As

Ethereum marks its 10th anniversary on July 30, 2025, the platform stands as a pillar of innovation, resilience, and global adoption. From a 2013 whitepaper to becoming the second-largest cryptocurrency by market cap, Ethereum's impact spans finance, technology, and culture. Here are the top 10 milestones that shaped its journey:

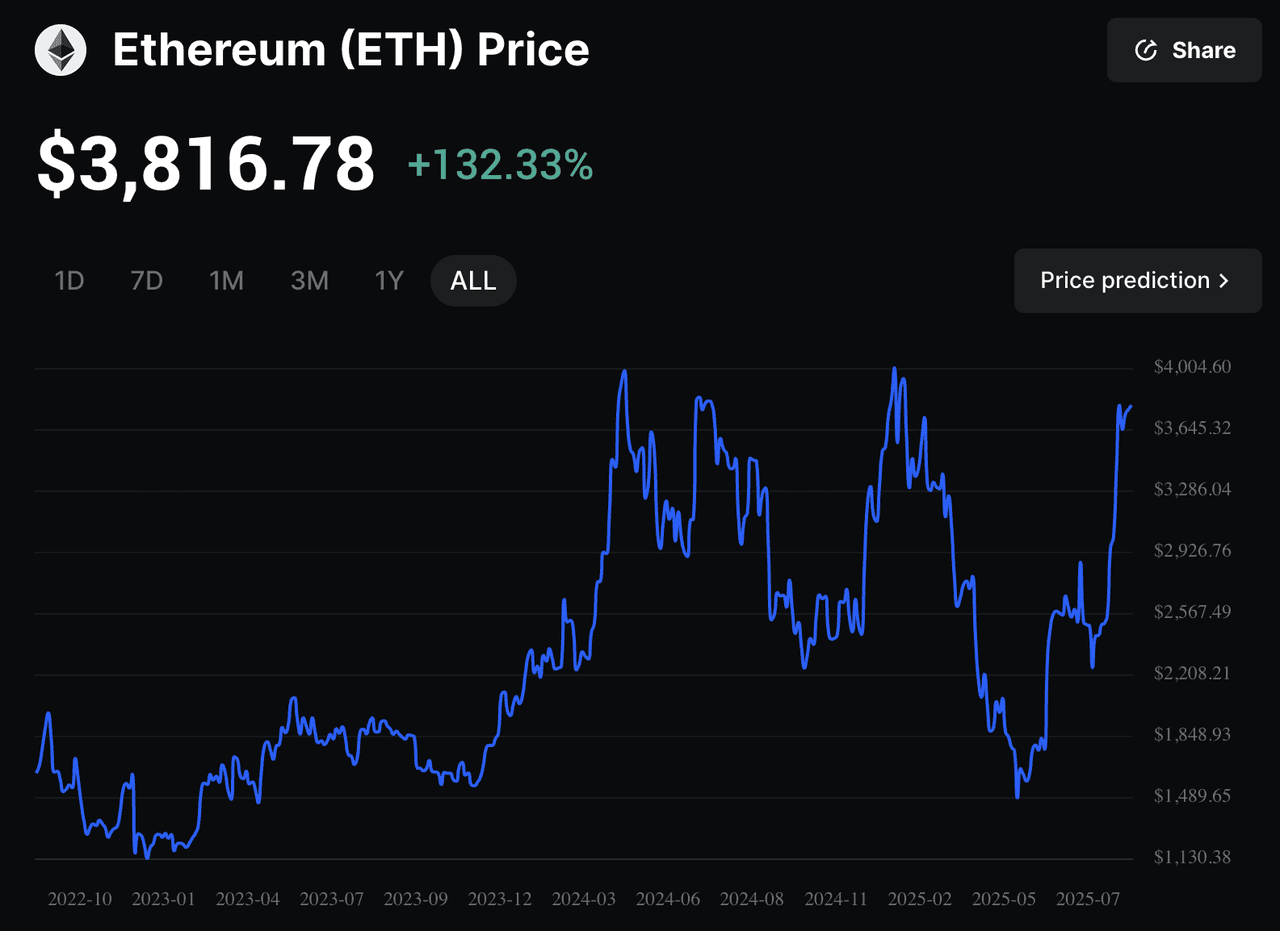

Ethereum price chart | Source: BingX

1. Whitepaper Launch: Ethereum's Vision (November 2013)

Ethereum began as a whitepaper authored by Vitalik Buterin on November 27, 2013, envisioning a decentralized platform for programmable contracts. Unlike Bitcoin, which was primarily focused on peer-to-peer money, Ethereum aimed to support a wide range of decentralized applications (dApps). This foundational vision introduced concepts like smart contracts and became the blueprint for what would later be known as Web3.

2. Ethereum ICO Raises $18 Million (July-September 2014)

Between July 22 and September 2, 2014, Ethereum conducted one of the earliest and most successful Initial Coin Offerings (ICOs), raising over $18 million in

Bitcoin. This set a new standard for crypto fundraising and demonstrated the power of community-driven financing. The funds were used to build out the Ethereum Foundation and fund development of the protocol leading up to its mainnet launch.

3. Ethereum Genesis Block and Perfect Uptime (July 30, 2015)

Ethereum officially launched on July 30, 2015, with the mining of its genesis block. Over the past decade, the network has achieved 100% uptime, showcasing unmatched resilience through market crashes, major forks, and high traffic periods. This uninterrupted operation underpins Ethereum's credibility as a global, decentralized infrastructure.

4. The DAO Hack and the Ethereum-ETC Split (June 2016)

On June 17, 2016, the Decentralized Autonomous Organization (DAO) raised $150 million on Ethereum but was exploited due to a vulnerability, leading to the loss of 3.6 million ETH. After much debate, the community implemented a hard fork to return the stolen funds, resulting in two blockchains: Ethereum (ETH) and

Ethereum Classic (ETC). The event raised critical questions about governance and immutability in blockchain networks.

5. Metropolis Upgrades: Byzantium, Constantinople (October 2017–February 2019)

The Byzantium and Constantinople hard forks were part of Ethereum’s third development phase, Metropolis. Byzantium, activated on October 16, 2017, introduced privacy improvements through zk-SNARKs compatibility, reduced block rewards from 5 ETH to 3 ETH, and delayed the “difficulty bomb” to ease the transition toward Proof-of-Stake. Constantinople, initially scheduled for January but implemented on February 28, 2019, included five Ethereum Improvement Proposals (EIPs) focused on gas optimization, new opcodes, and improved developer tooling. It also further delayed the difficulty bomb and reduced block rewards from 3 ETH to 2 ETH. Together, these upgrades enhanced performance, reduced costs, and laid technical foundations for Ethereum 2.0.

6. Ethereum's DeFi Summer (2020)

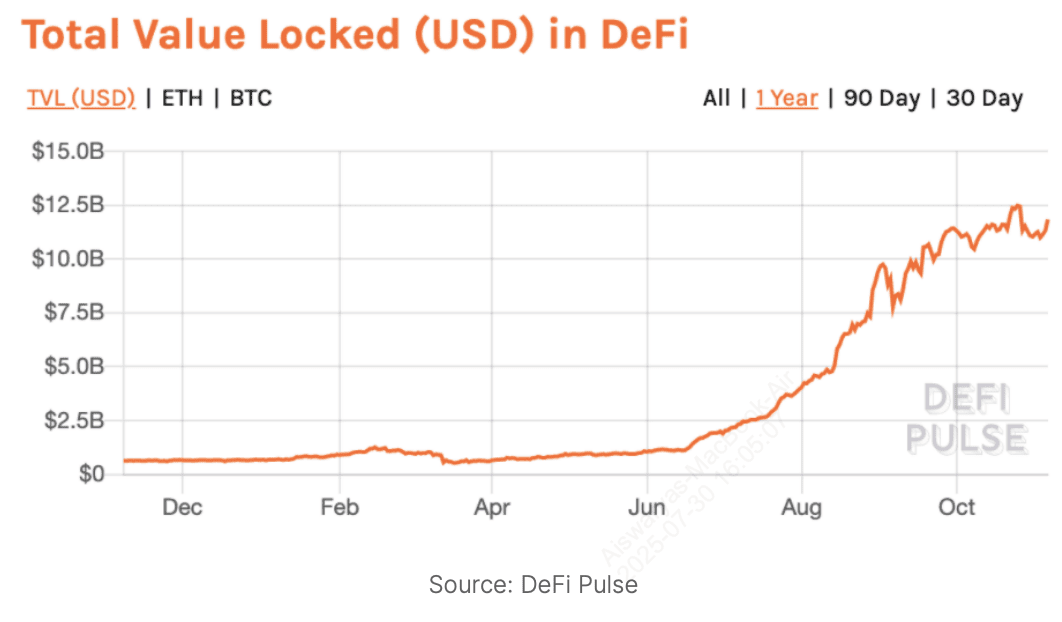

DeFi TVL growth | Source: TheBlock

By the end of 2020, Ethereum had firmly established itself as the foundation of decentralized finance (DeFi), with total value locked (TVL) rising from just $700 million in January to over $15 billion by December, a 2,100% increase. This surge was driven by the launch of key governance tokens like

Compound (COMP) (June 15),

Yearn Finance (YFI) (July 17), and

UNI (September 16), which sparked a wave of yield farming activity across protocols like Compound, Yearn.Finance, and Uniswap. The yield farming craze allowed users to earn rewards by providing liquidity or borrowing funds, and popular platforms like

Aave and

Curve quickly joined in, pushing DeFi adoption to new heights.

Uniswap’s daily trading volume briefly rivaled centralized exchanges like Coinbase, while its airdrop of 400 UNI tokens per wallet became one of the most iconic user rewards in crypto history.

SushiSwap, launched in August 2020, introduced the concept of “vampire mining” by siphoning liquidity from Uniswap. Meanwhile, Wrapped Bitcoin (WBTC) on Ethereum surpassed $1 billion in supply by mid-August, bringing Bitcoin liquidity into DeFi. Despite smart contract exploits and skyrocketing gas fees, Ethereum’s programmability enabled the rapid emergence of decentralized lending, exchanges, synthetic assets, and insurance, solidifying its role as the backbone of open finance.

7. Ethereum's ERC-271 Token Standard and NFT Mania (2021)

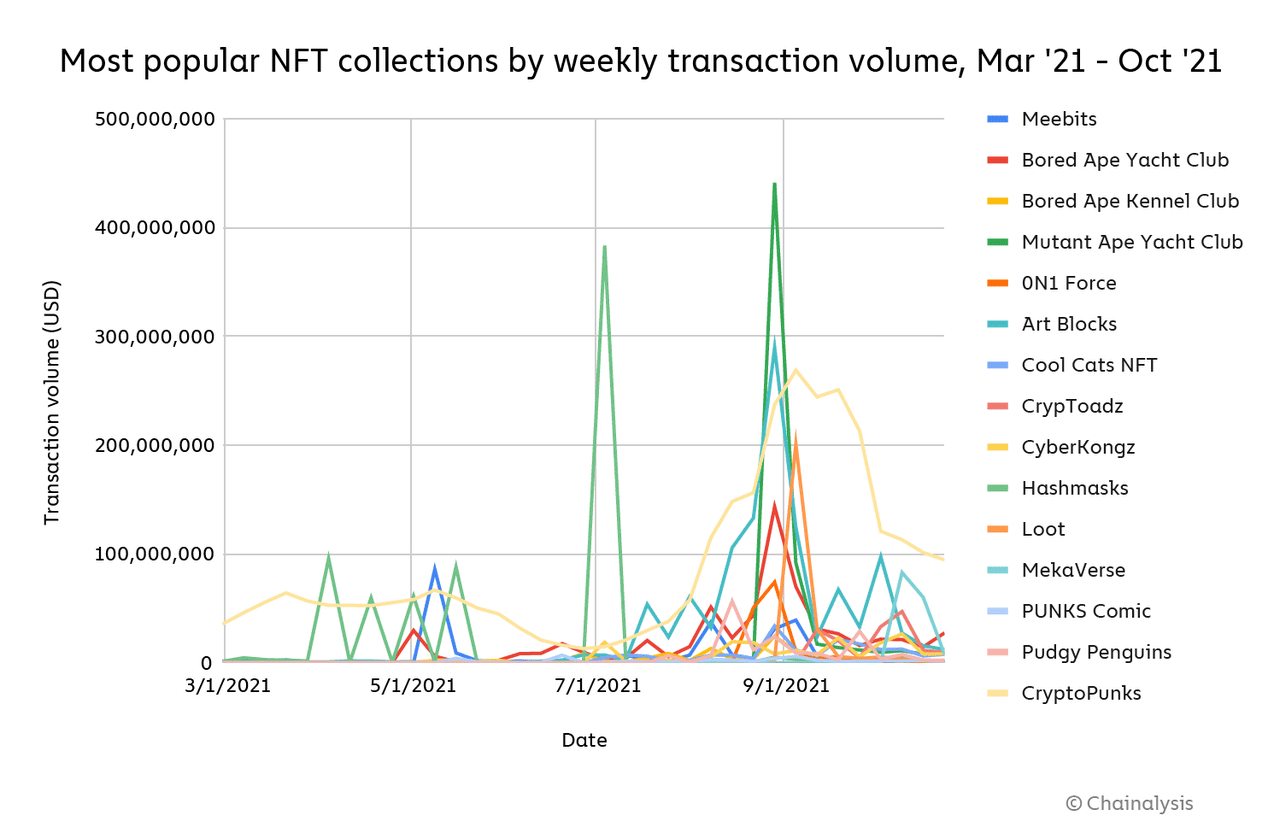

Most popular NFT collections | Source: Chainalysis

In 2021, Ethereum’s ERC-721 standard fueled the mainstream explosion of non-fungible tokens (NFTs). CryptoPunks, created in 2017, surged in value with multiple sales crossing the million-dollar mark by midyear. Beeple’s historic sale of "Everydays: The First 5,000 Days" for $69 million at Christie’s brought NFTs into the global spotlight, making him one of the most valuable living artists. The success of Bored Ape Yacht Club (BAYC), launched in May, introduced profile-picture NFTs with community membership, VIP events, and celebrity adoption, setting the tone for the rise of PFP NFTs during the so-called “JPEG Summer.”

At the same time, Ethereum saw a surge in cultural experimentation, from meme coins like Shiba Inu blending internet humor with DeFi mechanics, to Art Blocks’ generative series like "Fidenza" redefining digital creativity. The NFT boom was also marked by high-profile platform launches, IRL events like NFT.NYC, and experimental pieces like Dread Scott’s "White Male for Sale." All this helped push Ethereum (ETH) to an all-time high of $4,868.80 on November 9, 2021, reflecting investor excitement at the intersection of digital ownership, programmable value, and decentralized culture.

8. EIP-1559 and the Merge (August 2021–September 2022)

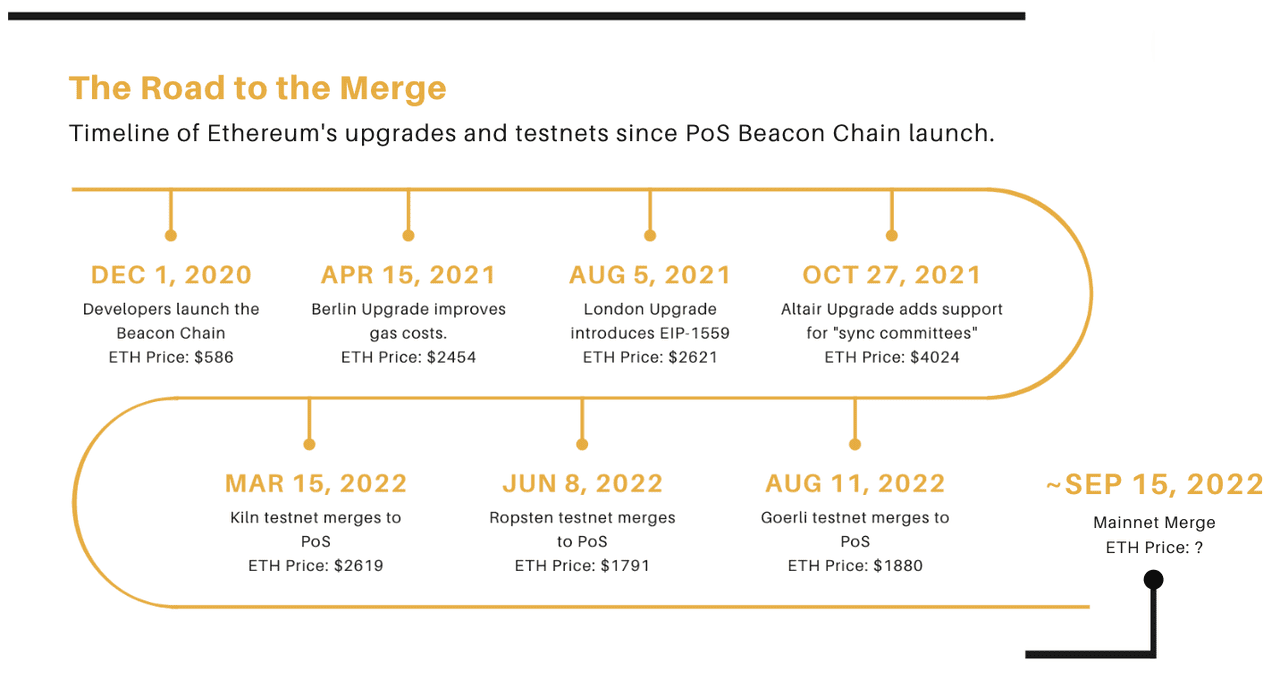

Ethereum 2.0 roadmap | Source: 21Shares

The London Hard Fork, activated in August 2021, introduced EIP-1559, a groundbreaking upgrade that replaced Ethereum’s first-price auction fee model with a base fee mechanism. This base fee, set algorithmically per block, is burned instead of paid to miners, making ETH scarcer with every transaction. While it did not directly lower gas fees, EIP-1559 dramatically improved fee predictability and transparency. The fee-burning mechanism introduced deflationary pressure on ETH, particularly during periods of high network activity, and shifted Ethereum's monetary policy toward a potentially deflationary model.

On September 15, 2022, Ethereum executed “The Merge,” the most significant protocol upgrade in its history. This event marked the transition from energy-intensive Proof-of-Work (PoW) to eco-friendly Proof-of-Stake (PoS), reducing the network’s energy consumption by over 99.95%. The Merge unified Ethereum’s Mainnet with the Beacon Chain and enabled staking rewards for validators who secured the network with their ETH holdings. It also slashed ETH issuance by nearly 90%, positioning Ethereum as a more sustainable, capital-efficient, and security-focused blockchain. The move to PoS laid the groundwork for future scalability features like sharding and advanced Layer-2 integration.

9. Rollup Era: Dencun, Pectra, and Layer 2s (March 2024–May 2025)

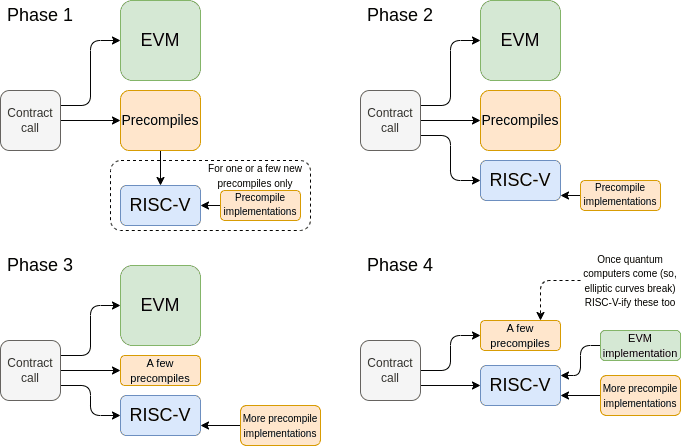

Vitalik's plan for the future of Ethereum | Source: Vitalik Buterin's blog

Between 2023 and 2025, Ethereum fully embraced its rollup-centric roadmap to scale the network while preserving decentralization. In March 2024, the Dencun upgrade introduced EIP-4844 (proto-danksharding), enabling blob-carrying transactions that drastically lowered Layer 2 data costs. This made rollups like Optimism, Arbitrum, Base, and Linea significantly cheaper and more efficient for end users. By May 2025, the Pectra upgrade implemented 11 EIPs that optimized validator operations, raising the max effective balance to 2,048 ETH (EIP-7251), slashing activation time to 13 minutes (EIP-6110), and supporting smart wallet functionality (EIP-7702). Pectra also raised blob limits (EIP-7691), enhancing scalability for rollups and enabling higher throughput. As a result, Ethereum became more cost-efficient, faster, and better equipped for the next billion users.

10. Ethereum ETFs and Institutional Adoption (July 2024–July 2025)

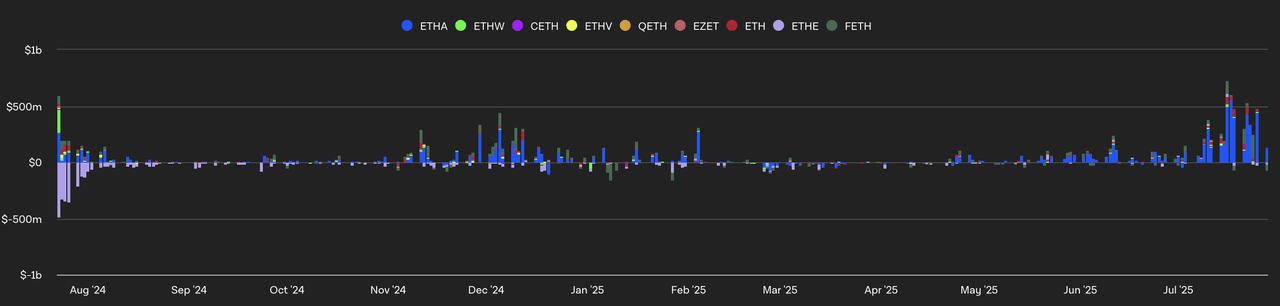

Spot Ethereum ETF flows | Source: TheBlock

The approval of U.S.

spot Ethereum ETFs in July 2024 marked a watershed moment for crypto markets. For the first time, institutional and retail investors could gain direct exposure to ETH through regulated, exchange-listed products, without the need for self-custody. Major asset managers including BlackRock, Fidelity, and VanEck launched spot ETH ETFs, accelerating capital inflows and legitimizing Ethereum as an investable digital asset on par with traditional commodities.

By early 2025, a growing number of public companies, such as SharpLink Gaming and BitMine Immersion, integrated

Ethereum into their corporate treasury strategies, not only holding ETH on their balance sheets but also staking it to earn yield. This convergence of liquidity and yield led to the emergence of

Ethereum staking ETFs, allowing investors to capture ETH rewards within a regulated framework. The passage of the

GENIUS Act further boosted Ethereum’s role in digital finance by legally recognizing

stablecoins, most of which operate on the Ethereum network, as programmable dollar equivalents. These combined developments positioned Ethereum as the financial backbone of

tokenized assets, on-chain treasuries, and real-world value settlement.

Read more:

Why Ethereum’s 10th Anniversary Matters, and What Comes Next

Ethereum’s 10-year milestone is more than a symbolic celebration. It reflects the platform’s evolution from a bold experiment into a foundational layer of modern crypto infrastructure. A full decade of uninterrupted uptime highlights Ethereum’s technical maturity and operational resilience, while its influence spans far beyond the developer community. With institutional investors increasingly integrating ETH into their treasuries and staking strategies, Ethereum is emerging as both a yield-generating asset and a programmable form of digital value. For traders and builders, this means the ecosystem now offers a unique blend of stability, utility, and upside, anchored by strong fundamentals and continued innovation.

Looking ahead, Ethereum’s roadmap includes key advancements like zkEVM scalability, account abstraction, and the modularization of its architecture through rollups and Layer-2s. These upgrades aim to reduce transaction costs, expand access, and support real-world asset tokenization at scale. As Ethereum transitions toward becoming the global settlement layer for everything from stablecoins to securities, its potential reach could extend to billions of users. Still, risks remain, regulatory shifts, smart contract vulnerabilities, and rising competition could shape its trajectory. For now, Ethereum remains at the heart of Web3 innovation, and its tenth anniversary marks both a moment of reflection and a new chapter in blockchain's future.

Related Reading