Artificial intelligence (AI) has moved from experimentation to infrastructure. By 2025, AI is no longer a speculative theme but a core driver of capital spending across cloud computing, semiconductors, enterprise software, and consumer platforms. According to multiple industry estimates, global AI-related spending exceeded $1.5 trillion in 2025, driven by large-scale investments in data centers, advanced chips, and generative AI deployment across enterprises. Big Tech companies such as

Nvidia,

Microsoft,

Google,

Meta,

Apple, and

Palantir sit at the center of this transformation, supplying the hardware, models, and platforms that power the AI economy.

At the same time, financial markets are undergoing their own structural shift.

Tokenized stocks are blockchain-based digital assets that track real-world equities and are gaining traction as investors seek more flexible, global access to leading U.S. companies. BingX has expanded access to tokenized stocks by supporting on-chain representations of major U.S. equities, allowing investors to gain AI stock exposure using

stablecoins rather than traditional brokerage accounts. By combining traditional equity exposure with crypto-native features such as fractional ownership, 24/7 trading, and on-chain settlement, tokenized stocks are emerging as a new gateway for investors who want exposure to AI leaders as adoption continues into 2026.

AI Market Overview in 2025: Key Segments Driving AI Stocks

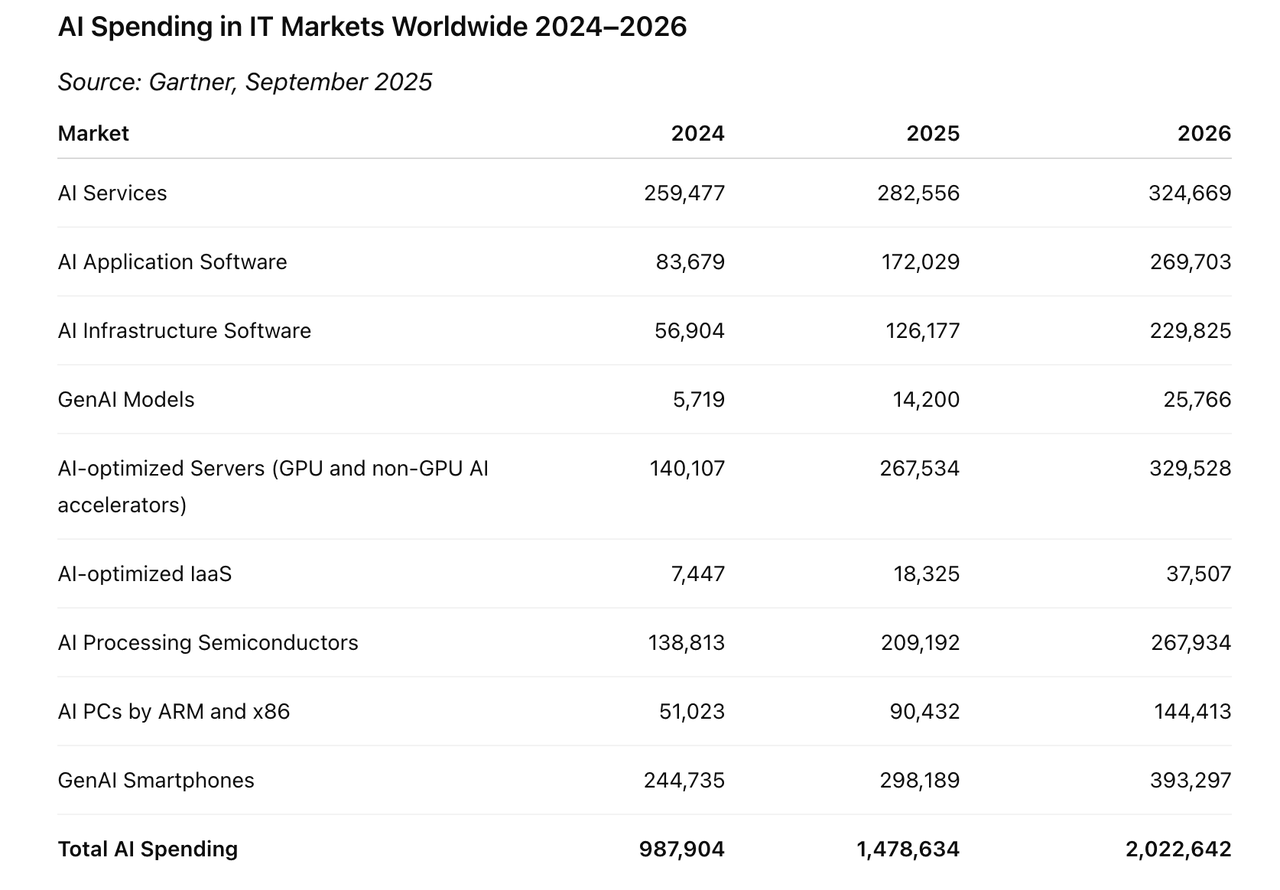

Source: Gartner Forecast (September 2025)

By 2025, artificial intelligence had firmly entered large-scale commercialization. According to Gartner Forecast Analysis Artificial Intelligence Worldwide, global AI-related spending was forecast to reach nearly $1.5 trillion in 2025, reflecting AI’s transition into a core component of enterprise and infrastructure investment. Gartner further projects that global AI spending will exceed $2 trillion in 2026, driven by continued deployment across cloud platforms, enterprise software, and physical infrastructure.

1. Cloud and Data Center Spending Reached $723 Billion

AI demand significantly accelerated cloud and data center investment as organizations scaled model training and inference workloads. Gartner forecasts global cloud services spending to reach $723.4 billion in 2025, with AI integration cited as a major driver of enterprise cloud usage. Industry analysis also suggests that AI workloads could approach 30% of total data center workloads, increasing pressure on compute capacity and power availability. As AI infrastructure scales, cloud platforms such as Microsoft Azure, Google Cloud, Amazon AWS, and Oracle OCI are positioned as direct beneficiaries of AI-driven infrastructure spending.

2. AI Semiconductor Spending Is Rising Toward $268 Billion

Semiconductors remained central to AI scalability in 2025. Gartner expects spending on AI processing semiconductors to rise from $209 billion in 2025 to $268 billion in 2026, highlighting sustained demand for AI-optimized chips. At the manufacturing level, wafer fabrication equipment spending is forecast to reach $126 billion by 2026, driven by AI applications in logic and memory. This environment continues to favor AI-focused semiconductor leaders including Nvidia, AMD,

Broadcom, ASML, Applied Materials, and KLA Corp, which sit at the core of AI model training and inference supply chains.

3. Enterprise AI Adoption Reached 78%–88%

At the application layer, AI adoption expanded rapidly across industries. According to McKinsey The State of AI, 78% to 88% of organizations reported using AI in at least one business function by 2025, signaling widespread adoption beyond experimentation. AI became embedded across productivity software, analytics, advertising platforms, and workflow automation, strengthening platform companies such as Microsoft, Google, Meta, Apple, and Palantir, which monetize AI through large distribution networks and recurring usage.

4. AI Data Center Electricity Demand Is Growing 17%–35% Annually

AI expansion significantly increased electricity demand from data centers. Projections cited by the International Energy Agency show AI data center electricity consumption rising from 176 TWh in 2024 to 325–580 TWh by 2028, implying an estimated compound annual growth rate of roughly 17% to 35%. Power availability and grid capacity increasingly became binding constraints for AI infrastructure expansion, linking AI growth to utilities and grid operators such as NextEra Energy, Duke Energy, Dominion Energy, and Southern Company, which support data center development and grid upgrades.

What Are Tokenized Stocks and How Do They Work?

Source: RWA.xyz

Tokenized stocks are blockchain-based digital assets that provide economic exposure to publicly traded company shares. Instead of trading through traditional brokerages, these tokens are bought and sold using

stablecoins such as

USDT on crypto platforms like BingX, making them globally accessible and enabling fractional exposure and extended trading hours. Tokenized stocks are designed to track the price movements of real equities while reducing reliance on traditional settlement and custody infrastructure.

As of late 2025, the tokenized stock market was still early but growing rapidly. Around $660 million worth of public equities were live on-chain as tokenized stocks, generating over $1.22 billion in monthly transfer volume and held by nearly 119,000 wallets. At the same time, the broader

real-world asset (RWA) tokenization market, which includes equities, government bonds, and private credit, surpassed $30 billion in total value. Industry estimates suggest that if even 1% of global equities become tokenized, the market could exceed $1.3 trillion by 2030, highlighting the long-term potential of this model.

In practice, tokenized stocks generally follow two structural approaches:

1. Fully backed tokenized stocks: Tokens are issued against real shares held with regulated custodians. Frameworks such as

Ondo Finance and

Backed Finance’s xStocks follow this model, offering 1:1 economic exposure to the underlying stock without shareholder rights.

2. Synthetic or protocol-based exposure: These models replicate stock price movements through on-chain mechanisms or financial contracts rather than direct share custody. Earlier implementations on platforms such as DeFiChain used this approach to provide decentralized price exposure.

Most tokenized stocks offer price exposure only and do not include voting rights, dividends, or other shareholder privileges. Despite these limitations, they are increasingly viewed as a bridge between traditional equity markets and blockchain-based trading, combining familiar stock exposure with the flexibility of crypto-native infrastructure.

Top 6 AI Tokenized Stocks to Watch in 2026

The following are six AI tokenized stocks to watch in 2026, representing leading companies across chips, cloud infrastructure, software, and AI platforms. Each tokenized stock mirrors the price performance of its underlying public company, offering an alternative access layer for investors interested in AI-driven growth.

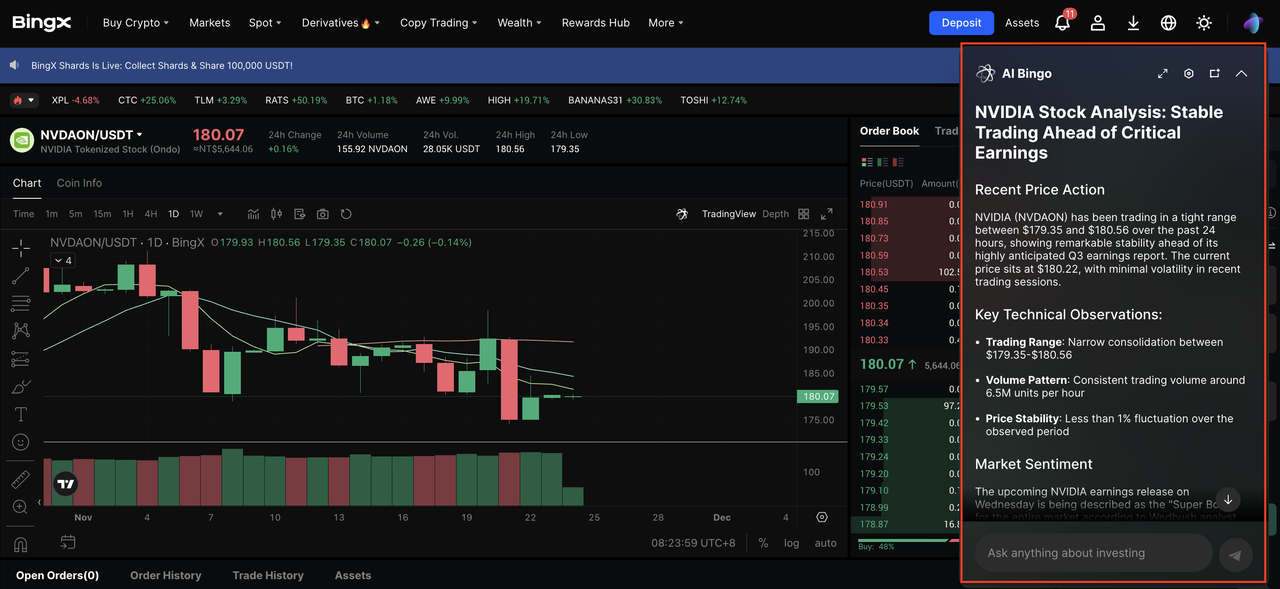

1. Nvidia Tokenized Stocks (NASDAQ: NVDA) – NVDAX, NVDAON

Source: Google Finance

• 2025 Nvidia Market Cap: $4.29 trillion

• Global Rank: #1 among publicly traded companies (as of Dec. 16, 2025)

Nvidia (NVDA) was the defining AI stock of 2025. In June 2025, Nvidia became the first publicly traded company in history to surpass a $5 trillion market capitalization at its peak, underscoring its central role in the global AI infrastructure buildout. Demand for its GPUs and accelerated computing platforms continued to surge across hyperscale cloud providers, enterprise AI deployments, and government-backed data center projects. From the start of 2025 through mid-December, Nvidia’s stock delivered approximately +31% year-to-date returns, rising from the low-$130 range earlier in the year to trade around $176 by mid-December. Despite periods of volatility, Nvidia remained one of the strongest large-cap contributors to overall technology sector performance as AI capital expenditure shifted decisively from experimentation to long-term deployment.

Within the tokenized stock market, Nvidia represented about 4.66% of total value as of December 13, 2025, equal to roughly $31 million in tokenized market capitalization, placing it among the largest non-ETF single-stock exposures on-chain. Nvidia exposure is mainly available via

NVDAX, an xStock issued on

Solana, and

NVDAON, issued by

Ondo Finance on

Ethereum and supported

Layer 2 networks, both offering 1:1 economic exposure to NVDA shares.

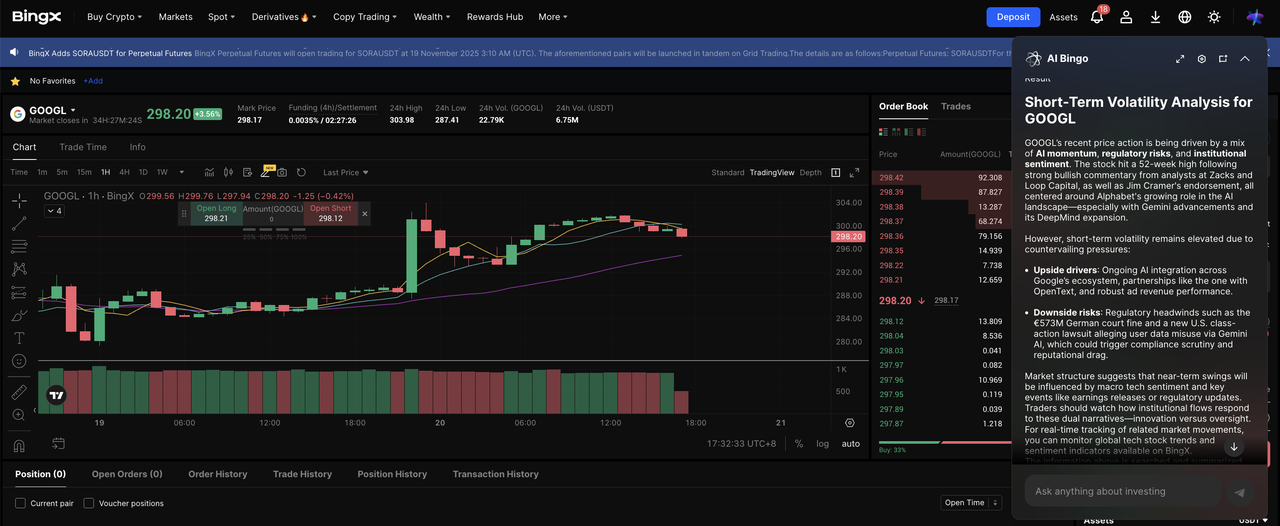

2. Google Tokenized Stocks (NASDAQ: GOOGL) – GOOGLX, GOOGLON

Source: Google Finance

• 2025 Alphabet Market Cap: $3.73 trillion

• Global Rank: #3 among publicly traded companies (as of Dec. 16, 2025)

Alphabet (GOOGL), Google’s parent company, was one of the strongest-performing mega-cap AI stocks in 2025 as its AI ecosystem gained traction across consumer and enterprise products. Alphabet delivered double-digit revenue growth, including a 34% increase in Google Cloud revenue to over $15 billion, driven in part by strong demand for AI infrastructure and services. Google’s generative AI efforts, anchored by the Gemini series of models, are embedded into Search, Workspace, and Cloud, contributing to both query engagement and monetization. The Gemini app surpassed 650 million monthly active users in 2025, and AI-powered features like “AI Mode” in Google Search expanded access to advanced reasoning and multimodal query responses. By mid-December 2025, Alphabet Class A shares were trading around $308, delivering approximately +62.8% year-to-date returns and outperforming broader indexes as the company reinforced its position as a leader in AI-driven services and cloud solutions.

As of mid-December 2025, Alphabet Inc. Class A represented about 3.3% of total tokenized stock value, or roughly $21–22 million in on-chain market capitalization, ranking among the largest non-ETF single-stock exposures. One of the most widely used Google tokenized stocks is

GOOGLon, issued by Ondo Finance, which provides 1:1 backed economic exposure on Ethereum and supported Layer 2 networks. Google exposure is also available through

GOOGLX, a Solana-based xStock issued by Backed Finance, offering an alternative on-chain format for accessing Alphabet’s stock price.

3. Microsoft Tokenized Stocks (NASDAQ: MSFT) – MSFTON

Source: Google Finance

• 2025 Microsoft Market Cap: $3.53 trillion

• Global Rank: #4 among publicly traded companies (as of Dec. 16, 2025)

Microsoft’s AI strategy in 2025 was shaped by its deep and expanding partnership with OpenAI, which became a key driver of Azure growth and enterprise AI adoption. OpenAI models were increasingly embedded across Microsoft’s ecosystem, including Azure OpenAI Service, Microsoft 365 Copilot, and GitHub Copilot, accelerating the shift from experimental use cases to production-scale deployment. This positioning reinforced Microsoft’s role as a core infrastructure and distribution layer for enterprise AI. By mid-December 2025,

Microsoft (MSFT) shares were trading around $474, delivering approximately +12.6% year-to-date returns after rebounding from a spring low in the mid-$360 range, supported by strong cloud demand and recurring enterprise revenue tied to AI workloads.

For tokenized exposure,

MSFTON is issued under Ondo Global Markets’ tokenized stock framework, providing 1:1 economic exposure to Microsoft shares without shareholder rights. It enables stablecoin-based, fractional access to Microsoft stock without relying on traditional brokerage infrastructure.

4. Apple Tokenized Stocks (NASDAQ: AAPL) – AAPLON, AAPLX

Source: Google Finance

• 2025 Apple Market Cap: ~$4.07 trillion

• Global Rank: #2 among publicly traded companies (as of Dec. 16, 2025)

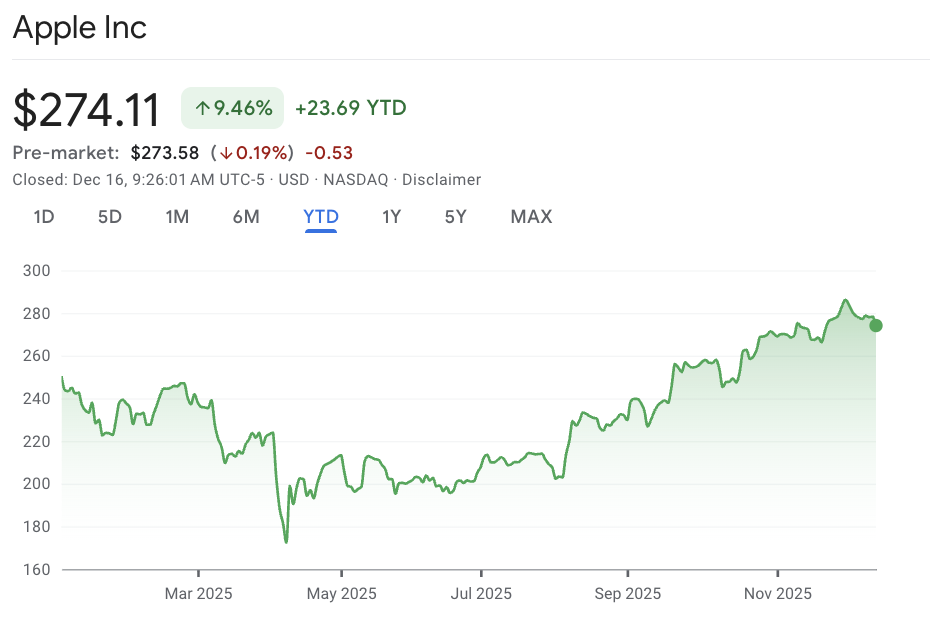

Apple’s AI strategy in 2025 emphasized on-device intelligence, privacy-first design, and deep ecosystem integration rather than standalone AI branding. AI capabilities were increasingly embedded across iOS, macOS, and Apple Silicon, powering features such as enhanced Siri interactions, image and video processing, and personalized system-level intelligence.

Apple (AAPL) shares experienced volatility in the first half of the year, briefly dipping below $180 in the spring before staging a steady recovery. By mid-December 2025, Apple stock was trading around $274, delivering approximately +9.5% year-to-date returns, supported by services growth, hardware refresh cycles, and growing investor confidence in Apple’s long-term AI roadmap.

Within the tokenized stock market, Apple represented a modest but visible on-chain presence in mid-December 2025. Apple Inc. accounted for roughly 1% of total tokenized stock value, equal to approximately $6.5–6.7 million in tokenized market capitalization. Apple exposure is available through

AAPLON and AAPLX, with AAPLON issued under Ondo Global Markets’ framework and

AAPLX offered as an xStock product, enabling fractional, stablecoin-based access to Apple equity on-chain.

5. Meta Tokenized Stocks (NASDAQ: META) – METAON, METAX

Source: Google Finance

• 2025 Meta Market Cap: $1.63 trillion

• Global Rank: #6 among publicly traded companies (as of Dec. 16, 2025)

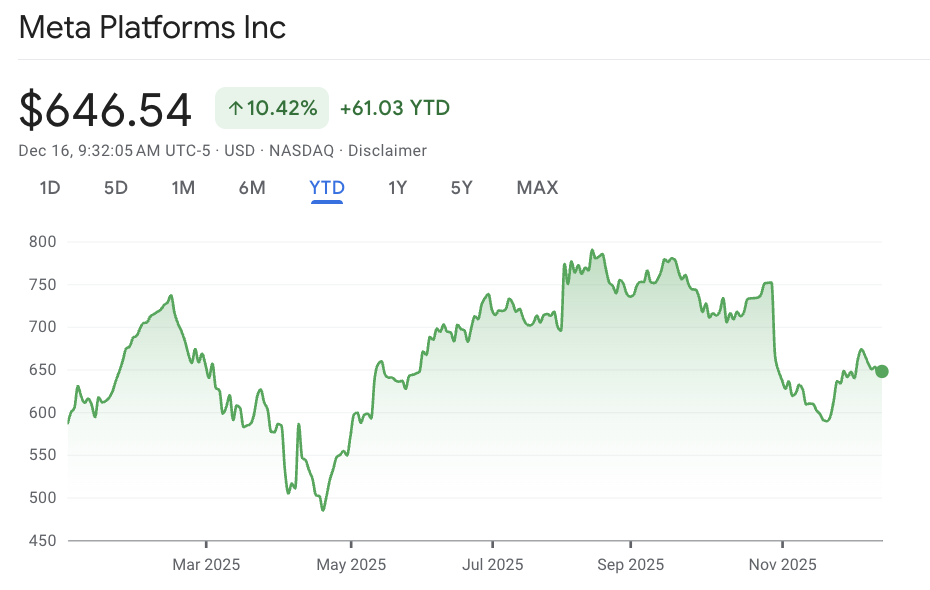

Meta’s AI strategy in 2025 focused on AI-driven advertising optimization, recommendation systems, and large-scale model deployment across its core platforms. AI played a central role in improving content ranking and ad targeting on Facebook and Instagram, directly supporting engagement and revenue efficiency. Meta also continued advancing its open-source Llama model family, reinforcing its position in foundational AI research while monetizing AI primarily through advertising. Meta shares saw notable volatility during the year, dipping below $500 in the spring before rebounding. By mid-December 2025, the stock was trading around $647, delivering approximately +10.5% year-to-date returns, supported by margin improvement, disciplined cost controls, and confidence in Meta’s AI-driven ad model.

For tokenized exposure, Meta equity is available through on-chain products such as METAON and METAX.

METAON, issued under Ondo Global Markets’ tokenized stock framework, provides 1:1 economic exposure to Meta shares without shareholder rights.

METAX, part of the xStock suite, offers an alternative on-chain representation, typically deployed on high-throughput networks such as Solana, enabling stablecoin-based and fractional access to Meta stock without relying on traditional brokerage infrastructure.

6. Palantir Tokenized Stocks (NASDAQ: PLTR) – PLTRON

Source: Google Finance

• 2025 Palnatir Market Cap: ~$420 billion

• Global Rank: Outside the top 20 among publicly traded companies (as of Dec. 16, 2025)

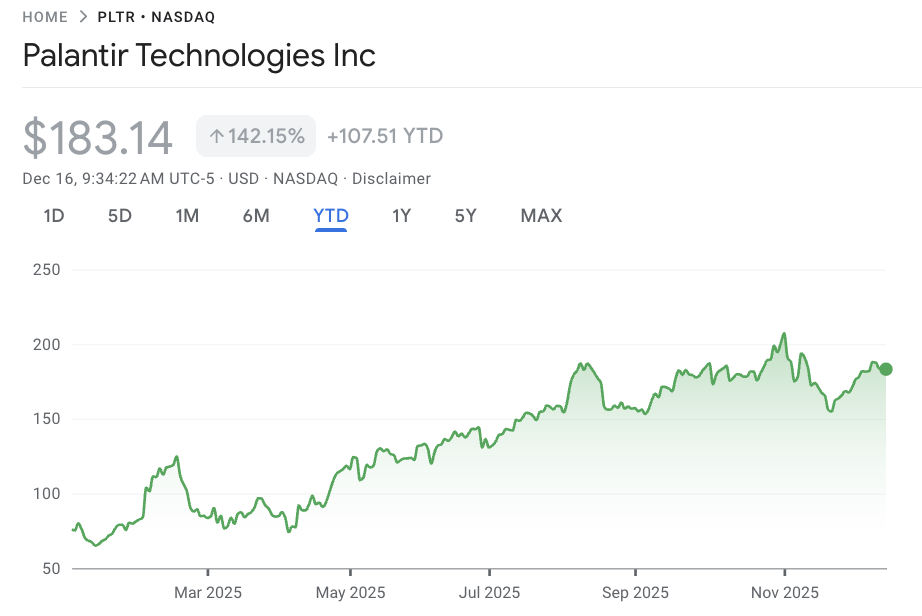

Palantir (PLTR) was one of the best-performing AI-related stocks of 2025, driven by growing adoption of its Artificial Intelligence Platform (AIP) across government and enterprise customers. The company focused on operational AI use cases such as data integration, decision support, and mission-critical workflows, rather than consumer-facing products. Palantir shares showed strong momentum throughout the year, rising steadily after the spring and maintaining elevated levels into year-end. By mid-December 2025, the stock was trading around $183, delivering approximately +142% year-to-date returns, reflecting investor confidence in Palantir’s ability to translate AI deployments into long-term, contract-based revenue.

For tokenized exposure,

PLTRON is one of the on-chain representations of Palantir equity issued under Ondo Global Markets’ tokenized stock framework. It provides 1:1 economic exposure to Palantir shares without shareholder rights, enabling stablecoin-based and fractional access to PLTR without relying on traditional brokerage infrastructure.

How to Buy AI Tokenized Stocks on BingX

BingX is one of the leading platforms to buy AI tokenized stocks, supporting assets issued through both Ondo Finance and Backed Finance’s xStocks framework. These tokenized equities allow investors to gain price exposure to major AI-focused U.S. companies using stablecoins, without opening a traditional brokerage account.

Currently, BingX lists 35 fully backed tokenized equities issued by providers such as Ondo, along with 6 Solana-based xStocks from Backed Finance. This lineup includes tokenized stocks linked to leading AI companies such as Nvidia, Google, Microsoft, Apple, Meta, and Palantir. These AI tokenized stocks mirror the price movements of their underlying equities and provide fractional, stablecoin-based exposure through on-chain trading.

Step 1: Create and Secure Your BingX Account

Step 2: Deposit USDT Into Your BingX Wallet

Transfer USDT into your BingX wallet using a supported blockchain network. Confirm the correct network, review minimum deposit requirements, and check any applicable fees before completing the transfer.

Step 3: Choose Between Spot Tokenized Stocks or Futures

On BingX, AI stock exposure is available through two formats.

1. Buy AI Spot Tokenized Stocks through BingX Spot

2. Trade AI Stock Price–Linked Futures Through BingX Futures

In the

Futures market, BingX offers USDT-settled perpetual contracts that track AI stock prices without representing ownership of shares or tokenized assets. Examples include

NVDA-USDT,

GOOGL-USDT,

MSFT-USDT,

AAPL-USDT, and

META-USDT perpetual contracts. These futures support leverage and both long and short positions, and are typically used for short-term trading or hedging.

Step 4: Use BingX AI for Market Insights

Before placing an order, tap the

BingX AI icon to view market insights such as support and resistance levels, recent volatility, trend indicators, and liquidity conditions for the selected AI stock.

Step 5: Buy the AI Tokenized Stock

Choose

a market or limit order, enter the amount of USDT you want to invest, review the order details, and confirm the trade. Once executed, the AI tokenized stock will appear instantly in your Spot wallet.

Are AI Tokenized Stocks a Good Investment?

AI stocks represent long-term growth exposure driven by the adoption of artificial intelligence across hardware, cloud infrastructure, enterprise software, and digital platforms. Companies such as Nvidia, Microsoft, Google, Apple, Meta, and Palantir operate at different layers of the AI value chain, and their performance is ultimately determined by fundamentals like revenue growth, margins, competitive positioning, and execution rather than the investment wrapper used.

As AI shifts from early hype to large-scale deployment, returns are likely to become more differentiated across companies. While AI stocks can offer structural growth potential, they also carry traditional equity risks, including valuation sensitivity, earnings volatility, and changes in technology spending cycles.

Tokenized stocks do not alter this underlying investment thesis. They function as an access layer that mirrors the price performance of the underlying AI stocks without providing shareholder rights. Their primary value lies in accessibility, including fractional exposure, stablecoin-based settlement, and extended trading hours.

In short, the investment case depends on the strength of the AI companies themselves. Tokenized stocks simply provide an alternative way to access that exposure, rather than a different risk–return profile.

Risks and Considerations Before Investing in AI Tokenized Stocks

Before trading AI tokenized stocks, it’s important to understand how these products differ from traditional equities and where additional risks may arise. While tokenized stocks improve access and flexibility, they do not remove the fundamental risks associated with AI investing.

• Underlying stock risk: Tokenized stocks still follow the price movements of AI equities, meaning investors remain exposed to market volatility, valuation risk, and earnings fluctuations.

• No shareholder rights: Tokenized stocks provide price exposure only and do not include voting rights, dividends, or ownership privileges.

• Issuer and structure risk: Tokenized stocks depend on the issuer’s backing and custody framework, which may differ across providers.

• Liquidity and tracking risk: Liquidity can vary, and prices may temporarily diverge from the underlying stock during volatile market conditions.

• Leverage risk in futures: Stock-linked futures involve leverage and liquidation risk and are better suited for experienced traders.

Final Thoughts

AI stocks continue to sit at the center of long-term technology and productivity trends, driven by the expansion of artificial intelligence across infrastructure, software, and digital platforms. Their investment appeal ultimately depends on fundamentals such as execution, profitability, and the ability to convert AI capabilities into durable revenue growth.

Tokenized stocks do not change this underlying thesis. Instead, they offer an alternative access layer that improves flexibility through fractional exposure, stablecoin settlement, and extended trading hours. For investors who already believe in the long-term potential of AI companies, tokenized stocks can be a practical way to access that exposure, particularly outside traditional brokerage systems.

Related Reading