Imagine scanning thousands of crypto charts, tweets, and news headlines in seconds, and spotting insights others miss. That’s the power of Large Language Models (LLMs) like

ChatGPT, Gemini, and

Grok, which are redefining how traders perform crypto research and make informed trading decisions.

These AI-driven copilots can interpret market data, summarize financial reports, and assess market sentiment from sources like Reddit, Twitter, and major news outlets. By processing complex technical and fundamental analysis, they turn scattered information into structured, actionable insights, helping traders

manage risk and adapt to changing market conditions with confidence.

Yet, their role isn’t to predict prices or replace traders. The real value of LLMs lies in supporting human judgment, amplifying analytical precision while leaving decision-making grounded in experience and discipline.

What Are Large Language Models (LLMs)?

Large Language Models (LLMs) are advanced AI systems trained on massive datasets to understand natural language, recognize patterns, and provide context-aware answers. In

crypto trading, they function as intelligent assistants, gathering market insights, interpreting historical data, and filtering noise so traders can focus on what truly matters: making smarter, faster, and data-backed trading decisions.

Understanding the Role of LLMs in Financial Markets

Large Language Models (LLMs) are advanced AI systems that use natural language processing and machine learning to analyze massive amounts of financial and crypto market data. They interpret news articles, social media posts, and

technical analysis reports to uncover

patterns, sentiment, and trading insights in real time.

Through reinforcement learning and integration with third-party APIs, web browsing, and vector databases, LLMs provide traders with context-rich, data-driven intelligence. They help simplify complex market conditions, evaluate risk, and support more informed trading decisions.

In essence, LLMs act as intelligent copilots in financial markets, bridging artificial intelligence and human judgment to deliver faster, more accurate market insights and a sharper edge in crypto research.

1. How to Use LLMs for Market Sentiment Analysis

In crypto trading, markets often move not just on data, but on emotion. Prices swing as traders react to excitement, fear, or hype around new developments. This emotional pulse, known as market sentiment, often signals price trends before they appear on charts.

Large Language Models (LLMs) like ChatGPT, Gemini, and Grok allow traders to quantify this emotion. By scanning thousands of social media posts, Reddit discussions, and news articles, they can detect subtle mood changes across the community. Instead of relying on gut feeling, traders gain measurable insight into whether the market feels bullish, bearish, or neutral about an asset or event.

Unlike traditional analytics tools, LLMs process unstructured natural language, meaning they understand tone, sarcasm, and narrative bias, the kind of nuance often missed by sentiment dashboards. This enables traders to spot shifts in confidence before major moves occur.

To get high-quality sentiment results, prompts must be specific and time-sensitive. A question like “What’s Bitcoin’s sentiment?” is too vague, but refining it to “Analyze Bitcoin sentiment on Twitter and Reddit over the past 48 hours” generates actionable data.

Best practices for LLM-based sentiment research:

• Be source-specific: Focus on platforms like X (Twitter), Reddit, or crypto-focused media for authentic trader conversations.

• Cross-check data: Compare tone between news sentiment and community mood to identify divergence, a common precursor to volatility.

• Set timeframes: Crypto narratives shift quickly, so limit your analysis to 24–72 hours for relevance.

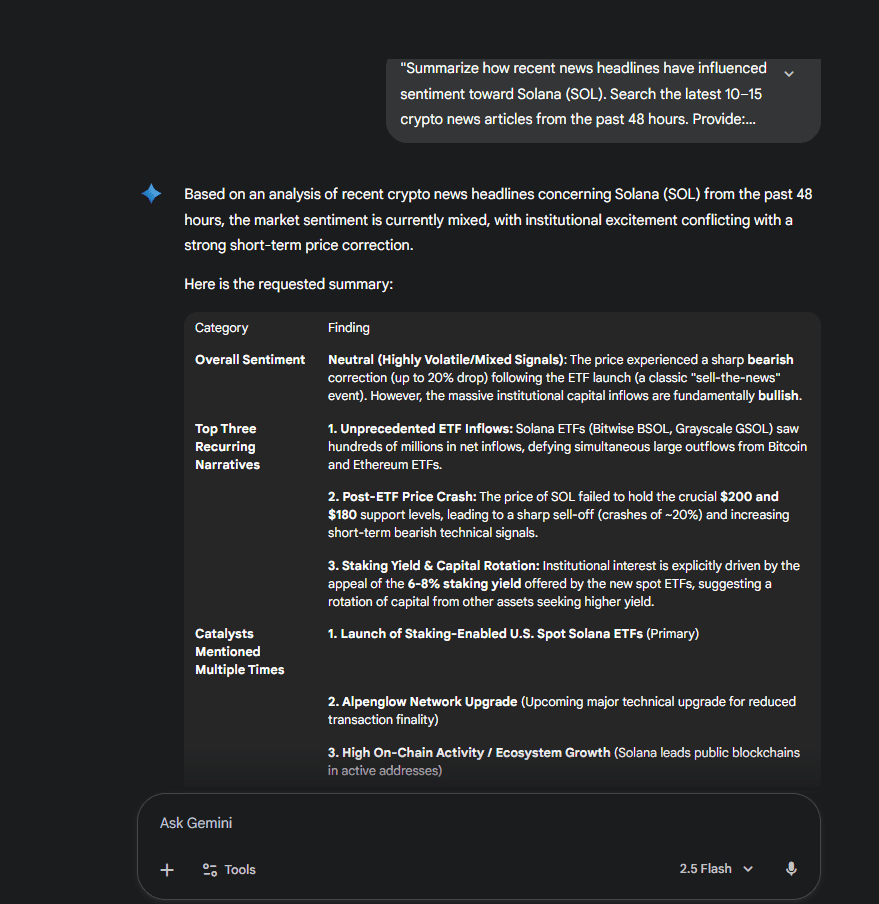

Headlines and News Flow Analysis (Gemini 2.5 Pro)

Gemini is strongest for real-time web access and summarizing sentiment from news articles, blog posts, and financial reports. It’s ideal for showing aggregated coverage sentiment across crypto media outlets.

Prompt

"Summarize how recent news headlines have influenced sentiment toward Solana (SOL). Search the latest 10–15 crypto news articles from the past 48 hours. Provide:

– Overall sentiment (bullish, bearish, or neutral)

– Top three recurring narratives

– Any catalysts mentioned multiple times

Present the result in a short table or list format."

Gemini analyzing SOL sentiment across crypto media - Source: Gemini

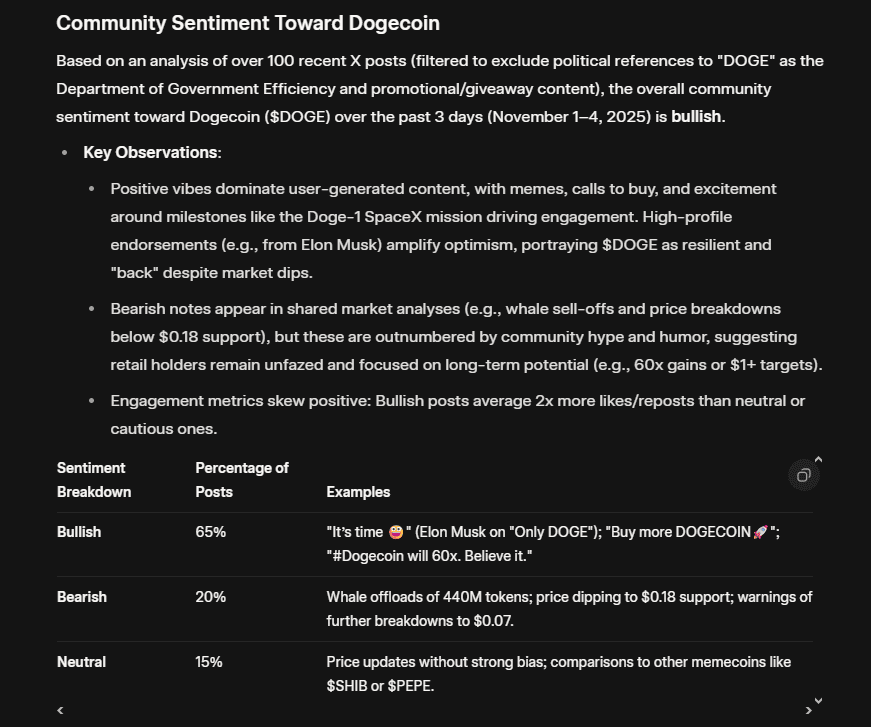

Social Media Pulse Check (Grok X AI)

Grok integrates directly with Twitter (X) and excels at live community sentiment scanning. It can pull tone from trending hashtags, viral tweets, and meme coins (like

DOGE,

PEPE).

Prompt

“Evaluate community sentiment toward Dogecoin using X posts from the past 3 days. Summarize whether the tone is bullish, bearish, or neutral. List top 3 trending hashtags or phrases and any influencers driving the discussion. Exclude promotional or giveaway posts.”

Grok visualizing bullish vs bearish mentions on X for Dogecoin - Source: grok

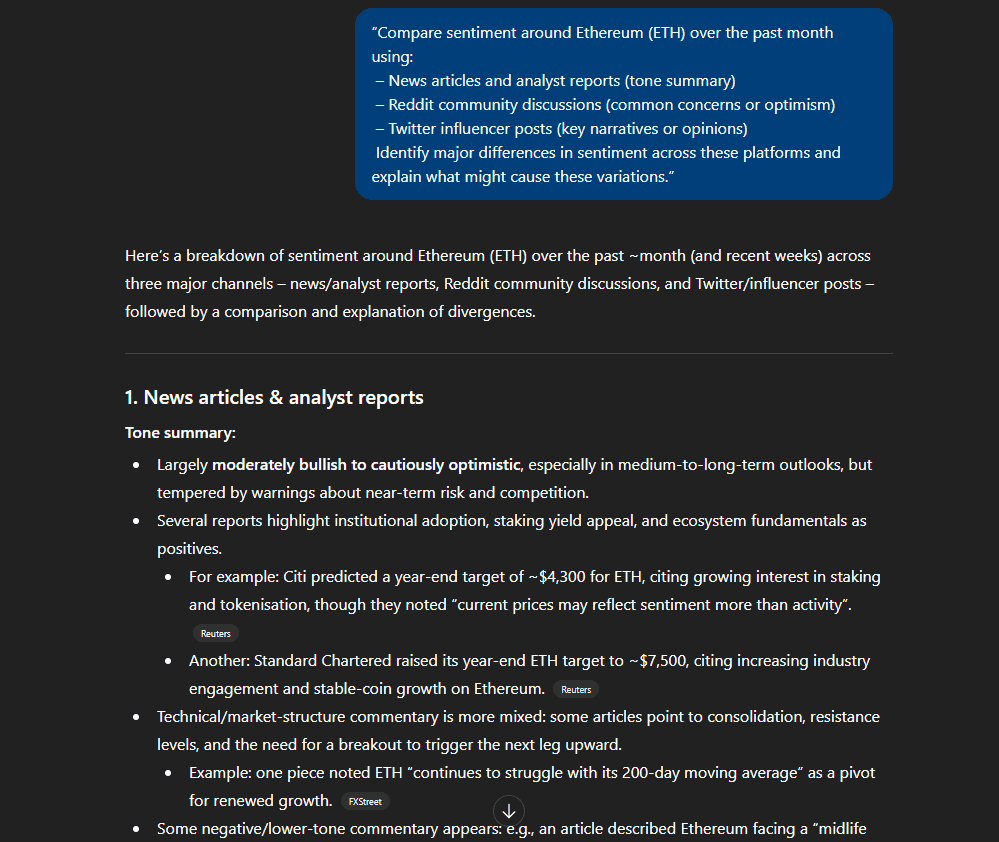

Cross-Platform Sentiment Comparison (ChatGPT GPT-5)

ChatGPT is best for multi-source correlation and reasoning. It handles structured comparisons across Reddit threads, influencer tweets, and crypto media tone, providing balance and context.

Prompt

“Compare sentiment around Ethereum (ETH) over the past month using: – News articles and analyst reports (tone summary) – Reddit community discussions (common concerns or optimism) – Twitter influencer posts (key narratives or opinions) Identify major differences in sentiment across these platforms and explain what might cause these variations.”

ChatGPT comparing ETH sentiment across news, Reddit, and X - Source: ChatGPT

By triangulating tone across platforms, LLMs help traders identify confirmation bias, detect false consensus, and capture emerging narratives early. These insights offer a fuller, more objective market read, supporting better risk-adjusted trading decisions.

Once you understand how market mood shapes prices, the next step is using LLMs to interpret fundamental and technical data.

2. How to Use LLMs for Fundamental and Technical Analysis

Large Language Models (LLMs) are becoming essential research tools for traders who want to merge data interpretation with market context. They help streamline both fundamental and

technical analysis, allowing traders to uncover patterns, interpret project data, and evaluate trends with far less manual effort.

Fundamental Analysis

In crypto, understanding a project’s real value goes beyond price charts. LLMs like ChatGPT and Gemini can quickly summarize whitepapers, earnings reports, and

on-chain updates, distilling complex details about tokenomics, team activity, and roadmaps into digestible insights. For instance, you can prompt:

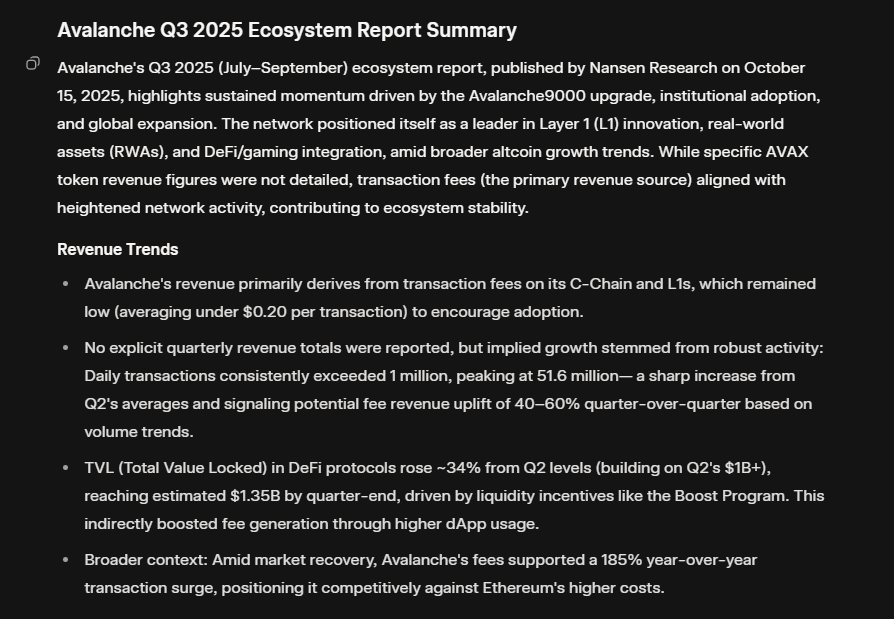

“Summarize Avalanche’s latest quarterly report. Highlight revenue trends, network growth, partnerships, and developer activity.”

Avalanche Q3 2025 Ecosystem Report Summary - Source: grok

These insights help traders evaluate long-term fundamentals, benchmark performance, and identify undervalued assets without sifting through hundreds of pages of documentation.

Technical Analysis

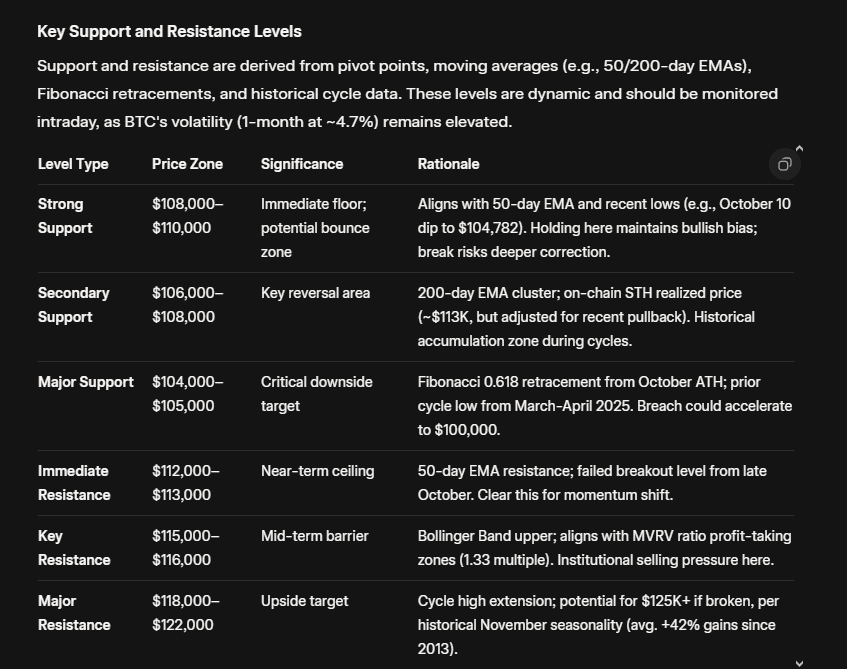

While LLMs can’t read live charts, they excel at explaining patterns, interpreting indicators, and analyzing historical data for context. Uploading candle data or describing price action allows models to interpret support and resistance zones, EMA crossovers, or RSI signals. Prompt example:

“Analyze this Bitcoin price data today and identify key support/resistance levels and recent trend direction.”

Bitcoin Price Analysis - Source: grok

By combining both approaches, LLMs enable traders to evaluate market conditions, measure cumulative returns, and assess quantitative metrics, turning raw data into actionable trading insights that support smarter decision-making.

3. How to Analyze Market Capitalization and Sector Trends with LLMs

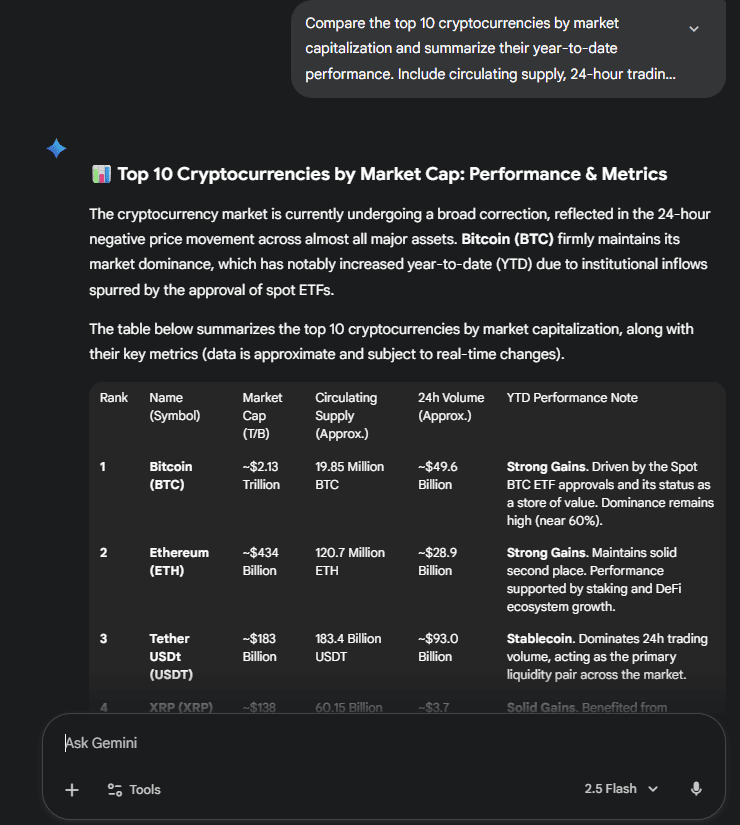

Market capitalization offers a snapshot of how value flows across the cryptocurrency market, helping traders understand which sectors or assets dominate at any given time. Yet, tracking these shifts manually can be time-consuming. Large Language Models (LLMs) simplify this process by analyzing

market cap rankings, trading volumes, and dominance changes across the top cryptocurrencies within seconds.

Using AI tools like Gemini or ChatGPT, traders can compare how individual assets perform relative to the broader market, identify which coins are gaining or losing share, and detect early signs of sector rotation, such as capital moving from Layer-1s to DeFi tokens or AI-linked projects.

Example prompt:

“Compare the top 10 cryptocurrencies by market capitalization and summarize their year-to-date performance. Include circulating supply, 24-hour trading volume, and any notable shifts in market dominance.”

10 crypto by market cap and year-to-date performance - Source: Gemini

LLMs turn this data into concise summaries or visual tables, allowing traders to spot emerging trends, optimize portfolio allocations, and gain instant sector-wide insights, all without manually compiling numbers from multiple platforms.

4. Using LLMs for Project-Specific Research and Risk Evaluation

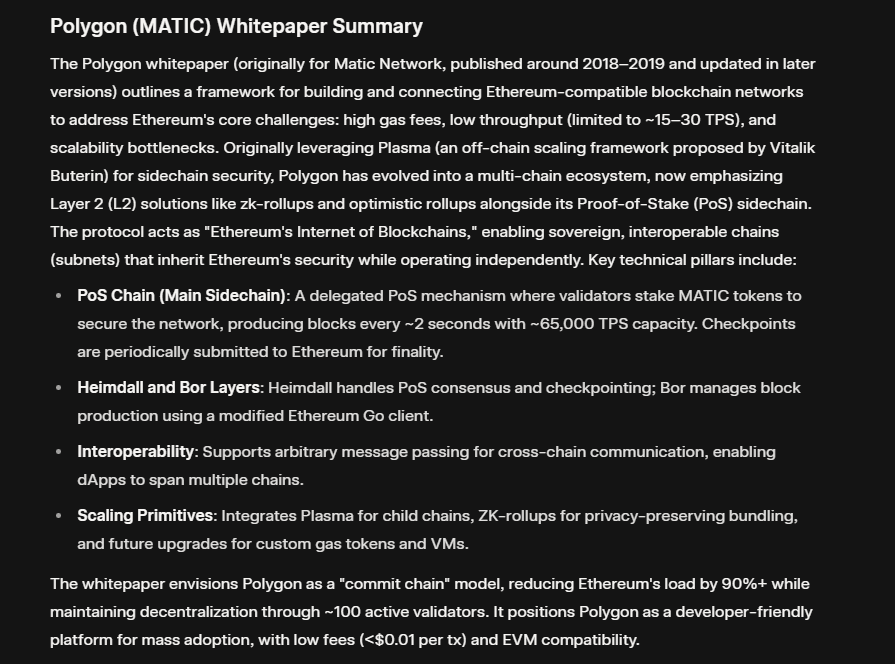

Before investing in any new crypto project, traders need to understand what they are getting into, and Large Language Models (LLMs) make that process much easier. These AI tools can scan whitepapers, tokenomics, and smart contracts to explain complex details in simple language. This helps traders assess how a project operates and whether it aligns with their goals.

For example, if you want to study a new token, you could ask:

"Summarize the whitepaper of Polygon (MATIC) and highlight its main use cases, token supply, and potential risks."

Polygon (MATIC) Whitepaper Summary - Soruce: Grok

In seconds, an LLM like ChatGPT or Gemini can provide a concise overview showing what makes the project strong and where weaknesses might exist.

LLMs can also detect red flags such as vague token distribution, exaggerated promises, or missing team details. For instance:

"Act as a crypto analyst and list possible risks in investing in a new project called LunaX. Categorize them as technical, financial, or regulatory risks."

To compare two projects, you might ask:

"Compare Avalanche (AVAX) and Solana (SOL) based on transaction speed, ecosystem growth, and developer activity."

Using LLMs in this way helps traders perform objective research, manage risk effectively, and make smarter, data-backed investment decisions without getting caught up in hype.

5. How to Build a Multi-Agent Research Framework with LLMs

A single Large Language Model (LLM) can handle many tasks, but when several AI tools work together, research becomes faster and more accurate. This is known as a multi-agent framework, where different AI agents are assigned specialized roles, just like a trading team.

For example, one AI agent can gather live market data from news sites and exchanges. Another can summarize market sentiment from platforms such as Twitter and Reddit. A third can analyze technical setups by reviewing chart patterns or support and resistance levels. Each agent focuses on its own task, and their combined outputs create a complete picture of the market.

This multi-agent approach allows traders to get context-aware insights that feel closer to human-level analysis. Instead of checking multiple sources manually, the agents communicate and verify each other’s findings, reducing bias and improving accuracy.

For instance, you can set up prompts such as:

"Agent 1: Collect Bitcoin market data and volume changes from the past 24 hours."

"Agent 2: Analyze social sentiment for Bitcoin from Reddit and X."

"Agent 3: Identify major support and resistance levels from historical price data."

When these results are merged, traders receive a clear, multi-layered view of the market that supports better decisions in real time.

Best Practices and Limitations of Using LLMs for Crypto Trading Strategies

As powerful as they are, Large Language Models (LLMs) work best when guided by precision, context, and human judgment. To make AI-driven research reliable, traders should follow a few key practices and stay mindful of its limits.

Best Practices

• Use context-rich prompts: Be clear and specific. Instead of asking “Analyze Bitcoin,” define the timeframe, data source, and goal, for example, “Summarize Bitcoin sentiment on Reddit and X over the past 48 hours.”

• Cross-check with official data: Always verify information with trusted sources like CoinMarketCap, Messari, or Glassnode, as AI models may reference outdated or incomplete datasets.

• Validate across different LLMs: Compare results from ChatGPT, Gemini, and Grok to filter out bias and ensure consistent, well-rounded insights.

Limitations

LLMs can’t predict prices, execute trades, or fully understand market context like a human. They rely on historical and textual data, not live market execution. Traders must also maintain data privacy, validate outputs, and apply human oversight before acting on AI-driven insights.

Used wisely, LLMs serve as powerful research copilots, not decision-makers, amplifying your analysis, not replacing it.

From AI Insight to Trading Action

The real value of Large Language Models (LLMs) comes when their insights are turned into practical trading steps. Think of them as research assistants that make your decision-making faster, not replacements for your experience or strategy.

For example, if you’re planning to trade Ethereum (ETH), you could ask:

“Summarize the latest Ethereum news, market sentiment from Reddit, and analyst opinions from the past 48 hours. Highlight whether the outlook is bullish or bearish.”

The LLM might show that traders are optimistic due to a recent network upgrade and rising trading volume. You could then combine that with your technical analysis, say, a bullish flag breakout, to confirm a potential entry point.

Similarly, before adjusting your portfolio, you might prompt:

“List the top 10 coins by market cap that gained the most in the past week and summarize key reasons for their moves.”

This helps you spot sector trends and decide whether to rotate capital into stronger assets.

The goal isn’t to let AI trade for you, it’s to use it for context, speed, and clarity. When paired with human judgment and risk control, LLMs make every step of the process, research, analysis, and execution, more efficient and informed.

Conclusion: Are LLMs Your AI Copilot for Smarter Trades?

Trading success comes from informed decisions, not just fast ones. Large Language Models (LLMs) make that easier by turning endless data into clear insights, filtering noise, spotting patterns, and helping traders understand what’s really driving the market.

Yet, no AI can replace human experience. The best results come when AI analysis and human judgment work together. AI handles data crunching while you interpret the results, manage risk, and act with discipline. This blend reduces emotional bias, strengthens confidence, and helps traders react quickly to shifting market conditions.

If you’re ready to apply these tools in real time, BingX gives you an edge. With live market data, advanced risk management tools, and AI-assisted trading insights, BingX helps you stay informed, adaptable, and one step ahead in every trading session.

Related Reading

FAQs on Using LLMs to Research and Make Crypto Trades

1. What are Large Language Models (LLMs) in crypto trading?

Large Language Models are advanced AI tools trained to process and understand language. In crypto trading, they read news, social media, and market data to identify sentiment, trends, and potential risks, helping traders make informed decisions.

2. Can LLMs predict crypto prices?

No. LLMs can analyze historical data, trading patterns, and community sentiment but cannot predict exact price movements. They assist traders in interpreting market behavior rather than generating buy or sell signals.

3. How can I use LLMs for crypto research?

You can use LLMs like ChatGPT or Gemini to summarize whitepapers, compare projects, track sentiment on Reddit and X, and analyze market capitalization trends. This saves time and helps you focus on meaningful insights instead of raw data.

4. Are LLMs safe to use for financial and crypto research?

Yes, if used responsibly. Always verify information with official sources such as CoinMarketCap or project websites. Avoid sharing personal data, wallet information, or private keys in AI chats to maintain data privacy.

5. What makes BingX useful with LLM-powered research for trading crypto?

BingX provides live crypto data, AI-assisted trading signals, and advanced risk management tools. When combined with LLM-based analysis, traders can act faster, manage risks better, and gain a complete market view for more confident trading decisions.