The

Invesco QQQ Trust (QQQ) is one of the most popular and actively traded ETFs in the world, widely recognized for its strong long-term performance and its concentrated exposure to high-growth innovators. Over the past decade, QQQ has consistently ranked among the top ETFs by daily volume and assets under management, attracting both beginners and experienced investors who want straightforward access to the Nasdaq-100, the index that represents the heart of the U.S. technology sector.

Among all major equity ETFs, QQQ stands out as the most focused large-cap ETF for technology,

AI, cloud computing, semiconductors, and digital innovation. It holds many of the world’s most influential companies such as

Apple (AAPL),

Microsoft (MSFT),

NVIDIA (NVDA),

Amazon (AMZN),

Alphabet (GOOGL), and

Meta (META), making it a gateway for investors who want to participate in the global AI boom and the broader digital transformation shaping the 2026 market. QQQ’s long-term track record, strong liquidity, and close alignment with U.S. tech leadership have made it a favorite among growth-focused investors worldwide.

This guide explains three practical ways to invest in the Invesco QQQ ETF in 2026:

1. Traditional brokerage and ETF investing

2. Tokenized QQQ ETF such as QQQON for crypto users

3. Tokenized QQQ ETF futures and other blockchain-native instruments

Whether you prefer a traditional investment method or an on-chain approach, platforms that support tokenized assets make it easy for global investors to access Nasdaq-100 exposure through QQQ.

What Is the Invesco QQQ Trust ETF (QQQ) and How Does It Work?

The Invesco QQQ Trust (QQQ) is an exchange-traded fund that tracks the Nasdaq-100 Index. This index includes 100 of the largest non-financial companies listed on the Nasdaq Stock Market, many of which are leaders in technology, AI, cloud software, semiconductors, consumer innovation, and digital platforms. QQQ is designed to give investors simple and efficient access to the performance of these companies in a single investment product.

QQQ operates through a passive index tracking structure. The fund holds the same stocks as the Nasdaq-100 in weights that closely mirror the index composition. When companies inside the index grow, innovate, or benefit from broader market trends such as AI adoption, QQQ reflects those gains. When market volatility increases or individual mega caps decline, the ETF adjusts accordingly through periodic rebalancing.

Investors choose QQQ for several reasons:

• It offers broad exposure to the biggest technology-driven companies in the United States.

• It provides strong historical performance supported by long-term growth in the tech and AI sectors.

• It trades on major U.S. exchanges with high liquidity and low transaction friction.

• It suits both beginners and experienced investors who want fast, diversified access to the Nasdaq-100 without selecting individual stocks.

Because QQQ captures the trajectory of the modern technology economy, it continues to be one of the most widely watched ETFs as global interest in AI and digital innovation expands.

What Companies Are in the Invesco QQQ Trust ETF?

The Invesco QQQ Trust tracks the Nasdaq-100 Index, which includes the 100 largest non-financial companies listed on the Nasdaq Stock Market. Because Nasdaq is home to many of the world’s leading technology and growth companies, QQQ provides concentrated exposure to sectors such as artificial intelligence, cloud computing, semiconductors, software, and digital services.

The ETF’s largest holdings usually include

Apple,

Microsoft,

Nvidia,

Amazon,

Alphabet,

Meta,

Broadcom (AVGO), Costco,

Tesla (TSLA), and Adobe. These companies often represent a significant portion of the index due to Nasdaq’s market-cap-weighted structure. As a result, QQQ’s performance tends to move closely with trends in AI investment, chip demand, cloud infrastructure spending, and digital consumer behavior.

QQQ is heavily allocated to technology, consumer discretionary, and communication services, with smaller positions in health care and industrials. This sector mix captures the core of the Nasdaq growth ecosystem and is a primary reason why QQQ is viewed as a targeted way to invest in long-term innovation.

QQQ Historical Returns: How Much Can You Make With the Invesco QQQ ETF?

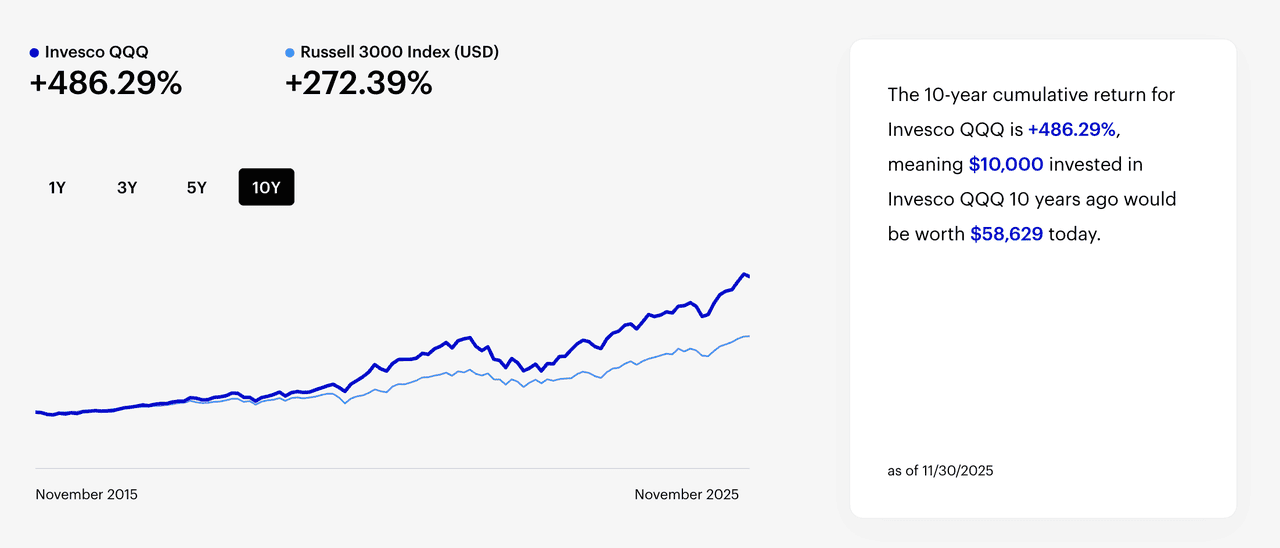

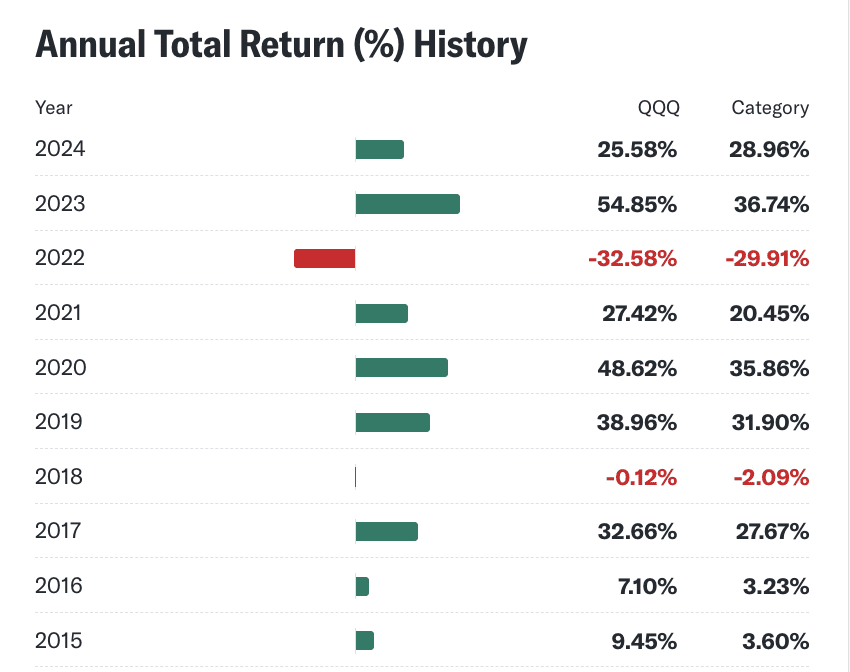

The Invesco QQQ Trust has historically delivered strong long-term performance, averaging about 10.5% to 11.2% annualized since its inception in 1999 when dividends are reinvested. This reflects the sustained growth of Nasdaq-listed technology and innovation companies.

Returns over the past decade have been even stronger. From 2015 to 2025, QQQ produced double-digit annualized returns, often above 15% per year, driven by significant gains in companies such as Apple, Microsoft, Nvidia, Amazon, and Alphabet.

Inveso QQQ Annual Return History | Source: Yahoo Finance

The shorter 2020 to 2025 period shows more volatility, but QQQ still delivered high growth. Over the past five years, the ETF generated a cumulative return of about 140.85%, which is roughly 19% annualized during a period marked by rapid expansion in AI, cloud computing, and semiconductor demand.

Analysts expect QQQ to remain sensitive to technology cycles, yet long-term performance may continue to benefit from AI adoption, chip innovation, and digital productivity gains.

Invesco QQQ vs. SPDR S&P 500 ETF SPY: Which Index Fund Should You Choose?

Invesco QQQ and SPY are both popular ETFs, but they track very different parts of the market. QQQ follows the Nasdaq-100, which is heavily concentrated in technology, AI, semiconductors, and other high-growth industries. This makes QQQ a strong choice for investors who want targeted exposure to innovation and are comfortable with higher volatility.

SPDR S&P 500 ETF (SPY) tracks the S&P 500, a broad index covering 500 large U.S. companies across all major sectors. It offers more diversification and generally smoother performance, which makes it suitable as a core long-term holding.

The key difference is focus versus balance. QQQ provides higher growth potential during strong tech cycles, while SPY provides stability across a wider range of industries. Investors who want concentrated tech exposure often choose QQQ, while those seeking broad market stability prefer SPY. Many use both to combine growth and diversification.

| Category |

Invesco QQQ (Nasdaq-100) |

SPY (S&P 500) |

| Index Tracked |

Nasdaq-100 |

S&P 500 |

| Number of Holdings |

100 large non-financial Nasdaq companies |

500 largest U.S. companies across all major sectors |

| Sector Focus |

Technology, AI, semiconductors, cloud, digital platforms |

Broad diversification across technology, health care, financials, industrials, energy, and more |

| Risk Level |

Higher volatility due to tech concentration |

Lower volatility due to balanced sector exposure |

| Return Potential |

Higher growth potential during tech-led cycles |

More stable long-term returns with smoother performance |

| Best For |

Investors seeking innovation-driven growth |

Investors seeking diversification and market-wide stability |

How to Invest in the Invesco QQQ ETF: A Step-by-Step Guide in 3 Different Ways

There are now more ways than ever to gain exposure to the Invesco QQQ Trust. Whether you prefer a traditional brokerage account or you invest through crypto platforms, the goal is the same: track the performance of the Nasdaq-100 Index, which represents 100 of the largest and most innovative companies listed on the Nasdaq Stock Market. Below are the three simplest methods available in 2026.

1. Buy the Invesco QQQ ETF on a Brokerage Platform

The most common way to invest in QQQ is through a traditional brokerage account. QQQ is one of the highest-volume ETFs in the world and closely mirrors the Nasdaq-100 Index. It offers exposure to leading technology, semiconductor, AI, and consumer innovation companies such as Apple, Microsoft, Nvidia, Amazon, Alphabet, and Meta. This method is ideal for long-term investors who want regulated access and a familiar trading experience.

Buying QQQ works just like purchasing any stock. Most brokerages support fractional shares, recurring deposits, and automatic dividend reinvestment, which makes this approach beginner-friendly and easy to maintain.

Step 1: Choose a brokerage: Select a regulated platform that offers U.S.-listed ETFs, transparent fees, and stable trading tools. Examples include Fidelity, Charles Schwab, Vanguard, TD Ameritrade, and Interactive Brokers.

Step 2: Verify your account: Complete registration and KYC by submitting identification and required tax documents, especially if you are a non-U.S. investor.

Step 3: Fund your account: Deposit USD using bank transfer, card, or supported local currency conversion features.

Step 4: Buy QQQ: Search for the ticker QQQ, review real-time market data, and place a market or limit order. Fractional shares let you start with smaller amounts, making QQQ accessible to beginners and dollar-cost-averaging strategies.

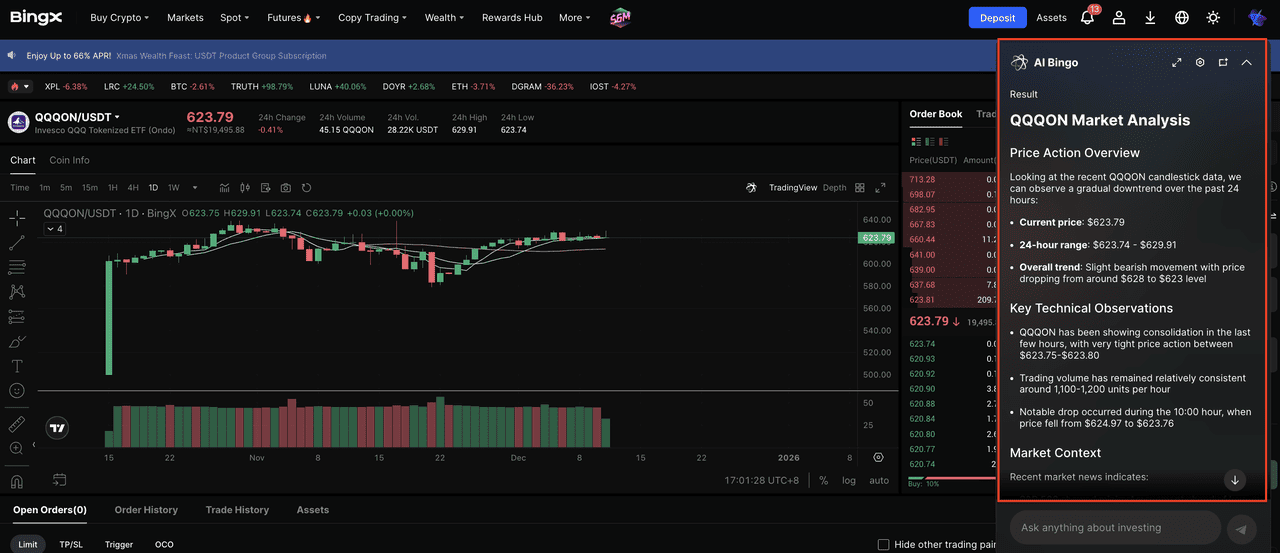

2. Buy Tokenized QQQ (QQQON) on BingX

If you prefer on-chain access, global availability, or a crypto-native investing experience, tokenized QQQ products such as QQQON offer a modern alternative. QQQON reflects the price movement of the Invesco QQQ ETF while providing fast settlement, 24-hour trading, fractional ownership, and seamless wallet transfers.

This method is ideal for crypto users who want Nasdaq-100 exposure without using a traditional brokerage account.

Step 1: Create and secure your BingX account: Register on BingX,

complete KYC verification, and enable security features such as two-factor authentication.

Step 2: Deposit USDT or supported assets: Transfer stablecoins into your

BingX Spot wallet. Confirm that you are using the correct blockchain network and review any deposit fees or minimums.

Step 3: Search for the QQQ token: Open the BingX Spot market and search for QQQON or an equivalent tokenized QQQ product. These tokens mirror the price of the underlying ETF.

Step 4: Use available analytics tools: BingX provides built-in AI tool

BingX AI and market insights. Use them to check price trends, volatility conditions, and liquidity before placing your order.

Step 5: Place your buy order: Choose a

market or limit order, enter your preferred amount, review current liquidity, and confirm your purchase.

Note: Availability of tokenized ETFs depends on your country or region. Tokenized assets may be restricted in some jurisdictions due to regulatory requirements. Always confirm eligibility before trading.

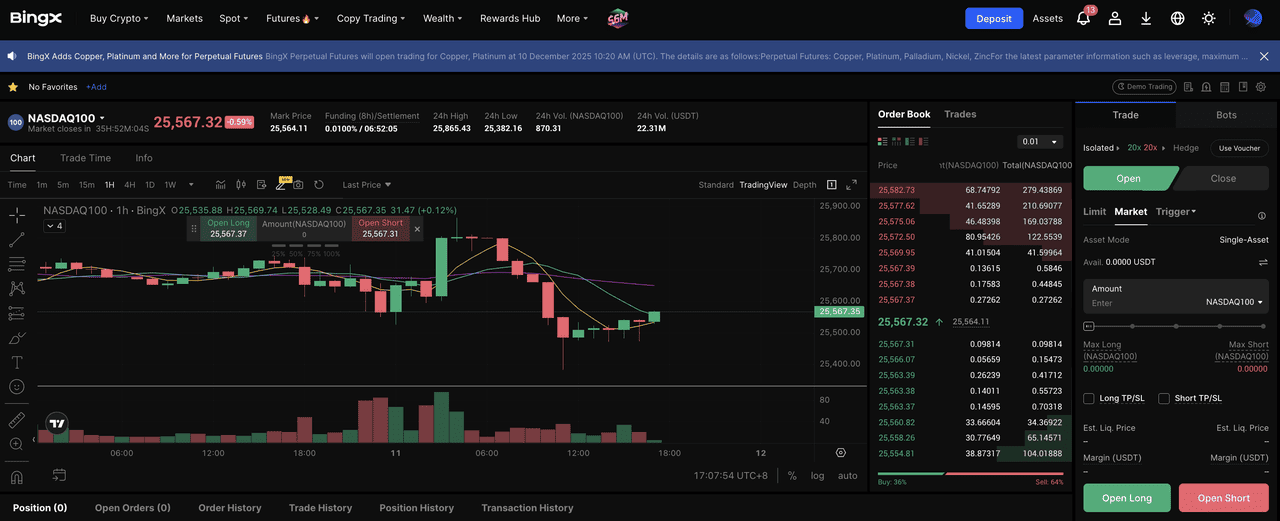

3. Trade Nasdaq 100 Perpetual Futures on BingX

If you want more flexibility than spot investing, you can trade Nasdaq 100 perpetual futures on platforms such as BingX. These contracts track the performance of the Nasdaq 100 Index, giving you exposure to the same market QQQ represents, but through a futures product instead of a tokenized ETF. This is not the same as trading QQQON. Futures allow you to go long or short, apply leverage, and hedge your existing equity or crypto positions around the clock.

Nasdaq 100 perpetual futures do not expire and are designed for short-term trading strategies, volatility management, and directional positioning.

Step 1: Create and secure your account: Register on a futures-enabled platform such as BingX, complete KYC verification, and enable two-factor authentication.

Step 2: Deposit USDT: Transfer

USDT into your

BingX Futures wallet. Double-check the blockchain network and confirm transaction details before depositing.

Step 3: Open the Nasdaq 100 futures market and review data: On BingX, search for the NAS100-USDT perpetual pair. Use available tools to review

funding rates, volatility, recent price action, and important

support or resistance levels.

Step 4: Choose long or short: Go long if you expect the Nasdaq 100 to rise. Go short if you expect a decline. Beginners typically start with low or zero leverage because futures amplify both potential gains and losses.

Step 5: Place your order: Select a market or limit order, set your leverage level, check your liquidation price, and confirm the trade. Use

stop-loss and take-profit tools to manage risk.

Note: Index-based perpetual futures may not be available in all countries due to local regulations. Product access varies by jurisdiction. Always verify availability before trading.

What Is Ondo's Invesco QQQ Tokenized ETFs (QQQON) and How Does It Work?

Invesco QQQ tokenized ETFs are blockchain-based assets that replicate the economic performance of the Invesco QQQ Trust, which tracks the Nasdaq-100 Index. Instead of buying QQQ through a traditional brokerage, investors can gain similar exposure on-chain using stablecoins such as USDT. The most common example is QQQON, issued by

Ondo Global Markets, which mirrors the value of the underlying QQQ ETF while remaining transferable across public blockchains.

These tokens are backed by regulated financial instruments held by licensed custodians, allowing them to closely follow the movements of the Nasdaq-100. Tokenized QQQ offers global accessibility through stablecoins, 24-hour trading, fractional ownership, fast settlement, self-custody, and the ability to integrate with

DeFi applications such as

lending,

staking or

liquidity pools.

How Tokenized QQQ ETFs Work

1. Economic exposure: Tokens such as QQQON track the value of the underlying Invesco QQQ Trust. Their prices rise and fall in line with the Nasdaq-100 Index.

2. Regulated backing: Issuers use licensed custodians to hold the underlying ETF or equivalent financial assets, ensuring real, audited backing.

3. On-chain issuance: Tokens can be held, transferred, or traded directly on blockchain networks without the need for a traditional brokerage account.

4. Transparent reserves: Issuers publicly disclose supply, backing assets, and attestation reports so users can verify collateral at any time.

Risk and Considerations Before Investing in an Invesco QQQ Tokenized ETF

Investing in a tokenized version of QQQ offers flexibility and global access, but it also introduces risks not present in the traditional ETF. Key considerations include:

• Market volatility: QQQ is heavily concentrated in technology and AI-driven companies, which can lead to sharper price swings compared with diversified indexes.

• Platform and custody risk: Tokenized ETFs rely on the issuer, custodians, and smart contracts. Even with regulated backing, users face additional counterparty and technical risks.

• Liquidity limitations: Trading volume for tokenized assets can vary across exchanges, which may cause wider spreads or short-term price deviations from the underlying ETF.

• Regulatory uncertainty: Tokenized products operate in evolving legal environments, and access may be restricted based on region.

• User-managed security: Investors must safeguard their wallets and private keys, unlike traditional brokerages that offer custodial protection.

These factors should be evaluated carefully before choosing a tokenized QQQ ETF over the conventional version.

Final Thoughts

The Invesco QQQ ETF remains one of the strongest ways to access the growth of the Nasdaq-100 and the broader technology and AI ecosystem. Whether you invest through a traditional brokerage account or prefer a crypto-native approach using tokenized products like QQQON, the goal is the same: participate in the long-term performance of leading innovation-driven companies.

Traditional QQQ offers regulated access, stable liquidity, and broad availability for long-term investors. Tokenized QQQ provides flexibility, global reach, and on-chain settlement for users who prefer digital assets or live in markets with limited ETF access.

As technology continues to drive market leadership, both formats give investors practical paths to gain exposure to the companies shaping the future of computing, AI, cloud infrastructure, and digital platforms. Choosing between the traditional ETF and its tokenized version depends on your trading style, risk tolerance, and preferred investment environment.

Related Reading

FAQs on the QQQ Tokenized ETF

1. What is the Invesco QQQ ETF?

The Invesco QQQ ETF tracks the Nasdaq-100 Index, giving investors exposure to major technology, AI, semiconductor, and cloud companies listed on the Nasdaq Stock Market.

2. What is the difference between QQQ and QQQON?

QQQ is the traditional ETF traded through brokerage accounts. QQQON is a tokenized version available on crypto platforms that mirrors QQQ’s price movement and can be traded using stablecoins such as USDT.

3. Does a tokenized QQQ ETF pay dividends?

Most tokenized ETFs, including QQQON, do not distribute dividends. Their value reflects the underlying ETF’s price, but dividend payments are usually not passed through to token holders.

4. Is a tokenized QQQ ETF suitable for beginners?

Tokenized QQQ offers convenience and global access, but it introduces platform risk, smart contract risk, and liquidity variation. Beginners may prefer the traditional ETF unless they are experienced with crypto platforms.

5. Are tokenized ETFs backed by real assets?

Reputable issuers use licensed custodians to hold the underlying ETF or equivalent financial instruments. They typically publish attestation reports so investors can verify collateral backing.

6. Should beginners choose QQQ or SPY?

QQQ offers higher growth potential through concentrated exposure to technology and AI. SPY provides broad diversification across the entire U.S. market and tends to deliver smoother long-term performance. Many investors hold both to balance growth with stability.