In the fragmented DeFi landscape of 2026,

Owlto Finance has emerged as a cornerstone of the "modular" future. By integrating

AI with intent-driven execution, Owlto solves the "fragmentation trap" that has long plagued Web3. While traditional bridges often require 10–20 minutes to settle, Owlto completes over 90% of transfers in under 30 seconds. As of early 2026, the protocol has processed over 13 million transactions, positioning itself as a high-speed "highway system" for assets moving between

Ethereum L2s,

Bitcoin L2s,

Solana, and beyond.

In this article, you will learn what Owlto Finance is, how its AI-intent engine optimizes cross-chain routes, the role of the OWL token in governance and revenue sharing, and

how to buy Owlto Finance (OWL) on BingX.

What Is Owlto Finance (OWL) Interoperability Protocol?

Owlto Finance is a decentralized, intent-centric interoperability protocol designed to eliminate the fragmentation of Web3 liquidity. Unlike traditional "lock-and-mint" bridges that rely on centralized vaults, often creating honey pots for exploits, Owlto utilizes a Peer-to-Peer (P2P) Maker model and AI-driven routing. This architecture allows users to execute cross-chain transfers in under 30 seconds with fees significantly lower than native bridges.

As of February 2026, Owlto has established itself as a market leader, capturing a 25% market share in cross-chain transactions during peak activity and routinely processing $2–$2.5 billion in daily volume.

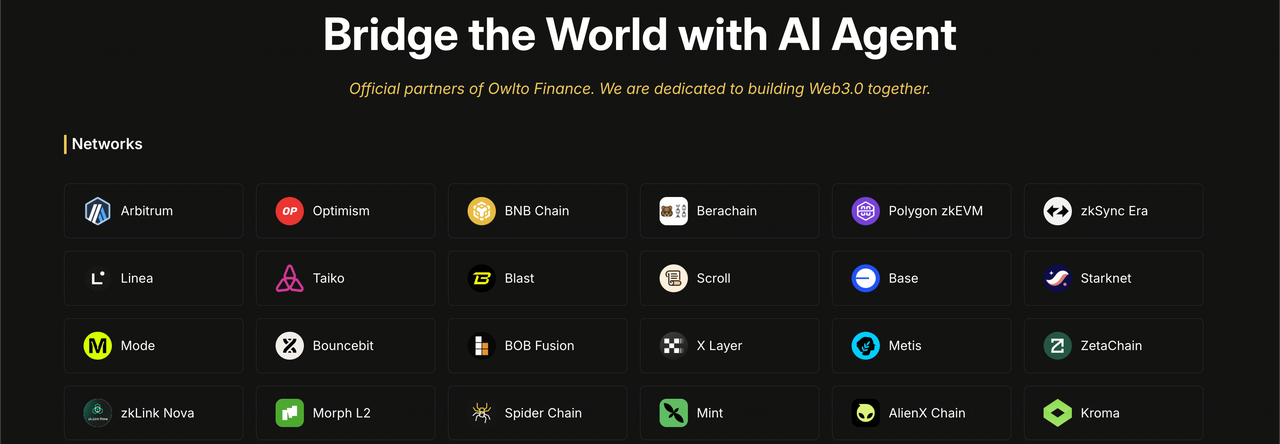

Owlto operates through three core pillars:

• AI-Intent Engine: Utilizing machine learning to monitor real-time network congestion and liquidity depth, Owlto’s AI abstracts the complexity of bridging. Users simply state their destination; the protocol then aggregates multi-path routes to deliver a near-zero slippage experience, even for high-volume transfers.

• Omnichain Coverage: Owlto natively supports 50+ blockchain networks. It has positioned itself as the #1 BTC Bridge for the Bitcoin L2 ecosystem while maintaining deep integration across all major EVM chains like

Arbitrum,

zkSync,

Base,

Linea and non-EVM networks like Solana.

• Modular "One-Click" Architecture: Built for composability, Owlto provides SDKs and APIs that allow dApps to integrate its liquidity engine directly. This empowers developers to offer native cross-chain functionality without forcing users to leave their platform.

In January 2026, Owlto transitioned into a full-fledged cryptographic economy with the launch of the OWL token, distributing ownership to its 3 million+ users and empowering the community to govern the protocol's future. With over 90,000 holders as of early February, the protocol uses OWL to drive its "Real Yield" model, where stakers earn a direct share of the protocol’s

on-chain transaction fees.

How Does Owlto Finance Work?

Owlto Finance ecosystem | Source: Owlto Finance

Owlto replaces complex, multi-step bridging processes with a peer-to-peer (P2P) style "Maker/User" model. This avoids the need for massive, centralized liquidity vaults, which are frequent targets for hackers.

1. The Intent-Based Request

When a user or the "Sender" initiates a transfer, they specify the asset and the destination chain. The

AI Agent analyzes real-time network conditions, gas prices, and liquidity depth across 50+ chains to find the optimal execution path.

2. The Maker/User Model for Atomic Swaps

Instead of locking funds in a bridge contract, the user sends funds to a "Maker" (Liquidity Provider) on the source chain. Simultaneously, the Maker releases the equivalent amount (minus a small fee) to the user's address on the destination chain.

3. AI-Driven Route Optimization

The protocol’s integration with networks like NebulAI allows it to predict demand spikes. If gas fees on a specific network like Linea spike, the AI automatically redistributes liquidity among nodes to ensure the transaction still completes in under 30 seconds.

4. Zero-Knowledge Proof (ZKP) Verification

For security, Owlto integrates

ZK-proof technology and smart contracts to verify that the Maker has fulfilled their obligation. If a Maker fails to send funds on the destination chain, the protocol’s smart contract can trigger a refund on the source chain, ensuring a trustless environment.

What Is the OWL Token Used for?

The OWL token, launched in January 2026 with a total supply of 2,000,000,000, is the utility and governance engine of the Owlto ecosystem.

Key OWL Token Utilities

• Governance Participation: OWL holders can stake their tokens to vote on protocol upgrades, new chain integrations, and fee structures via the Owlto DAO.

• Real Yield for Revenue Sharing: Owlto generates significant on-chain fees from its 13 million+ transactions. OWL stakers earn a portion of this protocol revenue, aligning user incentives with platform growth.

• Fee Discounts: Holding OWL unlocks tiered discounts on bridging fees across all supported networks, providing immediate value to frequent DeFi users.

• Community Airdrops: 15% of the total supply is reserved for airdrops. Following the initial 3% distribution at TGE, the remaining 12% is allocated for future rounds to reward long-term active users.

What Is Owlto Finance (OWL) Tokenomics?

OWL token allocation | Source: Owlto Finance docs

The $OWL token has a capped total supply of 2,000,000,000, with a strategic initial circulating supply of 16.5% (approximately 330 million tokens) designed to mitigate early sell pressure and support long-term sustainability.

• Community: 22% - For long-term incentives and on-chain culture

• Investors: 15.67% - 12-month cliff, then linear unlock over 18 months

• Team: 15% - 12-month cliff, then linear unlock over 18 months

• Airdrop: 15% - 3% at TGE; 12% for future loyalty incentives

• Ecosystem: 10.33% - For partnerships, developer grants, and innovation

• Liquidity: 7.5% - To support trading depth across CEXs and DEXs

• CEX Airdrop: 7% - Reserved for exchange distribution programs

• Advisory: 5% - 12-month cliff, then linear release over 24 months

• Marketing: 2.5% - To expand global presence and educational content

How to Trade Owlto Finance (OWL) on BingX

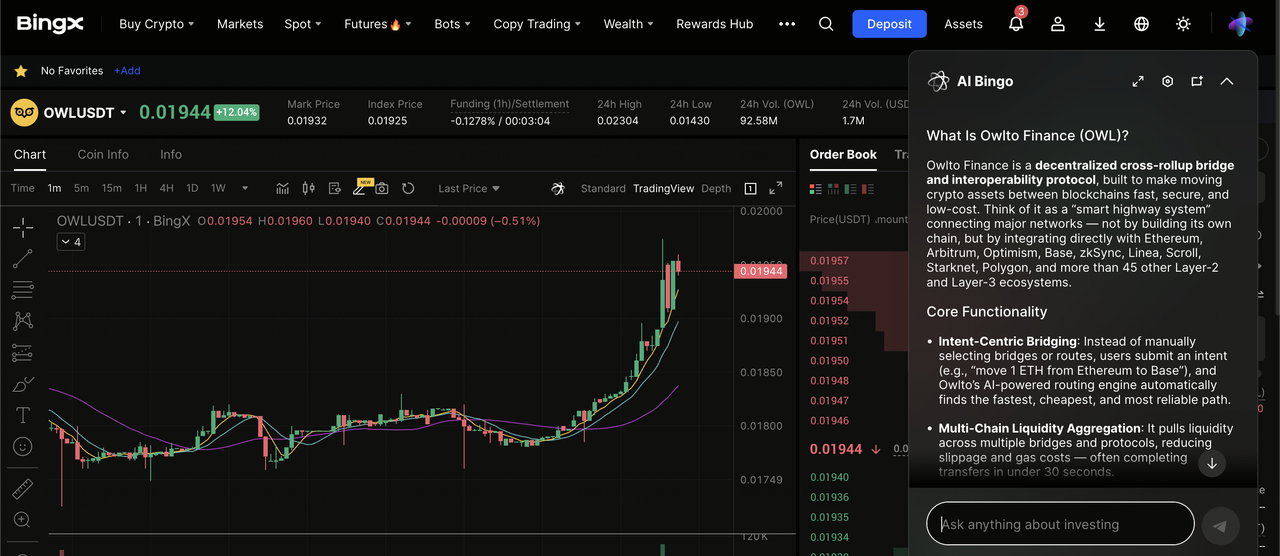

BingX provides deep liquidity and AI-enhanced trading tools to help you manage your OWL positions effectively in the 2026 bull cycle.

How to Buy or Sell OWL on the Spot Market

OWL/USDT trading pair on the spot market featuring BingX AI insights

2. Navigate to Spot: Search for the

OWL/USDT trading pair.

3. Execute Trade: Choose a

Market Order for instant purchase or a Limit Order to set a specific entry price.

Long or Short OWL with Leverage on Futures

OWL/USDT perpetual contract on the futures market powered by BingX AI insights

1. Enable Futures: Transfer

USDT to your Perpetual Futures account.

3. Trade: Go long if you anticipate ecosystem growth or short to hedge your holdings, applying leverage according to your risk tolerance.

Pro Tip: Use BingX Copy Trading to follow top-performing OWL traders and automate your strategy based on professional insights.

3 Key Considerations Before Trading Owlto Finance (OWL)

If you wish to trade Owlto Finance, you should be aware of its technological edge, its aggressive unlock schedule, and the inherent risks of its AI-centric architecture.

1. Market Positioning and “Intent” Competition

Owlto has positioned itself as the #1 BTC bridge within the Bitcoin L2 ecosystem, competing directly with cross-chain infrastructure giants like

LayerZero Labs and

Wormhole Foundation. Its 30-second settlement speed and intent-based routing give it a tactical edge, but as competitors integrate similar intent-centric models, sustaining P2P Maker network efficiency will determine whether Owlto maintains its premium positioning.

Practical Tip: Track Owlto’s share of Bitcoin L2 and Ethereum L2 bridge volume on DefiLlama. If its cross-chain market share drops below 15%, it may signal that the speed advantage is being commoditized and competitive pressure is rising.

2. Supply Dynamics and the “January 2027” Cliff

With only 16.5% of its total supply (330M OWL) circulating at launch, Owlto’s token structure creates strong short-term price sensitivity driven by liquidity cycles. However, a 12-month cliff on 15% Team allocation and 15.67% Investor allocation means January 2027 marks the start of linear unlocks that could materially increase monthly sell-side pressure.

Practical Tip: Compare Fully Diluted Valuation (FDV) to current Market Cap regularly. As of February 2026, the FDV of over $40 million significantly exceeds the $6.8 million market cap, and wide gaps like this often compress price performance as major unlock dates approach.

3. AI Reliability and Black Swan Events

Owlto’s AI Agents dynamically optimize routing and liquidity allocation in real time, replacing traditional static bridge models with predictive execution logic. While this enhances efficiency under normal conditions, extreme volatility events, such as the 75% price swing in early January 2026, can stress-test slippage models and Maker solvency assumptions.

Practical Tip: Before executing large bridge transactions, check Owlto’s Discord #status channel for routing updates during congestion. If latency or liquidity warnings appear, split large transfers into smaller batches to reduce slippage and execution risk.

Final Thoughts: Should You Buy Owlto Finance (OWL) in 2026?

As of early 2026, Owlto Finance has transitioned from a high-growth bridge into a foundational execution layer for the "modular" blockchain era. By combining sub-30-second bridging speeds with deep liquidity in the Bitcoin L2 and AI-routing sectors, the protocol has demonstrated its ability to solve real-world fragmentation for over 3 million active users. The $OWL token serves as the essential utility engine for this ecosystem, offering a "Real Yield" model that aligns long-term holders with the protocol’s consistent transaction fee revenue.

For investors, the long-term potential of $OWL depends on the protocol's ability to maintain its technological lead in the competitive "intent-centric" market. If Owlto continues to capture market share across emerging Layer 2 networks and effectively manages its supply expansion through 2027, it remains a high-beta bet on the future of seamless omnichain interoperability.

Related Reading