Crypto moves quickly, and its sharp price swings make it difficult for anyone to know the right moment to buy. Even long-term investors find it hard to stay calm when the market jumps or drops without warning. In such volatile conditions, timing the market becomes one of the most common challenges for both beginners and experienced crypto investors.

Dollar cost averaging offers a simpler way to approach long term investing. Instead of trying to predict every short-term move, you invest a fixed dollar amount at regular intervals. These recurring purchases help you build your crypto portfolio through rising and falling markets while reducing emotional decisions.

For beginners entering the crypto world, DCA provides a steady and disciplined investing strategy. It lets you grow your crypto holdings over time without worrying about catching every high or low, making the fast-moving market easier to navigate.

What Is Dollar Cost Averaging in Crypto?

Dollar cost averaging is an

investment strategy where you buy a crypto asset using a fixed dollar amount on a regular schedule. Instead of investing a lump sum all at once, you spread your purchases across different market conditions. Each recurring buy happens at the market price, which means you accumulate more units when prices drop and fewer units when the market rises.

This routine removes the pressure of timing the market. You don’t need to predict tops or bottoms in volatile markets because your average purchase price adjusts naturally over time. For beginner and long term investors, DCA offers a simple way to manage price fluctuations, stay consistent with investment goals, and build positions in established crypto assets with confidence.

How Dollar Cost Averaging Works: Step by Step

DCA follows a clear routine that helps you invest through volatile markets without timing every move. You choose a fixed dollar amount, pick a crypto asset like

BTC or

ETH, and buy at regular intervals such as weekly or monthly.

Here’s a simple example. If you invest $50 each week in

Bitcoin, every buy happens at the market price. If Bitcoin falls from $100,000 to $90,000, your $50 buys more units at the lower level. If it rises to $105,000, the same $50 buys fewer units. Over time, these recurring purchases create a balanced average purchase price and reduce the impact of large price swings.

A simple structure to follow

• Pick a fixed dollar amount

• Choose your crypto asset

• Set a consistent schedule

This approach helps long term investors build a portfolio steadily without worrying about catching exact highs or lows.

DCA vs. Lump Sum Investing: Which Strategy Fits You?

DCA and lump sum investing both aim to grow your crypto portfolio, but they work differently depending on market conditions. Lump sum investing means putting all your money into a crypto asset at once. This approach often performs well during strong bull markets. For example, if you invested $1,000 in BTC at the start of a rally, the entire amount benefits immediately from rising prices.

DCA spreads your purchases across multiple intervals instead of entering at a single moment. This approach is useful in volatile markets and

bear markets, where prices move sharply and timing becomes difficult. Investing gradually helps reduce the risk of buying at a short-term peak and smooths out price fluctuations over time.

A quick comparison:

• Lump sum performs better when markets trend strongly upward

• DCA offers stability when price swings are unpredictable

Lump sum can outperform DCA in certain periods, but DCA provides a consistent routine and helps beginners stay disciplined without relying on perfect timing.

How To Start DCA in Crypto on BingX

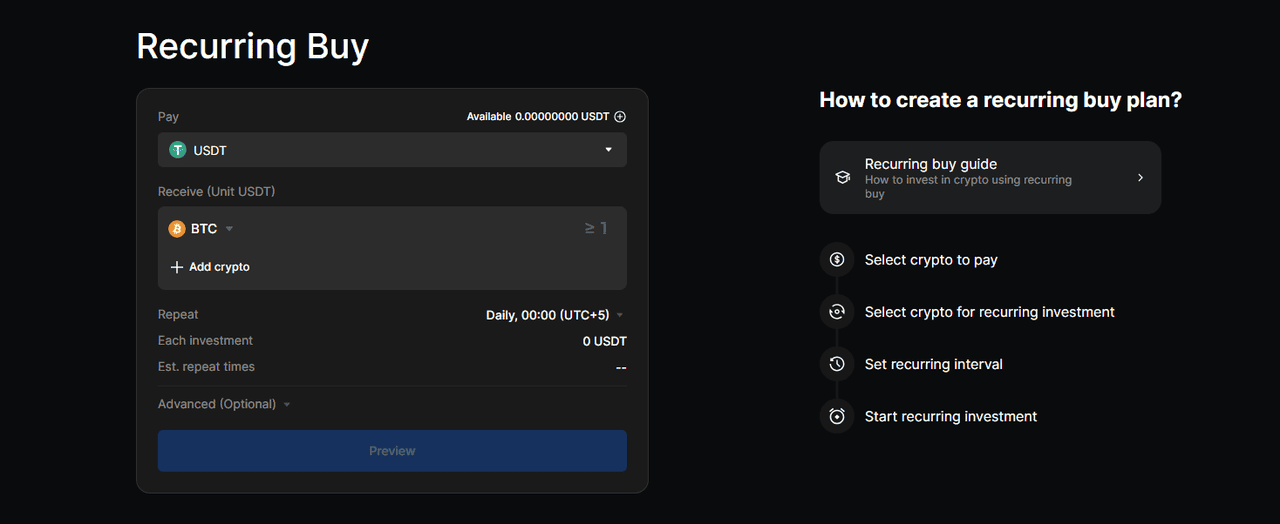

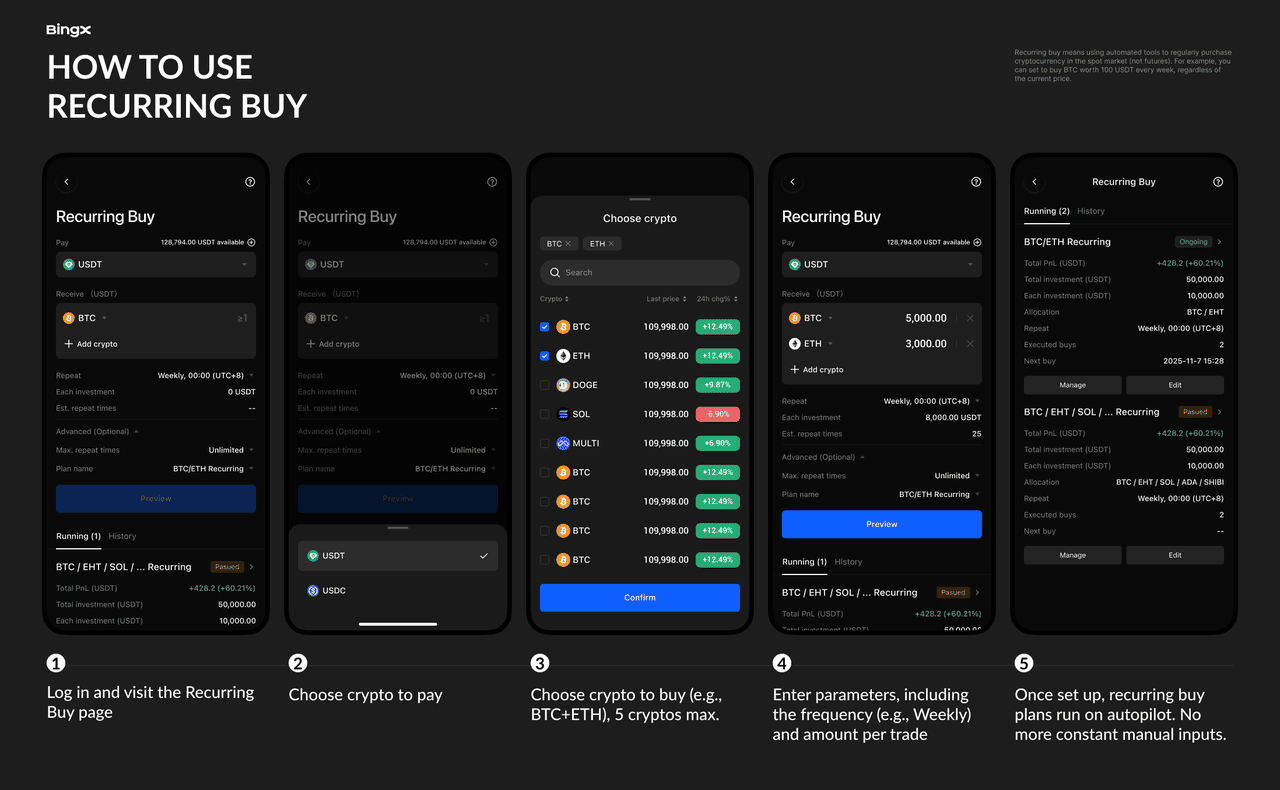

The easiest way to start Dollar Cost Averaging in crypto is to follow a simple routine and use tools that automate your recurring purchases. On BingX, the most beginner-friendly option is

Recurring Buy, which lets you invest fixed amounts on a schedule without looking at the market.

1. Recurring Buy Strategy on BingX: How It Works

The

Recurring Buy strategy lets beginners invest in crypto automatically by purchasing a fixed amount at regular intervals. Instead of trying to guess the perfect entry, you set a schedule such as weekly or monthly, choose an amount that fits your budget, and BingX executes each order at the market price.

This approach helps smooth out price volatility because you naturally buy more during dips and fewer units when prices rise.

For example, if you invest $20 each week in BTC, BingX Recurring Buy continues accumulating Bitcoin for you even when the market swings sharply. There’s no need to monitor charts or react to short-term moves. This strategy suits long-term investors who want steady growth, simple automation, and a hands-off way to build their crypto portfolio.

How to Implement DCA Using BingX Recurring Buy

• Open the Recurring Buy feature on the BingX app or website

• Select your crypto asset, for example BTC or ETH

• Enter your fixed dollar amount

• Choose a schedule such as daily, weekly, or monthly

• Confirm and let the plan run automatically

This tool buys at market price, collecting more during dips and fewer during rallies. It automates your plan, removes emotion, and keeps long-term investing consistent and manageable.

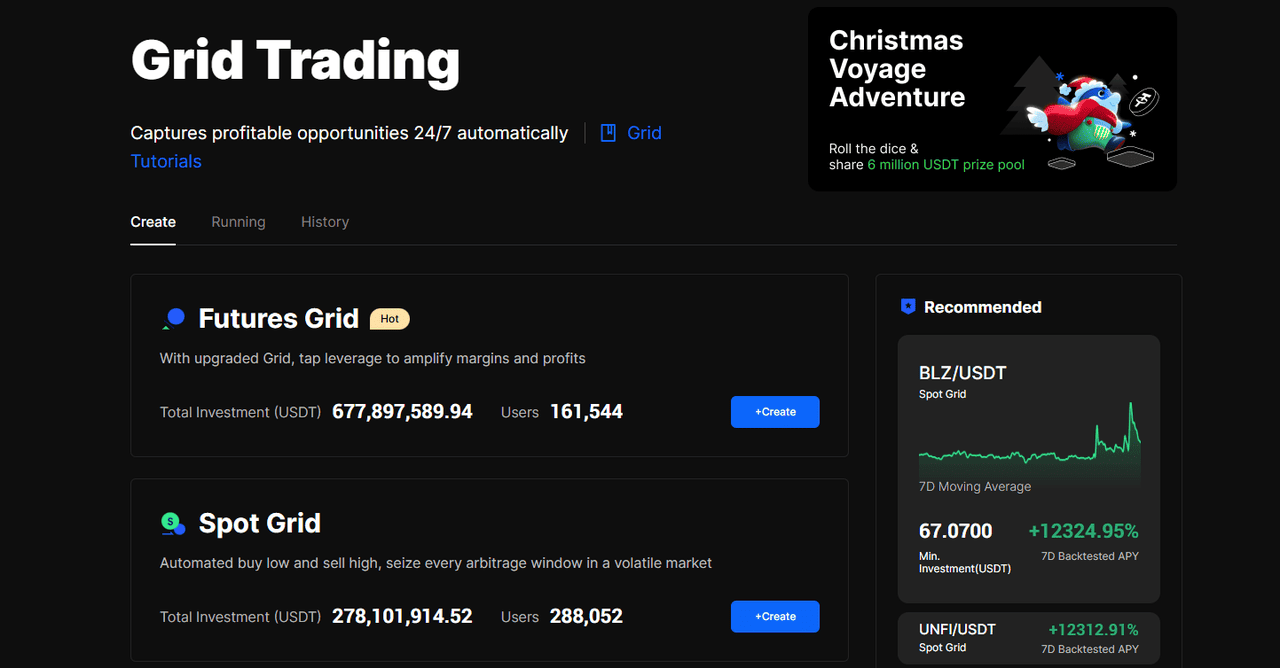

2. How to Use Spot Grid Trading for DCA-Style Accumulation on BingX

Spot Grid Trading can support a DCA-style strategy by helping you accumulate more crypto during price dips. While the grid bot is designed to buy low and sell high, you can adjust its settings so the focus shifts toward accumulation rather than frequent selling. This makes it a useful addition to a long-term DCA plan.

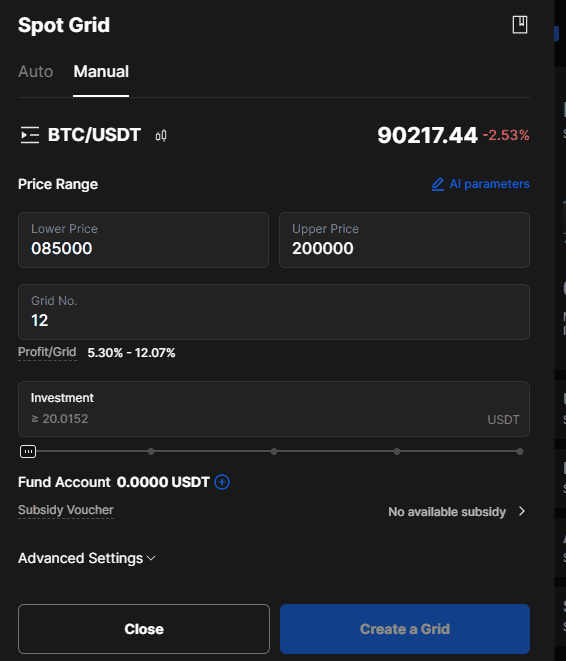

Step 1: Open Spot Grid Trading

Go to Grid Trading on the BingX app or website and select

Spot or Futures Grid. Let's say we are considering spot grid. It uses your spot balance with no leverage, which keeps the strategy beginner-friendly and suitable for long-term holding.

Step 2: Select Your Asset and Set a Wide Price Range

Choose a stable asset such as

BTCUSDT or

ETHUSDT. To make the bot behave more like a DCA tool, set a wide price range.

• Set a very high upper price so the bot does not sell too often

• Set a lower price level where you want to accumulate more if the market dips

For example, if BTC trades near $100,000, you might set a range from $85,000 to $200,000. This structure keeps most activity on the lower side of the range, helping you buy more during declines.

Step 3: Choose a Low Number of Grids

Use a small number of grids, such as 6 to 12. Fewer grids reduce unnecessary selling and create cleaner buy levels, similar to DCA tranches. This keeps the strategy focused on accumulating when prices fall, rather than trading too frequently.

Step 4: Set Your Investment Amount and Start the Bot

Enter your investment amount and activate the strategy. The bot will begin buying larger quantities as the price moves toward the lower grid levels, helping reduce your average cost over time. For example, if you place $300 across 10 grids, the bot will buy more BTC at $92,000, more at $90,000, and even more at $88,000. This creates a natural averaging effect similar to DCA.

Spot Grid Complements Recurring Buy

Spot Grid is not a replacement for scheduled DCA.

• Recurring Buy collects crypto at fixed time intervals

• Spot Grid collects extra units through price volatility

Using both can strengthen long-term accumulation by combining time-based buying with volatility-based buying. This helps smooth out your entry price while maintaining a consistent investment routine.

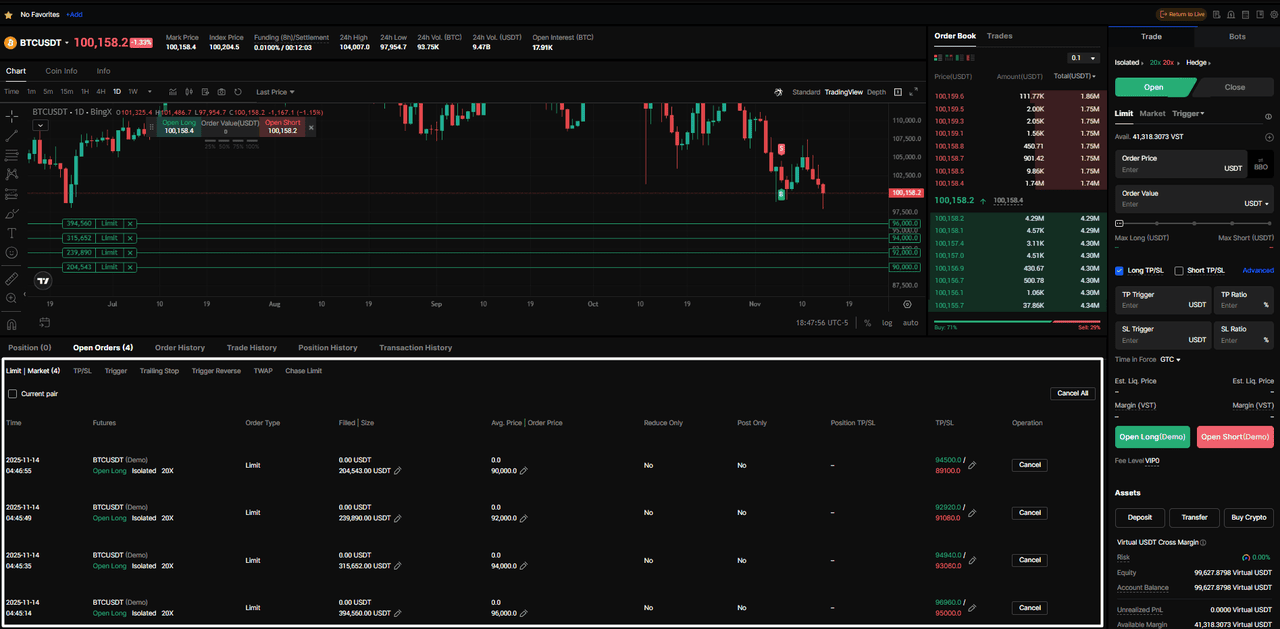

3. How to Use Manual Buy-Limit Orders for Custom DCA Levels

Some investors prefer more control over their DCA plan. Instead of relying only on automated tools like Recurring Buy or Spot Grid, you can set multiple buy-limit orders at different price levels. This creates a personalised DCA ladder that automatically buys more when the market dips into your target zones.

Step 1: Choose Your Asset and Budget

Decide how much you want to invest and which asset you want to accumulate, such as BTC or ETH. Divide your total amount into several smaller portions. Example: If your total budget is $500, you might split it into five $100 orders.

Step 2: Identify Your Price Levels

Pick the levels where you want to buy more. These can be round numbers, support areas, or simple percentage drops. For example, if BTC trades at $100,000, you might place buy-limit orders at:

• $96,000, $94,000, $92,000 and $90,000

Bitcoin (BTC/USD) Price Chart - Source:

BingX

Each order executes only if the market falls to that level, giving you a structured way to accumulate in dips.

Step 3: Place Multiple Buy-Limit Orders on BingX

On the BingX Spot trading page:

• Enter your chosen price

• Set the amount for that level

• Click Buy

• Repeat for each price level

These orders now sit in the order book, waiting for the price to reach them. You don’t need to monitor the market constantly; the system fills each order automatically.

Step 4: Review and Adjust as the Market Moves

If the market never touches your lower levels, you can adjust your orders upward. If it dips sharply, several orders may fill at once, reducing your average entry cost significantly.

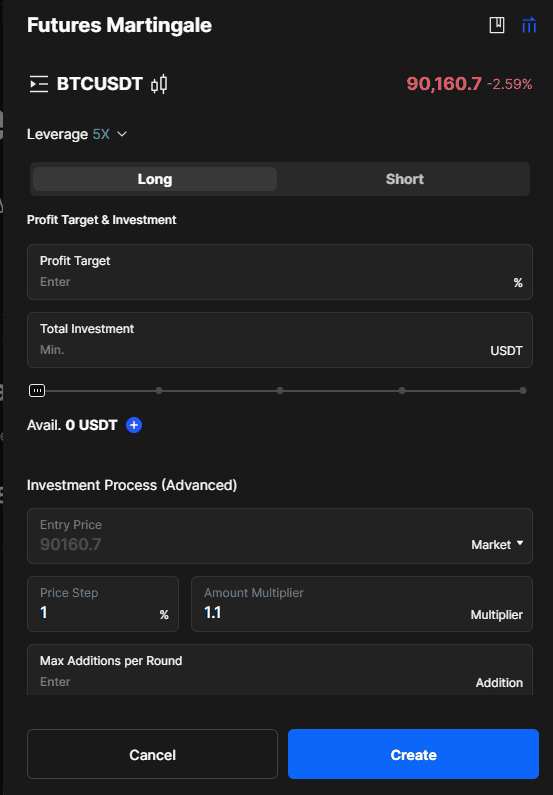

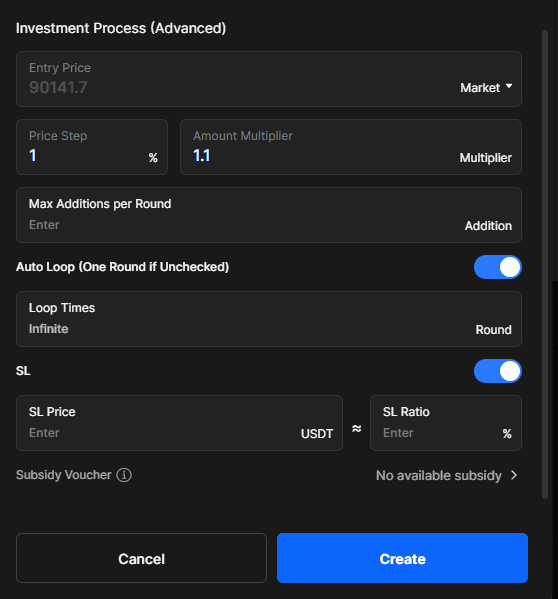

4. Using BingX Futures Martingale (DCA) for Advanced Dollar-Cost Averaging

BingX Futures Martingale is an advanced version of DCA designed for traders who want to accelerate their cost averaging during pullbacks. Instead of investing a fixed amount at fixed times, the system adds new positions automatically when the market moves against you.

Each addition is slightly larger than the previous one, which helps reduce your average entry price more quickly. At the same time, your maximum loss is capped at the total investment you assign to the strategy, so your risk stays contained.

The process begins by selecting Long or Short.

• Once you choose the direction, you enter your Profit Target, which tells the bot when to close all positions in profit.

• Next, you set your Total Investment, representing the maximum amount you are willing to allocate for the full cycle.

The strategy then uses a portion of this amount for the initial position and reserves the rest for future additions. Under the advanced settings, you configure how the bot reacts to market movement:

• Price Step (%): How often the bot adds when price moves against you

• Amount Multiplier: How much larger each added position becomes

• Max Additions per Round: How many times the bot can add

• Auto Loop and Stop-Loss: Optional tools for repeating cycles or limiting downside

For instance, if BTC trades near $90,160 and you set a 1 percent price step with a 1.1× multiplier, the bot adds positions as BTC dips lower. When the price rebounds 2–3 percent, the system closes all entries together, locking in your chosen profit target.

Martingale is not a beginner DCA tool, but for experienced users, it offers disciplined automation and faster averaging during volatility.

What Are the Common Mistakes New Crypto Investors Make With DCA?

DCA is simple, but beginners still fall into a few avoidable traps. The biggest issue is treating DCA like casual buying rather than a routine. The strategy only works when you stick to a fixed schedule. Changing the amount every week or buying “whenever the price looks good” removes the consistency that makes DCA effective.

Another mistake is using DCA on weak or speculative tokens. Averaging down only helps if the asset has long-term value. Fees also matter; frequent small buys can add up if you’re on a high-cost platform.

The most damaging mistake is stopping too early. Many investors quit during a bear market, even though that’s when DCA usually picks up the best-priced units.

Common Pitfalls of DCA Strategy

• Buying randomly instead of following a schedule

• Constantly adjusting amounts

• Averaging into weak or speculative assets

• Ignoring trading fees

• Stopping too soon during downturns

Should You Automate Your DCA Strategy? Pros and Cons

Automating DCA through tools like BingX Recurring Buy takes emotion out of the process. It ensures every purchase happens on time, helping you stay disciplined even when the market is volatile. For long-term investors, this hands-off structure makes it easier to build positions consistently.

But automation isn’t perfect. If the market drops for a long stretch, the system continues buying, which may not suit investors with lower risk tolerance. And automated purchases mean more transactions, so fees matter.

Pros

• Removes emotional decision-making

• Maintains consistent investing habits

• Supports long-term portfolio growth

Cons

• Keeps buying during extended downturns

• More frequent purchases can increase fees

Final Thoughts: Is DCA an Effective Strategy for Crypto Investing?

DCA remains one of the simplest and most balanced ways to invest in crypto. By spreading purchases across market fluctuations, it helps reduce timing stress and smooth out volatility. While it doesn’t guarantee profits, it gives beginners and long-term investors a steady path to build positions without relying on perfect market calls.

Before starting, consider your goals, risk tolerance, and preferred assets. With tools like BingX Recurring Buy, Spot Grid, and manual limit orders, staying consistent becomes much easier. For most users, this structure is what makes DCA a dependable long-term strategy in a fast-moving market.

Related Articles

FAQs on Dollar-Cost Averaging (DCA) in Crypto Trading

1. What is Dollar Cost Averaging in crypto?

Dollar Cost Averaging (DCA) is a method of investing a fixed amount at regular intervals—weekly or monthly—regardless of price. This smooths out volatility and lowers the impact of poor timing.

2. Is DCA good for beginners in cryptocurrency?

Yes. DCA removes emotional decision-making, reduces stress around timing the market, and allows beginners to build positions gradually without needing trading experience.

3. Does DCA work in a crypto bear market?

DCA often performs best during bear markets because lower prices allow investors to accumulate more units. Consistency during downturns is what lowers the long-term average cost.

4. How long should I continue DCAing into Bitcoin or Ethereum?

Most long-term investors follow a DCA plan for several months or years. The ideal duration depends on your financial goals and risk tolerance rather than short-term price movements.

5. Which is better: DCA or lump sum investing?

Lump sum investing typically performs better in strong bull markets, while DCA works best in volatile or uncertain conditions. DCA reduces timing risk and keeps your plan disciplined.

6. Can I automate DCA on BingX?

Yes. BingX offers automated DCA tools including Recurring Buy, Spot Grid for volatility-based accumulation, and Futures Martingale for advanced cost averaging during deeper pullbacks.

7. Can DCA reduce my average entry price?

Yes. Because you buy more units during price dips and fewer during rallies, your overall average price becomes more balanced than investing at a single moment.