BNB Chain’s L2, opBNB, is built on the

Optimism OP Stack (Bedrock) and tuned for high throughput and ultra-low fees. As per official documentation, opBNB features 100 million gas/second, a block time of around 1 second, and fees that can be fractions of a cent, making it ideal for gaming, social, and retail-scale apps.

On the usage side, BNB Chain dashboards have shown heavy, retail-led activity, top games and DeFi dapps on BSC + opBNB lead daily rankings, with DappBay surfacing millions of weekly users and double-digit growth spurts across titles.

Below are the 10 best opBNB ecosystem projects, spanning

DePIN,

gaming, DeFi,

memecoins,

AI, and

stablecoins, worth watching in 2025. For each, you’ll find what it is, why it matters on opBNB, and key signals to track.

What is opBNB, BNB's Layer-2 Chain, and How Does It Work?

opBNB is BNB Chain’s

Layer-2 network built using the Optimism OP Stack (Bedrock). It works as a faster, cheaper execution layer that still benefits from BNB Smart Chain’s security. Users bridge assets from BSC to opBNB, then transact on the L2 where gas fees are a fraction of a cent and blocks confirm in about one second. Because opBNB is EVM-compatible, developers can deploy smart contracts using familiar tools, wallets, and Solidity code, no rebuilding from scratch.

Under the hood, opBNB processes transactions off-chain using a sequencer, which orders and executes thousands of transactions per second. These transactions are bundled into batches and posted back to the BNB Smart Chain as calldata. BSC then acts as the settlement layer, storing the data and enabling fraud-proofs, so if anyone detects invalid activity, they can challenge the batch. This lets opBNB scale far beyond BSC while still inheriting the Layer-1 security model.

The result is a network designed for high-volume activity: gaming loot drops, NFT trading, micro-payments, and fast swaps. With a 100 million gas-per-second target, a simple transfer (~21k gas) can theoretically process over 4,700 TPS, and many users pay under $0.001 per transaction. For everyday users, this means faster apps and near-instant confirmations. For builders, it means lower costs, more throughput, and seamless access to the wider

BNB Chain ecosystem.

Why Is the opBNB Ecosystem Growing in 2025?

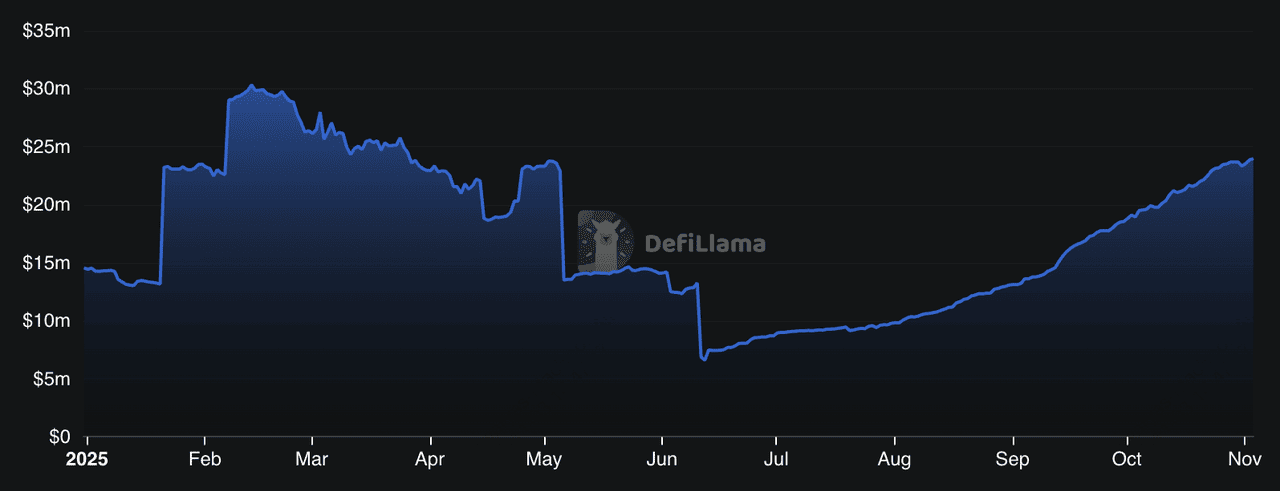

opBNB DeFi TVL sees a steady increase since June 2025 | Source: DefiLlama

opBNB’s growth in 2025 is driven by measurable throughput and real user demand. Transactions routinely cost under $0.001, and block times hover near 1 second, soon improving further as the Fourier upgrade cuts block times from 500ms to 250ms, effectively doubling capacity. That performance matters: BNB Smart Chain already processed 20.7 million transactions in a single day from 2.52 million active users, with opBNB contributing to that scale through high-DAU games, social apps, and micro-payment rails where fees would otherwise kill engagement.

Developers can deploy with standard Solidity tooling and MetaMask-style wallets, while inheriting BNB Chain’s deep liquidity and user base, now the third-largest blockchain with $8.66 billion TVL (total value locked). Interoperability via LayerZero brings access to 40+ chains, giving builders cross-chain user funnels and liquidity routes from day one.

To make onboarding easier, BNB Chain has also run 0-Fee transfer campaigns for stablecoins like

USD1 and

USDC, removing the need for newcomers to buy gas just to move funds. In short, opBNB gives builders speed, low costs, multichain reach, and an on-ramp friendly enough for non-crypto natives, exactly the mix needed to scale consumer-facing Web3 apps.

The 10 Most Popular opBNB Ecosystem Projects to Watch

As more developers and users migrate to low-fee, high-speed networks, these are the 10 opBNB ecosystem projects gaining the most traction and shaping what people actually do on-chain in 2025.

We prioritized live deployments or integrations on BNB Chain/opBNB, visible traction, including users/tx, TVL, listings, and ecosystem programs, and fit with opBNB’s low-fee, high-throughput strengths. Sources include BNB Chain’s DappBay rankings, DappRadar, and CoinGecko data.

1. Piggycell (PIGGY)

Piggycell is a

DePIN project that tokenizes South Korea’s largest shared power-bank network, claiming over 4 million users, 14,000+ hubs, 100,000+ batteries, and more than 31 million on-chain rental events. Every borrow, charge, and return is recorded on-chain and linked to “Charge-to-Earn” and “Dominate-to-Earn” rewards, making it one of the most active real-world usage cases in the opBNB ecosystem. Because the system generates thousands of tiny transactions daily, opBNB’s efficient infrastructure make the business model possible without eating user rewards.

The token,

PIGGY, trades with a $14.6 million market cap and a circulating supply of 7.2 million as of November 2025. NFT-based infrastructure rights, cross-chain plans, and data-driven rewards give the token utility beyond speculation. Going forward, the key signals to watch are new charging deployments, on-chain user metrics, and partnerships that plug PIGGY rewards into other opBNB apps, proof that real-world usage can scale when the chain is fast and fees stay near zero.

2. World of Dypians (WOD)

World of Dypians (WoD) is a large-scale MMORPG built on BNB Chain and opBNB, designed for persistent worlds with constant item trades, quests, and NFT updates. It’s one of the most active Web3 games, claiming 4 million monthly active users, 2.5 million community members, and over 580 million on-chain transactions, plus a Closed Beta on Epic Games, a rare milestone for crypto gaming. The WOD token shows real activity too, with a $11.9 million market cap, $5.2 million daily volume, and 320 million circulating supply.

MMORPGs generate thousands of tiny on-chain events per session, so opBNB’s ~1s block time and sub-cent gas make gameplay smooth and affordable. For 2025, key signals to watch are WoD’s DappBay ranking, daily active wallets, marketplace volume, and Binance Alpha progress. A full Binance Spot listing would expand liquidity and player onboarding, making WoD a flagship gaming case for opBNB.

3. PancakeSwap (CAKE)

PancakeSwap (CAKE) is the

top DEX in the BNB and opBNB ecosystems, with its opBNB deployment built for retail-heavy activity, micro-swaps, memecoin launches, and constant LP rebalancing. As of late 2025, PancakeSwap holds $2.7 billion TVL, $100 million in daily volume, and a circulating supply of 341 million CAKE, with Smart Router v3 and Infinity improving price execution and gas efficiency.

On opBNB, trades clear in ~1 second with sub-cent fees, making it cheap to swap small caps, claim rewards, or adjust LP positions frequently. For 2025, key things to watch are opBNB pool depth, routing quality across deployments, and Tokenomics 3.0 burns; if CAKE continues burning more than it emits, and liquidity keeps shifting on-chain, opBNB could become the main venue for fast retail flow on PancakeSwap.

4. SERAPH: In the Darkness (SERAPH)

SERAPH: In the Darkness is a fast-paced 3D action RPG running on BNB Chain and opBNB, with real-time combat, loot drops, class builds, and a marketplace for player-owned items. It frequently sits in DappBay’s top gaming rankings and continues to ship seasonal content, like Season 4 lasting Oct–Nov 2025 with Abyssal Treasure Hunts, GvG battles, and NFT-driven dungeons. The token trades around with a $10 million market cap and 292 million circulating supply, supporting a living economy of upgrades, crafting, and asset trading.

Why opBNB matters: every dropped item, dungeon reward, or marketplace listing triggers small on-chain updates. With ~1s blocks and sub-cent fees, players can actually mint, upgrade, and trade without gas fatigue, critical for action games with frequent interactions. To gauge traction, track DappBay rankings, daily wallet counts, NFT/marketplace volume, and how often new seasons, raids, or limited-loot events refresh. If SERAPH keeps pushing fast content cycles and on-chain asset sinks, it could become opBNB’s showcase for real-time, loot-driven Web3 gameplay.

5. LayerZero (ZRO)

LayerZero (ZRO) is a cross-chain messaging layer that connects 40+ blockchains, enabling tokens, NFTs, and smart contracts to move without bridges or wrapped assets. It went live on opBNB in 2023, unlocking OFT/ONFT standards and seamless app flows between opBNB, BSC,

Ethereum, and more. With over $50 billion in transferred value, 300+ integrated dApps, and a market cap near $180 million, LayerZero acts as core infrastructure for cross-chain DEXs, gaming assets, lending, and omnichain governance, making it one of the most adopted interoperability protocols in Web3.

For opBNB, LayerZero matters because it moves liquidity and messages in and out of the network cheaply and securely, helping builders reach multi-chain users without relying on custodial bridges. Key signals to track are OFT adoption on opBNB, new cross-chain deployments, and V2 upgrades like Decentralized Verifier Networks (DVNs), which improve security by requiring multi-party validation. If LayerZero keeps consolidating markets, highlighted by its

$110 million Stargate acquisition, opBNB could become a default settlement rail for omnichain apps, driving TVL, users, and asset flow across BNB Chain.

6. Thena

Thena is a ve(3,3)-style liquidity hub on BNB Chain that has expanded to opBNB, letting protocols “rent” deep liquidity via gauges, emissions, and bribe markets, now cheap to run thanks to opBNB’s sub-cent gas. As of November 2025, Thena reports $39.6B total volume, $40.3 million protocol revenue, and a $19.1 million TVL.

For builders, this means cost-efficient liquidity bootstrapping (bribes/claims/airdrop farming) and programmable routing across opBNB ⇄ BSC; for LPs, veTHE locks can capture fee + bribe flow while concentrated-liquidity pools target tighter ranges. What to track: weekly opBNB emissions and bribing APRs on your pairs, cross-routing fill rates vs. Pancake/1inch, and roadmap deliverables, such as perps/options, AI assistants,

RWA/

DeFAI integrations, that could redirect order flow and fees to opBNB.

7. ChainGPT (CGPT)

ChainGPT pairs an AI model for Web3 with real products, including launchpads, agents, NFT generators, and contract auditorsm and was recognized at the BNB Chain Awards as one of the chain’s top AI infrastructures. With $43 million market cap, 866 million circulating CGPT, and a steady cadence of 2025 releases, such as Buzzdrops, IBOs, no-code tooling, and AIVM progress, it gives builders plug-and-play AI that can mint, sign, analyze, and deploy on-chain.

On opBNB, these agents can fire thousands of low-cost actions, mints, verifications, quests, without gas friction, making it a practical base layer for AI-driven user campaigns and automated smart-contract flows. What to track: AIVM roadmap, opBNB-native modules in the SDK, and whether Buzz-style token launches become a standard for community-driven airdrops across BNB Chain.

8. Four.meme (FORM)

Four.meme is a no-code

memecoin launchpad on BNB Chain that hit $1.4 million in 24h protocol fees and 812,000+ daily users during

BNB “meme season,” even surpassing

Pump.fun in revenue. Deploying a token costs ~0.005 BNB, and once a bonding curve fills for 24 BNB, liquidity auto-seeds to PancakeSwap, creating instant markets without manual setup.

On opBNB, this model gets even cheaper, letting communities spin up fair-launch tokens and meme experiments with sub-cent gas, frequent mints, and high-volume trading. Watch the daily new-token pace on opBNB, improvements to anti-honeypot/security tools like X Mode’s fee spikes to block bots, and whether FORM liquidity incentives start shifting meme trading from BSC to opBNB pairs.

9. USD1 (USD1)

USD1 is a fast-growing stablecoin with $3 billion market cap, now the 6th-largest globally, and heavily used on BNB Chain thanks to “gas-free transfer” campaigns that remove fees for USD1/

USDT/USDC transfers during promo windows. That model, plus opBNB’s sub-cent base gas, makes retail payments, remittances, and micro-commerce practical even for small amounts.

Backed by World Liberty Financial, USD1 has pushed over $500 million in trading activity in just two months through its points program and is expanding via Enso for cross-chain liquidity across

Solana, Ethereum,

Tron, and

Aptos. Watch for gas-free transfers expanding to more wallets and bridges, stronger CEX support for opBNB deposits and withdrawals, and UX upgrades that make stablecoin payments feel like Web2 (tap, send, zero gas).

10. Quack AI (Q)

Quack AI is building a “sign-to-pay” and gasless governance layer for the Agent Economy, and BNB Chain has become its main execution environment thanks to 1-second blocks and low fees that suit high-frequency autonomous transactions. In October 2025, the project launched

x402 BNB, enabling one-click, gas-sponsored transfers using EIP-7702 delegated execution and EIP-712 witness signatures, removing repeated approvals and reducing UX friction for both humans and

AI agents.

With a $30 million market cap and nearly $8 million in daily trading volume, Quack AI’s traction is tied to real usage: as more wallets and opBNB dapps integrate x402 for gasless payments, signature-based swaps, and bot-level governance, its “AgentFi” pitch becomes more practical than speculative.

How to Trade opBNB Ecosystem Tokens on BingX

BingX lets you engage BNB-ecosystem tokens through Spot and Futures, with

BingX AI on the chart to surface support/resistance, trend shifts, and volatility alerts.

Buy and Sell opBNB Tokens on the Spot Market

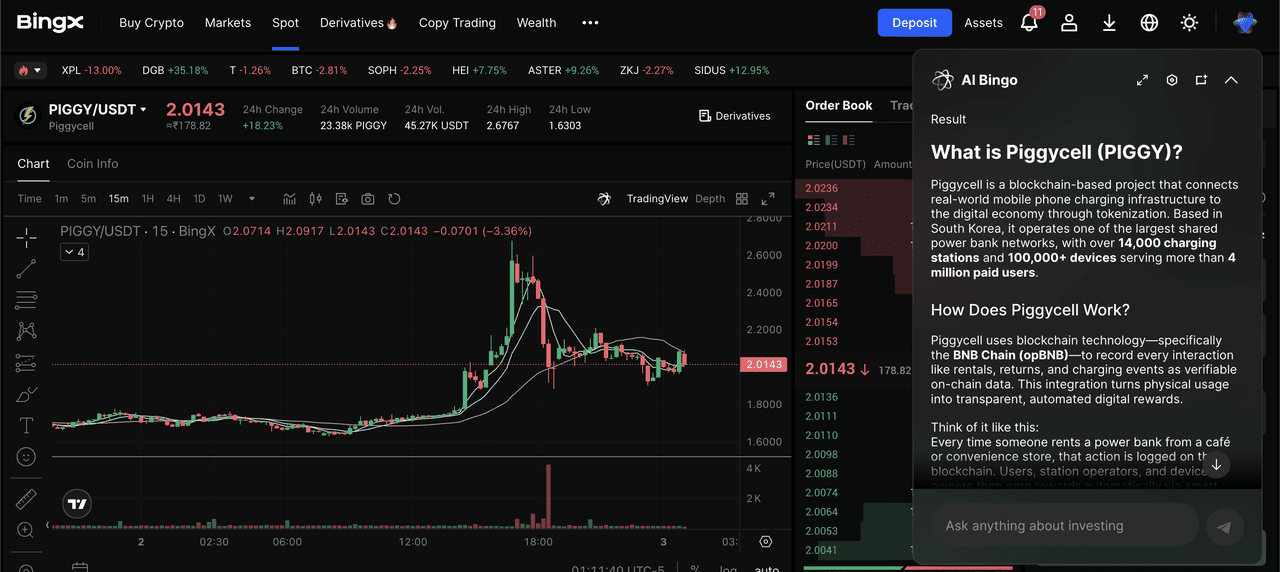

PIGGY/USDT trading pair on the spot market powered by BingX AI insights

2. Tap the AI button to view BingX AI insights, price trends, and support/resistance levels.

3. Choose

Market if you want an instant buy/sell, or Limit if you want to set your own price. After purchase, you can hold your tokens in BingX, stake them (where supported), or withdraw to a

Web3 wallet such as

MetaMask or

Trust Wallet.

Long or Short opBNB Coins on the Futures Market

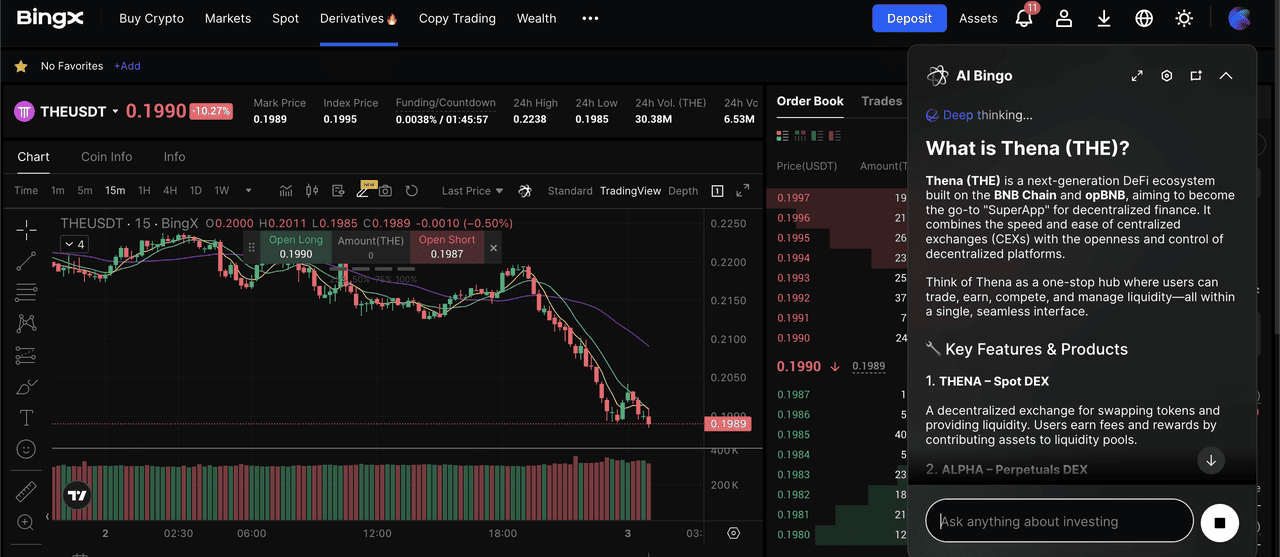

THEUSDT perpetual contract on the futures market powered by BingX AI

2. Turn on BingX AI to get real-time signals and volatility alerts.

3. Set your leverage carefully, choose Long if you expect the price to rise or Short if you expect it to fall, and always place

Take-Profit and Stop-Loss to manage risk in fast markets.

Closing Thoughts

opBNB’s value proposition remains simple: faster blocks, lower fees, and real utility for apps that need frequent on-chain actions. That’s why high-DAU games like World of Dypians, omnichain infra like LayerZero, AI agents such as Quack AI, and payments like USD1 campaigns continue to cluster around it. If BNB Chain sustains its mix of L2 performance, incentives, and cross-chain reach, these projects could keep expanding user share through 2025. Still, adoption is never guaranteed; network upgrades, security events, or market volatility can slow momentum, so users and builders should stay informed, test carefully, and manage risk as the ecosystem scales.

Related Reading

FAQs on opBNB Ecosystem Projects

1. What is opBNB in simple terms?

opBNB is a Layer-2 network built on top of BNB Smart Chain that processes transactions off-chain and then settles them back on BSC, allowing faster speeds and cheaper fees than using BSC alone.

2. How much does it cost to use opBNB?

Fees are typically a fraction of a cent, and many ecosystem campaigns, like USD1 promos, temporarily remove gas fees for certain transfers, making it friendly for small payments and gaming.

3. Is opBNB secure?

opBNB inherits security from BNB Smart Chain and uses rollup-style fraud proofs to verify data posted back on BSC, helping protect users from invalid transactions.

4. Which wallets support opBNB?

Wallets like MetaMask, Trust Wallet, and

SafePal can connect by adding the opBNB network RPC; many dApps also offer one-click “Add to Wallet” buttons for beginners.

5. What can I do on opBNB?

You can play blockchain games, mint NFTs, trade memecoins, make micro-payments, use AI agents, and bridge assets from BSC or other chains using supported bridges.

6. How do I bridge tokens to opBNB?

Use a supported cross-chain bridge like LayerZero or official BNB bridges, choose the source network, pick opBNB as the destination, confirm gas fees, and wait for finality.

7. Can I trade opBNB ecosystem tokens on BingX?

Yes, tokens like CAKE, W, and FORM can be bought or sold on BingX Spot, and some also have Futures markets for long/short trading with leverage.

8. Why is opBNB popular for games and memecoins?

1-second blocks and sub-cent fees let users make many tiny transactions without high gas costs, which suits games, meme launches, and NFT markets.

9. What risks should I know before using opBNB?

Like any blockchain, network congestion, contract exploits, or market volatility can create losses; always research tokens, use known dApps, and avoid trading more than you can afford to lose.

10. Is opBNB the same as BNB Smart Chain (BSC)?

No, opBNB is a Layer-2 on top of BSC. It processes transactions faster and cheaper but still posts data back to BSC, giving it the security and liquidity of BNB Chain’s main network.