Bitcoin mining in 2026 is no longer about simply plugging in hardware and waiting for rewards. After the

2024 halving reduced block rewards to 3.125 BTC, profitability now depends on tight cost control, hardware efficiency, and

Bitcoin’s market price.

This guide explains whether Bitcoin mining is still profitable in 2026, what actually determines mining returns today, and how to calculate BTC mining profitability step by step. It also helps you compare mining against simply buying and holding Bitcoin, so you can make a rational decision instead of relying on outdated narratives.

What Is Bitcoin Mining Profitability and How Is It Measured?

Bitcoin mining profitability refers to how much money you actually earn from mining Bitcoin after subtracting all costs, mainly electricity and hardware expenses. It answers a simple but critical question: Are you making more money than you are spending to mine BTC?

In 2026, profitability is no longer about how many machines you own. It’s about efficiency, power cost, and accurate calculations.

How to Measure Bitcoin's Mining Profitability

Bitcoin mining profitability is measured in net profit, not revenue.

• Revenue = the value of Bitcoin you mine

• Profit = revenue minus costs

If your miner earns $25 worth of BTC per day but costs $30 per day to run, you are losing money, even though you are “earning Bitcoin.”

How to Calculate BTC Mining Profitability

The most practical formula used by Bitcoin miners is:

Daily Profit = (Daily BTC Earned × BTC Price) − Daily Electricity Cost

This formula focuses on what actually matters day to day.

How Daily BTC Earnings Are Determined

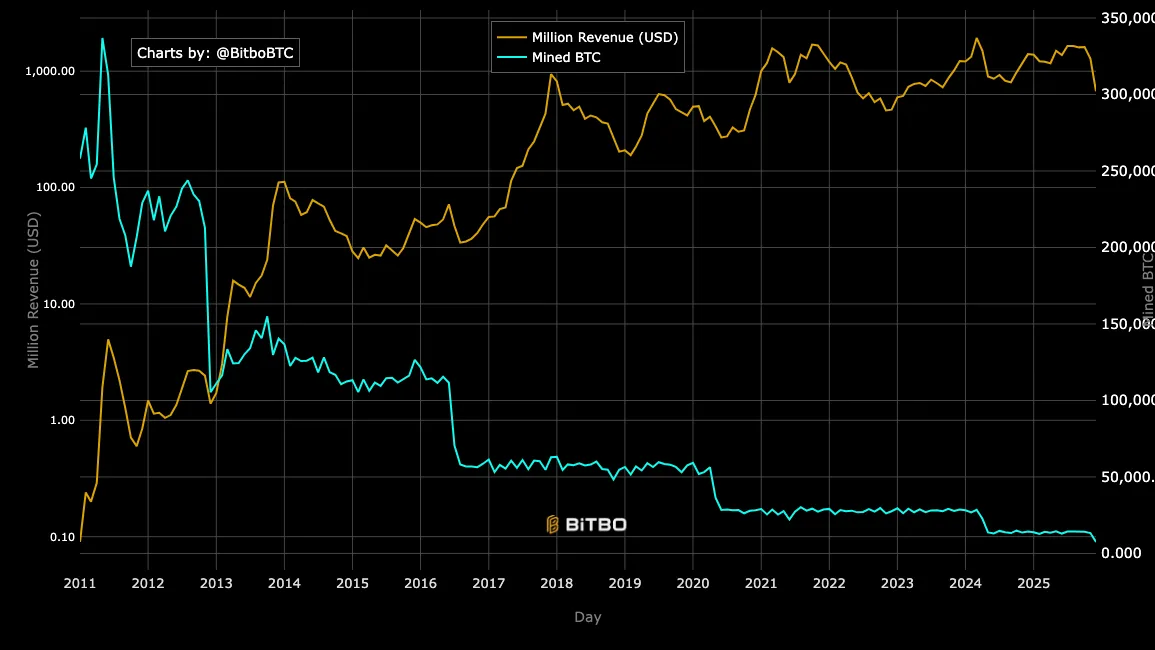

Bitcoin hashrate vs. price | Source: Bitbo

Your daily BTC earnings depend on three network-level variables:

1. Your hashrate, e.g., 110 TH/s

2. Total network hashrate

3. Block reward of 3.125 BTC after the 2024 halving

In simplified terms:

Daily BTC Earned = Your Share of Network Hashrate × BTC Issued Per Day

Bitcoin issues 3.125 BTC per block for around 144 blocks per day, which works out to around 450 BTC daily.

What Factors Determine Bitcoin Mining Profitability in 2026?

Bitcoin mining profitability depends on five core variables. Ignoring even one can completely distort your calculations.

1. Bitcoin Block Reward: The current reward is 3.125 BTC per block, paid roughly every 10 minutes. This value is fixed until the next halving and sets the upper limit on network-wide mining revenue.

2. Bitcoin Price: BTC price directly multiplies mining revenue. A $10,000 change in BTC price can be the difference between profit and loss for many miners.

3. Electricity Cost: Electricity is the single biggest ongoing expense.

• Below $0.06/kWh: strong profitability potential

• $0.06–$0.08/kWh: moderate margins

• Above $0.10/kWh: high risk of losses

This is why most profitable miners operate near hydroelectric, geothermal, or subsidized energy sources.

4. ASIC Hardware Efficiency: Modern ASICs measure efficiency in joules per terahash (J/TH).

• Competitive in 2026: ≤20 J/TH

• Older hardware (>30 J/TH): often unprofitable

High hashrate alone is not enough, hashrate per watt matters more.

5. Network Difficulty and Hashrate: As more miners join the network, Bitcoin automatically increases difficulty. This reduces the BTC earned per unit of hashrate, even if prices rise.

Is Bitcoin Mining Still Profitable in 2026?

Bitcoin miner revenue | Source: Bitbo

Yes, Bitcoin mining is still profitable in 2026, but only under clearly defined conditions.

As of 2026, Bitcoin mining profitability is determined less by luck and more by power cost, hardware efficiency, and scale. After the 2024 BTC halving reduced the block reward to 3.125 BTC, the network now distributes roughly 450 BTC per day across all miners. With global network hashrate at record highs, each miner’s share of this fixed daily issuance is increasingly small.

Mining remains economically viable primarily for operators who meet three measurable thresholds:

1. Electricity cost below $0.08 per kWh: At $0.05–$0.06/kWh, efficient ASIC miners can still generate $12–$25 in net daily profit per unit, depending on BTC price and difficulty. Once electricity rises above $0.10/kWh, margins compress sharply, and many setups fall to break-even or negative cash flow unless BTC prices surge.

2. High-efficiency ASIC hardware (≤20 J/TH): Modern miners achieving 15–20 joules per terahash can withstand higher difficulty and lower block rewards. Older ASICs operating above 30 J/TH often fail to cover electricity costs in average residential power markets, even during favorable price conditions.

3. Consistent uptime via mining pools: Nearly 99% of individual miners now rely on mining pools. Pool participation converts extremely volatile solo-mining outcomes into predictable daily payouts, typically at the cost of a 1–2.5% pool fee, which is far less damaging than prolonged zero-reward periods.

For most individual miners using residential electricity, profitability is highly sensitive to power pricing. At electricity rates above $0.10/kWh, a standard 3–3.5 kW ASIC may spend $7–$12 per day on power alone, which can consume more than 40–60% of daily mining revenue at current difficulty levels.

As a result, Bitcoin mining in 2026 behaves less like a

passive income activity and more like an energy arbitrage business. Profits depend on converting low-cost electricity into Bitcoin more efficiently than the global average. Without access to cheap power or efficient hardware, simply buying and holding BTC often delivers a superior risk-adjusted outcome.

How Did the 2024 Bitcoin Halving Impact Bitcoin Miner Profits?

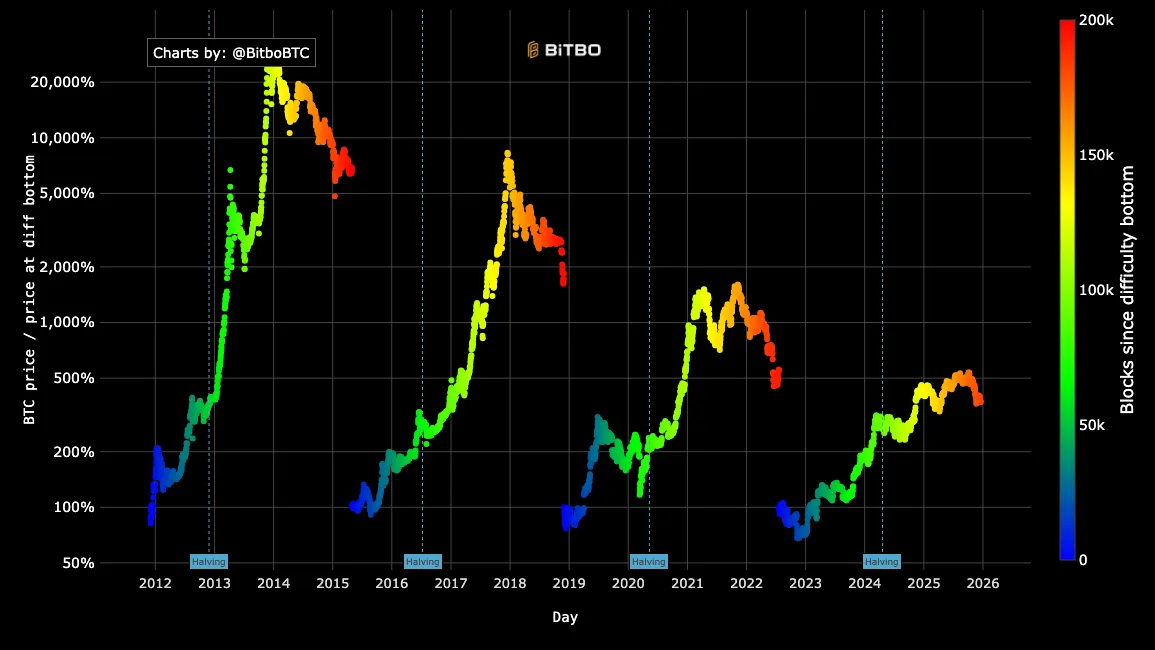

BTC miner capitulation after halving events | Source: Bitbo

The April 2024 Bitcoin halving fundamentally reset mining economics. It did not “kill” mining, but it permanently raised the bar for profitability by cutting issuance while competition continued to grow.

Here’s what changed, numerically and structurally.

1. Block rewards were cut by 50% overnight: Before April 2024, miners earned 6.25 BTC per block; after the halving, rewards dropped to 3.125 BTC per block. This immediately reduced daily Bitcoin issuance from about 900 BTC to ~450 BTC, meaning every miner earned 50% less BTC for the same electricity and hardware costs.

2. Revenue pressure increased despite higher BTC prices: Although Bitcoin’s price rose after the halving, mining revenue per terahash did not double. Rising network hashrate, higher difficulty, and the influx of more efficient ASICs absorbed much of the price upside, keeping USD revenue per TH/s capped, especially for miners with average or high power costs.

3. Network difficulty reached new highs: Higher BTC prices attracted fresh capital, allowing large operators to deploy next-gen ASICs (≤20 J/TH), immersion-cooled farms, and sub-$0.06/kWh power contracts. This pushed difficulty steadily upward, reducing BTC earned per unit of hashrate and steadily shrinking the share of rewards for miners who failed to upgrade.

4. Efficiency became the deciding factor: Before the halving, inefficient hardware could still survive during strong price rallies; after the halving, that buffer disappeared. In 2026, efficient ASICs (15–20 J/TH) can remain profitable at $0.06–$0.08/kWh, while older units (>30 J/TH) often turn unprofitable above $0.08–$0.10/kWh, making power cost and energy efficiency more important than raw hashrate.

The fourth Bitcoin halving in April 2024 shifted BTC mining from a scale-driven race to an efficiency-driven business, where cost per BTC mined matters more than BTC price alone. Large mining farms dominate not because they are bigger, but because they secure cheaper electricity and deploy more efficient hardware, allowing them to mine at a lower marginal cost. Even during price rallies, miners who fail to optimize power costs or upgrade aging ASICs are gradually pushed out, making Bitcoin mining in 2026 less about producing more hashpower and more about running a high-efficiency energy operation.

How to Calculate Bitcoin Mining Profits in 2026: Step-by-Step Guide

To understand whether mining makes sense for you, you need to calculate net profit, not just revenue.

Basic Bitcoin Mining Profitability Formula

Daily Profit = (BTC Earned per Day × BTC Price) − Daily Electricity Cost

A more detailed version:

Daily Profit = (Your Hashrate ÷ Network Hashrate) × (Block Reward × BTC Price) − Electricity Cost

Let’s walk through a realistic scenario using common assumptions.

Example: ASIC Miner in 2026

This example assumes a modern ASIC miner delivering 110 TH/s of hashrate with a power consumption of 3,250 W, operating in a market where Bitcoin is priced at $60,000 and electricity costs are $0.10 per kWh, illustrating how hardware efficiency and power pricing directly influence mining profitability.

Step 1: Calculate Daily Electricity Cost

• Convert watts to kilowatts: 3,250 W ÷ 1,000 = 3.25 kW

• Daily energy usage: 3.25 kW × 24 hours = 78 kWh/day

• Daily electricity cost: 78 × $0.10 = $7.80/day

Step 2: Estimate Daily BTC Earnings

Based on current difficulty and hashrate share:

• Estimated BTC earned: ~0.00038 BTC/day

Revenue in USD: 0.00038 × $60,000 = $22.80/day

Step 3: Calculate Net Daily Profit

$22.80 − $7.80 = $15.00/day

If electricity rises to $0.15/kWh, profit drops to near break-even. This illustrates why electricity pricing is the decisive factor in 2026.

How to Calculate ROI and Break-Even Time

Mining profitability also depends on how long it takes to recover your initial investment.

ROI Formula

Break-Even Time = Hardware Cost ÷ Daily Net Profit

This example assumes an ASIC miner priced at $5,000 generating $15 in daily profit, resulting in an estimated break-even period of around 333 days. In practice, this calculation is highly sensitive to changes in Bitcoin price, mining difficulty, electricity costs, and network competition, meaning actual break-even timelines can be significantly longer or shorter than projected.

Mining Pools vs. Solo Mining in 2026

Solo mining offers full block rewards but comes with an extremely low probability of success, highly volatile income, and long periods with no payouts, making it unrealistic for most individual miners. As network hashrate continues to rise, the chances of a solo miner finding a block in 2026 are minimal without industrial-scale resources.

Mining pools combine the hashrate of many miners and distribute rewards proportionally, resulting in smaller but more consistent payouts. While pools charge fees, typically between 1% and 2.5%, they significantly reduce income variance. As a result, nearly all individual miners in 2026 rely on mining pools to achieve predictable cash flow and manageable risk.

Is Bitcoin Mining Better Than Buying BTC in 2026?

For many users, buying and holding Bitcoin is often more efficient than mining. Mining may make sense if:

1. You have access to cheap electricity

2. You can deploy efficient ASICs

3. You want operational exposure to mining

Buying BTC directly may be better if:

1. Electricity is expensive

2. You want price exposure without operational risk

3. You prefer liquidity and simplicity

Mining adds complexity, capital risk, and ongoing costs that

buying BTC does not.

How to Buy and Trade Bitcoin (BTC) on BingX

BTC/USDT trading pair on the spot market powered by BingX AI insights

Buying and trading Bitcoin on BingX is simple and beginner-friendly. Start by creating and verifying your BingX account, then fund it using

crypto deposits,

P2P trading, or supported fiat on-ramps, depending on your region. Once your account is funded, go to the

Spot Market, search for the

BTC/USDT trading pair, and place a

market order for instant execution or a limit order to buy Bitcoin at your preferred price.

BingX also supports multiple trading styles for Bitcoin. You can trade BTC on the spot market, use

futures trading to go long or short with leverage, or automate your strategy using

BingX trading bots. For long-term investors, BingX offers

Recurring Buy (DCA), allowing you to invest in Bitcoin at fixed intervals to reduce market timing risk. After purchasing BTC, you can store it securely on BingX or withdraw it to a personal wallet at any time.

Key Risks of Bitcoin Mining in 2026

Before committing capital, consider these risks carefully:

1. Rising network difficulty

2. BTC price volatility

3. Hardware obsolescence

4. Regulatory restrictions

5. Cooling and maintenance failures

6. Overestimating long-term profitability

Mining rewards are not guaranteed and must be recalculated frequently as conditions change.

Final Verdict: Is Bitcoin Mining Worth It in 2026?

Bitcoin mining in 2026 can still be profitable, but only for operators with strict cost control and a long-term mindset. Success depends on access to low-cost electricity, high-efficiency hardware, accurate profitability modeling, and disciplined operational management. Mining is no longer driven by scale alone; it is driven by efficiency, energy economics, and margins.

For most individuals, Bitcoin mining is not an easy entry point into earning BTC. It is a capital-intensive and energy-dependent business with exposure to price volatility, difficulty adjustments, regulatory changes, and hardware obsolescence. For those unwilling or unable to manage these risks, buying or trading Bitcoin directly on platforms like BingX may offer a simpler and more flexible way to gain exposure; though all crypto investments still carry market risk and no returns are guaranteed.

Related Reading