Boundless (ZKC) is transforming zero-knowledge proving into a live, on-demand compute marketplace, already showing strong traction with 2,800+ provers, over 500T cycles generated in Season 1, and a record 2.6T daily cycles across 8,000 orders during the first week after the mainnet's beta launch. It became the first network to fully prove

Ethereum consensus with 50B-cycle proofs, while auctions cleared in under 100 ms and most requests priced at zero thanks to incentives outpacing demand.

Built on Proof of Verifiable Work (PoVW) and backed by the Ethereum Foundation, Base, and others, Boundless enables builders to post proof jobs, provers to compete for rewards, and all settlement to happen securely on-chain.

Learn what Boundless (ZKC) is, how its Proof of Verifiable Work marketplace operates, and why the mainnet launch, backed by hard numbers from Mainnet Beta and Season 1, matters for builders, provers, and token participants.

What Is Boundless Network (ZKC)?

Boundless is a newly launched

zero-knowledge (ZK) proving protocol that aims to scale and unify blockchain ecosystems by treating compute as a tradable commodity. On September 15, 2025, Boundless officially launched its mainnet on Base, backed by the Ethereum Foundation,

Wormhole,

EigenLayer, and Base itself. Already, more than 30 protocols have integrated Boundless proof capabilities, signaling strong early adoption across the ecosystem .

At its core, Boundless operates as a marketplace for verifiable compute. Developers (requestors) post proof requests, and independent operators (provers) compete to fulfill them using their GPUs or hardware. Payments and verification happen trustlessly on-chain. This model transforms proof generation from a costly, centralized bottleneck into a scalable, permissionless market, similar to how early

Bitcoin mining decentralized transaction validation.

How Does Boundless Protocol Work?

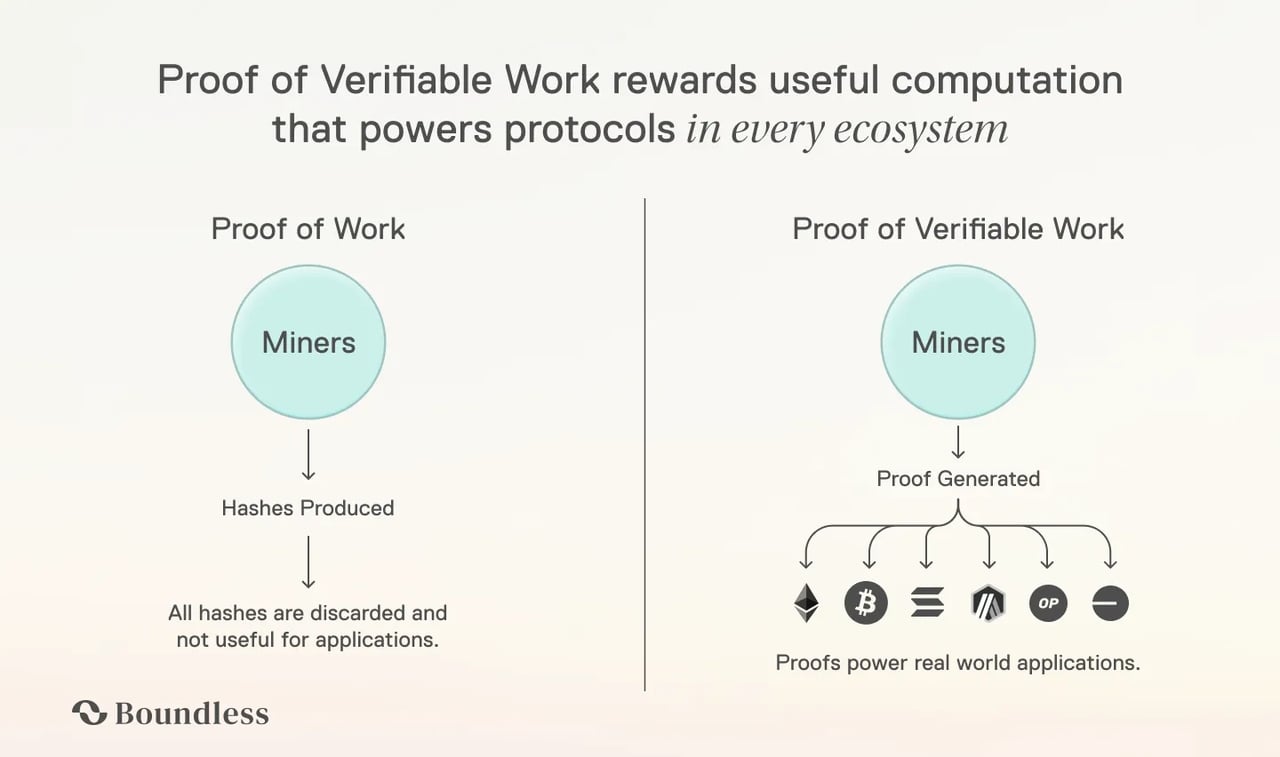

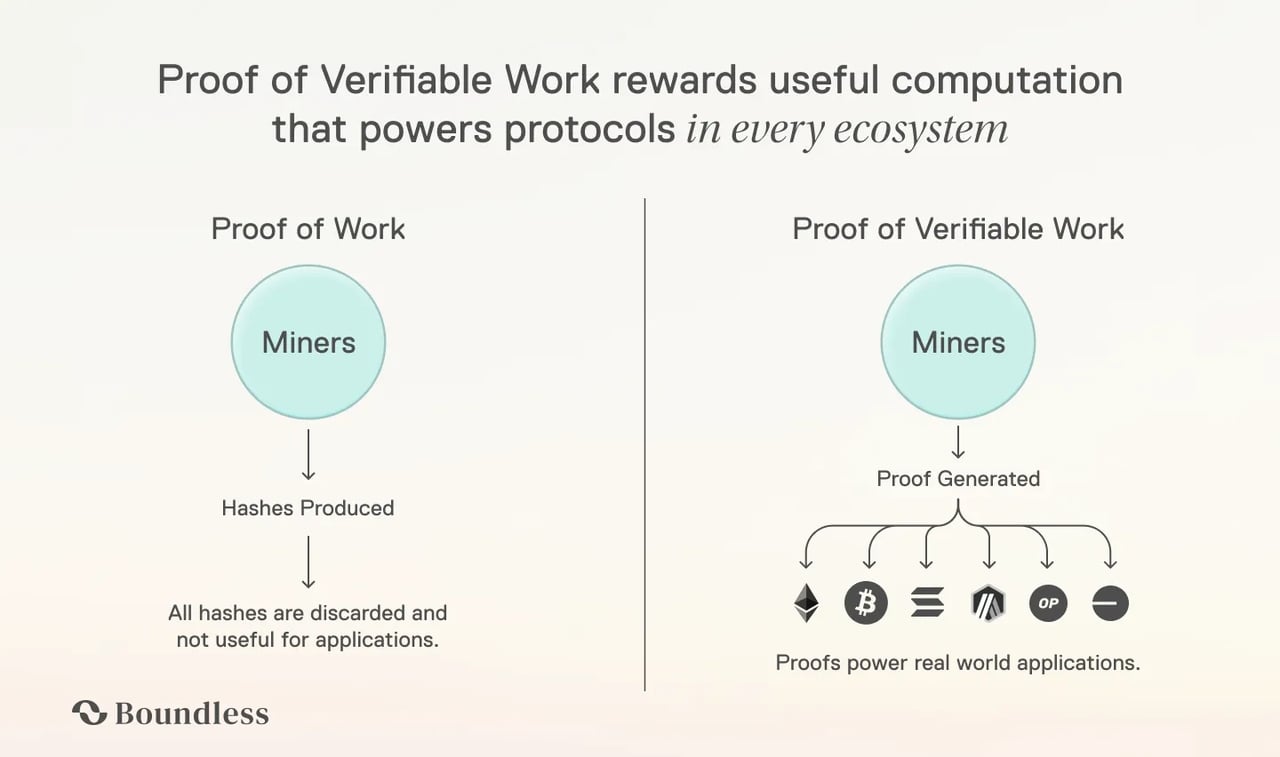

Boundless introduces a new consensus-economic primitive called Proof of Verifiable Work (PoVW). Unlike

Bitcoin’s Proof of Work, which requires brute-force hashing, PoVW rewards provers for performing useful zero-knowledge computations.

How Boundless network's PoVW consensus works | Source: Boundless blog

Here’s how the Boundless network works:

1. Proof Requests: Developers request ZK proofs for apps, rollups, or infrastructure. Jobs can be priced via reverse Dutch auctions, ensuring the lowest possible cost.

2. Collateral & Staking: Provers must stake ZKC before accepting jobs, often 10× the job’s maximum fee. If they fail to deliver, 50% of their stake is burned, and 50% is reassigned as a bounty.

3. Execution and Verification: Once completed, the proof is verified on-chain, and provers receive both the requestor’s payment and additional PoVW rewards in ZKC.

4. Market Dynamics: Supply and demand for compute are balanced by the open marketplace. If one operator dominates, new provers can easily join with commodity hardware like gaming PCs or cloud GPUs, ensuring decentralization.

This model has already been tested at scale: during Season 1 of Boundless prover incentives, more than 2,800 provers participated, generating over 500 trillion cycles of proofs, with a single-day peak of 40 trillion cycles. The core team has even shut down its own internal prover nodes, declaring external supply “sufficient,” a milestone in decentralization.

What Sets Boundless Network Apart From Other Blockchains?

Boundless stands out from other blockchains because it doesn’t treat computation as a scarce, fixed resource. Traditional blockchains like Ethereum rely on validators re-executing transactions, which limits throughput and forces users to compete in gas markets. Boundless flips this model by financializing zero-knowledge proofs and creating a decentralized marketplace where provers compete to deliver computation as a service. This turns verifiable compute into an elastic, on-demand resource, similar to how AWS scaled Web2, while remaining fully decentralized.

The difference is already measurable. In Season 1, 2,800+ provers generated over 500T cycles, and during Mainnet Beta, throughput scaled 10× to 2.6T daily cycles across 8,000 orders without core team intervention. Backed by the Ethereum Foundation, Base, Wormhole, and EigenLayer, Boundless has over 30 protocols integrated at launch, proving that the demand for proving is not just theoretical but already live.

What also sets it apart is its token model: provers must stake ZKC collateral, often 10× the maximum fee of a job, which can be slashed if deadlines are missed. This mechanism aligns incentives, reduces circulating supply, and ensures proof delivery. For developers, it means easy access to scalable proving power; for provers, it’s a new way to earn from hardware; and for the ecosystem, it creates a self-correcting market that grows with usage.

ZKC Token Utility

The ZKC token powers every part of the Boundless ecosystem:

• Proof of Verifiable Work Rewards: Provers earn ZKC based on cycles proven and value delivered, with 75% of rewards going to provers and 25% to stakers.

• Collateral for Proofs: Provers must lock ZKC before accepting jobs. Slashing ensures reliability.

• Staking & Service Agreements: Users stake ZKC to secure long-term proving contracts, adding predictability for protocols.

• Vault Rewards: ZKC holders can lock tokens in the Vault to earn points and claim a share of fees from the marketplace.

• Governance: Tokenholders vote on critical parameters like minting rate, take rate, and reward frequency.

• Payments & Incentives: ZKC is used for settlement of compute services, liquidity incentives, and ecosystem rewards.

This dual design, powering compute while anchoring governance, makes ZKC more than just a speculative asset; it is the backbone of verifiable compute across chains.

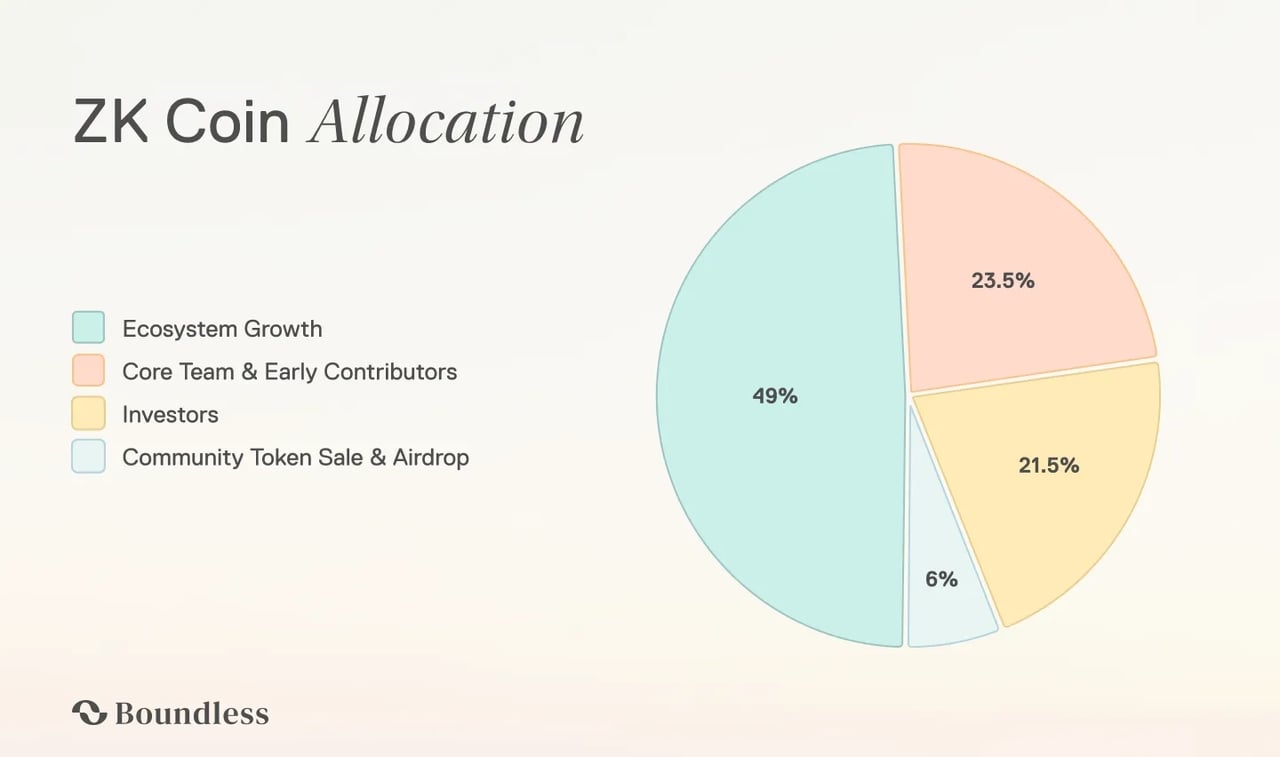

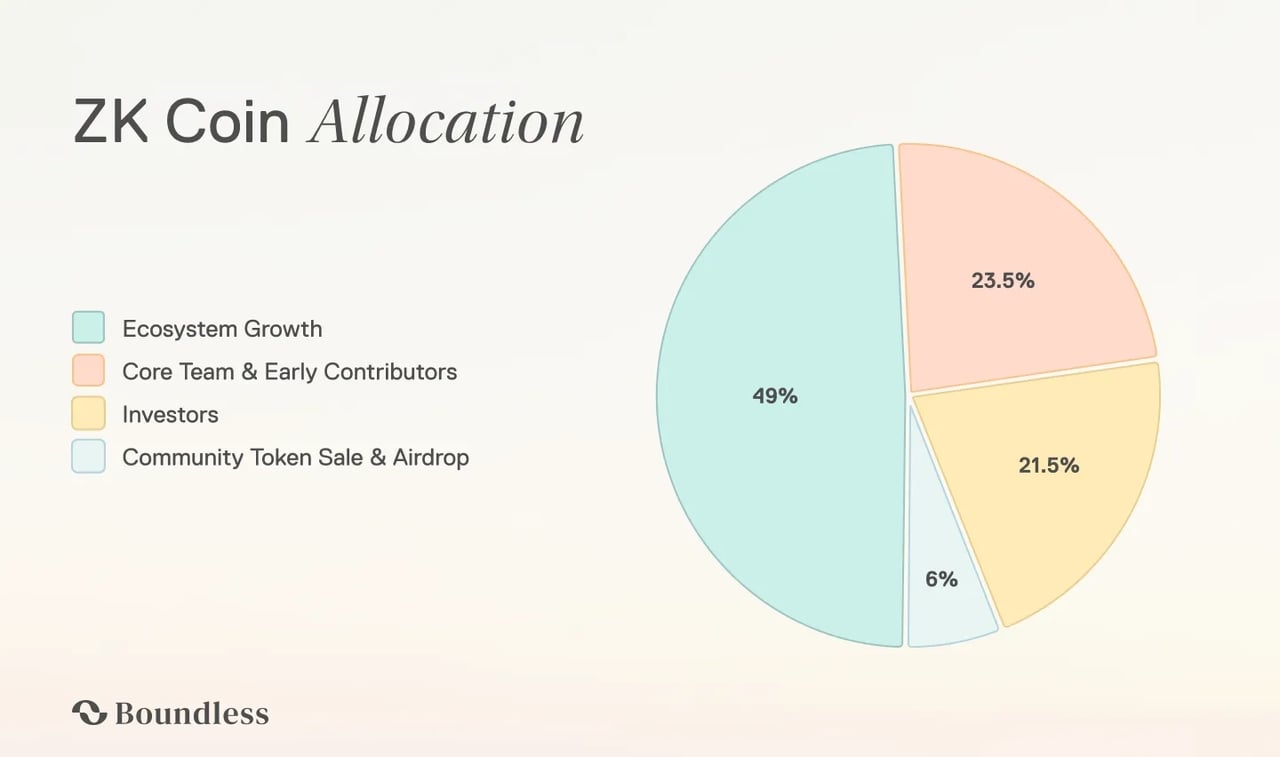

ZKC Token Allocation

ZKC token distribution | Source: Boundless blog

ZKC has a fixed supply of 1 billion tokens, distributed as follows:

• Ecosystem Growth – 49%

- 31% Ecosystem Fund: Grants, developer tooling, protocol maintenance. Vesting: 1-year cliff, then 24 months linear.

- 18% Strategic Growth Fund: Enterprise integrations and institutional prover onboarding. Unlocks gradually over 12 months.

• Core Team & Early Contributors – 23.5%

- 20% Core Team: Builders and engineers behind Boundless. Vesting: 1-year cliff, then 24 months linear.

- 3.5% RISC Zero: zkVM research and development. Same vesting schedule.

• Investors – 21.5%: Strategic backers like Blockchain Capital, Bain Capital Crypto, Delphi Ventures, Maven11. Vesting: 25% unlock after 1 year, then 24 months linear.

• Community Sale & Airdrop – ~6%

- Community Sale: 50% unlock at TGE, 50% after 6 months.

- Airdrop: 100% unlocked at TGE, rewarding provers, manifesto signers, and campaign participants.

Inflation is controlled, starting at 7% annually in Year 1, tapering to 3% by Year 8. With collateral requirements and slashing, circulating supply is expected to remain tight.

Boundless Airdrop and Prover Incentives

The

Boundless airdrop sets aside about 6% of ZKC supply to reward its earliest contributors and community members. Eligible wallets include more than 2,800 Mainnet Beta provers from Season 1, contributors who reached Bronze through Diamond ranks, manifesto signers, campaign participants, and allied groups like validators and

Kaito Yappers.

The snapshot has already been taken, with tokens set to unlock at the Token Generation Event (TGE) on August 25, 2025. Airdrop tokens are 100% unlocked at TGE, while community sale allocations release 50% at TGE and 50% after six months, giving both instant rewards and longer-term exposure.

Beyond the airdrop, Boundless continues to incentivize provers through its Season 2 rewards program, which launched on August 20, 2025. Each week, 0.1% of ZKC supply is distributed to active provers who run nodes, complete proof requests, and climb the leaderboard. This creates an ongoing earning opportunity for anyone with suitable hardware, turning zero-knowledge proving into a competitive and rewarding activity while strengthening the network’s decentralized capacity.

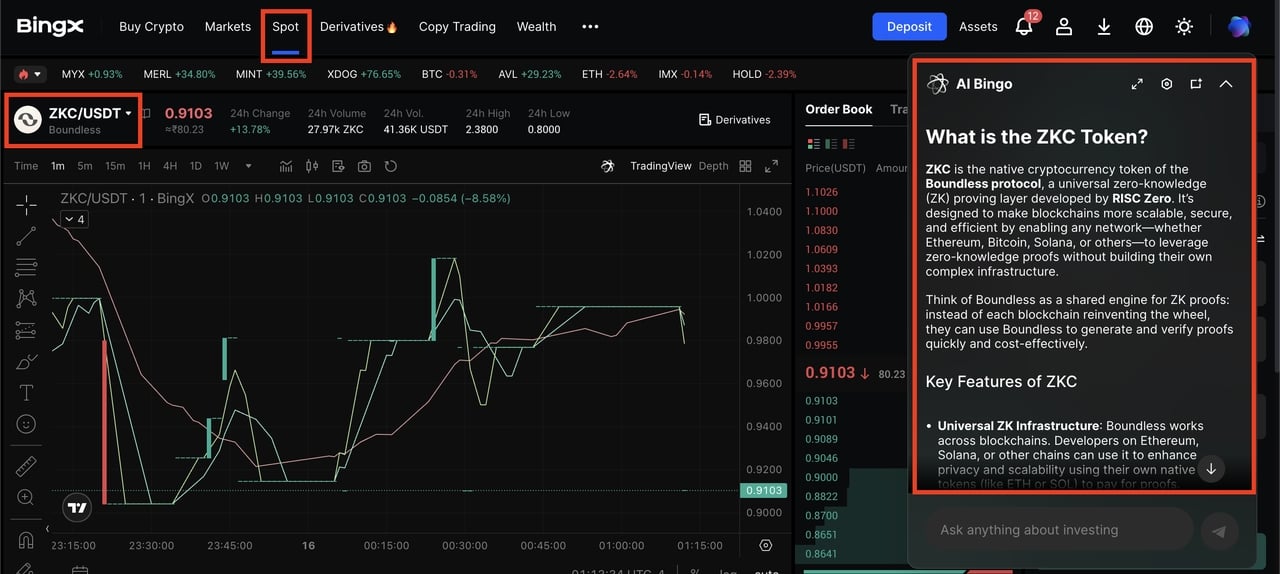

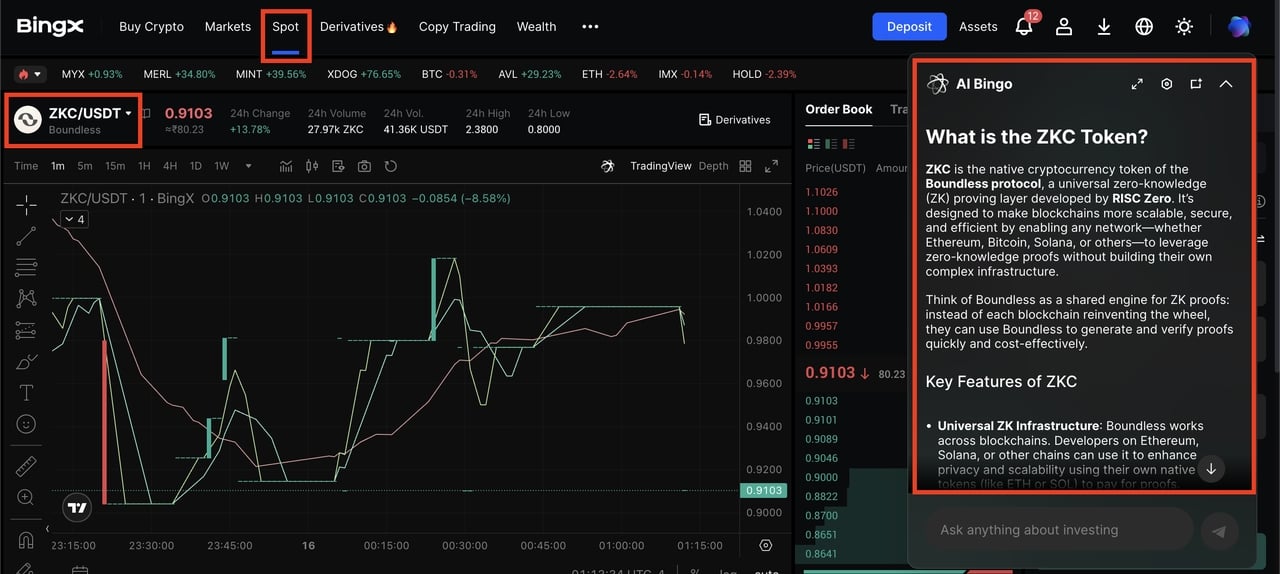

How to Trade Boundless (ZKC) on BingX

ZKC/USDT trading pair on the spot market, powered by BingX AI

Once you’ve received ZKC tokens through the airdrop, community sale, or secondary markets, you can easily trade them on the BingX Spot Market. BingX is designed to be beginner-friendly, while also giving you advanced insights powered by BingX AI to help make smarter trading decisions.

Step 1: Create and Verify Your Account

Sign up on BingX using your email or phone number. Complete the

KYC verification to unlock full trading features, higher withdrawal limits, and ensure account security.

Step 2: Deposit ZKC or USDT

Go to your BingX wallet and deposit ZKC if you already hold it or

USDT to buy ZKC. Always double-check the network, e.g., Ethereum ERC20 when transferring tokens to avoid loss of funds.

Step 3: Find the ZKC/USDT Trading Pair

In the

Spot Market section, search for

ZKC/USDT. This is the main pair that lets you buy or sell ZKC directly against USDT.

Step 4: Place Your Order

• Market Order – Buy or sell instantly at the best available price, ideal for beginners.

• Limit Order – Set your preferred price, and your trade executes only when the market reaches that level, better for traders who want more control.

Step 5: Use BingX AI for Insights

Before trading, check

BingX AI tools for real-time market sentiment, liquidity depth, volatility alerts, and technical signals. These insights can help you decide when to enter or exit a position.

Step 6: Secure Your Tokens

If you plan to hold ZKC long-term, you can keep it in your BingX wallet for convenience. For active trading, keeping it on BingX lets you react quickly to price movements.

How to Stake ZKC Tokens on the Boundless Network

Staking on Boundless lets you earn passive rewards, support the network, and gain a voice in protocol governance. By staking ZKC, you commit tokens to the network, helping secure proof requests while earning a share of emissions every epoch.

Rewards are split between a passive pool of 25% for all stakers and an active pool of up to 75% for provers running nodes. Epochs last two days each, meaning rewards are calculated and distributed 182.5 times per year. The emission rate starts at ~7% annually in Year 0 and gradually tapers to ~3% from Year 8 onward, ensuring long-term sustainability.

1. Go to the Portal: Visit the official Boundless Staking Portal.

3. Enter Amount: Choose how many ZKC tokens you want to stake.

4. Confirm Transaction: Approve the transaction in your wallet. Once confirmed, your tokens are locked.

5. Receive veZKC NFT: You’ll automatically receive a veZKC NFT, which tracks your staked balance, governance rights, and rewards.

6. Withdraw (Optional): If you want to withdraw, start a 30-day cooldown. During this period, your rewards and voting rights are paused. After 30 days, your tokens become available for withdrawal.

Conclusion: Could Boundless Become Web3’s Universal Proving Layer?

Boundless is emerging as the universal ZK compute layer, providing developers, provers, and communities with a scalable, decentralized, and incentive-driven system. With over 30 integrations at launch, 2,800+ provers active in beta, and strong institutional backing, it is already proving its value as core infrastructure.

That said, risks remain. Token prices may fluctuate, vesting schedules could impact supply, and running a prover requires technical setup. Still, if adoption of ZK applications continues to accelerate, Boundless has positioned itself to be the AWS-like backbone of verifiable compute in Web3.

Related Reading