On July 29, 2025, the U.S. Securities and Exchange Commission (SEC) formally approved in-kind creation and redemption mechanisms for

spot Bitcoin (BTC) and

Ethereum (ETH) ETFs. This shift marks a major alignment of crypto-based ETFs with traditional commodity ETFs, allowing authorized participants to exchange ETF shares directly for the underlying cryptocurrency instead of cash.

Key Highlights

• Institutional investors can now redeem or create ETF shares directly for

BTC or

ETH, bypassing cash-only conversions.

• This streamlines settlement, cuts operational costs, and narrows the gap between ETF share price and asset value.

• SEC Chair Paul Atkins highlighted the broader regulatory vision: “a fit‑for‑purpose crypto framework” that makes ETFs more efficient for market participants.

What Is the SEC’s In‑Kind Redemption Approval, And Why Does It Matter?

The SEC’s approval of in-kind redemptions for Bitcoin and Ethereum ETFs marks a fundamental shift in how these crypto funds operate. Instead of relying solely on cash-based transactions, ETF issuers and institutional investors can now redeem or create shares using the actual underlying assets, BTC or ETH. This change makes crypto ETFs more efficient, cost-effective, and aligned with traditional commodity ETFs like those for gold. Here's why this matters for investors and how it reshapes the crypto ETF landscape.

Source: SEC newsroom

1. Spot ETFs Go From Cash‑Only to Crypto‑Native

Previously, Bitcoin and Ethereum spot ETFs allowed only cash-based redemptions: ETF issuers sold crypto asset holdings into fiat to meet redemption demand. This model introduced timing inefficiencies, liquidation risk, and potential capital gains distributions. The new in-kind method eliminates these inefficiencies by permitting direct swaps with BTC or ETH.

2. Institutional Appeal: Lower Costs and Tax Efficiency

In-kind transactions reduce the fees and slippage associated with fiat conversions and avoid triggering taxable events until investors choose to liquidate their crypto holdings. This is especially appealing for long-term institutional portfolios managing large exposures.

3. Improved Liquidity and Arbitrage

Institutional participants can now arbitrage mispricings between ETF share price and the underlying digital asset more efficiently. The structural change is expected to enhance liquidity across Bitcoin and Ethereum ETFs, with tighter spreads and reduced tracking error.

Spot ETF Flows Reflect Capital Rotation Between Bitcoin and Ethereum

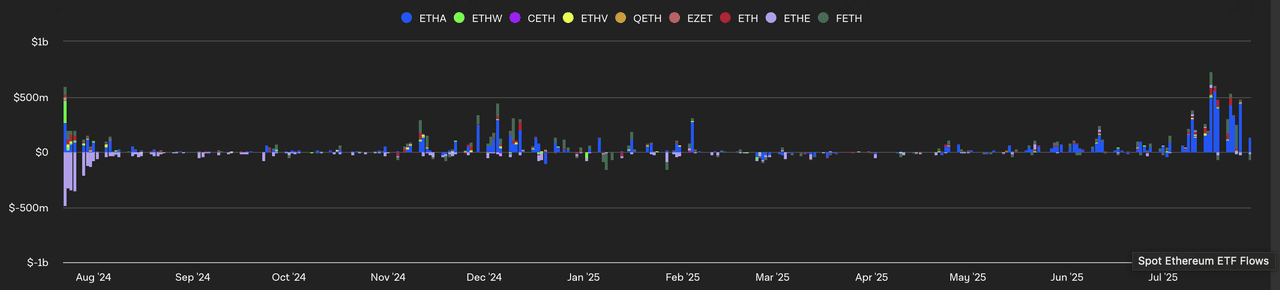

Spot Ethereum ETF flows | Source: TheBlock

Recent ETF data highlights a notable divergence in investor behavior toward Bitcoin and Ethereum. As of late July 2025, Ethereum ETFs have logged a record-breaking 17 consecutive days of net inflows, bringing in over $2.3 billion in just seven trading sessions. This surge reflects growing institutional interest in Ethereum’s long-term positioning, particularly around its staking economy and infrastructure relevance.

-- https://bingx.com/en/spot/ETHUSDT

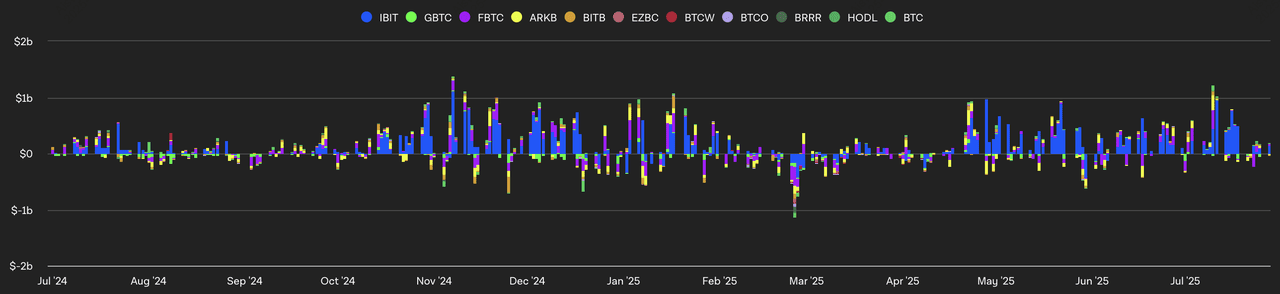

Spot Bitcoin ETF flows | Source: TheBlock

Meanwhile, Bitcoin ETFs remain fundamentally strong, with cumulative inflows surpassing $54.9 billion and daily volumes exceeding $3.3 billion. On July 28 alone, BTC ETFs pulled in $157 million, continuing a three-day streak. However, analysts from Glassnode noted a clear capital rotation from Bitcoin into Ethereum, citing ETH perpetual futures dominance reaching a 2-year high. As ETF products mature, investors may increasingly view Ethereum as a core asset alongside Bitcoin, reshaping the institutional crypto landscape.

--https://bingx.com/en/spot/BTCUSDT

You can

buy Bitcoin (BTC) and Ethereum (ETH) easily on BingX Spot Market using

USDT or other supported trading pairs with low fees and real-time execution.

How ETF Issuers, Institutions, and Investors Benefit from the New SEC Framework

The biggest winners from the SEC’s approval of in-kind redemptions are authorized participants (APs) and ETF issuers, who now gain a more efficient and cost-effective way to create and redeem ETF shares using actual BTC or ETH. This shift reduces reliance on intermediaries and lowers operational costs, streamlining fund management. Institutional investors also stand to benefit significantly, as the new structure provides a more flexible and tax-efficient vehicle for gaining exposure to Bitcoin and Ethereum through regulated products.

While the change primarily targets institutional mechanisms, retail investors may benefit indirectly as well. Increased participation by large asset managers enhances liquidity, reduces price slippage, and supports tighter tracking between ETFs and their underlying assets. Several major issuers, including BlackRock, Fidelity, Bitwise, Ark21, VanEck, and Franklin Templeton, have already received fast-track approval to adopt the in-kind model, signaling strong institutional alignment and broader market readiness.

How Does SEC's In-Kind Redemption Approval Benefit Investors?

The shift to in-kind redemptions makes crypto ETFs more cost-effective and structurally sound, directly benefiting both institutional and retail investors. By streamlining how ETF shares are settled, the change improves access, reduces fees, and enhances overall market efficiency.

Key benefits for investors include:

1. Lower Transaction Costs: In-kind redemptions remove the need to convert crypto to fiat, cutting trading fees and minimizing slippage.

2. Tax Efficiency: Direct asset transfers help investors delay capital gains taxes, offering more flexibility in managing taxable events.

3. Improved Liquidity: Faster settlements and institutional inflows boost liquidity and tighten trading spreads.

4. Better Price Tracking: ETFs can now more closely reflect the market value of the underlying assets, reducing volatility tied to operational inefficiencies.

5. Greater Institutional Participation: A more efficient and familiar redemption process increases interest from large funds, adding depth and credibility to the crypto ETF market.

Overall, the approval strengthens Bitcoin and Ethereum ETFs as viable investment tools, aligning them more closely with traditional financial products and expanding access to crypto exposure.

What’s Next for Crypto ETFs?

With in-kind redemptions now approved for Bitcoin and Ethereum ETFs, analysts expect the regulatory framework to expand to other digital assets. This could pave the way for altcoin-based exchange-traded products (ETPs) that adopt similar mechanisms, bringing a wider range of cryptocurrencies into the ETF ecosystem. As investor demand grows, we may see the launch of multi-asset or sector-specific crypto ETFs offering diversified exposure with improved efficiency.

Additionally, the shift is likely to influence how funds are structured, with a focus on tax-optimized strategies that take advantage of in-kind redemptions to defer capital gains. The SEC’s move toward a “merit-neutral” approach suggests further regulatory alignment with traditional commodities like gold or oil, signaling a maturing attitude toward digital assets. This broader acceptance could drive innovation in ETF design and create more secure, cost-effective options for institutional and retail investors alike.

Conclusion

The SEC’s approval of in-kind redemptions is more than a technical adjustment, it’s a paradigm shift. By enabling direct settlement in Bitcoin and Ether, the agency has effectively bridged a critical gap between traditional finance and crypto investing. For institutional and retail investors alike, this change enhances usability, efficiency, and trust, making crypto ETFs a more attractive investment vehicle.

As the market adapts, investors should stay informed on developments around altcoin ETPs and evolving tax treatments.

Related Reading