Gold has entered a new phase of price discovery. By December 2025, spot gold prices surged above $4,500 per ounce, marking new all-time highs driven by persistent inflation, elevated geopolitical risk, central bank accumulation, and expectations of looser global monetary policy. At the same time,

silver also reached a new all-time high of $83.90, reinforcing renewed investor interest in precious metals as both stores of value and inflation hedges amid growing macroeconomic uncertainty. As traditional markets remain volatile, investors have increasingly turned to gold as a long-term store of value and portfolio hedge.

Combined market cap of gold-backed cryptos | Source: CoinGecko

This renewed demand has accelerated the growth of

tokenized gold, a digital asset class now valued at over $4.3 billion globally. Among these assets,

Tether Gold (XAUT) leads the market with a capitalization of approximately $2.2 billion, representing over 52% of total tokenized gold supply. Its scale, liquidity, and consistent on-chain activity have positioned

XAUT as the dominant standard for digital gold exposure, offering investors efficient access to bullion-backed value without the friction of physical ownership.

In this guide, we break down how Tether Gold (XAUT) works, why tokenized gold is gaining traction, and how it compares with owning physical gold. We examine the key differences in fees, custody, liquidity, redemption, and risk to help you decide which form of gold exposure best fits your investment strategy.

What Is Tether Gold (XAUT) Gold-Backed Crypto?

Tether Gold (XAUT) is a blockchain-based digital asset that represents direct ownership of physical gold. Each XAUT token is backed 1:1 by one fine troy ounce of LBMA-certified gold stored in professional vaults in Switzerland. The asset is issued by TG Commodities, S.A. de C.V., a subsidiary of Tether Holdings.

Unlike synthetic or price-tracking instruments, XAUT grants holders ownership rights to specific gold bars, identifiable by serial number and verifiable on-chain. This structure bridges the gap between traditional bullion ownership and modern digital finance, allowing investors to hold, transfer, or trade gold without relying on paper certificates or intermediaries.

XAUT operates as an ERC-20 token on

Ethereum, enabling 24/7 global trading, instant settlement, and fractional ownership down to 0.000001 troy ounce. As of late 2025, XAUT has a circulating supply of approximately 520,000 tokens, representing more than 16 metric tons of vaulted gold, with a total market capitalization exceeding $2.2 billion.

How Does Tether's Tokenized Gold XAUT Work?

Understanding how Tether Gold works helps investors evaluate its structure, security, and practicality as a digital alternative to holding physical gold.

1. Tokenization of Physical Gold

Tether Gold (XAUT) is issued by TG Commodities and backed 1:1 by LBMA-certified physical gold bars stored in professional Swiss vaults. Each XAUT token represents one fine troy ounce of gold and is linked to a specific bar that can be verified on-chain by serial number. This structure allows investors to gain direct exposure to physical gold without managing storage, insurance, or transportation.As of December 2025, more than 16 metric tons of gold back XAUT, with total market capitalization exceeding $2.2 billion, making it the largest tokenized gold asset in circulation.

2. Transferability and On-Chain Liquidity on Ethereum

XAUT is issued as an ERC-20 token on Ethereum, meaning it can be held in standard crypto wallets and transferred globally within minutes. Unlike physical gold, which requires custodians and settlement windows, XAUT can be traded 24/7 on supported exchanges.

Because the token is divisible down to 0.000001 troy ounces, investors can gain precise exposure regardless of portfolio size. This flexibility makes XAUT suitable for both institutional portfolios and individual traders seeking gold exposure without capital constraints.

3. Redemption and Settlement Mechanics

XAUT holders who meet minimum thresholds can redeem tokens for physical gold. A full redemption typically requires ownership of one LBMA Good Delivery bar, around 430 troy ounces, with delivery arranged from Swiss vaults. Alternatively, holders may opt to sell their XAUT back into the market or request cash settlement through the issuer. A one-time minting or redemption fee applies, and standard blockchain transaction fees apply for transfers. For most investors, however, XAUT is used as a liquid gold instrument rather than a physical delivery vehicle.

4. Onboarding and Compliance Requirements

Investors purchasing XAUT directly from the issuer must complete KYC verification. Requirements include:

• Government-issued identification

• Proof of address (within 90 days)

• Proof of funds and ownership structure for entities

• A one-time verification deposit

Once approved, purchases are typically processed within a few business days. Alternatively, users can bypass onboarding by acquiring XAUT directly on supported exchanges, where standard exchange KYC applies and trading is available 24/7.

Why Is Tokenized Gold Gaining Traction in 2026?

Tokenized gold sits at the intersection of traditional finance and blockchain infrastructure. It offers a way to preserve value during periods of inflation or market stress while retaining the flexibility of digital assets. For investors navigating an environment of monetary uncertainty, rising sovereign debt, and geopolitical risk, assets like XAUT provide an alternative form of capital preservation that combines the historical trust of gold with the efficiency of blockchain technology.

As adoption grows and regulatory clarity improves, tokenized gold is increasingly viewed not as a niche product, but as a core building block of modern digital portfolios.

The Growth of XAUT Gold Token: Gold Gains 65% in 2025

XAUT’s appeal lies in its combination of physical backing, on-chain transparency, and liquidity. Each token corresponds to a specific gold bar stored in insured Swiss vaults, and holders can verify bar details through public lookup tools. At the same time, XAUT trades continuously on crypto markets, allowing investors to move in and out of gold exposure without waiting for market hours or relying on intermediaries.

As of December 2025, XAUT consistently ranks as the largest tokenized gold asset by market capitalization, with daily trading volumes often exceeding $300 million. This liquidity makes it especially attractive for traders, portfolio managers, and institutions seeking a gold-backed asset that behaves more like a digital instrument than a physical commodity.

How Does Tether Gold (XAUT) Differ From Physical Gold?

While both XAUT and physical gold offer exposure to the same underlying asset, the way they are stored, traded, and accessed differs significantly. Understanding these top five differences between XAUT tokenized gold and physical gold can help you choose the option that best fits your goals, time horizon, and risk tolerance:

1. Ownership and Custody: XAUT represents direct digital ownership of LBMA-accredited gold stored in Swiss vaults, with each token linked to a verifiable bar on-chain. Physical gold requires direct possession or third-party custody, placing responsibility for storage, insurance, and security on the owner.

2. Storage, Costs, and Maintenance: XAUT eliminates storage and insurance costs, as custody is handled by professional vault providers. In contrast, physical gold ownership involves recurring expenses such as vault fees, insurance premiums, and transportation costs.

3. Liquidity and Trading Access: XAUT trades 24/7 on global crypto exchanges with near-instant settlement, allowing investors to enter or exit positions at any time. Physical gold trading is limited to dealer hours and often involves slower settlement and price negotiation.

4. Flexibility and Divisibility: XAUT can be divided down to 0.000001 troy ounces, making it accessible for small or incremental investments. Physical gold is sold in fixed bar or coin sizes, which limits flexibility and increases capital requirements.

5. Verification, Transparency, and Accessibility: XAUT ownership can be verified

on-chain through bar serial numbers and public records, offering transparent proof of backing. Physical gold requires manual inspection or third-party verification and involves logistical barriers such as transport and secure storage.

Tether Gold (XAUT) vs. Pax Gold (PAXG) Gold Crypto: Key Differences at a Glance

XAUT and PAXG both provide tokenized exposure to physical gold, but they serve slightly different investor needs. XAUT prioritizes liquidity, flexibility, and on-chain usability, making it popular among crypto-native users who want fast trading and seamless integration with digital markets. PAXG, by contrast, is structured for regulatory clarity and institutional confidence, backed by NYDFS oversight and regular third-party audits. In short, XAUT favors liquidity and accessibility, while PAXG emphasizes compliance, transparency, and long-term capital preservation.

Which Is Better: XAUT Tokenized Gold or Physical Gold?

XAUT is better suited for investors who want speed, flexibility, and digital access. It allows users to gain gold exposure instantly, trade 24/7, and rebalance portfolios without worrying about vaulting, transport, or insurance. For traders, portfolio managers, and crypto-native users, XAUT functions as a liquid, on-chain version of gold.

Physical gold, on the other hand, appeals to those who prioritize direct ownership and long-term wealth preservation outside the financial system. Holding bars or coins removes reliance on issuers or blockchains but introduces storage costs, security concerns, and lower liquidity.

For many investors, the most practical approach is a hybrid strategy, holding physical gold for long-term security while using XAUT for liquidity, hedging, and tactical positioning within digital portfolios.

How to Get Tether Gold (XAUT) Crypto

XAUT can be acquired in two primary ways:

1. Direct issuance from Tether: Eligible buyers can purchase XAUT directly from the issuer, subject to identity verification and minimum purchase thresholds. Physical redemption is also available for qualifying holders, with gold delivered from Swiss vaults.

2. Secondary market trading: Most users access XAUT through cryptocurrency exchanges like BingX, where it trades against USDT and other pairs with deep liquidity. This allows investors to gain gold exposure instantly, without handling physical assets or dealing with logistics.

Unlike traditional gold ETFs, XAUT does not charge annual custody or management fees. Instead, users incur standard blockchain transaction costs and a one-time fee when minting or redeeming tokens directly with the issuer.

How to Buy Tether Gold (XAUT) on BingX

BingX offers multiple ways to trade Tether Gold (XAUT), whether you want long-term exposure to gold or short-term trading opportunities. With integrated

BingX AI tools, users can analyze price trends,

manage risk, and execute trades more efficiently across both spot and futures markets.

Buy, Sell and Hold XAUT Tokens on the Spot Market

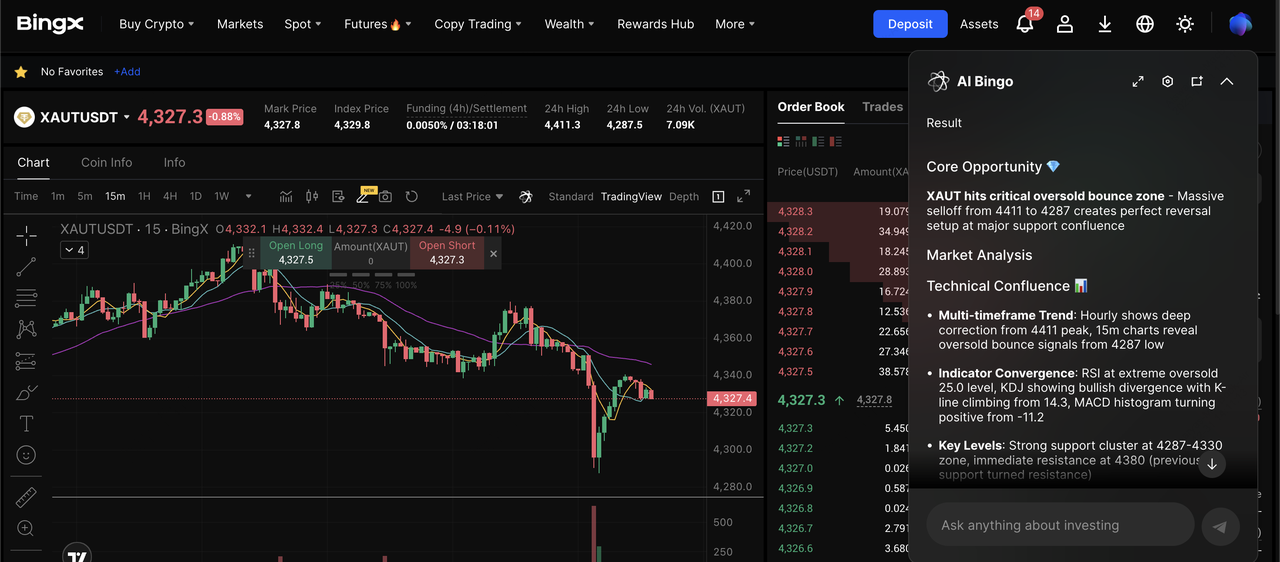

XAUT/USDT trading pair on the spot market powered by BingX AI

Spot trading is ideal for investors who want direct exposure to gold-backed assets without leverage.

1. Open BingX Spot Trading and search for the

XAUT/USDT trading pair.

2. Review the live price chart and activate BingX AI insights to identify trend direction, support, and resistance levels.

3. Choose a

Market order for instant execution or a Limit order to buy at a specific price.

4. Confirm the trade and hold XAUT in your wallet or transfer it as needed.

Trading XAUT crypto on the spot market is best suited for long-term investors, portfolio diversification, and users seeking gold exposure without leverage or liquidation risk.

Trade XAUT Price Movements With Leverage on Futures Market

XAUT/USDT perpetual contract on the futures market powered by BingX AI

For more advanced traders, BingX also offers XAUT/USDT perpetual futures, allowing speculation on gold price movements without owning the underlying asset.

2. Choose your position type (Long or Short) based on your market outlook.

3. Select leverage (e.g., 5× or 10×) and define your position size.

5. Monitor

funding rates, margin levels, and unrealized P&L in real time.

Futures trading allows you to profit from both rising and falling gold prices, but it also carries higher risk. Proper risk management is essential, especially during periods of high volatility.

Is It Safe to Buy XAUT Gold Tokens?

Tether Gold (XAUT) offers a regulated way to gain on-chain exposure to physical gold, but like any financial product, it comes with trade-offs. Each XAUT token is backed 1:1 by LBMA-certified gold bars stored in professional vaults, with ownership recorded both on-chain and in the issuer’s custody records. Holders can verify bar serial numbers through official lookup tools, helping reduce the risk of unbacked or rehypothecated gold.

However, XAUT is not risk-free. Ownership depends on the operational integrity of the issuer, TG Commodities, and on the continued availability of redemption and custody services. As an ERC-20 token, XAUT also carries standard blockchain risks, including wallet security, smart-contract exposure, and network fees. While XAUT is generally considered one of the safer crypto-based gold instruments, it should not be viewed as equivalent to holding physical bullion in hand.

Key Risks and Practical Considerations When Buying Tether Gold

1. Issuer and Custody Risk: XAUT relies on the issuer to maintain gold reserves, manage vault custody, and process redemptions. Any disruption in these operations could affect access or liquidity.

2. Redemption Constraints: Physical redemption typically requires a full LBMA bar of around 430 troy ounces, making direct redemption impractical for most retail investors. Most users therefore treat XAUT as a tradable gold proxy rather than a redemption vehicle.

3. Blockchain and Wallet Risk: As an ERC-20 token, XAUT is subject to wallet security risks,

phishing attacks, and user error. Lost private keys or compromised wallets can result in permanent loss of funds.

4. Fees and Market Costs: While XAUT has no ongoing storage fees, users may incur network gas fees, trading fees, or a one-time redemption fee when interacting directly with the issuer.

5. Regulatory and Access Risk: XAUT availability depends on jurisdiction. Certain regions may face restrictions on direct purchases or redemptions through the issuer, making secondary markets the primary access point.

Bottom Line: Should You Buy Tether Gold (XAUT) in 2026?

XAUT is well-suited for investors who want gold exposure without physical storage, along with the flexibility of 24/7 trading and blockchain-based settlement. It works best as a digital gold allocation within a diversified portfolio, particularly for those already active in crypto markets.

However, investors who prioritize direct ownership, offline custody, or minimal counterparty risk may still prefer physical gold. For many, a blended approach, holding physical gold for long-term security and XAUT for liquidity and tactical positioning, offers the most balanced solution.

Related Reading