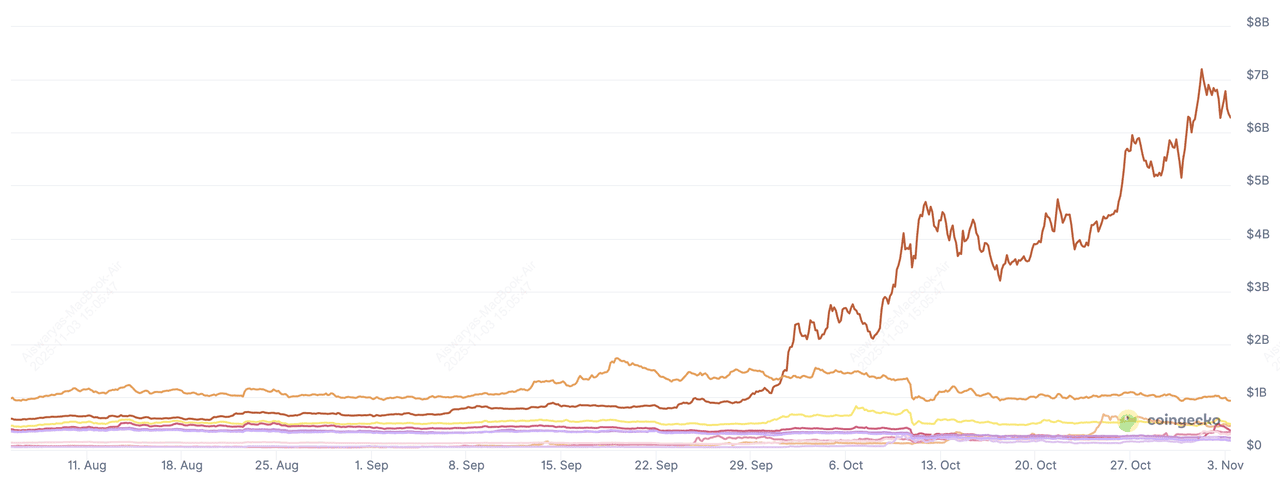

Zero Knowledge (ZK) technology isn’t a niche anymore but is also eating Web3 at scale. With over $11.7 billion in ZK project market cap and $3.5 billion in 24-hour trading volume, validity proofs (SNARKs/STARKs) now power real rollups, slash withdrawal times, compress on-chain data, and enable privacy-preserving identity. In 2025, ZK moves from research labs to production: faster payments, chain-level gaming, NFT settlement, DeFi order routing, and one-human-one-wallet proof across identity networks.

Market cap of popular ZK coins | Source: CoinGecko

This guide explores the 10 ZK-powered projects that matter this year, detailing what each does, why it’s trending now, and the key things to watch.

What is Zero-Knowledge (ZK) and How Does It Work?

A zero-knowledge proof is a cryptographic method that lets someone prove a statement is true without revealing any of the underlying secret data. Instead of sharing your password, financial records, or identity documents, you share a tiny proof that mathematically confirms you followed the rules. Think of it like showing the cover of a solved puzzle to prove you solved it, without handing over the pieces.

In practice, the prover combines public data (like a website’s password hash or a smart contract’s rules) with private data (your secret input) to generate a short proof. Anyone can verify this proof instantly using public information, but they learn nothing about the secret itself. For example, you can log in by proving you know the correct password without sending the password, or prove you’re 18+ using a signed credential without revealing your date of birth or name.

This makes ZK extremely useful in crypto and finance. ZK-rollups batch thousands of transactions off-chain and post one validity proof to

Ethereum for cheap, fast settlement. Identity apps use ZK to offer one-person-one-airdrop without storing biometrics.

DeFi protocols can check whether your collateral is healthy without exposing wallet history, and cross-chain bridges can verify facts from Web2, like payroll or exchange balances, without leaking raw data. In short: ZK lets systems verify correctness instead of exposing private information, enabling faster scaling and privacy-first finance.

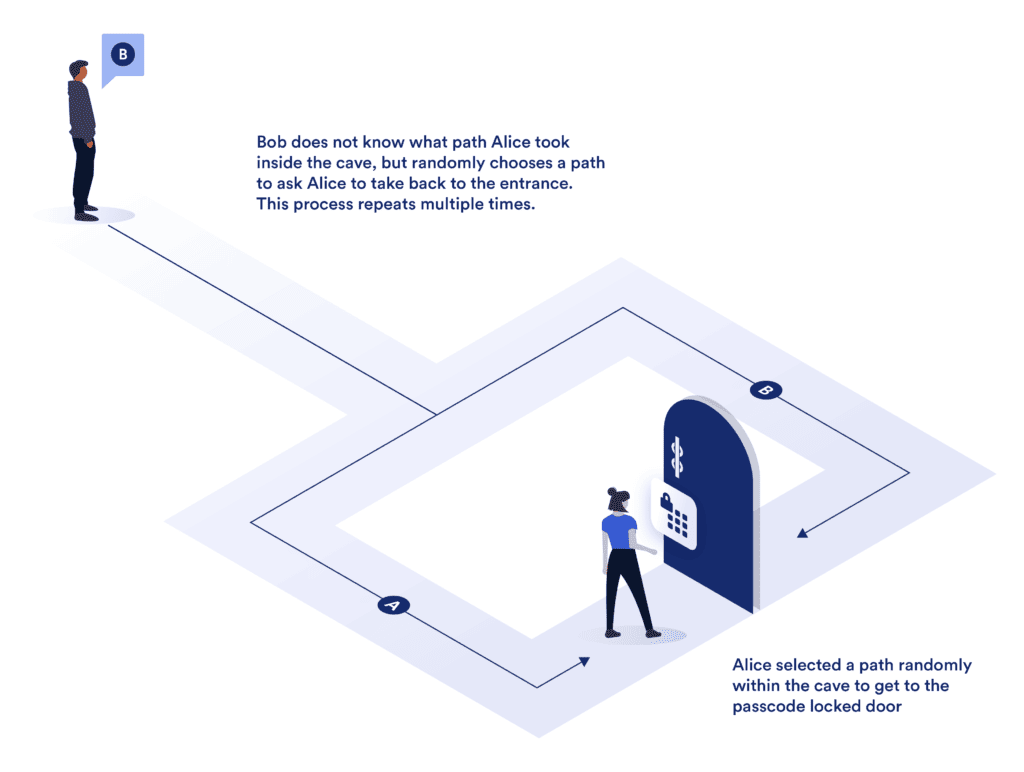

How Zero Knowledge Technology Works

How zero-knowledge (ZK) technology works | Source: Chainlink

1. Model the rule as a circuit/program. Example: “Hash or password equals the stored hash” or “All transfers in this block follow the ledger rules.”

2. Combine public inputs + your secret or “witness”. Public inputs might be a smart-contract address, a Merkle root, or a policy threshold (e.g., 18 years). Your witness is the private data you won’t reveal.

3. Prover creates a proof. A prover algorithm runs the circuit with your secret and emits a short proof (SNARK/STARK). You can share this proof anywhere.

4. Verifier checks the proof. A verifier algorithm or a smart contract quickly checks the proof against the public inputs. If valid, the statement is accepted, no secret exposed.

Key ZK Trends in 2025 to Keep an Eye on

Zero-knowledge is shifting from experiments to infrastructure in 2025, especially in identity and L2 scaling. Worldcoin resumed operations in the U.S. and continues onboarding millions of verified users worldwide, while Humanity Protocol raised at a reported $1.1 billion valuation and introduced palm-scan verification for one-human-one-airdrop distributions. Both rely on ZK proofs to confirm uniqueness without exposing biometrics, signaling that Sybil resistance is becoming a mainstream requirement for airdrops, DePIN rewards, and DAO governance.

On the scaling side, zkEVM deployments are accelerating: Linea launched its LINEA token and Season 1 rewards, Immutable is routing live games to its Immutable zkEVM, and Ronin will ship app-specific zkEVM chains via Polygon CDK. This points to a shift from single shared rollups to many tailored L2s anchored by ZK validity proofs.

ZK infrastructure is also getting commoditized through proving networks and privacy-with-auditability. Succinct’s Open Prover Layer (OPL) turns proving into a marketplace, letting chains outsource heavy computation while slashing or rewarding provers based on correctness, an early step toward decentralized, pay-as-you-go proving. Meanwhile, Zcash continues to demonstrate that private systems can still support compliance: view keys allow auditors to check shielded transactions without exposing full histories, and shielded supply has grown steadily year over year. Together, these trends show that ZK is evolving from a cryptography showcase into a production-grade toolkit for secure identity, fast settlement, and regulated privacy.

What Are the 10 ZK Crypto Projects to Watch in 2025?

Below are 10 zero-knowledge projects gaining real traction in 2025, each showing how ZK is moving from theory to everyday products, including payments, gaming, identity, and fast L2 scaling.

We prioritized networks/protocols that (a) ship real ZK features (proofs, zkEVMs, zkRollups, ZK-ID) or (b) are actively adopting ZK at the protocol/app layer, and (c) showed 2025 traction—mainnet upgrades, token launches, ecosystem growth, or regulatory milestones.

1. Zcash (ZEC)

Zcash remains the most proven

privacy coin using zk-SNARKs at the protocol layer, and 2025 data shows real usage, and not just speculation. In October, its shielded pool crossed 4.5 million ZEC, about 20% of total supply, and the token rallied 400% in a month, lifting market cap past $6.3B with nearly $1B in daily volume. At the infrastructure level, over 70% of nodes have migrated to the faster Zebra client, improving verification speeds by 30% and cutting memory load by 40%.

Adoption is also rising due to better UX and compliance-friendly privacy. The Zashi wallet passed 120,000 installs, cuts shielded transaction setup times by ~60%, and supports view keys, which let users prove legitimacy to auditors without exposing full histories. Cross-chain swaps via THORSwap and Maya Protocol now move $9–12 million per week without wrapped assets. In short, Zcash combines private payments, optional transparency, and modern infrastructure, helping it separate from older privacy-coin narratives.

2. Immutable (IMX)

Immutable is becoming the leading ZK gaming stack by combining Ethereum security with gas-free gameplay and

NFT ownership. In 2025, it rolled out Immutable zkEVM powered by Polygon ZK, moved

IMX staking on-chain, and built onboarding tools like Passport and SDKs to help Web2 studios go crypto-native. The ecosystem now holds a $920 million market cap as of November 2025, $29 million daily volume, and $22 million TVL, with a new Mobile Gaming Division targeting a market where mobile generates $121 billion annually and over 50% of global players.

The real momentum comes from live games, not hype. TOKYO BEAST hit #1 on Japan’s App Store, and Ubisoft’s Might & Magic: Fates is a flagship partner, proof that AAA studios are embracing ZK rails. With gas-free trades, shared order books, and reward systems that bridge Web2 users to on-chain assets, Immutable is positioning zkEVM as the default home for mobile Web3 titles. The key metric to watch in late 2025: how many new top-tier games launch directly on Immutable zkEVM and how much player activity moves fully on-chain.

3. Worldcoin (WLD)

Worldcoin uses the Orb plus zero-knowledge proofs to verify a user is a unique human without exposing their iris data. In November 2025, WLD trades around a $1.7 billion market cap, $130 million daily volume, and 2.27 billion circulating supply. The project restarted operations in the U.S., focusing on wallet onboarding and L2 integrations where apps can accept “verified human” users without storing biometrics.

The outlook is cautious. Token unlocks continue, leadership has been quiet, and partnerships remain thin, keeping WLD range-bound. The key metrics to watch are Orb availability, number of verified IDs, and real apps using proof-of-personhood for Sybil-resistant airdrops, governance, or compliance. Regulation will make or break adoption: if governments embrace “private but verifiable” identity, WLD gains utility; if not, progress stalls.

4. Starknet (STRK)

Starknet is a STARK-powered

Layer-2 that settles to Ethereum and increasingly integrates

Bitcoin, using its Cairo VM instead of the EVM to push high-throughput, low-fee apps. In November 2025, STRK sits near a $490 million market cap, over $700 million TVL, and strong 24h volumes as governance, staking, and data-compression upgrades lowered L2 fees and boosted adoption.

The network is expanding into

BTCFi, letting users stake wrapped

BTC and earn

STRK incentives with 100 million STRK allocated, while DeFi and gaming deployments grow as toolchains mature. The key signals to watch: Kakarot EVM compatibility, how fast TVL and app usage scale, and prover performance gains from STWO, StarkWare’s next-gen prover, critical for cheaper proofs, faster finality, and sustaining Starknet’s push to become a multi-chain execution layer.

5. zkSync (ZK)

zkSync is Matter Labs’ ZK-rollup stack with EVM-compatible smart contracts, settling to Ethereum while using the ZK token for governance and ecosystem incentives. In November 2025, ZK trades around a $370 million market cap, over $540 million 24h volume, and a 7.2 billion circulating supply, with activity rebounding after fee cuts and DEX/NFT incentives.

The Atlas upgrade introduced a high-performance sequencer of up to 30,000 TPS (transactions per second) and faster cross-chain confirmations via Airbender, pushing zkSync toward institutional payment and tokenization use cases. With ZK Nation running grants and onchain voting, the key things to monitor are the roadmap, app growth, and governance dashboards that track how capital is deployed and which protocols scale on zkSync Era.

6. Linea (LINEA)

Linea is ConsenSys’ zkEVM with full EVM-equivalence and native MetaMask/Infura support, making it one of the easiest L2s for developers and retail users to adopt. In November 2025, LINEA trades near a $200 million market cap, boosted by its token launch and Season 1

Linea airdrop, where 10% of supply was unlocked for users and 75% reserved for a 10-year ecosystem fund, with no VC or team allocations.

Institutional signals are emerging:

SharpLink committed to deploy $200 million in

ETH onto Linea for yield strategies, while dozens of DeFi apps and gaming pilots are onboarding thanks to low fees and near-instant withdrawals. What matters now is post-airdrop retention, fee trajectory as throughput scales, and whether

MetaMask’s potential airdrop drives sustained user activity instead of short-term farming.

7. Humanity Protocol (H)

Humanity Protocol (H) is a decentralized identity network that turns palm biometrics into zero-knowledge proofs, no raw images stored, to issue a reusable “Human ID” credential for Sybil-resistant airdrops, governance, and on-chain access. In H2 2025, it raised at a $1.1 billion valuation, surged into the top-100 as H’s market cap climbed toward $450 million, and Phase 2 palm-scan verification is slated for late-2025 as

Humanity “Fairdrop” mechanics gain traction across DeFi and gaming.

Beyond proof-of-personhood, Humanity is rolling out zkTLS, letting users prove financial or identity facts, like “I have funds to buy a house,” without exposing documents, making it one of the most advanced privacy-preserving identity stacks to watch as verifier networks, DAO integrations, and real-world applications expand.

8. Succinct (PROVE)

Succinct (PROVE) is building an “Open Prover Layer," a decentralized marketplace where rollups, bridges, or even

AI agents can outsource zero-knowledge proof generation to independent provers instead of running expensive in-house infrastructure. After its TGE and exchange listings, PROVE jumped into the ZK-infra conversation with a $120 million+ market cap and fast growth in developer integrations.

The network uses off-chain auctions for speed and settles results on Ethereum for trustlessness; provers stake PROVE and can be slashed for bad proofs, making quality and reliability measurable. In 2025, watch how many L2s, oracles, and dApps decide to outsource proving. If proving becomes a commodity, Succinct could become the “proof marketplace” powering cross-chain bridges, verifiable computation, and ZK-rollups at scale.

9. Ronin (RON)

Ronin (RON) is the

Axie-backed gaming chain now adding zkEVM infrastructure via

Polygon CDK, letting studios spin up their own app-specific L2s with fast ZK settlement and shared liquidity. In November 2025, RON sits near a $230 million market cap with games like Axie, Pixels, and Cambria driving on-chain activity, even as Messari data shows DAAs cooled earlier in the year.

The big pivot is timeline-based: the first Ronin zkEVM chains are slated for Q1 2025, and their success depends on how well they connect through Polygon’s AggLayer to keep assets and liquidity flowing across game-chains. If multiple titles launch on schedule and avoid fragmented liquidity, Ronin could become a hub for scalable, low-fee Web3 gaming beyond just Axie.

10. Horizen (ZEN)

Horizen (ZEN) has pivoted from a legacy sidechain model to “Horizen 2.0,” a ZK-first smart-contract hub that now runs as an ERC-20 on Base, giving it Ethereum security and Coinbase-level distribution. In November 2025,

ZEN trades near a $300M market cap with surging volume as the network positions itself as a privacy-centric rollup platform, offering zkEVM tooling, modular proof services, and appchain deployment paths for developers that want embedded privacy without deep cryptography work.

The thesis to watch is whether EON/zkEVM infrastructure and Base integrations translate into real builders and cross-chain deployments; if so, Horizen could evolve from a former privacy coin into a rollup-centric ecosystem for compliant, confidential smart contracts.

How to Trade Top ZK Tokens on BingX

With

BingX AI built into Spot and Futures, you can trade leading ZK tokens with smart signals, risk prompts, and real-time market analysis. Here’s the simplest way to get exposure:

Spot Trading to Buy and Sell ZK Ecosystem Coins

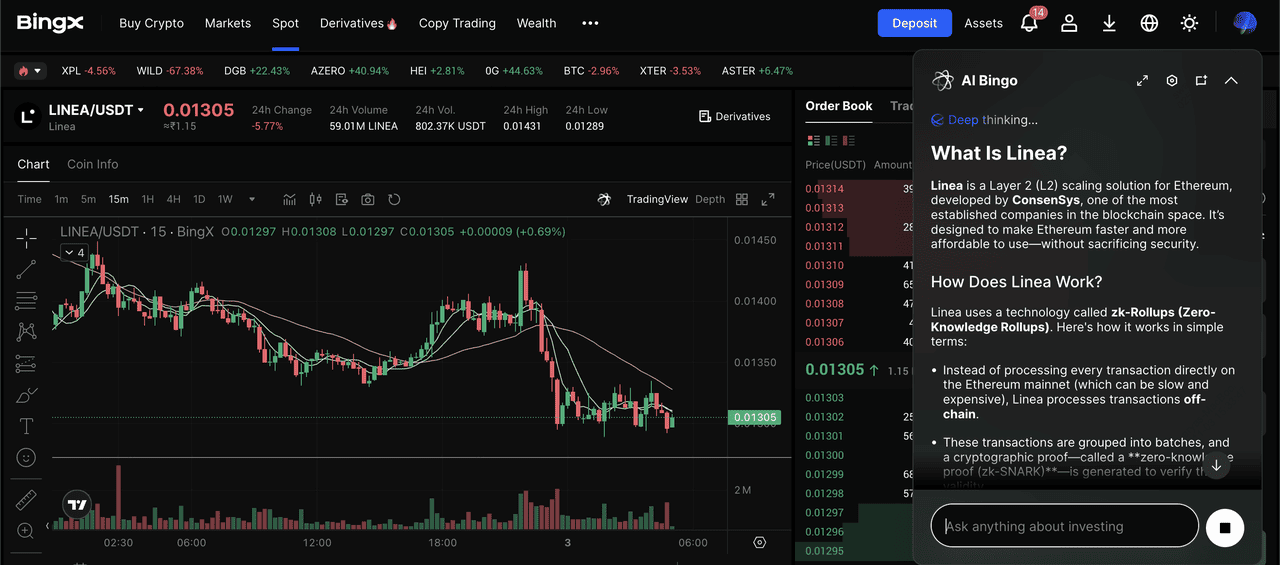

LINEA/USDT trading pair on the spot market powered by BingX AI insights

Spot is the easiest way to buy and hold ZK tokens.

2. Tap the AI icon to unlock BingX AI’s support/resistance zones, volatility alerts, and entry signals.

3. Choose

Market for instant purchase or Limit to set your preferred price.

4. Your tokens settle to your Spot account; you can hold for the long term or withdraw to a

Web3 wallet if you plan to stake or use them on-chain.

Tip: If you want to stake or participate in ecosystem apps, send tokens to a chain-specific wallet, e.g.,

MetaMask for zkSync/Linea, Argent for Starknet, and always keep a small amount of gas in the native token for fees.

Futures Trading for Leverage

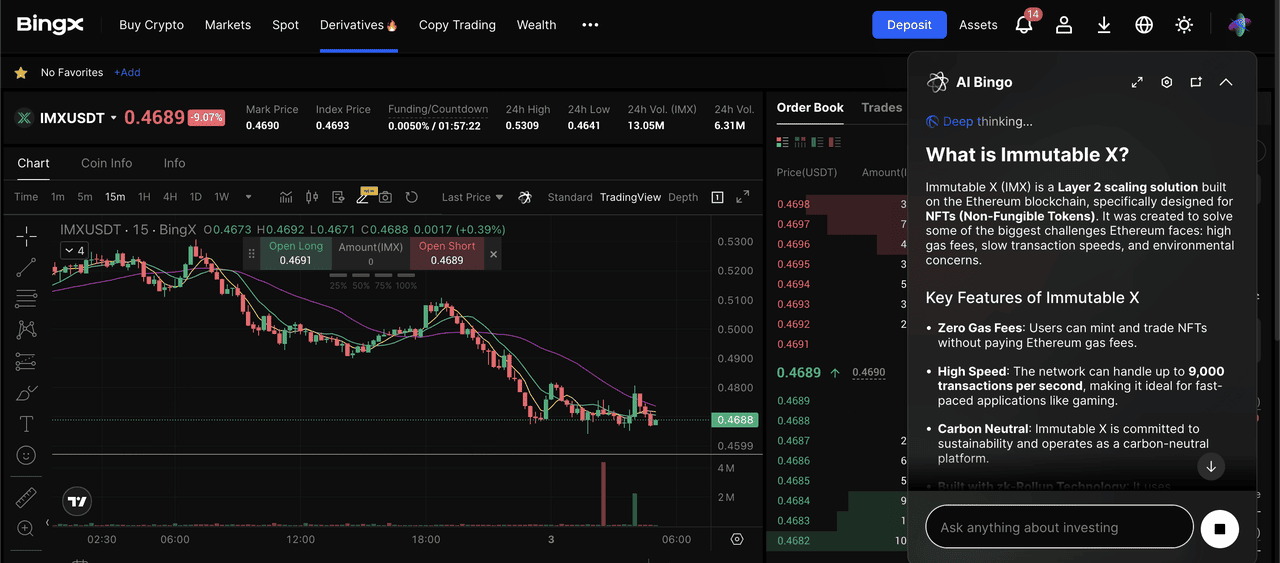

IMX/USDT perpetual contract on the futures market powered by BingX AI

Futures let you trade price direction with leverage, with higher potential reward but higher risk.

1. Open

BingX Futures and search for the token’s USDT-M perpetual market, where supported.

2. Enable BingX AI for trend direction,

funding rate alerts, and automated risk prompts.

3. Set leverage, then place a Long (price up) or Short (price down) trade.

4. Always add

Stop-Loss and Take-Profit, and size positions conservatively; ZK tokens can be volatile after news, listings, or ecosystem announcements.

On-chain tip: Many ZK tokens use EVM chains. Verify the official contract address, use trusted bridges, and never interact with unknown dApps; ZK ecosystems each have specific wallets, explorers, and bridge tools.

Conclusion

Zero-knowledge technology is no longer theoretical but is powering identity systems, high-throughput rollups, cross-chain settlement, and developer platforms that aim to scale blockchain without sacrificing privacy. The projects above show ZK is moving from research labs into real products with users, liquidity, and measurable on-chain activity.

Still, the sector remains early. Tokens tied to ZK infrastructure can be volatile, adoption timelines may shift, and not every roadmap milestone guarantees market impact. If you choose to explore ZK assets on BingX, start small, use BingX AI for risk prompts and trend signals, and always apply stop-losses and proper position sizing.

Related Reading

FAQs on Zero Knowledge (ZK) Projects

1. What is zero-knowledge (ZK) technology in simple terms?

A zero-knowledge proof lets you prove something is true, like balance or identity, without exposing the underlying data. It enables private logins, private payments, and safer blockchain scaling.

2. Why are ZK rollups important for Ethereum?

ZK rollups batch thousands of transactions off-chain and post a single proof on-chain, cutting costs and speeding finality. Users get faster confirmations without trusting a central party.

3. How are ZK and AI connected in 2025?

As AI models generate more sensitive data, ZK proofs allow apps to verify results or user credentials without revealing inputs, which are useful in fraud prevention, identity, and high-frequency trading.

4. Are ZK tokens risky?

Yes, ZK infrastructure is early, roadmap timelines can slip, and prices are highly volatile. Research token utility, funding, and adoption before investing.

5. Can I store ZK tokens in a normal crypto wallet?

Most ZK project tokens are ERC-20 assets, so they work with common wallets like MetaMask,

Base App, and

hardware wallets. Always verify the official contract address before transferring.

6. What real-world problems do ZK projects solve?

They enable private logins, Sybil-resistant airdrops, faster blockchain settlement, compliance-friendly privacy, and cross-chain messaging without trusted bridges.

7. How do I trade ZK coins on BingX?

Search pairs like ZK/USDT, IMX/USDT, WLD/USDT, or STRK/USDT on Spot or Futures. You can enable BingX AI for price levels, volatility alerts, and risk reminders.