Staking has become one of the most popular ways to

earn passive income in crypto. As of mid-2025,

Ethereum alone has more than 37 million

ETH staked, representing nearly 30% of its supply, with annual yields between 4–5% APY.

Solana and other Proof-of-Stake (PoS) blockchains see similar trends, offering 5–7% APY for participants. As of August 2025, the restaking sub-sector of the DeFi market accounts for a total value locked (TVL) of nearly $27.5 billion.

Restaking TVL | Source: DefiLlama

But

traditional staking has a problem: capital inefficiency. Once tokens are staked, they’re locked and can’t be used elsewhere. This is where restaking comes in. It takes the idea of staking further by allowing the same tokens to secure multiple protocols simultaneously, boosting both capital efficiency and potential rewards. As of August 2025, CoinGecko lists around 70 restaking tokens on its platform with a combined market cap of over $21.3 billion.

In this guide, you will learn what crypto restaking is, how it works in boosting capital efficiency and rewards, and why it matters in 2025.

What Is Restaking in Crypto?

Restaking is a way to reuse your staked crypto to earn extra rewards. Normally, when you stake coins like Ethereum (ETH) or Solana (SOL), your tokens are locked and only secure the main blockchain. With restaking, those same tokens, or their liquid versions like

stETH from

Lido, can also be pledged to secure other networks and decentralized applications, without needing to unstake first.

Think of it as putting your money to work in two places at once. Your tokens continue earning the base staking yield on the main blockchain (around 4% APY on ETH or 6% on

SOL) while also being reused to secure Actively Validated Services (AVSs), such as

EigenLayer’s

data availability services,

Jito’s Solana validators, or cross-chain bridges like

Hyperlane. This “double duty” can boost returns; Ethereum stakers, for example, can earn ~4% APY from staking alone and potentially an extra 1–3% APY from restaking rewards, depending on which AVSs they support.

In short, restaking improves both rewards and capital efficiency, but it requires careful selection of AVSs and a clear understanding of the slashing risks that come with securing multiple protocols.

How Does Restaking Crypto Work?

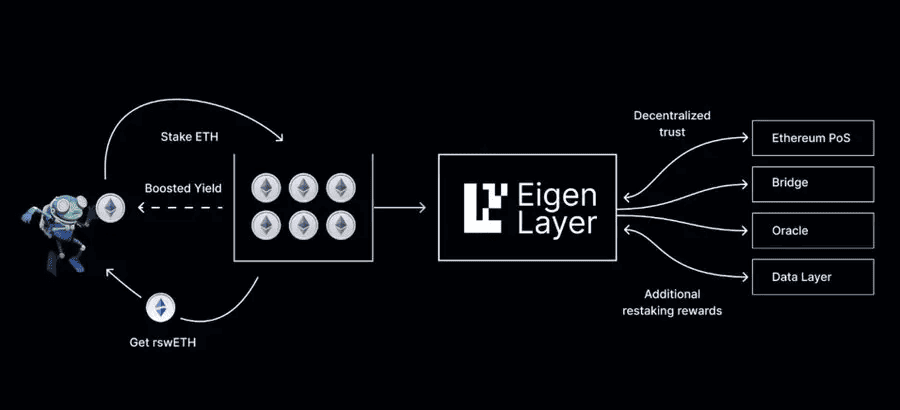

An overview of how crypto restaking works | Source: ChainCatcher

Restaking builds on the normal staking process and adds an extra layer of rewards. Here’s a step-by-step breakdown:

1. Base Staking – You first stake tokens on a Proof-of-Stake (PoS) network. For example, staking ETH on Ethereum earns around 4% APY, while staking SOL on Solana earns 5–7% APY. These rewards come from helping secure the blockchain.

2. Restaking Layer – Instead of letting those staked tokens sit idle, you commit them again - directly or through a

liquid staking token (LST) like stETH, into a restaking protocol such as EigenLayer (Ethereum) or Jito (Solana). These platforms allow your staked assets to support extra services.

3. Shared Security – The restaking protocol lets new projects “rent” security from existing validator networks. Instead of building their own validator set from scratch, which is expensive and slow, protocols like data layers, oracles, and bridges can tap into the security of Ethereum or Solana validators.

4. Extra Rewards – In return, these protocols pay you additional compensation. The exact yield depends on demand, risk, and the protocol you secure.

How Restaking Works: An Example

Staking ETH alone earns about 4% APY, but adding EigenLayer restaking can increase returns to 5–7% APY by securing extra services. If you use liquid restaking with stETH, you may also receive a Liquid Restaking Token (LRT) like ezETH, which can be deployed in DeFi for lending or trading, unlocking an additional layer of yield beyond standard staking rewards.

To put it simply, restaking means your tokens aren’t just “sleeping” while staked. They keep securing the main blockchain while also working overtime to support other protocols, potentially boosting your overall returns.

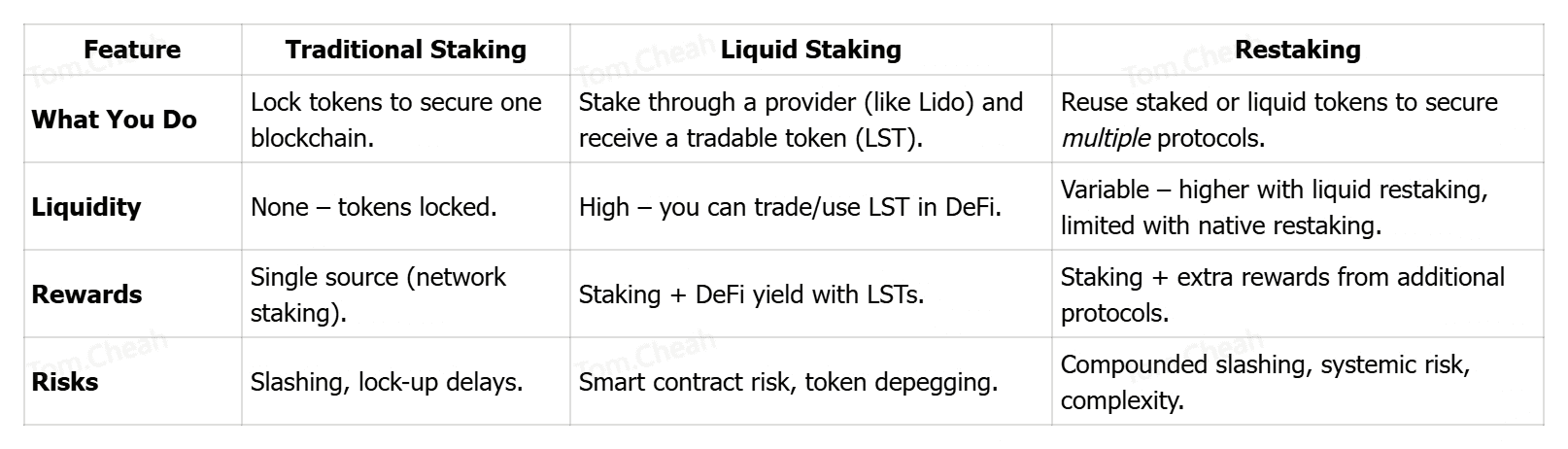

How Is Restaking Different from Staking and Liquid Staking?

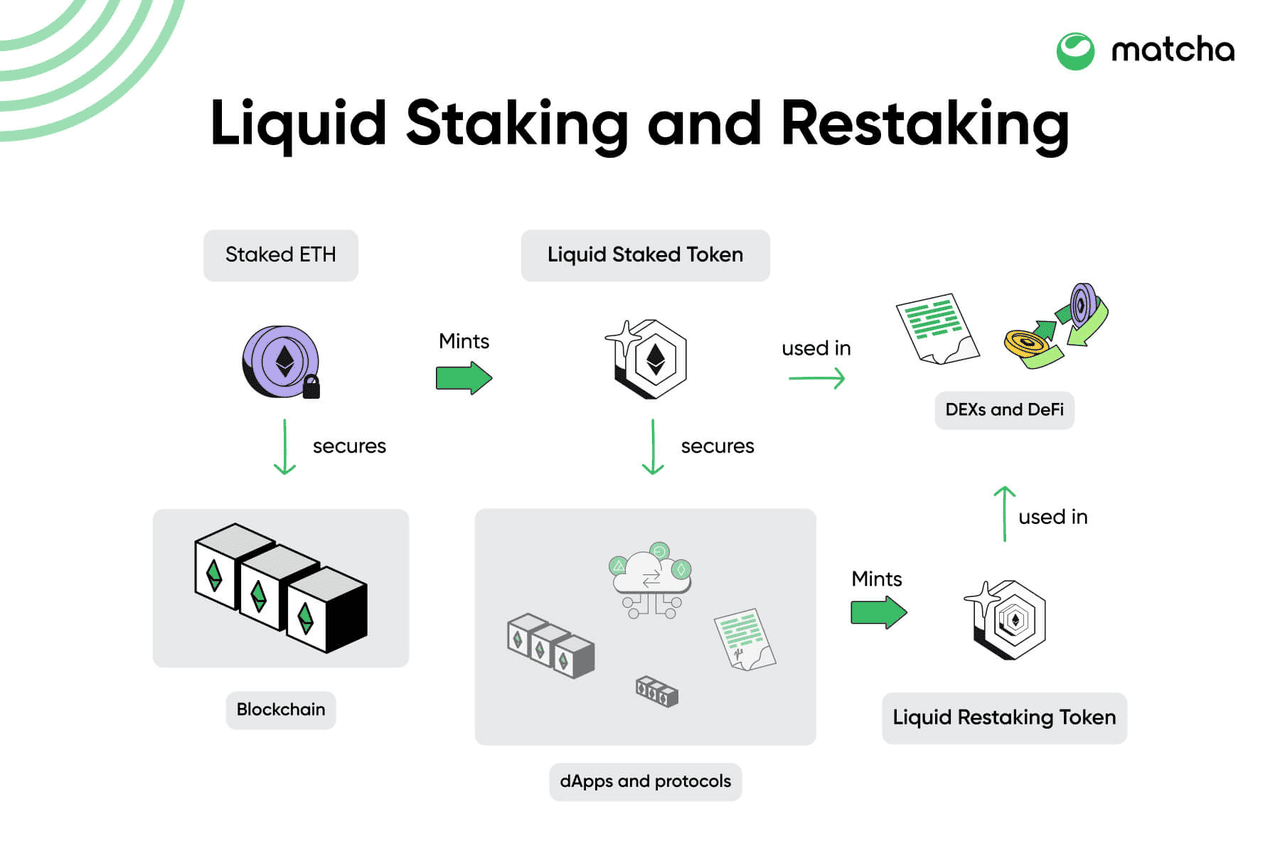

Restaking vs. liquid staking | Source: Matcha.xyz

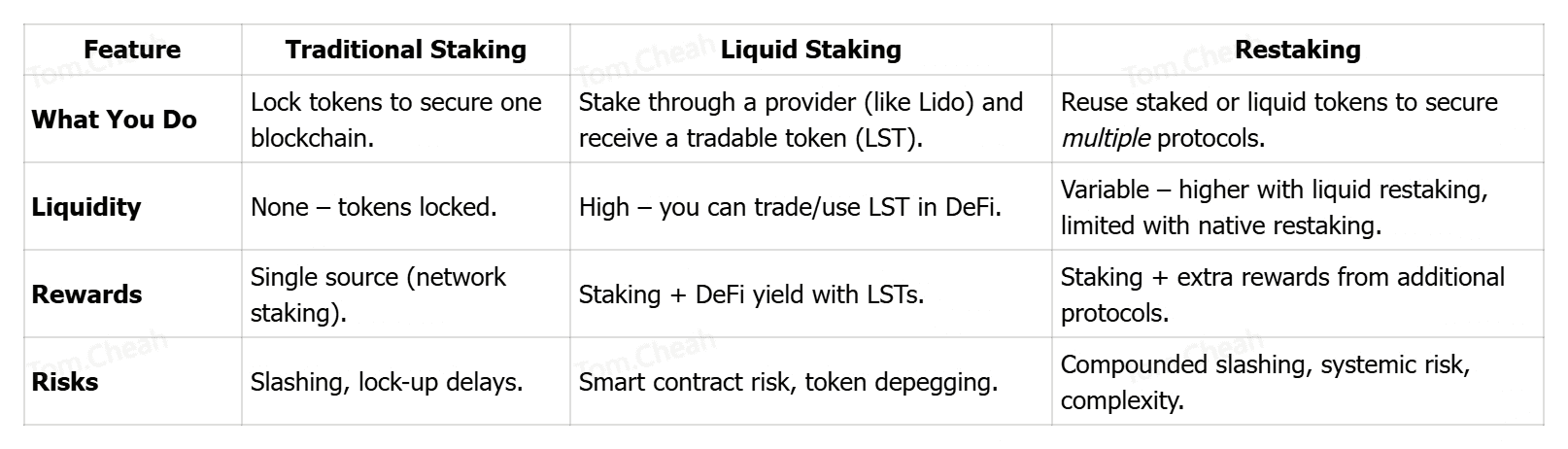

Restaking is different from traditional staking because it allows you to reuse already staked assets instead of locking them into a single network. With staking, you secure one blockchain, like Ethereum, which offers about 4% APY, and your tokens remain locked and inactive elsewhere. With

liquid staking, you still earn staking rewards but also receive a liquid staking token (LST), such as stETH, which can be traded or used in DeFi apps. This boosts liquidity and capital efficiency but introduces smart contract and depegging risks.

Restaking goes a step further by letting you commit those same tokens (or LSTs) to additional protocols, effectively putting your crypto to work in multiple places at once. For example, ETH stakers can restake on EigenLayer and earn an extra 1–3% APY on top of their base staking yield. This makes restaking more rewarding but also riskier, since you take on compounded slashing penalties and depend on the security of both the base chain and the restaked protocols. In short: staking pays once, liquid staking pays twice (staking + DeFi), and restaking can pay three times (staking + restaking + DeFi), but with higher layers of risk.

In simple terms:

• Staking = Earn one set of rewards, tokens locked.

• Liquid Staking = Earn rewards + keep tokens liquid in DeFi.

• Restaking = Earn rewards twice, but with higher risks.

What Is Liquid Restaking?

Liquid restaking is an advanced strategy that lets you keep your staked assets working in multiple ways at once. First, you stake tokens like ETH through a liquid staking provider such as Lido or

Rocket Pool and receive a Liquid Staking Token (LST) like stETH. Instead of holding that LST passively, you can deposit it into a restaking protocol such as EigenLayer, Renzo, or Ether.fi, which then issues you a Liquid Restaking Token (LRT) like ezETH. This LRT represents your staked-and-restaked position and can still be used across DeFi.

In practice, this means you can earn three layers of rewards: base staking yield (~4% APY on ETH), extra restaking rewards (typically 1–3% APY depending on the protocol), and additional DeFi yield (for example, depositing ezETH into

Curve or

Aave to earn another 1–2%). For beginners, liquid restaking is attractive because you don’t need to run validator software; it’s as simple as moving tokens through a supported protocol. The trade-off is complexity and higher risk: you’re depending on multiple platforms (staking, restaking, and DeFi), which means more smart contract exposure and the potential for losses if any layer fails.

What Are the Benefits of Restaking?

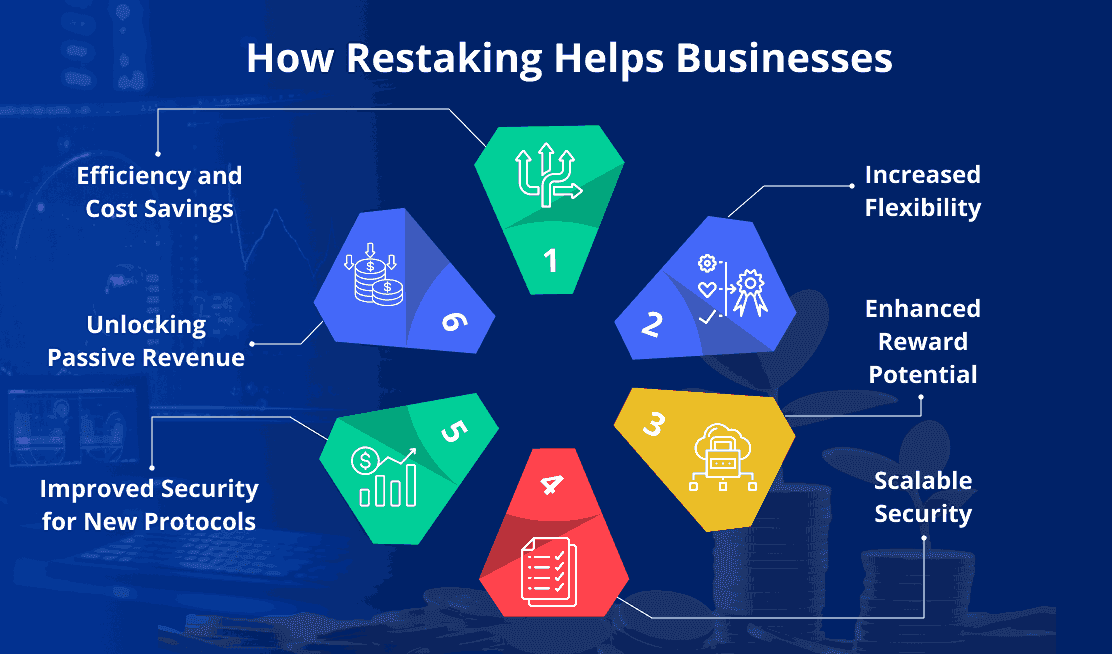

Restaking's benefits for businesses | Source: Oodles.io

Restaking is gaining popularity because it not only boosts returns for investors but also strengthens the security and efficiency of new blockchain projects. Here are the key advantages:

1. Higher Yields: Staking ETH on its own gives around 4% APY, but restaking can add another 1–4% depending on the protocols you secure. With liquid restaking, rewards can stack even further by using LRTs in DeFi, sometimes pushing returns above 7–8% APY.

2. Capital Efficiency: Instead of buying more tokens, you reuse the same staked assets to earn multiple income streams. This makes your crypto work harder without requiring additional investment.

3. Security for New Protocols: Restaking helps emerging projects like oracles, data layers, and bridges by letting them “rent” validator security instead of building their own from scratch. For example, EigenLayer has already surpassed $19 billion in TVL and 4.6 million ETH restaked in 2025, showing how powerful this model can be.

4. Flexibility with Liquid Restaking: If you use liquid restaking, you’ll receive LRTs that can be traded, repurposed, or used in DeFi whenever you want. This gives you more liquidity compared to traditional staking, where funds are usually locked.

How to Get Started with Restaking: A Beginner's Guide

If you’re new to restaking, the first step is to buy the crypto you want to stake, such as ETH or SOL, on a trusted exchange like BingX and fund your

crypto wallet. Once you hold your tokens, you can begin by staking them on their base blockchain (Ethereum, Solana, etc.) to earn the standard yield (around 4% APY for ETH and 5–7% APY for SOL).

From here, you have two main options:

1. If you’re comfortable running your own validator node, you can explore native restaking directly on protocols like EigenLayer (Ethereum) or Jito (Solana).

2. For most beginners, though, the simpler path is liquid restaking. With this method, you stake through providers like Lido to receive a Liquid Staking Token (LST) such as stETH, then deposit it into a restaking protocol like EigenLayer,

Renzo, or

Ether.fi. In return, you’ll get a Liquid Restaking Token (LRT) such as ezETH, which can be used in DeFi for lending, liquidity farming, or trading, stacking rewards across multiple layers.

Practical Tips for Beginners

As a beginner, it’s best to start small with liquid staking options like stETH or mSOL before moving into restaking. Focus on reputable platforms such as EigenLayer, Jito, or Renzo, always checking their TVL and audit history, and diversify your assets instead of committing everything to one protocol. Remember that while restaking can add 2–3% extra APY, it also increases slashing risks, so prioritize flexibility with Liquid Restaking Tokens (LRTs) that can be traded or repurposed when needed.

Does Restaking Crypto Have Any Risks?

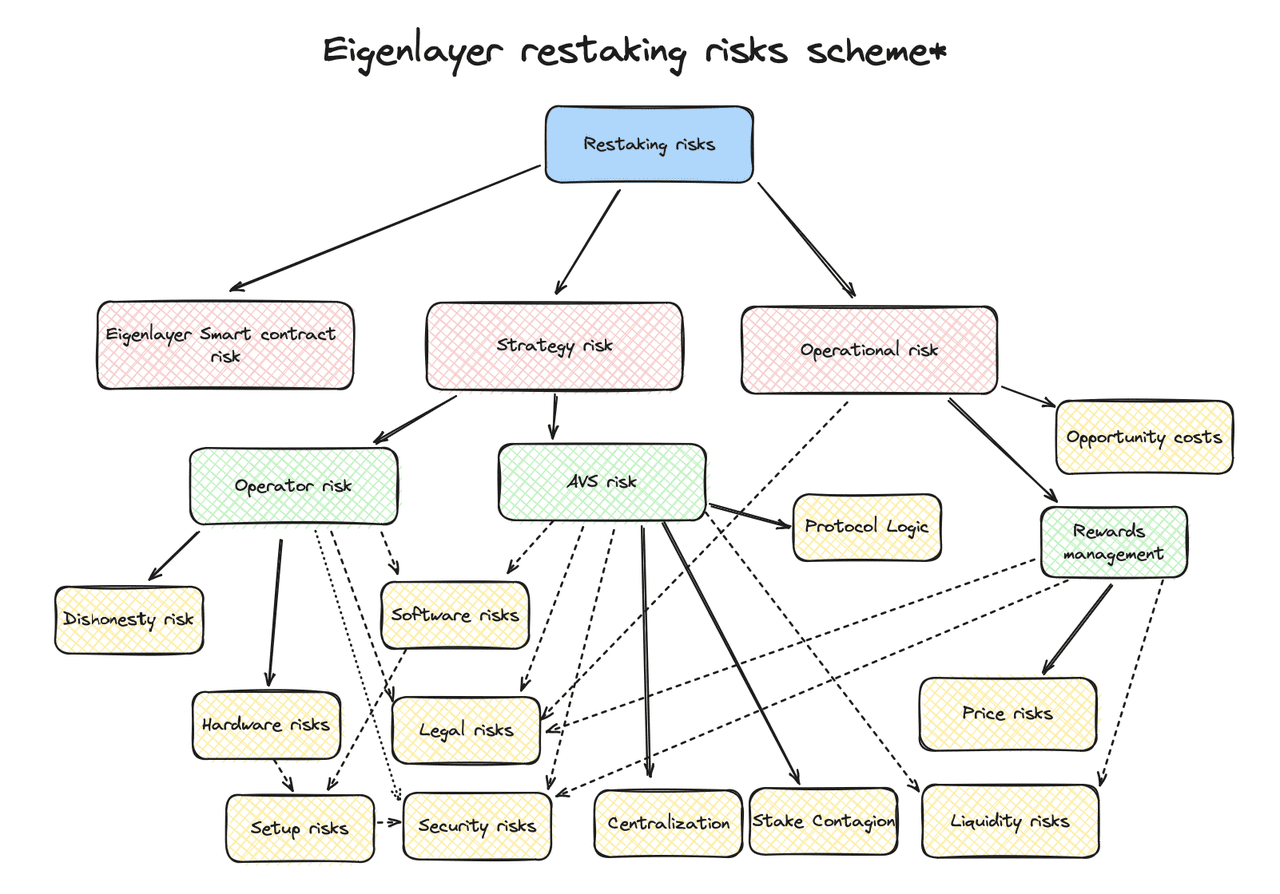

Risks in Eigenlayer restaking | Source: Galaxy

While restaking looks attractive, it comes with added complexity and risk:

1. Compounded Slashing: If any protocol you secure breaks rules, you risk losing a portion of your staked tokens.

2. Systemic Risk: Multiple protocols rely on the same collateral; failure in one could trigger cascading losses (similar to 2008’s financial crisis “rehypothecation”).

3. Smart Contract Vulnerabilities: Each additional protocol adds risk. Bugs or exploits could lead to lost funds.

4. Validator Centralization: Higher yields may push users toward a few big operators, reducing decentralization.

Pro Tip: Restaking is better suited for advanced users familiar with DeFi risks, rather than complete beginners.

Final Thoughts

Restaking represents the next frontier in staking innovation. By letting the same tokens secure multiple protocols, it maximizes capital efficiency and opens new revenue streams for investors. With EigenLayer and similar platforms driving billions in restaked assets, it’s clear this model is reshaping the DeFi landscape.

But remember: with higher rewards come higher risks. Compounded slashing, systemic vulnerabilities, and smart contract risks mean restaking isn’t risk-free. Beginners may want to start with liquid staking before exploring restaking.

If you’re looking to amplify your staking rewards and are comfortable managing DeFi risks, restaking could be a powerful strategy. Just do your due diligence, diversify, and never risk more than you can afford to lose.

Related Reading