Is

Aptos (APT) one of the most trending Layer-1 blockchains to watch in 2025? According to Messari’s H1 report, Aptos’

stablecoin market cap rose around 86% in H1 to $1.2 billion while average fees fell 61% QoQ to around $0.00052. Monthly active users stayed above 10 million through H1, and consensus upgrades such as Baby Raptr shaved 100–150 ms off finality latency.

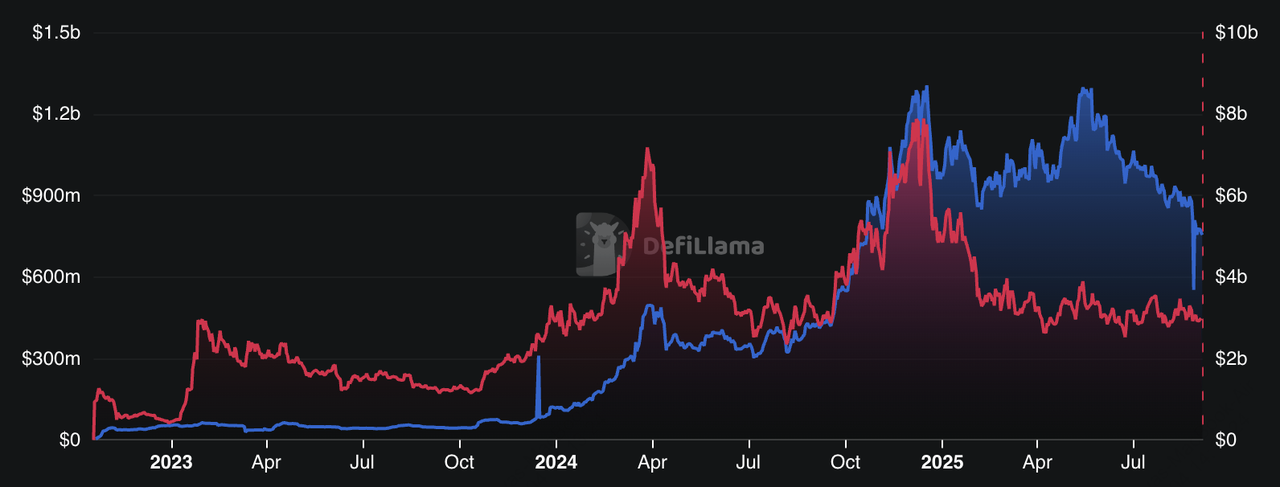

Aptos DeFi TVL, APT market cap | Source: DefiLlama

On the ground, Aptos TVL and volumes remain healthy: DefiLlama shows over $1.15 billion in stablecoins on Aptos, with weekly on-chain DEX volume near $1 billion in recent snapshots. Meanwhile,

real-world assets (RWA) on Aptos surpassed $540 million by late June, propelling the network into the top three

blockchains for RWAs, helped by BlackRock’s BUIDL, Franklin Templeton’s BENJI, and the PACT credit programs.

What Is Aptos (APT) and How Does It Work?

Aptos (APT) is a next-generation Layer-1 blockchain designed to make crypto apps feel as fast and reliable as mainstream Web2 platforms. It was originally built by former Meta engineers behind the Diem and Novi projects, and it launched in October 2022 with backing from top investors. Like

Sui, Aptos uses the Move programming language, which was created for safer asset handling, reducing bugs and hacks that are common in other ecosystems.

What makes Aptos stand out is its tech stack focused on speed and safety. Its consensus mechanism, AptosBFT, and execution engine, Block-STM, allow millions of transactions to run in parallel instead of queuing up, which keeps costs low and throughput high.

On average, Aptos transactions settle in under one second, and fees are typically fractions of a cent. For developers and users, this translates to smooth DeFi trading, NFT minting, and

gaming experiences without long waits or unpredictable fees. Aptos also introduced modern token standards like FA and DFA, which let tokens automatically perform functions such as distributing

staking rewards or enforcing compliance rules, making apps easier to use and more flexible for real-world finance.

Aptos Has Emerged as One of the Fastest-Growing Layer-1 Chains in 2025

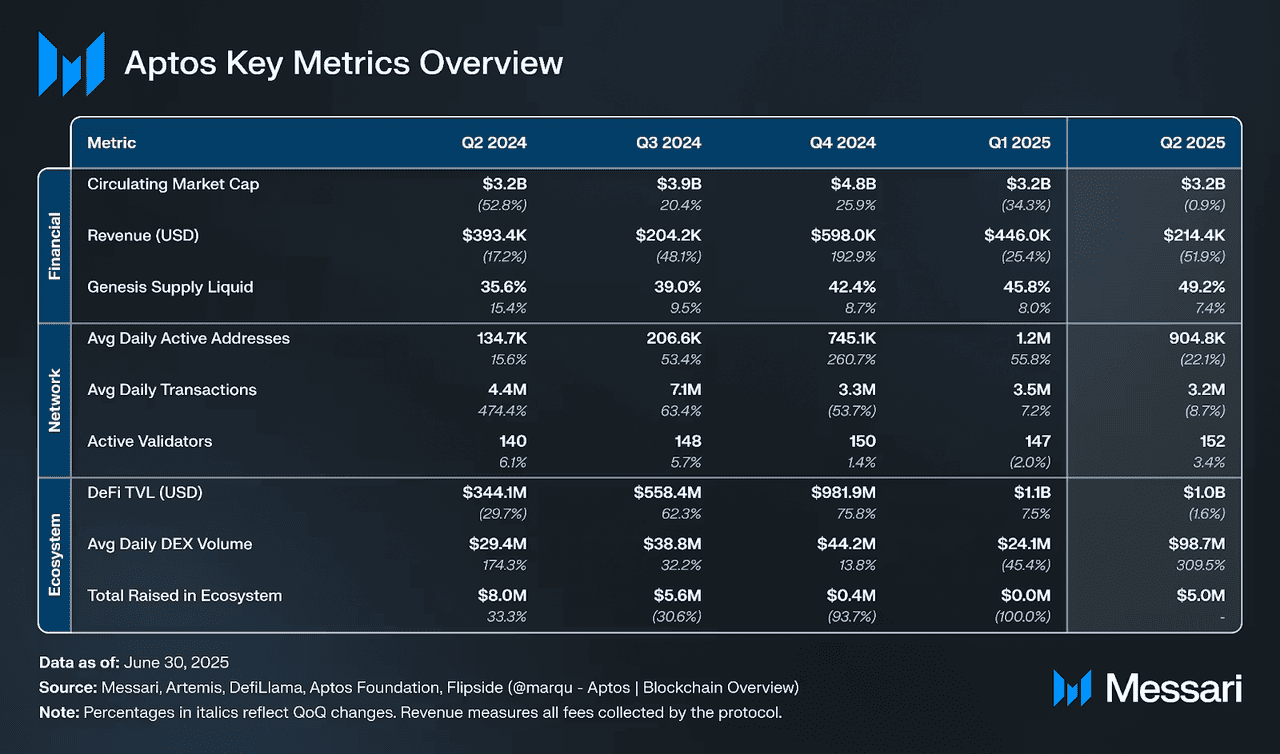

An overview of Aptos's key metrics | Source: Messari

Aptos has emerged as one of the fastest-growing Layer-1 chains by combining performance, asset programmability, and institutional liquidity. Fees averaged just 0.00011 APT , around ~$0.00052 in Q2 2025, with finality reduced by 100–150 ms after the Baby Raptr upgrade, delivering a Web2-like UX for orderbooks, perps, and real-time apps. This efficiency helped drive over $9 billion in DEX volume in Q2, with Hyperion and ThalaSwap V2 accounting for the bulk of trading activity.

Beyond speed, Aptos is pioneering programmable assets through its FA/DFA standards, allowing tokens to auto-accrue rewards, enforce compliance, or embed logic directly at the token layer. This innovation simplifies liquidity provision and staking while making complex workflows invisible to end users. Meanwhile, institutional on-ramps are scaling fast: native USDT/USDC, BlackRock’s BUIDL, Ondo’s USDY, and

Ethena’s sUSDe have boosted Aptos’ stablecoin supply to $1.2 billion, cementing the network as a top-three chain for RWAs. The arrival of Aave’s first non-EVM deployment in August 2025 reinforces Aptos’ reputation as a hub where high-frequency DeFi meets real-world capital.

The 10 Best Aptos dApps and Projects to Watch in 2025

From lending platforms and decentralized exchanges to real-world assets, fitness apps, and NFT marketplaces, these are the top 10 projects most Aptos users are likely to encounter first.

1. Aave (V3 on Aptos)

Aave, one of the world’s largest DeFi lending protocols with over $70B in deposits across chains, made its first-ever non-EVM deployment on Aptos on August 21, 2025. Rewritten in the Move language for security and performance, Aave V3 launched with support for APT,

USDC,

USDT, and sUSDe, bringing deep liquidity and institutional-grade lending infrastructure to the Aptos ecosystem.

For users, this means you can now supply stablecoins or APT to earn yield or borrow assets against your holdings directly on Aptos, with lower fees and faster confirmations than EVM chains. Stablecoins already make up over 86% of Aptos assets, so Aave’s arrival not only improves capital efficiency but also unlocks new collateral markets like

liquid staking tokens (LSTs), expanding lending opportunities for both retail and institutional players.

2. Hyperion (RION)

Hyperion is an Aptos-native hybrid DEX that combines an orderbook with a concentrated-liquidity AMM (CL-AMM), giving traders both deep liquidity and capital efficiency. In Q2 2025, Hyperion drove over $5.4 billion of Aptos’ $9.0B DEX volume, making it the dominant trading venue on the network. Its July RION token generation event (TGE) introduced governance and yield features, with users able to stake RION for xRION, which grants voting rights and revenue-sharing from protocol fees.

For liquidity providers, Hyperion offers practical tools like custom price range pools, auto-compounding vaults, and a “Drips” rewards system that tracks contributions across trading, LPing, and referrals. With nearly 1 million participants, $97.9M in TVL, and over $13.2B in accumulated trading volume as of mid-2025, Hyperion has become the go-to hub for both retail traders seeking better swap prices and professional market-makers deploying automated strategies on Aptos.

3. BUIDL (BlackRock’s USD Institutional Digital Liquidity Fund)

BUIDL is BlackRock’s first tokenized money market fund, designed to bring traditional short-term U.S. Treasuries and cash-equivalent assets on-chain. By representing these assets as blockchain tokens, BUIDL offers investors a stable $1-pegged digital share that pays daily accrued dividends, distributed monthly as additional tokens. Since launch in 2024, BUIDL’s assets under management have grown rapidly, jumping from $667 million to $1.8 billion in just three weeks, and surpassing $2.2 billion in value by March 2025 across seven supported chains, including

Ethereum,

Solana, and Aptos.

On Aptos, BUIDL acts as a core building block for real-world asset (RWA) strategies, allowing both institutions and crypto-native investors to hold and trade a tokenized fund with 24/7 liquidity and faster settlement compared to traditional money markets. It integrates with bridges like Wormhole for cross-chain mobility, meaning users can move tokenized fund shares across ecosystems without friction. For DeFi participants on Aptos, this means stable, yield-bearing capital that can be plugged into lending markets, treasuries, or collateral strategies, blending the security of traditional finance with the efficiency of blockchain settlement.

4. Sweat Economy (SWEAT)

Sweat Economy is one of the largest “move-to-earn” applications, rewarding users with

$SWEAT tokens for every verified step they take. Since launch, the project has attracted over 20 million token holders and maintains 3 million monthly active users, with around 20,000 new users joining daily. Originally built on NEAR and later expanded to EVM chains, Sweat has become a gateway for mainstream users to experience crypto through a simple mobile app that tracks daily activity and converts it into digital assets. Its Sweat Wallet, available on iOS and Android with a 4.7-star rating, enables users to store tokens, redeem rewards, and participate in special offers.

In 2025, Aptos users can access SWEAT liquidity via bridges and decentralized exchanges, making it possible to trade or integrate the token into broader SocialFi and consumer dApps on the network. Practical use cases include redeeming SWEAT for in-app perks, marketplace deals, or converting tokens into stablecoins for DeFi participation. With recent updates like a 50% reduction in minting emissions to strengthen scarcity and new features such as Step Jars for goal-based rewards, Sweat Economy continues to evolve into a more sustainable and engaging fitness-to-finance ecosystem, positioning itself as one of the most consumer-friendly onramps into Web3.

5. Propbase (PROPS)

Propbase is an Aptos-native, tokenized real-estate marketplace that turns property shares into on-chain tokens you can buy and sell from about ~$100 per slice. Live listings show hotel-managed units (e.g., Wyndham Garden Residences and Cassia Banyan Tree) priced around $104–$109 USDT per token, with indicative net yields ~6.5–6.8% and project IRR ~12%. The platform reports ~60,410 on-chain holders, ~$11.1 million market cap, ~$4.06 million 24h volume, ~$3.79 million staking TVL, and ~543k total transactions, plus a P2P secondary market for 24/7 liquidity via mobile. Tokens represent direct legal ownership through a U.S.-registered DAO LLC structure, with all transfers and records kept on-chain for auditability.

Practically,

PROPS is the utility token that powers the app: it’s used for transaction fees, governance, staking for membership tiers (early access, fee discounts, exclusive deals), and rewards (35% of supply earmarked to incentivize users). Getting started is straightforward: sign up, complete your KYC, fund your wallet, browse the Propbase marketplace, purchase property tokens, then claim monthly rental yield or sell your stake anytime in the in-app P2P market. Built on Aptos, Propbase benefits from low fees and fast settlement, aligning with the chain’s “RWAs + payments” thesis while giving retail users a practical route into income-generating real estate.

6. Thala (THL) / ThalaSwap V2

Thala is a flagship DeFi suite on Aptos, offering a mix of AMM trading, concentrated liquidity (CLMM), liquid staking, and CDP-style borrowing. Its latest upgrade, ThalaSwap V2, introduced xLPT, a Dispatchable Fungible Asset (DFA) that auto-accrues rewards directly at the token level, removing the need for manual claims. This innovation, combined with deep integrations across Aptos (e.g., Petra, Pontem, MSafe wallets; LayerZero and Wormhole bridges), makes Thala a central liquidity engine. As of mid-2025, the platform has handled $10.4B+ in cumulative volume, onboarded 652,000+ users, and holds ~$97 million TVL, according to analytics dashboards.

Practically, Thala functions as a one-stop DeFi hub. Users can swap Aptos-native tokens at low cost, provide liquidity in CLMM pools to earn trading fees, or stake thAPT (its liquid staking derivative) while still using it in DeFi strategies. Borrowing against APT or stablecoins via its CDP vaults allows composable leverage, while launchpad access supports early-stage project participation. In Q2 2025 alone, ThalaSwap V2 processed around $2.9 billion in trading volume, per Messari, showing strong adoption alongside Hyperion. For investors and traders on Aptos, Thala offers both retail-friendly yield opportunities and institutional-grade liquidity infrastructure.

7. Ethena USDe (USDE) and sUSDe

Ethena’s USDe is a synthetic dollar designed to act as a stable, internet-native cash equivalent, backed by crypto collateral and delta-neutral futures strategies. Its staked version, sUSDe, automatically accrues yield, averaging ~19% APY in 2024 and currently offering around 9% APY in 2025. By February 2025, both USDe and sUSDe were bridged to Aptos via Stargate, making them directly usable in Aptos-based money markets, DEXs, and DeFi strategies. This integration brought billions in liquidity to the network, with Ethena reporting $14.1 billion USDe supply and $1.6B USDtb supply globally, reinforcing its position as one of the largest synthetic stablecoin providers.

For Aptos users, sUSDe is particularly practical because it combines stable dollar exposure with auto-compounding yield. Instead of manually claiming rewards, holders see their balance grow over time, which makes it attractive for passive investors and DeFi participants. sUSDe has been quickly adopted across Aptos lending markets and DEXs, where it can be supplied as collateral, paired in LP pools, or used for margin trading. With real-time proof of reserves, weekly third-party audits, and integrations with platforms like Aave,

Morpho, and

Pendle, Ethena’s arrival gives Aptos users a transparent, yield-bearing stable asset that strengthens both individual portfolios and overall liquidity on the network.

8. Ondo US Dollar Yield (USDY)

Ondo’s USDY is a tokenized,

yield-bearing dollar instrument backed by short-term U.S. Treasuries and bank deposits, designed to serve as a stable, “cash-like” asset for DeFi portfolios. Launched on Aptos in 2024, USDY accrues yield at around 4.2% APY and distributes it directly to token holders, making it more efficient than holding idle stablecoins. By mid-2025, USDY had become a widely integrated asset across Aptos DeFi, appearing in lending protocols, DEX liquidity pools, and custody solutions. Its stable structure and institutional-grade transparency have positioned it as a safer option for users looking to earn passive income while retaining on-chain liquidity.

Beyond USDY, Ondo has also launched Ondo Global Markets, a platform that tokenizes public U.S. stocks and ETFs for non-U.S. investors. This expansion means Aptos users can access not just yield-bearing dollars but also tokenized equities and funds, bringing Wall Street–grade products directly on-chain. Practically, users can supply USDY into Aptos lending markets for collateralized borrowing, or pair it in DEX pools to earn swap fees—while institutions can treat it as a dollar-denominated, yield-bearing treasury asset. Together, USDY and Global Markets make Ondo a cornerstone of Aptos’s RWA + DeFi strategy, bridging traditional capital markets with blockchain efficiency.

9. Echo Protocol (ECHO)

Echo Protocol is Aptos’ BTCFi hub, enabling Bitcoin holders to bridge, stake, and deploy BTC directly into Aptos DeFi. By July 2025, Echo secured a leading share of Aptos’ bridged BTC supply, with 2,849 BTC staked and over $271 million in TVL. The protocol launched its TGE on July 2, 2025, introducing the ECHO token to govern incentives and ecosystem growth. Echo supports aBTC (a wrapped/staked BTC asset) and integrates yield strategies like restaking and lending to maximize BTC capital efficiency while keeping exposure to Bitcoin.

For practical use, Aptos users can bridge BTC into Echo, receive aBTC or liquid staking tokens, and put them to work in yield farms, lending pools, or restaking layers. Echo’s lending market shows over $220 million in net assets with ~9% utilization, while dedicated yield strategies advertise up to 22% APY on BTC. This makes Echo attractive to

Bitcoin holders who want to

earn passive income without leaving the Aptos ecosystem, while also expanding Aptos’ collateral options beyond stablecoins and APT. In effect, Echo brings Bitcoin’s deep liquidity into Aptos DeFi, helping the network compete in the broader

BTCFi movement.

10. GUI INU (GUI) and GUI Gang

GUI Gang is a 3k-supply PFP NFT collection on Aptos tied to the

GUI INU community token. Minted in 2024 (after GUI INU launched in Dec 2023), the drop doubled the GUI raised at mint and permanently burned it from supply, reinforcing the project’s culture-first ethos of “what is dead cannot die.” The collection positions itself as the visual identity of GUI INU, aiming to keep Aptos culture lively during tougher market phases with memes, art, and frequent community activations.

Practically, holding a GUI Gang NFT serves as a membership badge into one of Aptos’ more active meme communities: it’s used to access community channels and social campaigns, and it sits alongside a growing GUI INU footprint, including 20+ integrations, exchange listings, Echelon market support, Trust Wallet integration, the GUI Telegram trading bot, mini-games, e.g., Coinflip, Aptos Shaker, periodic token burns, and 50k+ GUI holders cited by the team. To participate, join the Discord/TG, pick up a GUI Gang NFT on Aptos marketplaces, and plug into events, collabs, and meme-driven opportunities the community spins up around the GUI INU ecosystem.

How to Trade Aptos Tokens on BingX

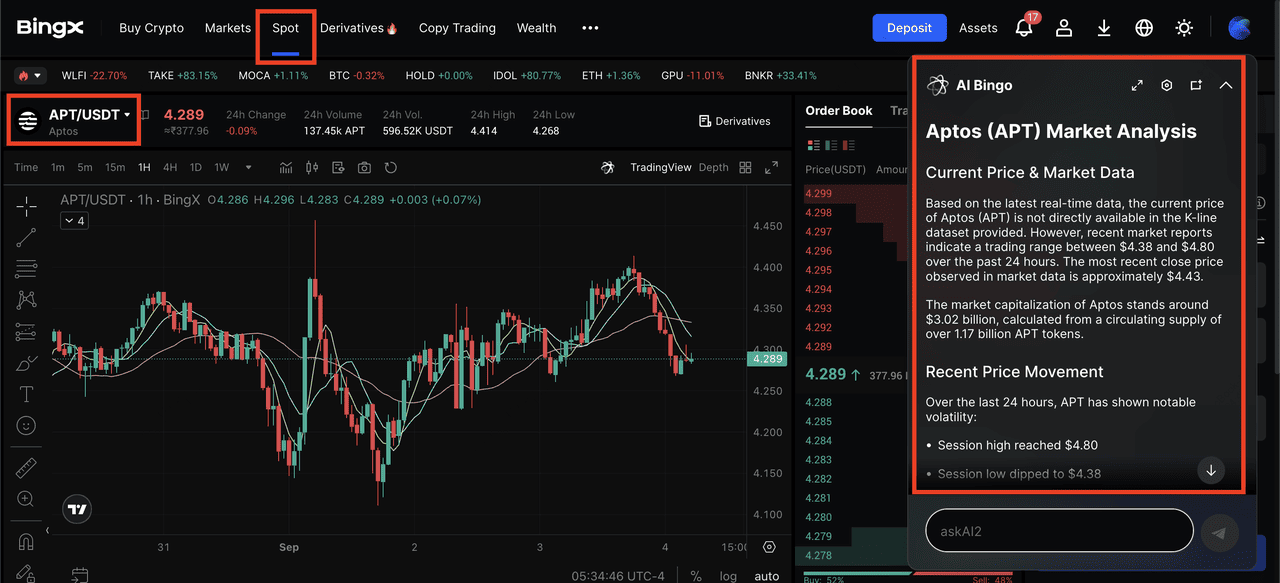

APT/USDT trading pair on the spot market powered by BingX AI insights

Getting started is beginner-friendly; here’s a quick path many new users take:

1. Fund your account: Deposit USDT/USDC (or fiat where available) to your BingX Spot wallet.

3. Place an order: Select Market or Limit orders, enter size, and confirm.

4. Secure your tokens: After buying the token on BingX, keep your funds safe by storing them in your BingX wallet. Enable security features like 2FA and withdrawal whitelists to reduce risk, and always verify that you are interacting only with official BingX platforms.

Pro Tip: You can use BingX AI prompts in the trading panel like “What’s Thala (THL)’s 30-day volume on Aptos?” or “Summarize Aave’s risk parameters on Aptos” to see key stats and disclosures before you place an order.

Key Considerations Before Investing in Aptos Projects

Before putting money into Aptos tokens or dApps, keep these simple checks in mind to avoid costly mistakes and manage your risk.

1. Bridged Tokens: Many Aptos assets come from other chains. Always check the official docs for the correct contract address. Start with a small test transfer before moving bigger amounts.

2. Token Rules: Some tokens may have hidden rules like fees, auto-staking, or locks. Read the project docs carefully. If your wallet allows, simulate the transaction to see exactly how much you’ll receive.

3. Liquidity & Trading: Trading volume on Aptos is concentrated in a few places. Check Hyperion and Thala first for pair depth and daily volume. Using USDC or USDT pairs often reduces trading costs and slippage.

4. New Projects: Be extra careful with new launches. Look for audits, bug bounties, and transparent governance. Also check if the liquidity and trading volume look real, or just boosted by incentives.

Conclusion

Aptos in 2025 has positioned itself as a practical Layer-1 for both retail and institutional users, with sub-cent fees, sub-second finality, and growing adoption of stablecoins and RWAs. The integration of platforms like Aave, Hyperion, and Thala highlights its ability to support high-throughput DeFi, while tokenized assets and cross-chain liquidity are broadening its role in programmable finance.

That said, crypto assets remain highly volatile and experimental. Smart-contract risk, liquidity depth, and regulatory uncertainty are ongoing factors to consider. Always do your own research, start with manageable positions, diversify exposure, and never invest more than you can afford to lose.

Related Reading