Following its Token Generation Event (TGE) on November 4, 2025, MMT surged over 250% in 24 hours, becoming one of the top-performing DeFi tokens of the month. The strong debut reflects rising investor confidence in Sui-based protocols and the growing demand for cross-chain liquidity solutions.

In this article, we’ll cover what Momentum Finance is and how it works, key details of the MMT tokenomics, the recent TGE and airdrop, and how to trade MMT on BingX.

What Is Momentum Finance (MMT) and How Does It Work?

Source: app.mmt.finance

Momentum Finance (MMT) is a

DeFi infrastructure protocol that powers trading, liquidity, and asset tokenization on the

Sui blockchain. Its goal is to make all assets, from crypto tokens to

real-world assets (RWAs), tradable within a single, composable ecosystem.

The project operates through several core products that form the foundation of the Momentum ecosystem:

• Momentum DEX: A high-performance

decentralized exchange (DEX) that uses a concentrated liquidity market maker (CLMM) model, allowing liquidity providers to allocate capital efficiently across specific price ranges. This design delivers deeper liquidity, tighter spreads, and lower slippage compared to traditional AMMs.

• xSUI: A

liquid staking solution for Sui that lets users stake SUI tokens, earn rewards, and maintain liquidity through xSUI tokens that can be used across DeFi protocols.

• MSafe: A multi-signature treasury and token management platform offering institutional-grade security for teams managing on-chain assets and vesting schedules.

• Vaults: Automated

yield strategies that allow users to deposit assets and earn optimized returns through curated, cross-chain strategies.

• Momentum X: A compliance-ready trading platform for tokenized real-world assets (RWAs), enabling secure and verified transactions across multiple blockchains.

Built with

Wormhole’s cross-chain messaging layer, Momentum Finance connects liquidity across different ecosystems while maintaining fast and cost-efficient execution on Sui. Its design integrates vote-escrowed (veMMT) governance to align incentives and reward long-term contributors.

In summary, Momentum Finance aims to bridge decentralized finance and traditional markets by combining liquidity, compliance, and scalability to support the next generation of tokenized assets.

Momentum Finance (MMT) Tokenomics Overview

Momentum Finance designed the MMT token to ensure sustainable growth, fair distribution, and long-term community alignment. None of the team or investor tokens were unlocked at the Token Generation Event (TGE), meaning early supply remains primarily community-driven. This structure helps maintain market stability while rewarding early participants who contribute to ecosystem growth.

$MMT Token Utilities

The MMT token supports multiple functions within the ecosystem:

• Governance: Locking MMT generates veMMT, which gives holders voting power over emissions, protocol parameters, and ecosystem proposals.

• Incentives and Rewards: Traders, liquidity providers, and stakers earn MMT through campaigns such as the HODL Yield Program.

• Fee Sharing: veMMT holders receive a portion of protocol and trading fees from across Momentum’s DeFi products.

• Access and Privileges: Long-term holders gain early access to vaults, Token Generation Lab (TGL) launches, and beta features.

• Ecosystem Growth: The ve(3,3) model encourages bonding and sustained participation, strengthening liquidity and user engagement.

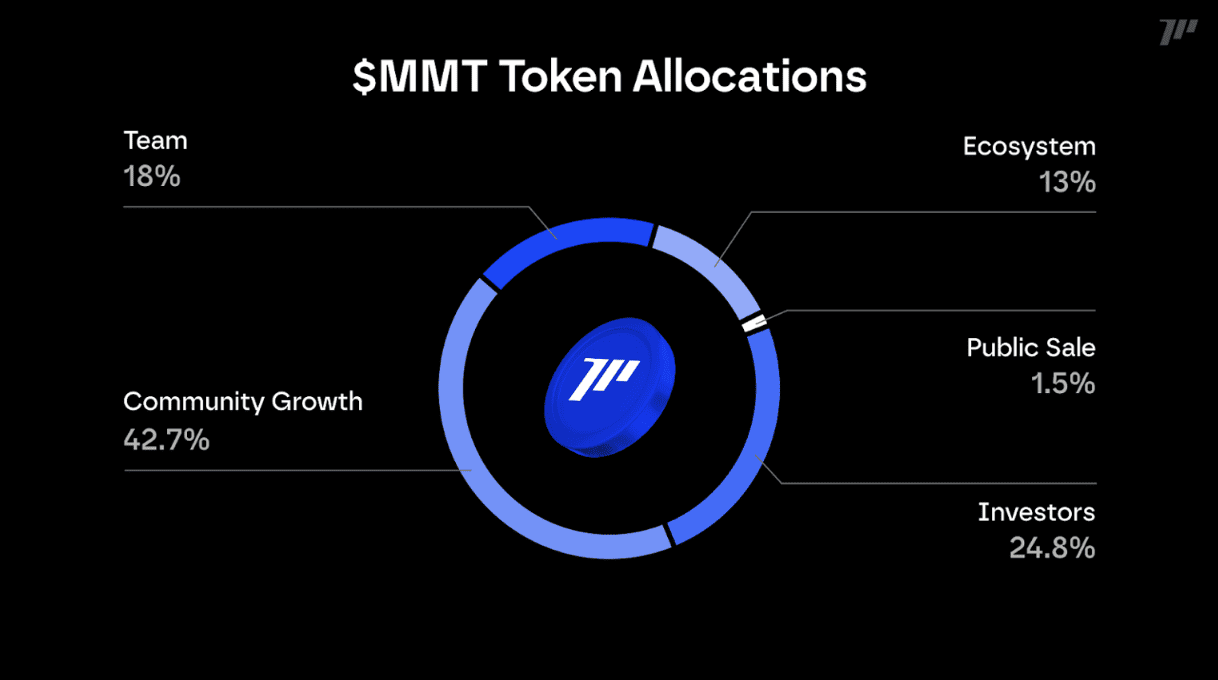

$MMT Token Allocation

Momentum Finance has a total supply of 1,000,000,000 MMT, with 20.41% unlocked at TGE, mainly for public sale and community growth.

| Allocation |

Percentage |

% Unlocked at TGE |

Lock-Up |

Vesting Duration |

| Early Backers / Investors |

24.78% |

0% |

12 months |

48 months |

| Team |

18.00% |

0% |

48 months |

Fully locked for 48 months |

| Ecosystem |

13.00% |

9.00% |

0 |

24 months |

| Community Growth |

42.72% |

9.91% |

0 |

60 months |

| Public Sale |

1.50% |

1.50% |

0 |

Fully unlocked |

| Total |

100% |

20.41% |

— |

— |

Notes:

• Early backer allocations are subject to a 12-month lock-up and 24-month linear vesting schedule.

• Community Growth includes airdrop allocations, some of which may be locked under the ve(3,3) mechanism.

In summary, the tokenomics model is designed to reward long-term contributors, reduce early sell pressure, and distribute governance power to the most active users within the Momentum ecosystem.

MMT Token TGE on November 4: Surges 250% as Momentum Finance Makes Its Market Debut

The Momentum Finance (MMT) token officially launched on November 4, 2025, marking one of the biggest DeFi events on the Sui blockchain this year. The token opened around $0.34, surged to a high of $4.03, and closed near $1.20, representing a 250% gain within 24 hours. Daily trading volume exceeded $3 billion, bringing MMT’s fully diluted valuation to roughly $1.19 billion.

The strong debut reflected a combination of community-driven demand and a tight supply structure, with all team and investor tokens locked at launch. Over 20% of supply was allocated to public and community participants, boosting liquidity and engagement through the MMT Airdrop Wave 1 and the ongoing HODL Yield Campaign. The TGE also introduced the veMMT governance model, allowing holders to lock tokens for rewards and voting rights, setting the foundation for Momentum’s long-term DeFi ecosystem.

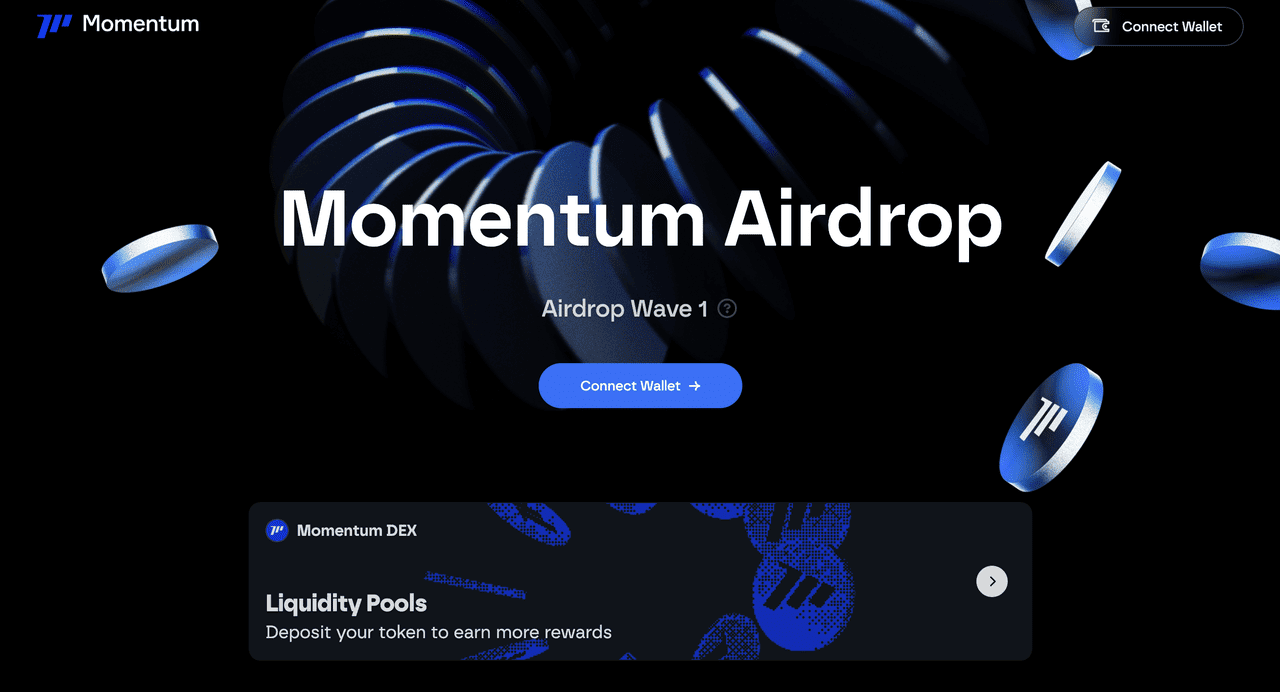

How to Participate in the Momentum (MMT) Airdrop?

Momentum Finance launched its MMT Airdrop Wave 1 alongside the Token Generation Event to reward early users, testnet participants, and community contributors. The campaign is part of Momentum’s plan to build long-term engagement through the veMMT governance and reward model.

$MMT Airdrop Key Dates

• Subscription Window: November 3, 2025, 02:00 UTC – November 5, 2025, 01:59 UTC

• Claim Opens: After the MMT TGE on November 4, 2025

• Distribution: Up to 90% of allocations are delivered as veMMT, visible once the bonding platform goes live

How to Claim Your $MMT Token: Step-by-Step Guide

Step 2: Connect your wallet: Use a

Sui-compatible wallet such as Suiet, or Ethos Wallet. Ensure you have a small amount of SUI for gas fees.

Step 3: Verify your X (Twitter) account: Link your account to confirm eligibility and prevent duplicate claims.

Step 4: Subscribe for TGE distribution: Click “Subscribe for TGE” within the 48-hour window. Once subscribed, your allocation will be added to the first distribution batch.

Step 5: Claim your tokens: Return after the TGE to claim your MMT. Most rewards will appear as veMMT, representing locked governance tokens that can be bonded later for voting and boosted yields.

Note: If you miss the subscription window, you can still verify eligibility later. Your allocation will roll into future Airdrop Waves. Always interact only with official links from @MMTFinance and double-check domains to avoid phishing risks.

The MMT Airdrop program reflects Momentum’s focus on rewarding active contributors while aligning them with the long-term growth of the ecosystem.

Momentum Finance Future Roadmap: What’s Next?

Following the launch of MMT and Airdrop Wave 1, Momentum Finance is advancing into its next development phase. The roadmap emphasizes liquidity expansion, product innovation, and integration of real-world assets to strengthen its role as a leading DeFi hub on Sui and beyond.

1. Ongoing Campaigns and Community Programs

Source: Momentum MMT X (Twitter)

HODL Yield Campaign: Phase 2 (October 25 – November 15, 2025) Rewards liquidity providers across major pairs such as

SUI–USDC, xSUI–SUI, and LBTC–wBTC. Returning participants can earn up to 200% APR, while new users receive up to 110%. The campaign deepens liquidity and supports long-term ecosystem participation.

Future Airdrop Waves: Additional airdrop rounds and reward campaigns are planned to recognize active users, governance participants, and veMMT holders. These programs aim to sustain engagement and align incentives with the protocol’s growth.

2. Product and Ecosystem Expansion

• Multichain Vaults: New vaults will support assets from Sui,

Solana, and

EVM-compatible networks, attracting external liquidity into Momentum’s ecosystem.

• Momentum X: The upcoming compliance layer will enable verified trading of tokenized real-world assets (RWAs) through on-chain identity and programmable access controls.

• Enhanced veMMT Governance: veMMT holders will gain expanded control over emissions, fee sharing, and product launches, moving the ecosystem toward full decentralization.

3. Long-Term Vision

Momentum Finance aims to evolve from a Sui-native DEX into a cross-chain financial operating system that connects DeFi liquidity with regulated RWA markets. By combining scalability, compliance, and community governance, it seeks to create a unified marketplace where all asset classes can trade efficiently on-chain.

How to Trade $MMT Tokens on BingX?

MMT is the native token of Momentum Finance, a DeFi protocol on the Sui blockchain that powers governance, staking, and ecosystem rewards through veMMT. The token is available on both the Spot and Futures markets on BingX, giving traders and investors flexible ways to participate in the project’s growth.

Step 1: Search for MMT/USDT on BingX

For Spot Market:

Spot trading is best for users who want to hold MMT long term, participate in veMMT governance, and earn potential rewards from staking or liquidity programs within the Momentum Finance ecosystem.

2. Buy MMT instantly using a market order, or set a limit order at your preferred entry price.

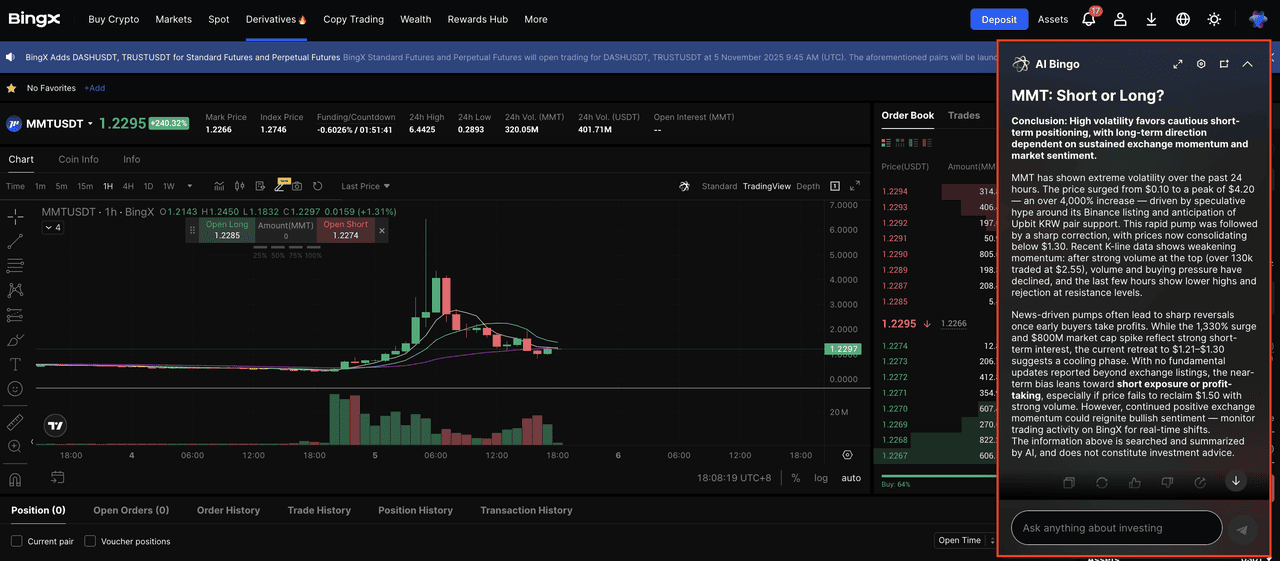

For Futures Market:

2. You can open a long position if you expect prices to rise or a short position if you anticipate a correction.

3. Use trading tools such as take-profit,

stop-limit, or trailing stop to manage volatility and protect your position. Before trading, ensure your leverage and margin match your risk tolerance.

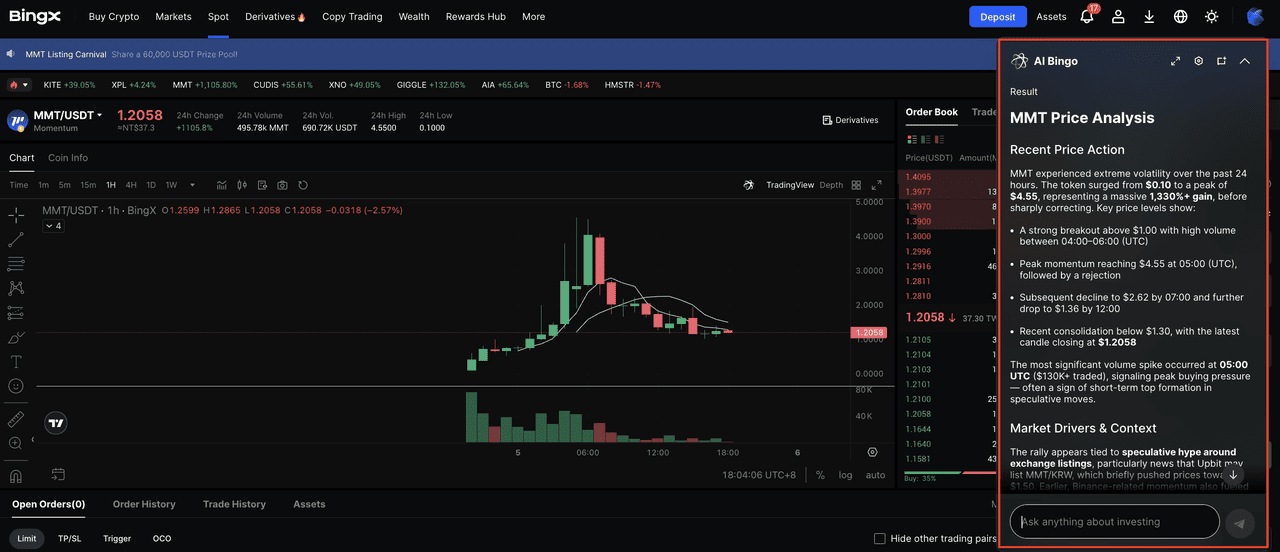

Step 2: Analyze the Market with BingX AI

Click the AI icon on the trading chart to activate

BingX AI Bingo. This tool analyzes market data in real time, identifying key support and resistance levels, trend directions, and notable market events related to Momentum Finance (MMT) and the Sui ecosystem.

By using these insights, traders can make more informed decisions and better time their entry and exit points in both Spot and Futures markets.

Step 3: Manage and Track Your MMT Position

Once your trade is executed, you can hold MMT in your BingX wallet for convenience or transfer it to a

Sui-compatible wallet if you plan to stake or bond for veMMT rewards. Regularly track market movements and project updates to stay informed about new campaigns, airdrops, or governance events related to Momentum Finance. Whether you’re holding MMT for long-term participation or trading short-term trends, BingX offers the liquidity, insights, and flexibility to help you make the most of every market move.

Final Thoughts

Momentum Finance is positioning itself as one of the most promising DeFi ecosystems on the Sui blockchain, combining efficient liquidity infrastructure with real-world asset integration. The successful MMT token launch and ongoing HODL Yield Campaign highlights growing adoption and strong community engagement around the project.

For users, MMT offers both practical utility and long-term potential through its governance model, staking incentives, and expanding cross-chain roadmap. Whether you’re an investor looking to participate in Momentum’s ecosystem or a trader seeking short-term opportunities, BingX provides a simple and reliable way to access MMT through both Spot and Futures markets.

As the Momentum Finance ecosystem continues to evolve, its focus on liquidity, compliance, and tokenized assets could make it one of the key players bridging decentralized finance with traditional markets in 2025 and beyond.

Related Reading

Frequently Asked Questions (FAQ) on Momentum Finance

1. What is veMMT and how does it work?

veMMT is a vote-escrowed version of the MMT token. By locking MMT for a set period, users receive veMMT, which grants voting power, higher yield rewards, and exclusive access to upcoming Momentum Finance products and governance decisions.

2. When was the MMT Token Generation Event (TGE)?

The MMT Token Generation Event (TGE) took place on November 4, 2025, marking the official launch of Momentum Finance’s native token on the Sui blockchain. The event saw strong market performance, with MMT rising over 250% within 24 hours and achieving more than $3 billion in trading volume across major exchanges.

3. When is the MMT airdrop and how can I join?

The first MMT Airdrop Wave 1 ran from November 3, 2025, 02:00 UTC to November 5, 2025, 01:59 UTC, allowing eligible users to subscribe through

airdrop.mmt.finance. Participants needed to connect a Sui-compatible wallet and verify their X (Twitter) account before the claim window closed. Future airdrops will follow similar steps through the official portal and verified social channels.

4. Will there be more MMT airdrops?

Yes. Momentum Finance has confirmed that additional airdrop waves are planned to reward long-term contributors, liquidity providers, and veMMT holders. These future rounds will align with upcoming campaigns such as the HODL Yield Program and new product launches within the ecosystem.

5. What if I miss the airdrop claim period?

If you miss the claim window for Wave 1, you can still verify your eligibility later. Unclaimed allocations are rolled over into future distribution rounds, so users will have more chances to receive their tokens in later airdrop phases. Always check official announcements from @MMTFinance for the latest claim deadlines and eligibility updates.