain for stablecoin payments, and that real usage keeps TRON relevant in 2025 even when market sentiment is cautious.

6. Hyperliquid (HYPE)

Hyperliquid matters in 2025 because it’s a purpose-built L1 for derivatives that pairs an on-chain order book with ~0.2s blocks and low-latency matching, turning it into the busiest decentralized perps venue with 60–70% DEX-perps share, with over $2 billion TVL and $600–700 million in 24h DEX volume. The economics are powerful; recent months show $100 million+ protocol revenue/month with 97% of fees recycled to users, while HyperEVM opens EVM apps to the same liquidity and HIP-3 lets any team stake 1M HYPE to launch new perp markets, sharing fees back to

HYPE.

Institutional signals are building, e.g., an SEC filing for a Hyperliquid ETF; SPAC/treasury plans to accumulate HYPE, even as critics flag validator concentration (dozens of validators vs. thousands on major L1s) and upcoming unlocks as key risks. Net: high throughput, tangible cash flows, and rapid product iteration, such as staking, buybacks, permissionless markets, make Hyperliquid a top on-chain trading hub, provided decentralization and issuance overhang are managed.

7. Zcash (ZEC)

Zcash’s 2025 story is measurable progress toward mainstream-ready private payments. Around 20–25% of circulating ZEC now sits in shielded addresses, and 30% of transactions touch the shielded pool, with the Orchard pool surpassing 4.1 million ZEC, evidence that privacy usage is no longer niche.

UX and rails are catching up: Zashi adds swaps/off-ramps and NEAR Intents support (ephemeral addresses, reduced reuse), while the network transitions full nodes from zcashd to the Rust zebrad client for performance and maintainability; throughput is a roadmap focus via Project Tachyon. Marketwise, ZEC has briefly flipped

Monero by market cap peaking at $7.2 billion amid rising volumes, helped by Zcash’s optional privacy model that can satisfy audits/compliance when needed, positioning it as a pragmatic bet on encrypted payments.

8. Sui (SUI)

Sui (SUI) is emerging as a high-performance Layer-1 built for consumer-scale apps, with its object-centric Move architecture enabling parallel execution and low-latency throughput. DeFi traction is now measurable: Sui’s TVL hit an all-time high of $2.6 billion, up 37% in a month and 160% in a year, while cumulative DEX volume surpassed $156 billion, making it a top-six chain by 24-hour trading volume.

Core protocols like Suilend with $745 million TVL, Navi with $723 million, and

Momentum with $551 million TVL , up 249% MoM, show deepening liquidity, and Sui’s native CLOB,

DeepBook, continues iterating toward easier order-book app deployment via V3 SDKs. Institutional confidence is rising too: Nasdaq-listed Mill City Ventures deployed $441M into a Sui treasury strategy managed by Galaxy, while consumer-facing projects like EVE Frontier are migrating to Sui, reinforcing its positioning as a throughput-optimized L1 competing directly for DeFi and gaming user bases.

9. Avalanche (AVAX)

Avalanche (AVAX) continues to differentiate itself in 2025 through Subnets, application-specific blockchains with custom fees, validators, and VM logic that still plug into Avalanche’s tooling and liquidity. It’s quietly working: daily active addresses on the C-Chain climbed from 200,000 to 481,000 in November 2025, while gaming-focused subnets like Beam have held 22,000 active users for months.

Institutional confidence is rising as well: a Nasdaq-listed firm is building a $1 billion

AVAX treasury, running validators and staking to support network growth. With $1.68 billion in DeFi TVL, over $300 million in daily DEX volume, and corporations and governments using Avalanche infra for stablecoins and asset tokenization, Subnets remain one of crypto’s most pragmatic paths to high-TPS, regulated, and enterprise-grade blockchain deployments.

10. Plasma (XPL)

Plasma (XPL) is a stablecoin-centric L1 built for payments at scale: zero-fee USDT transfers via a Paymaster model, EVM compatibility for swift dApp ports, and PoS staking with XPL for security and governance. Since the mainnet + XPL launch in late Sept 2025, Plasma has attracted $3.83 billion DeFi TVL and about $44.8 million in 24h DEX volume, helped by an airdrop-first, open distribution and a Binance partnership that lets ~280M users route deposits directly into Aave.

The roadmap leans into real-world usage, Plasma One neobanking targets Turkey, Brazil, and Argentina, while a Tether-aligned strategy doubles down on USDT’s distribution to drive network effects. The pitch is ambitious (Visa-scale settlement) but coherent: concentrate on stablecoin throughput, remove gas frictions for simple transfers, and use XPL staking + ecosystem incentives to lock in liquidity and builders, positioning Plasma for the next leg of trillions-in-stablecoin commerce.

How to Trade Layer-1 Tokens on BingX

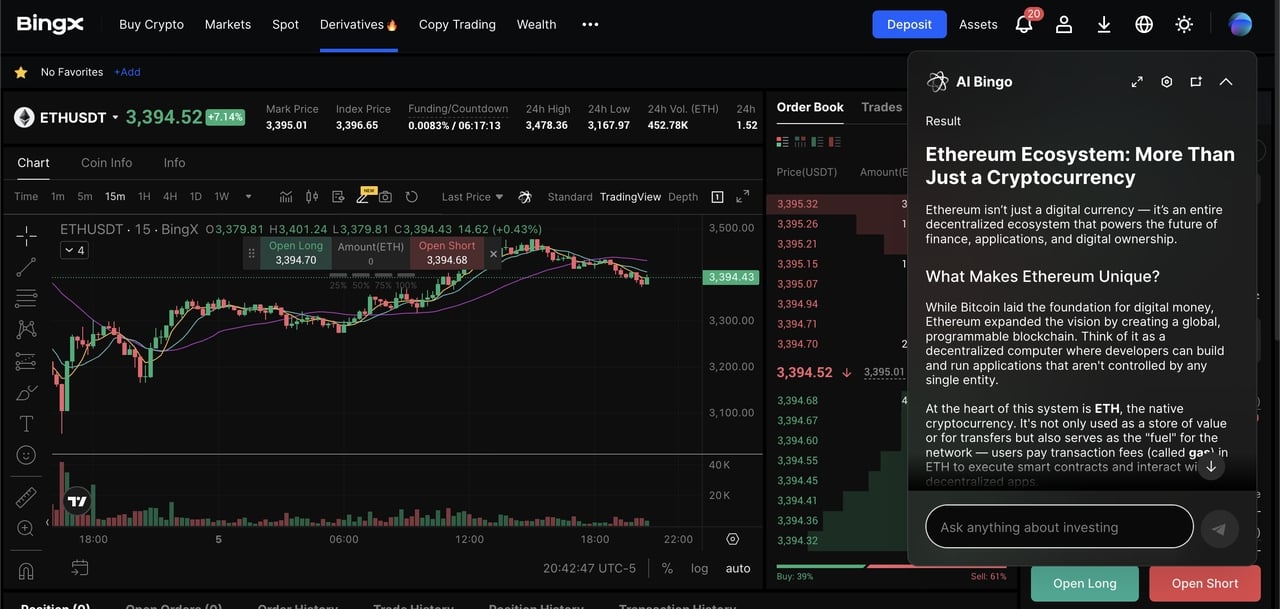

BingX lets you access major Layer-1 tokens through both Spot (buy/hold) and Futures (long/short with leverage) markets with real-time BingX AI trade insights.

BingX AI makes it easier for beginners to analyze volatility, spot trends, and manage risk while trading major L1 tokens.

Spot Trading to Buy, Hold, or Dollar-Cost Average L1 Tokens

2. Tap the AI icon to view momentum signals, support/resistance hints, and volatility alerts before placing a trade.

3. Choose a

Market Order for instant execution, or a Limit Order if you want to buy at a specific price.

4. For long-term investing, use Spot Grid or

DCA (dollar-cost averaging) tools on BingX to automate periodic buys and reduce timing risk.

Futures Trading to Long or Short L1 Coins With Leverage

2. Turn on BingX AI for real-time signals; AI highlights trend strength, funding rate changes, and liquidation clusters.

3. Set leverage responsibly (e.g., start with 2–5x on volatile assets), then add

Stop-Loss and Take-Profit before opening a position.

4. Monitor

funding fees and margin levels; liquidations happen fast on high-volatility L1 assets.

Security tip: Always double-check official tickers, start small on newer L1s where validator decentralization and token unlock schedules may increase risk, and use BingX AI to stay ahead of sudden volatility.

Closing Thoughts

Layer-1s are converging on different edges of the same blockchain trilemma of security, scalability, and usability. In 2025, Bitcoin anchors the macro bid, Ethereum secures the programmable economy, Solana, Sui, and Hyperliquid push real-time UX, BNB Chain keeps retail flows cheap, TRON moves dollars at scale, Zcash normalizes private settlement, Avalanche lets apps roll their own chains, and Litecoin remains a low-friction settlement rail with optional privacy.

As always, verify claims through primary sources, monitor token unlocks and network health, and size positions carefully; L1 cycles are volatile, and past performance does not guarantee future returns.

Related Reading

FAQs on L1 Blockchain Networks

1. What is the difference between L1 and L2 blockchains?

Layer-1 blockchains finalize transactions on their own base chain. Layer-2s run transactions off-chain (or on separate execution layers) and settle back to the L1 for security, boosting throughput and lowering fees.

2. Which L1 network is best for payments right now?

For stablecoin transfers at scale, TRON leads global USDT volume and address activity in 2025. For censorship-resistant settlement and high-assurance finality, Bitcoin remains the primary base layer.

3. Which L1 focuses on privacy by default?

Zcash, where shielded addresses, Zashi tooling, and the zebrad full-node migration increased private usage in 2025, with a rising share of transactions touching the shielded pool.

4. Which L1s emphasize performance for order-book trading?

Solana (consumer throughput), Sui (DeepBook CLOB), and Hyperliquid (perps-first L1) all target low-latency execution with different architectures and validator trade-offs.

5. Which L1 is best for app-specific blockchains?

Avalanche via Subnets, where developers can launch custom Layer-1s with their own fees, validator sets, and virtual machines.