Linea is a zero-knowledge

Ethereum Layer-2 network developed by ConsenSys, offering full zkEVM equivalence for seamless compatibility with Ethereum dApps, tools, and smart contracts. With ultra-low fees around ~$0.0014 per transaction, instant finality via zkSNARKs, and direct

MetaMask integration, Linea has become a go-to L2 for developers and users seeking speed, scalability, and

Ethereum-aligned economics. Every transaction on Linea burns

ETH, reinforcing long-term ETH value and supporting decentralized finance growth.

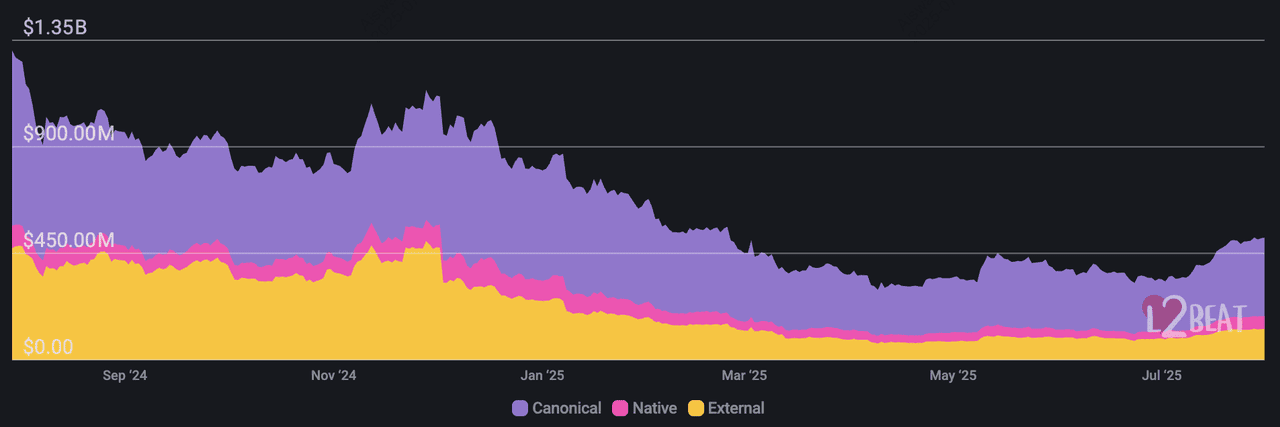

Linea Network's TVL | Source: L2Beat

As of July 2025, Linea secures over $516 million in total value, including $331.83M in bridged ETH and $53.58M in natively minted assets. The network is in Stage 0 of its decentralization roadmap but continues to expand rapidly across DeFi, NFTs, and cross-chain integrations. With the

$LINEA token airdrop and TGE expected in Q3 2025, early participation in top dApps may improve airdrop eligibility and position users at the forefront of Ethereum’s scaling future.

This guide explores the top Linea ecosystem projects to watch in 2025, and how they’re shaping the next phase of Ethereum Layer-2 innovation.

What Is Linea Network, and What Sets It Apart From Other Ethereum L2s?

Linea is a next-generation Ethereum Layer‑2 (L2) scaling solution built by ConsenSys, the team behind MetaMask and Infura. It uses zkEVM technology, a form of zero‑knowledge (zk) rollup, to boost Ethereum’s speed, reduce fees, and support broader adoption, without sacrificing security or developer experience.

Unlike some Layer‑2s that are only partially compatible with Ethereum, Linea offers full EVM equivalence at the opcode level. This means any smart contract, dApp, or tooling, like MetaMask, Hardhat, Truffle, or Infura, that works on Ethereum mainnet will work out of the box on Linea, no code rewriting required.

Trade Linea (LINEA) on BingX Pre-Market to secure early exposure ahead of the official token launch.

Linea's Key Features

Here are Linea’s standout features that make it one of the most promising Ethereum scaling solutions in 2025:

• Ultra-Low Fees and Instant Finality: Linea uses zkSNARK proofs to batch and validate transactions, which are then posted to Ethereum.

This approach offers:

- Average transaction fees of approximately $0.0014

- No 7-day withdrawal delays, as seen in some optimistic rollups like Arbitrum and Optimism

- Immediate finality after proof submission, reducing settlement times

• ETH-Burning and Ethereum Alignment: Every transaction on Linea consumes ETH as the native gas token. In fact, 20% of all transaction fees are burned, reducing ETH supply and helping increase its long-term value. This mechanism aligns Linea’s growth with Ethereum’s monetary policy.

• Capital Efficiency with Bridged ETH: ETH bridged to Linea can be natively staked within the network.

Staking rewards are distributed to liquidity providers and dApp users. This structure allows ETH to remain productive while supporting decentralized finance activity

• Developer and User Familiarity: Developers can build on Linea using the same tools they already use on Ethereum. Users benefit from direct MetaMask support and easy bridging interfaces via apps like Circle, 1inch, or the official Linea bridge.

• Transparent Roadmap Toward Decentralization: Linea is currently in Stage 0 of its rollup lifecycle, meaning it still relies on centralized sequencing and proving. However, it has laid out a public roadmap to introduce decentralization, open participation, and governance in future phases.

Top Linea Ecosystem Projects to Know

Here are seven notable projects within the Linea ecosystem that are contributing to its growth across DeFi, cross-chain infrastructure, and Web3 utilities.

1. PancakeSwap (CAKE)

PancakeSwap launched its v3 protocol on Linea in August 2023, bringing enhanced capital efficiency and support for concentrated liquidity, offering up to 4,000× more efficient trading compared to its earlier versions. Already one of the largest DEXs in the DeFi space, PancakeSwap enables users on Linea to trade, swap, farm, and provide liquidity with minimal fees. Its integration with Linea enhances the network’s DeFi capabilities by offering an established

AMM protocol with high-speed execution and low slippage. PancakeSwap is fully compatible with MetaMask and supports a wide range of wallets, making it accessible to both new and experienced users.

The platform’s native token, CAKE, plays a central role in governance, staking, and reward mechanisms. As of mid-2025, CAKE has a market cap of ~$985 million, supported by a total value locked (TVL) of over $2.08 billion across chains. PancakeSwap’s appeal extends beyond traditional trading; it also offers features like lotteries, NFT rewards, yield farming, and Initial Farm Offerings (IFOs), making it a comprehensive DeFi hub within the Linea ecosystem and beyond.

2. Axelar (AXL)

Axelar is a decentralized interoperability network built on the Cosmos SDK, designed to enable seamless communication and asset transfers across over 80 blockchain networks, including Ethereum,

Cosmos,

Avalanche, and Linea. Its infrastructure relies on a unique Gateway smart contract system and multi-party cryptography, which allow for secure cross-chain messaging and token transfers without requiring users to hold the AXL token directly. Axelar simplifies the developer experience through tools like SDKs, APIs, and a CLI, making it easier to build and scale interoperable dApps across Web3. By mid-2025, Axelar has processed more than 2.5 million transactions and enabled over $10 billion in value transfers, positioning itself as a key infrastructure layer for omnichain dApps and institutions alike.

The native AXL token (~$0.36, with a market cap of ~$368 million) powers the network’s proof-of-stake security, governance, and validator incentives. AXL can be staked to support network security and used for transaction fees (even if users pay in source-chain tokens). It also plays a role in ecosystem growth through protocol governance and rewards for validators and developers. As demand for cross-chain functionality rises, Axelar’s integration with platforms like Uniswap, J.P. Morgan’s Onyx, and Deutsche Bank highlights its importance in both decentralized and institutional finance. Within the Linea ecosystem, Axelar supports bridging and token routing, helping drive liquidity and connectivity across chains.

3. Renzo (REZ)

Renzo is a liquid restaking protocol that allows users to earn staking rewards on ETH and SOL while maintaining liquidity through its native restaked assets like ezETH and ezSOL. Built on top of EigenLayer and other modular restaking networks, Renzo auto-compounds yield and integrates with DeFi protocols across Ethereum, Solana, and Layer-2s like Linea. Its restaked ETH token (ezETH) can be used in lending, trading, or farming strategies while continuing to earn rewards from Ethereum validators. As of mid-2025, Renzo has over $1.3 billion in total value restaked, with $703 million in ezETH and growing traction across multiple chains.

The protocol’s governance token, REZ, is among the top Linea-based tokens by market cap, currently valued at around $50.7 million and a total supply capped at 10 billion REZ. REZ is designed to support community governance and incentivize users through staking and participation in protocol decisions. Renzo is backed by top-tier investors such as Galaxy Digital, Brevan Howard Digital, and Consensys, and has undergone multiple audits to ensure smart contract security. On Linea, Renzo expands utility for restaked assets by allowing users to earn additional DeFi rewards without locking their capital.

4. Trusta.AI (TA)

Trusta.AI is a decentralized identity and reputation protocol designed to verify both human users and

AI agents across blockchain networks. Built to address Sybil resistance, identity fragmentation, and the rise of autonomous agents in Web3, Trusta.AI introduces a modular system that includes tools like the Trusta Attestation Service (TAS), MEDIA Score, and Proof of Intelligence (PoI). These components allow for verifiable credentials, trust scoring, and on-chain reputation, which can be used for applications such as Sybil-resistant airdrops, credit scoring, and fair token launches. With over 3 million users, 2.5 million on-chain attestations, and partnerships with projects like

Celestia,

Gitcoin, and

Starknet, Trusta.AI is becoming a key infrastructure layer for identity in the AI+Crypto space.

The native TA token powers staking, governance, gas fees, and payments within the ecosystem. As of mid-2025, 180 million TA tokens are in circulation, with a max supply of 1 billion. TA can be traded on platforms like BingX, where it is also available for futures trading. Trusta.AI’s roadmap includes issuing verifiable identities for AI agents, launching its mainnet, and expanding into areas like undercollateralized lending and privacy-preserving DeFi. With its unique approach to identity and AI-agent verification, Trusta.AI aims to address core challenges in decentralized trust, making it a project to watch within the Linea ecosystem and beyond.

5. Sidus Heroes (SIDUS)

Sidus (SIDUS) is a native token within the SIDUS Heroes Web3 gaming metaverse, which blends

play-to-earn mechanics, NFT collectibles, and

AI-powered gameplay across multiple game titles like Xenna, Nidum, and Sidus Maze. Built with interoperability and multi-platform access in mind, SIDUS supports gameplay on PC, Mac, iOS, Android, and Telegram, while offering ecosystem tools like SidusPad (a launchpad) and Ton Station, its Telegram-based farming and leveling app. The SIDUS token plays a central role in the project's economic infrastructure, enabling in-game purchases, staking, LP farming, governance voting, and DAO participation. As the Linea ecosystem grows, SIDUS is positioned as a community-centric asset contributing to user incentives, on-chain governance, and token utility across its expanding metaverse.

As of mid-2025, SIDUS has a market cap of ~$9.66 million, with 14.4 billion tokens in circulation out of a 30 billion max supply. The project has burned over 11 billion SIDUS tokens, reflecting a deflationary mechanism aimed at sustaining long-term value. Though the SIDUS token initially launched on other chains, its expansion to Linea highlights its intent to engage new users and developers through a lower-cost Layer-2 environment. With a growing user base, frequent updates, and cross-chain gaming integrations, SIDUS continues to build toward its vision of a decentralized, player-owned metaverse with token-driven coordination and rewards.

6. ZeroLend (ZERO)

ZeroLend is a multi-chain lending protocol built on a fork of Aave V3, designed to support a wide range of digital assets including Liquid Restaking Tokens (LRTs) like Renzo (ezETH), EtherFi, and Kelp, along with stablecoins, LP tokens, and memecoins. It operates across several blockchains, Linea, zkSync, Manta, Blast, and Ethereum, and is known for launching with a zero-fee model for lending and borrowing, which attracted rapid user growth and liquidity. The protocol enables high-yield carry trades, making it attractive for advanced DeFi strategies, while its infrastructure is supported by integrations with major oracles and automation tools like Pyth, Redstone, Gelato, and LayerZero.

The ecosystem’s native token, ZERO, powers governance, staking rewards, and airdrop incentives. During its early rollout, the protocol held a token snapshot for active users on Linea and other chains, with claims beginning on May 6, 2024. As of mid-2025, ZERO has a market cap of $2.73 million, a TVL of over $60 million, and more than 82,000 unique holders, highlighting its community-driven traction. ZERO holders can stake to earn a share of protocol revenue, partner airdrops, and benefit from deflationary buyback mechanics. With its cross-chain strategy, deeply integrated DeFi tooling, and emphasis on LRTs, ZeroLend is emerging as a versatile lending hub within the Linea ecosystem.

7. DMAIL Network (DMAIL)

DMAIL Network (DMAIL) is a decentralized messaging protocol designed to bring secure, AI-powered communication to the Web3 space. Built for interoperability across 25+ chains, including Linea, it offers encrypted emails, on-chain notifications, and DID-linked marketing tools tailored for users, developers, and marketers. Its core product, the Dmail DApp, serves as a decentralized mailbox solution, while the Subscription Hub enables wallet-targeted notifications for dApps, DAOs, and protocols. With over 52 million registered users and nearly 3.2 million on-chain transactions, DMAIL is quietly establishing a niche as the communications backbone of decentralized infrastructure.

With a market cap of $8.4 million and a total supply of 200 million tokens, DMAIL delivers a crucial utility layer within the Linea ecosystem. It supports secure, user-owned identity messaging and monetized marketing, allowing users to earn rewards for viewing curated ads while keeping control over their data. With its growing adoption and mainnet launch, DMAIL aims to scale toward mass communication in Web3, offering a key building block for cross-chain dApp development, social messaging, and user engagement tools.

Why These Projects Matter & How They Elevate Linea

These seven projects play a vital role in strengthening Linea’s ecosystem across multiple layers. PancakeSwap boosts liquidity and daily trading volume, while Axelar connects Linea to other blockchains, enabling seamless cross-chain activity. Renzo and ZeroLend enhance DeFi capital efficiency through restaking and lending. Meanwhile, Trusta.AI, Sidus, and DMAIL introduce tools for on-chain identity, governance, and secure messaging, key components for user-friendly Web3 experiences. Participating in these dApps not only supports Linea’s growth but may also improve your chances of qualifying for the upcoming $LINEA airdrop, as on-chain activity, bridging, staking, and holding ecosystem tokens could all influence eligibility.

How to Trade Linea Ecosystem Tokens on BingX

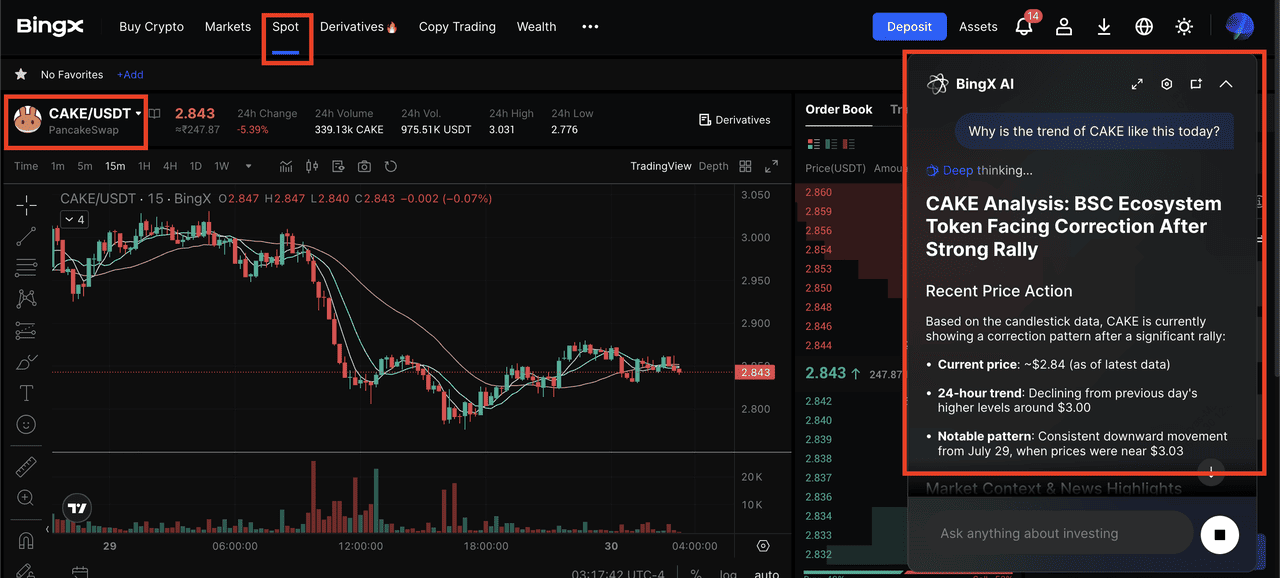

CAKE/USDT trading pair on spot market powered by BingX AI

Getting started with Linea ecosystem tokens like

CAKE,

AXL, or

TA is easy on BingX, a user-friendly crypto exchange that supports both spot and futures trading. Whether you're a beginner or an experienced trader, you can access real-time market data, smart AI tools, and low trading fees in just a few steps.

1. Create or log into your BingX account at bingx.com. Complete the basic

KYC verification if prompted.

2. Deposit USDT or ETH into your BingX spot wallet using your preferred payment method or wallet.

3. Search for tokens using the BingX search bar. Type the token name or symbol, such as CAKE, AXL, TA, ZERO, or DMAIL.

4. Choose your market:

• Use

Spot Trading to buy and hold tokens at the current market price.

5. Use

BingX AI Assistant to simplify your trades. Just type commands like “Review market trends for AXL” and the AI will assist with market analysis and trading insights.

6. Track performance and risk. Monitor real-time charts, liquidity depth, recent trade history, and order book metrics directly on the platform.

Pro Trading Tips

• Set limit orders when trading Linea tokens to avoid price slippage, especially during high volatility.

• Leverage BingX AI for smart trading insights like market insights, token info, and latest developments.

• If you're trading restaked tokens like Renzo (rsETH) or interacting with ZeroLend, check their official dApps for staking dashboards and real-time APYs before executing trades on BingX.

Final Thoughts

Linea is steadily evolving into a key Ethereum Layer-2 network, offering the scalability of zk-rollups with full Ethereum compatibility. Its low fees, fast finality, and seamless MetaMask integration make it an attractive platform for both developers and users. In 2025, ecosystem projects like PancakeSwap, ZeroLend, Axelar, Renzo, Trusta.AI, Sidus, and DMAIL are helping to shape Linea’s infrastructure across DeFi, cross-chain bridging, identity, and messaging.

With the anticipated $LINEA token airdrop on the horizon, exploring and interacting with these dApps may offer more than just utility; it could increase your eligibility for future rewards. However, it’s important to stay cautious. Always do your own research (DYOR), use audited smart contracts, and start with small amounts when testing new platforms. Like all blockchain ecosystems, Linea carries risks such as token volatility, bugs, or centralization concerns at this early stage. Engage thoughtfully and stay informed.

Related Reading